In the news this week: China’s (heavily disrupted) February manufacturing activity report, final Q4 GDP growth rates for Italy and Australia, trade balance for Canada, Australia, and the US. On Friday the February US jobs report. Overall nothing that is likely to bump news of the corona virus spread from the front pages.

Summary: ROOF Scores to Markets: “Stop telling lies about us and we’ll stop telling the truth about you”. The age-old question of which came first, investor sentiment or market moves, has finally been answered. After three consecutive weeks of denial, markets succumbed to sentiment last week in quite a spectacular fashion. But, if the (SARS) past is any guide to our future, we may not be done yet. There will be the inevitable denial of the denial (a.k.a. dead cat’s bounce), and only then (if Elisabeth Kübler-Ross has anything to say about it), acceptance. Yes, central banks will inject the monetary equivalent of Prozac into the system but what they will not add is earnings and cashflow. And so, while they wait for Wall Street’s scribblers to crunch the new numbers, investors cram into whatever haven they can find (a.k.a. Gold, USTBs, the Swiss Franc, and the Japanese Yen) as sentiment continues to weaken across all markets.

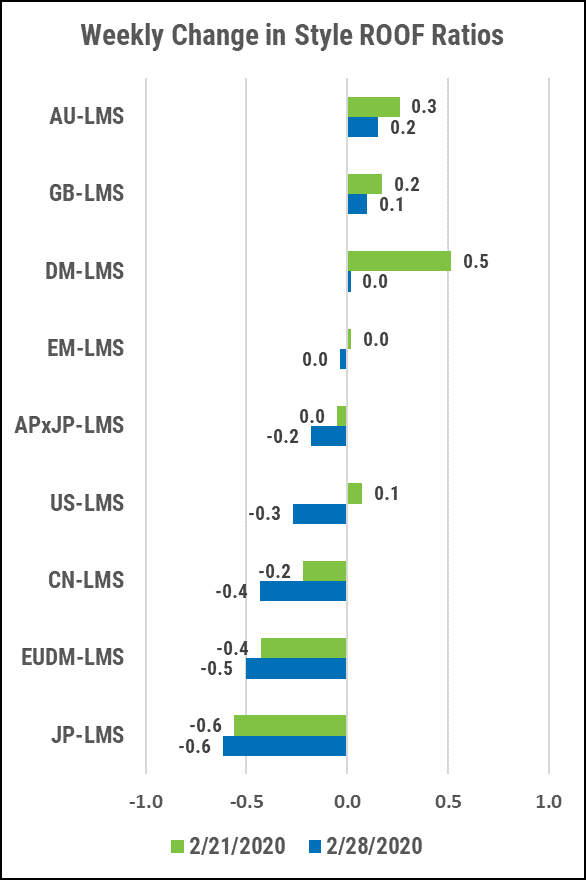

- Sentiment continues to retreat globally in all markets we compute ROOF scores for. Some (Japan and Developed Europe) have now entered bearish territory (ROOF Ratio <-0.5).

- Investors had a visceral reaction last week to market’s February denial of their increasing angst. Both are now back at equilibrium although one is licking its wounds.

- Uncertainty is high, volatility is high, and so the cost of being wrong have all gone up. Speculation of a V-shaped recovery from this health crisis has been proved wrong and investors now want some facts, data, and new earnings forecast to move forward.

- Last week’s selloff should not be seen as the panic selling that usually accompanies a market bottom, but simply a slap in February’s speculative face by the invisible hand of investor sentiment for ignoring its warning.

- Investing in this environment has become an effort to prevent a lot of money from becoming a little, not trying to turn a little money into a lot.

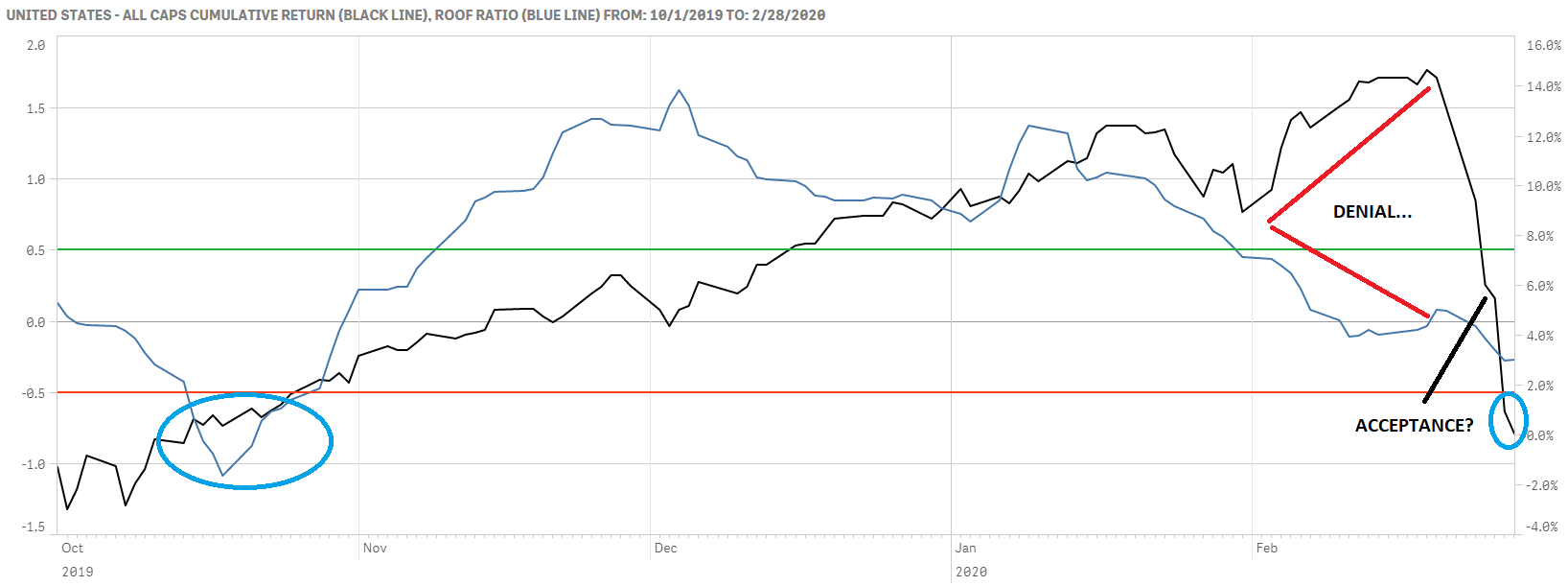

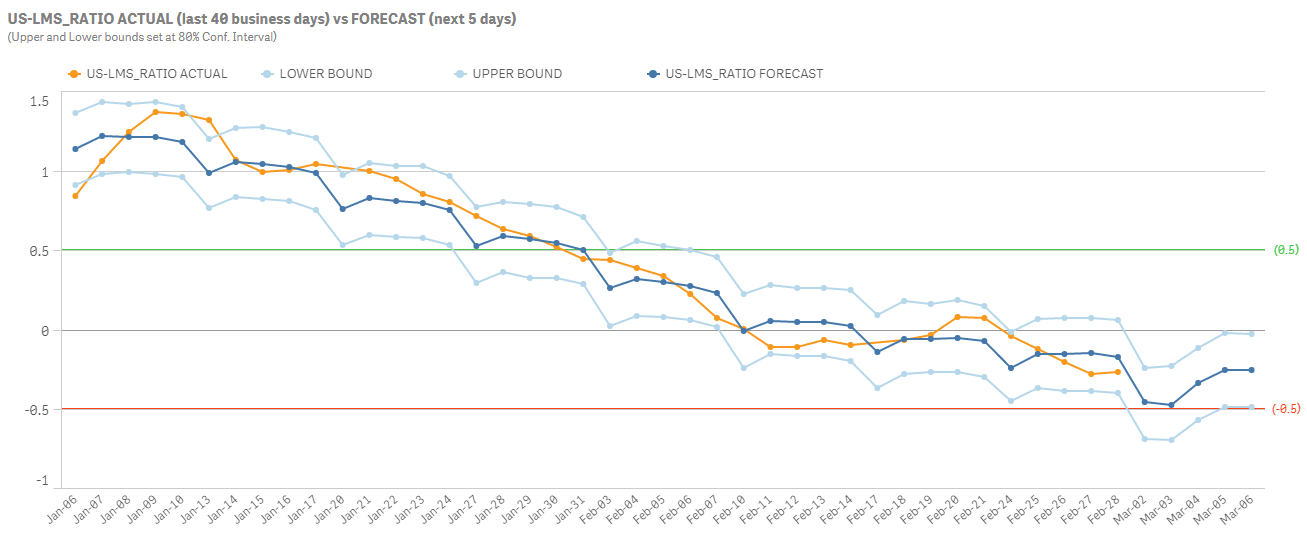

Sentiment in the US continued to weaken last week into negative territory but remains in the neutral zone in a reflection of investor’s continued uncertainty about the impact of Covid 19 on earnings.

US ROOF ratios dipped further into negative territory, albeit timidly, and our forecast shows a slight rebound this week preventing it from crossing into bearish territory (<-0.5) at this point. This refusal to turn bearish should not, however, be interpreted as confirmation that the worst is over, simply that uncertainty levels make it difficult for investors to make their mind where to go next (i.e. is it safe to try and catch a falling knife?). Markets have paid for their denial last week (and then some), dropping to levels not seen since the ROOF Ratio was in bearish territory last October.

There is at this point a lot of noise about the health crisis but not a lot of answers or facts as the first batch of economic data releases encompassing the first full month of the crisis are only just being released, starting with China and Japan – and those are not good at all. It will be another month before the effects are measurable for Europe and the US given that the crisis has only spread to these geographies in February. Meanwhile the earning season is over, and it will be another two months before CEOs take to the stage again to give investors a preview of the corporate impact of the crisis on earning.

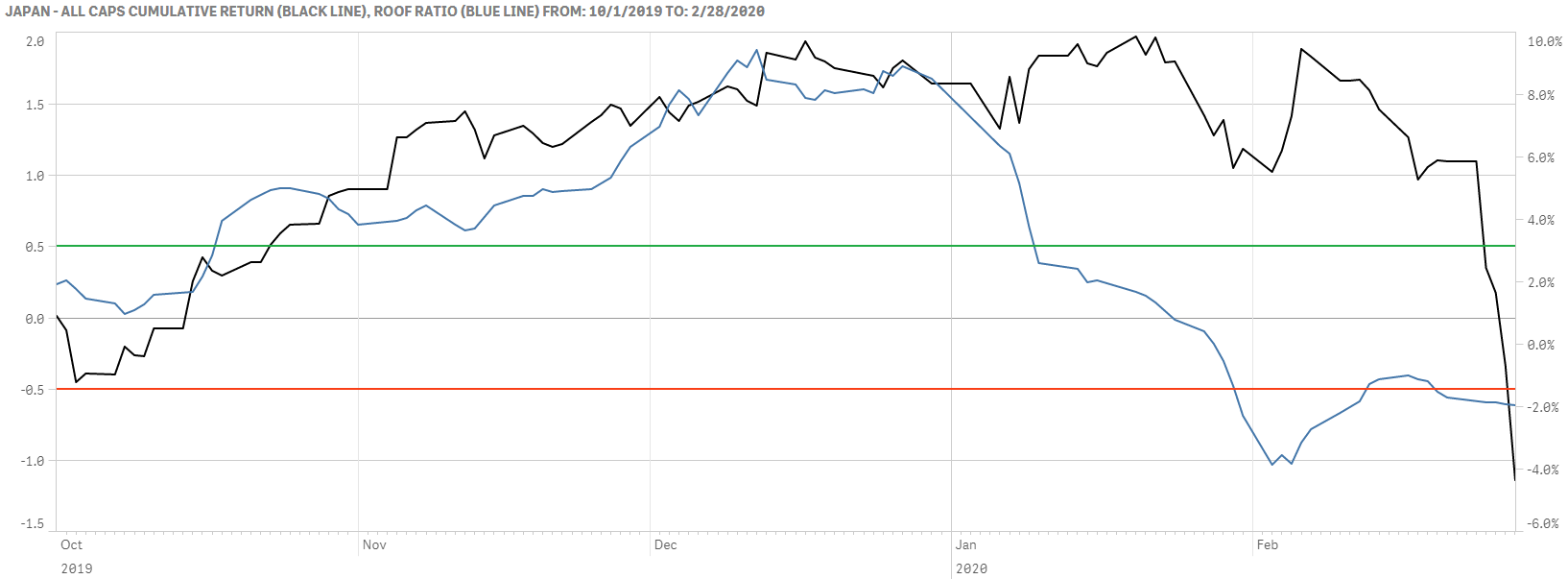

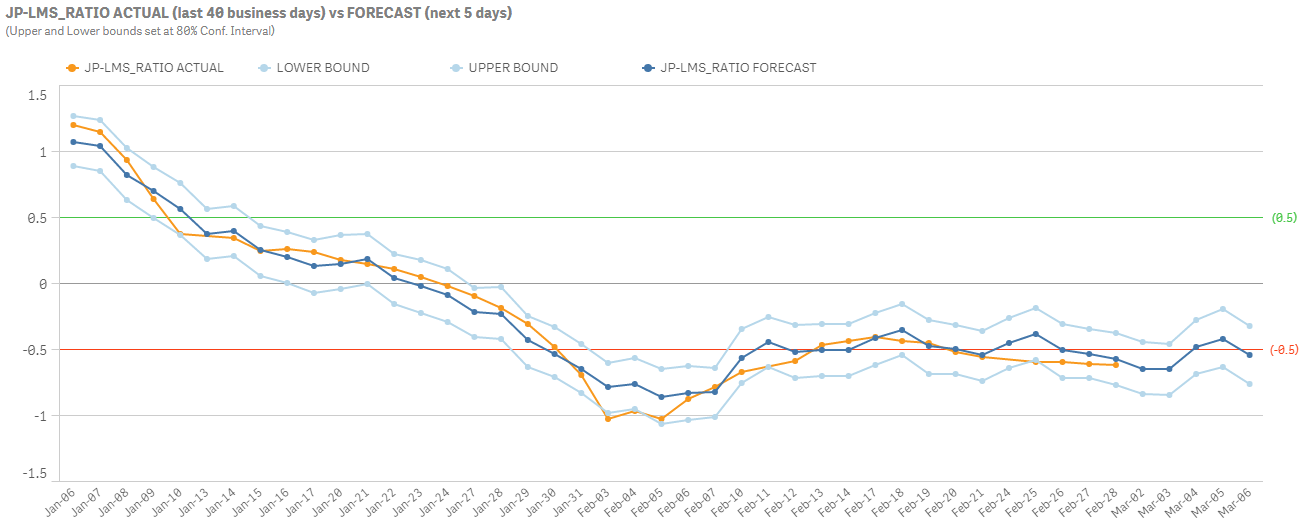

Sentiment in Japan remains in bearish territory, albeit barely, and is forecasted to remain in this unsupportive state this week.

Investors in Japan have been bearish since the end of January, preventing the market’s attempt at new high in early February and remaining unsupportive of another since, making February 2020 one of the worst months in the market’s history. Stocks initially rose 3% only to give up those gains and end the month down 10%.

The market’s volatility cannot be blamed on mood swings as investor sentiment has been on a downtrend since peaking last December. Markets have made two attempts at ignoring this change of mood only to be caught in the global sell-off of last week without a chair to sit on when the music stopped. To be fair, both attempts at new highs were done in concert with similar attempts to ignore sentiment elsewhere, but, with Japan a month ahead of other developed markets with regards to their corona virus impact, and having more earnings at risk given the possible cancelation of the Olympics this summer, investors there are understandably a little bit more negative than elsewhere at the moment.

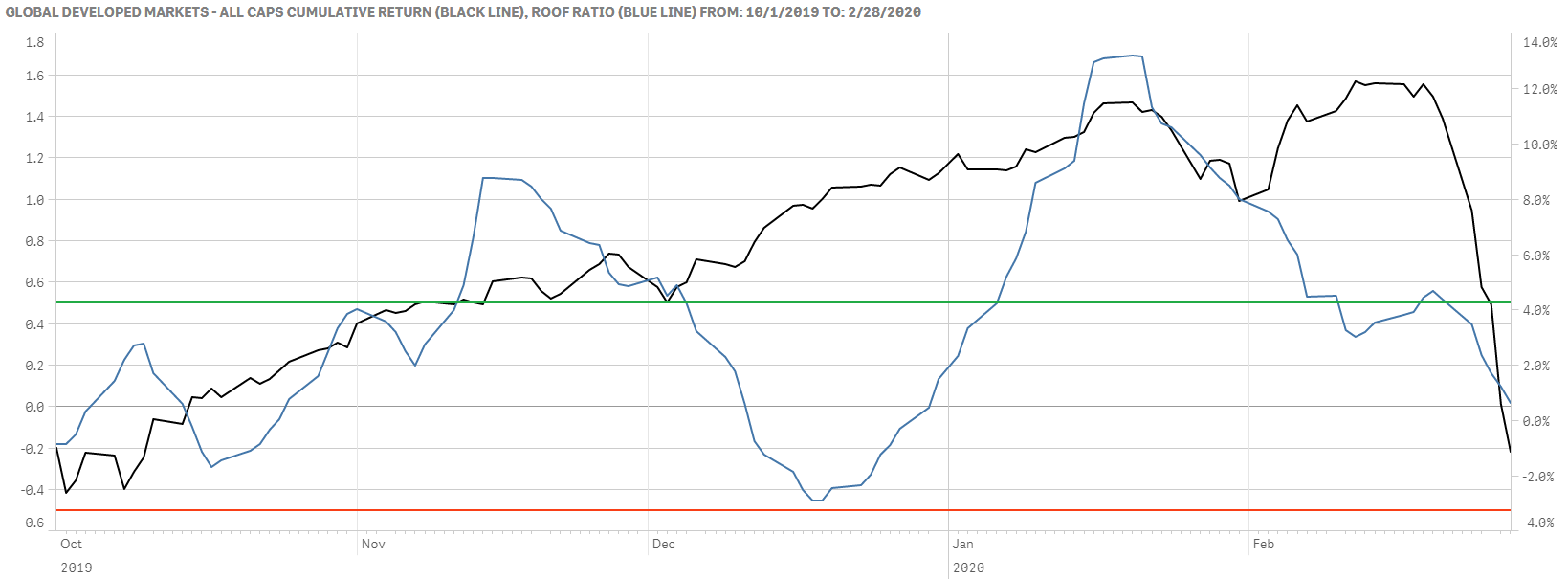

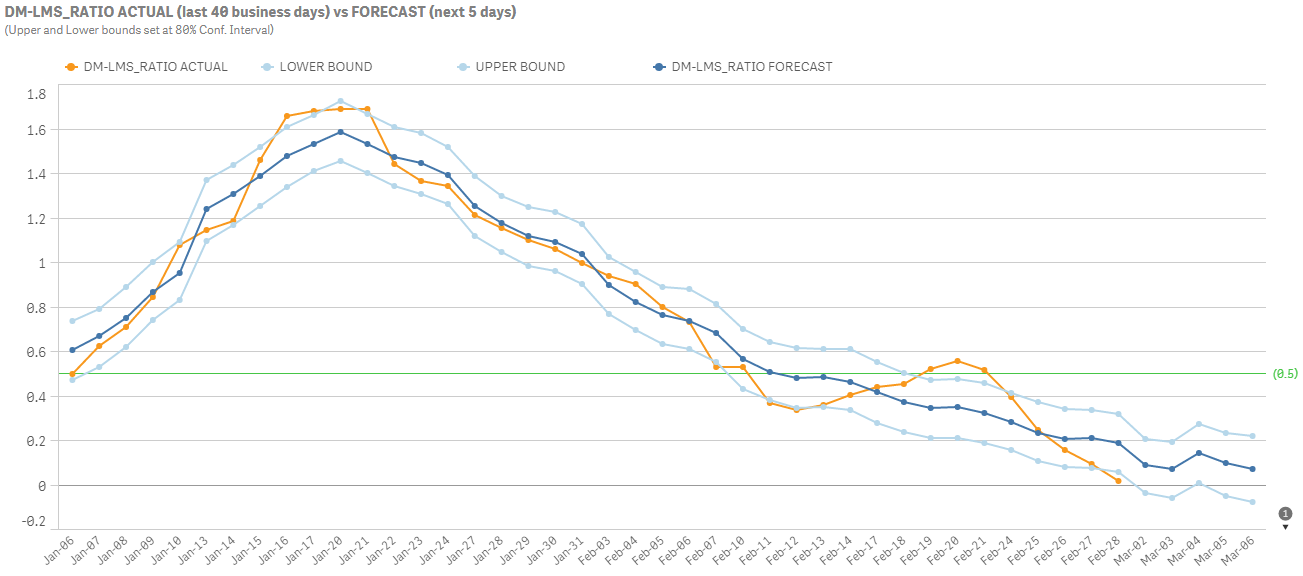

Global investors remain neutral this week as they await direction from the narrative around the coronavirus pandemic as well as revised economic and earnings forecast that includes its impact.

Sentiment in global developed markets also continued to weaken last week but is – and should – remain in neutral territory this week. As in other markets, global investors are awaiting factual data and signs that the spread of the health pandemic is slowing down before deciding on their next move. They may have to wait longer for either of those.

Equity market correlations will have spiked last week pushing portfolio active risk higher and potentially forcing some to de-risk further for compliance reasons. Only multi-asset class investors will have been spared by an increasingly negative correlation between equities and bonds, everyone else will have had a difficult conversation with their investor clients. For now, global equity investors seem to have given up their bets on growth (a risk tolerant style) in favor of a renewed one on leverage (also a risk tolerant style), with the odds for more quantitative easing from the Fed at 100%. Still, the ROOF metrics remain 7-to-3 in favor of risk aversion this week.