Potential triggers for sentiment this week1 :

- US: FOMC meeting minutes.

- Europe: ECB meeting minutes.

- APAC: COVID-19 related lockdowns in China/Hong Kong.

- Globally: The ongoing conflict in Ukraine and the response from the West will continue to dictate investor sentiment.

1 If sentiment is bearish/bullish, a negative/positive surprise on these data releases could trigger an overreaction.

Summary of changes in investor sentiment from the previous week:

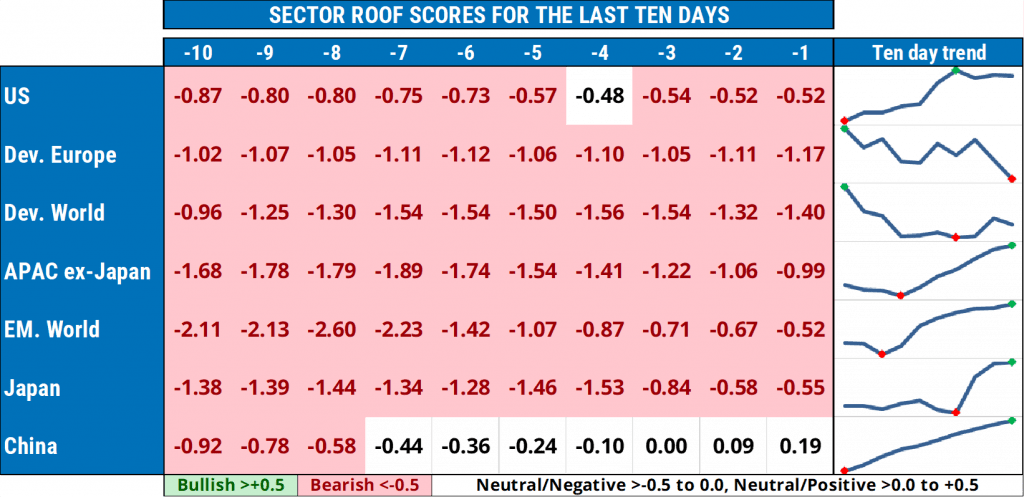

- Investor sentiment ended the week bearish in all markets we track except China, where strong regulatory support has lifted it back to neutral. Sentiment among US, Japan, Asia ex-Japan and emerging-markets investors ended the week well off their recent lows and may be on a recovery path, if it can carry this momentum into this week and the next.

- Europe’s proximity to the war in Ukraine and its large dependence on Russian oil, coal, and natural gas, will continue to weigh heavily on investor sentiment in those markets, as the potential damage to European economies from this war becomes painfully obvious, and obviously painful.

- As of this week, the war narrative is likely to add a focus on the human cost of this war along with the ongoing military development. The media will focus on describing in unimaginable details all instances of war crimes committed by the Russian army in Ukraine, and assign responsibility for them squarely on Vladimir Putin. The impact will be to focalize the western world on the idea of (Russian) leadership change as the way to end the war.

- The increased emotional impact of any genocide visuals is likely to cause more anger and drive by NATO members to end the war sooner rather than later. A firmer commitment to end the war by any means necessary may allow investors to begin planning for its aftermath and a decline in inflationary pressures globally.

- Generally, sentiment will rebound first in those markets furthest from the ongoing war. So, look for improvements in the US, China, and Japan markets first, followed by emerging markets (as soon as oil prices fall), and lastly Europe.

US investor sentiment:

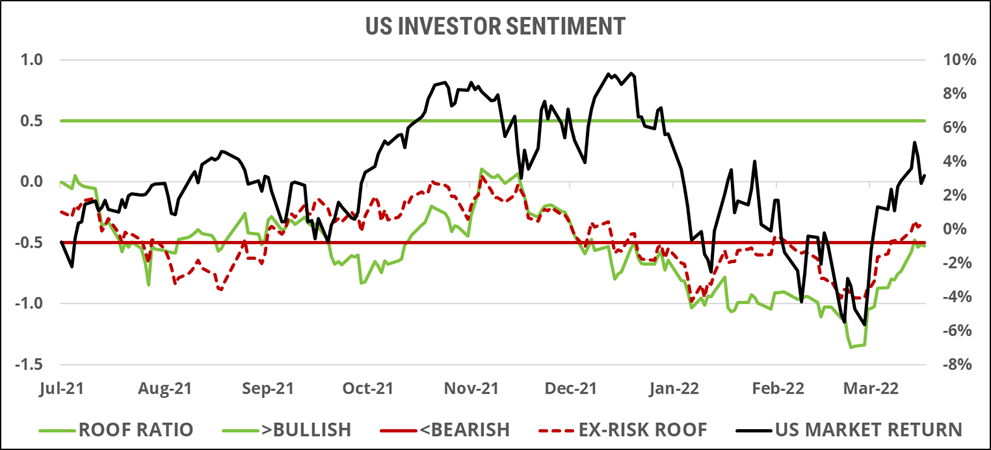

US investor sentiment (green line) continued to recover last week, ending bearish but just shy of neutral. Improvement was fueled by news of a stalling and possibly retreating Russian army in Ukraine, which could pave the way for negotiations to resume. Last week’s jobs report showed that the US economy is still strong, hampered only by the possibility of higher interest rates, caused by higher inflation, caused by higher energy prices, caused by oil market disruptions, caused by the war in Ukraine… Take away a major inflationary source (oil prices), and investors might start to scale back some of their rate-hike expectations of the past two months, driving equity markets up.

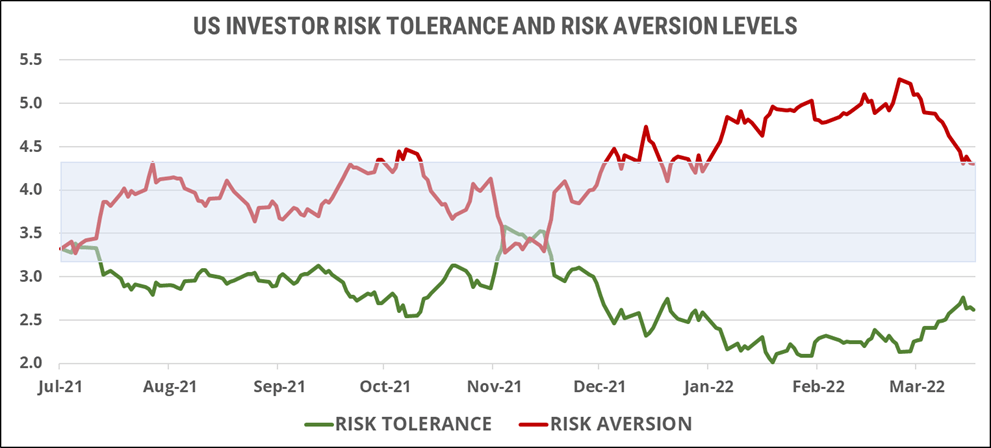

Risk aversion (red line) declined sharply last week, while risk tolerance (green line) rose slightly, indicating that investors feel less risk-averse about the situation in Ukraine than a week ago. Risk appetite has now risen for two consecutive weeks, bringing it back to a level not seen since December last year. Inflation fears had already made investors de-risk their portfolios since late November 2021. By the time the war in Ukraine started (February 24, 2022), risk aversion had been rising continuously, and risk tolerance declining, on the back of macroeconomic worries. The war added another two weeks to the de-risking, but it seems that risk aversion may have run out of steam in mid-March. From here on, positive news from Ukraine will only help to narrow the gap further until net risk appetite reverts to positive.

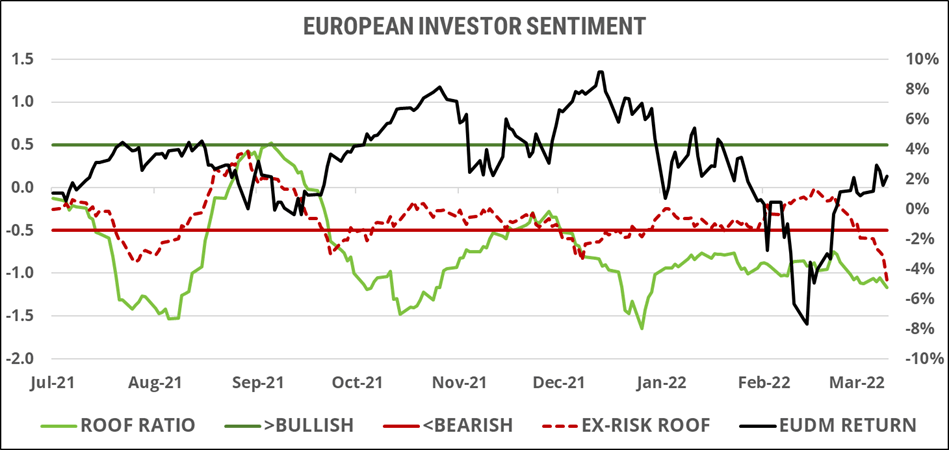

European investor sentiment:

European investors’ sentiment (green line) ended last week bearish and at its lowest level since early January. The war in Ukraine and its associated economic impact on Europe is keeping investors on the defensive. The inability to predict when this war will end, makes it impossible to forecast even macroeconomic variables for the European bloc, leaving investors in a state of uncertainty. Despite a mostly flat volatility level over the past two weeks, they have increasingly been implementing risk-averse strategies through their sector allocation decisions (red dotted line). This rotation into Europe’s risk-averse sectors can been looked at in conjunction with the renewed popularity of risk-tolerant sectors in the US market these past few weeks. Global investors have reallocated their risk assets to the US technology and domestic sectors and away from Europe and global sectors with a heavy dependence on European consumers or the global supply chain.

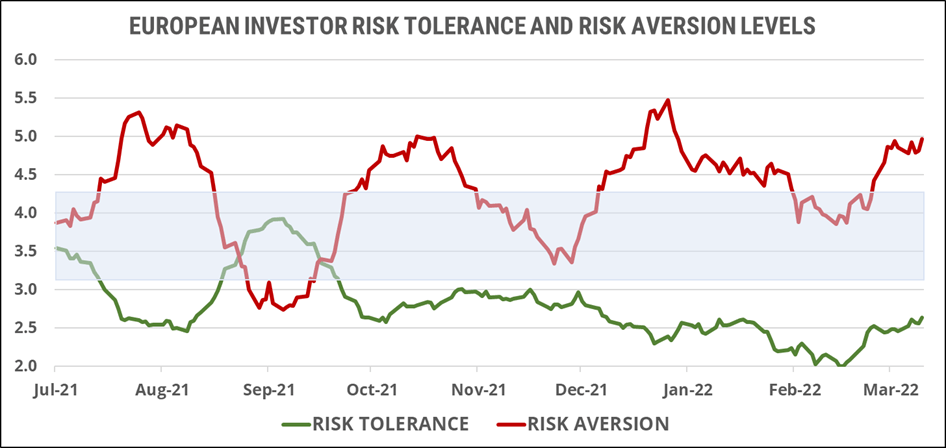

Risk-aversion (red line) remained high last week, even as risk tolerance (green line) rose slightly. The imbalance between the potential supply and demand for risk in Europe continues to describe a very negative risk appetite among investors. Clearly, at this juncture, they prefer to be safe than sorry given the unpredictability of the situation on the ground in Ukraine as well as economically in Europe. Not surprisingly, the biggest contributor to the risk aversion metric were the Energy, Industrials, Materials and Financials sectors.

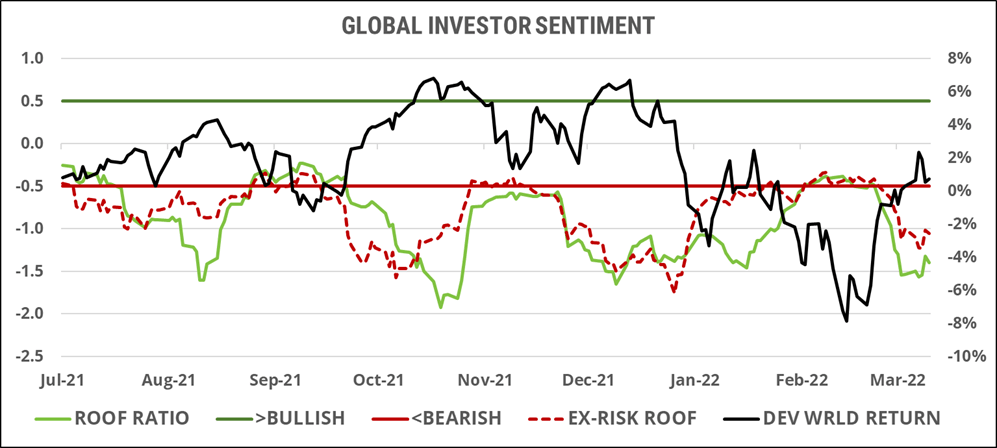

Global developed markets investors sentiment:

Sentiment among global developed-markets investors (green line) ended the week slightly less bearish than the previous week, but directionless. Investors continue to trade out of Europe’s economic-sensitive sectors and into the relative safety of the US market. The move away from European financials, energy, materials, and industrials, and into corresponding US ones has little impact on the ROOF score for those global sectors. Global investors are risk-averse and are simply looking for relative safety wherever they can find it until the global macro situation regains some clarity.

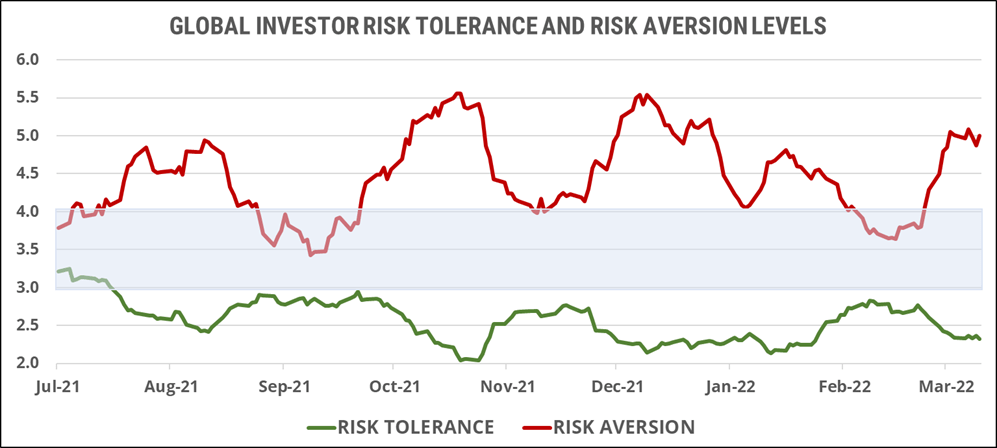

Both risk tolerance (green line) and risk aversion (red line) remained flat last week amid very negative risk appetite. At the global level, there seems to be more than two potential sellers for each potential buyer, but looking at the regional situation, we see that there are really two potential sellers of European assets for each potential buyer of US ones. A worsening situation on the ground in Ukraine will likely accelerate this geographic reallocation but it is unlikely to become an across-the-board selling event as investors seem convinced that not all economies will be affected equally.

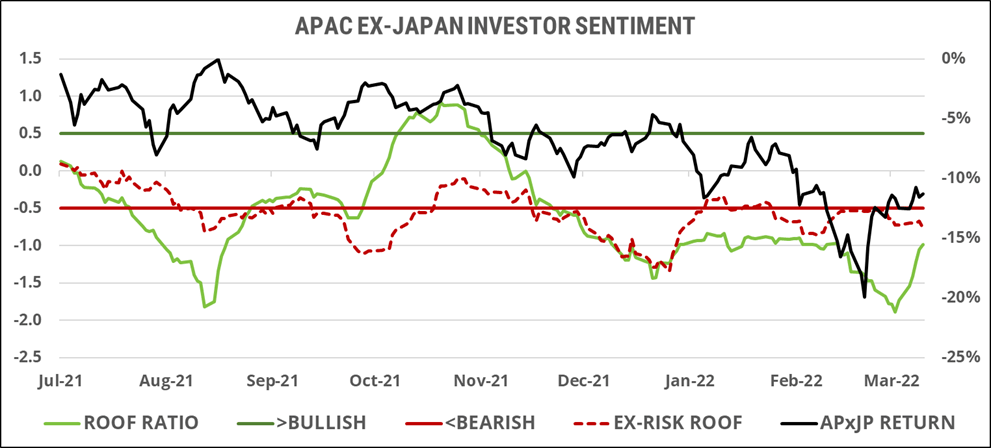

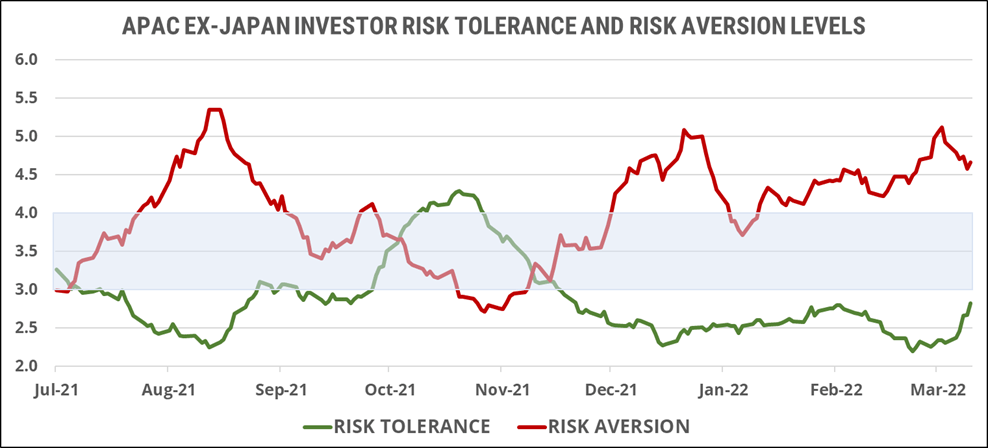

Asia ex-Japan markets investor sentiment:

Sentiment among Asia ex-Japan investors (green line) experienced a sharp rebound last week, led mostly by Chinese-owned companies listed in Hong Kong after the regulatory threat of forced delisting and (the announcement of?) further monetary stimulus was echoed by domestic regulators. The drop in market volatility was also a key driver behind the rebound in sentiment last week, but sector allocations (red dotted line) continue to point to the implementation of mostly risk-averse strategies.

Risk tolerance (green line) rose sharply last week while risk aversion (red line) declined on a perceived lower regulatory risk premium. Medium-term, risk aversion remains on an uptrend and risk tolerance flat. The longer the question marks hang over the fate of the global economic recovery, the more investors will join the ranks of the risk-averse, especially during a cycle of rising interest rates. Investors see the economy under pressure and central banks unable to help for the time being. Locally, China’s ongoing efforts to clamp down on both new waves of COVID-19 infections and the debt buddle situation in its real estate sector is also putting pressure on risk tolerance levels.

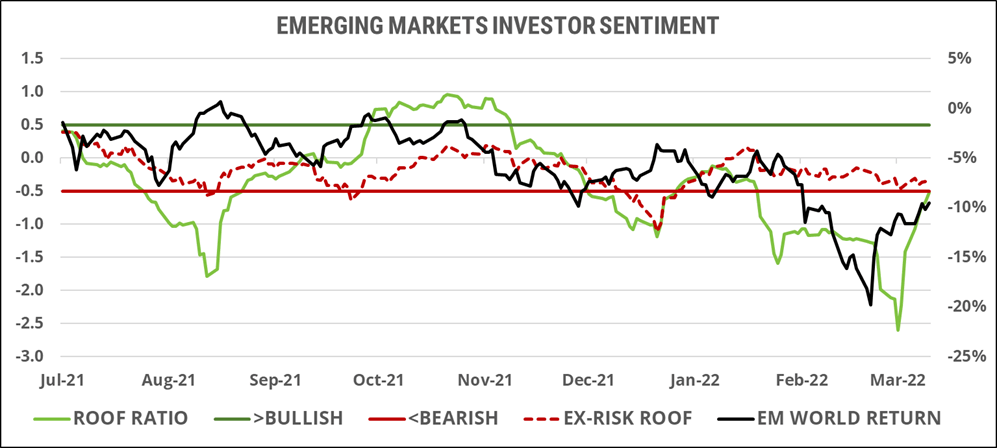

Global emerging markets investor sentiment:

Sentiment among global emerging-markets investors (green line) shot up last week on the back of falling market volatility. Despite lower risk, investors’ sector allocations (red dotted line) continue to point to the implementation of more risk-averse strategies rather than bullish ones. Emerging economies are the first to directly feel the economic pain of higher commodity prices as well as any political fallout from the ongoing war in Ukraine. A large part of the market rebound was led by China and its more pro-business regulatory rhetoric of the past few weeks, but major questions remain as to the ability of emerging markets to withstand a macro environment of high commodity prices, higher US interest rates, and a stronger US dollar.

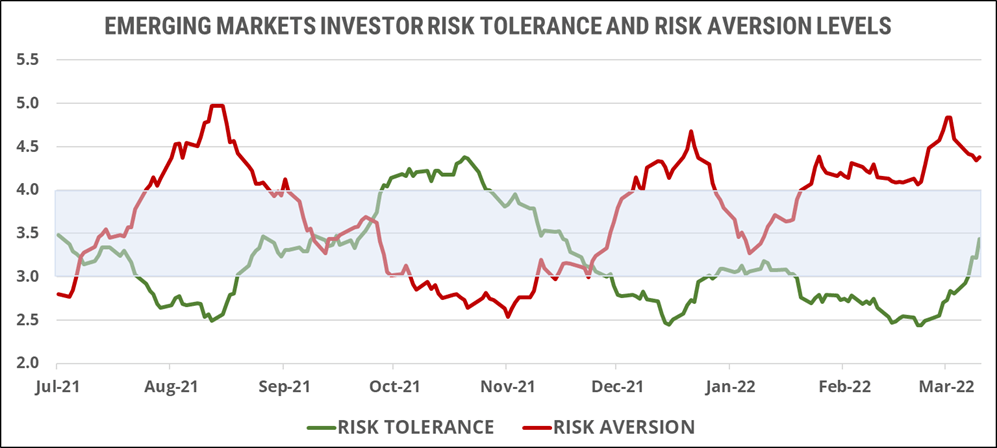

The gap between risk aversion (red line) and risk tolerance (green line) narrowed sharply last week as investors jumped on risk-tolerant assets in response to falling volatility levels. Changing risk appetite tends to be a balancing act involving both supply and demand. When only one of those is experiencing a major realignment, as has been demand (risk tolerance) these past two weeks, the indicator tends to be a false positive. Risk tolerance (green line) is now back to its equilibrium level of 3.5, but risk aversion (red line) is still above its own equilibrium, at 4.3, meaning that there is still more potential sellers than buyers in the market at this time and any negative new development could trigger an oversupply situation, sending markets back down rapidly. The selling pressure isn’t as big as it used to be a month ago, but remains bigger than it was back in September 2021 when risk tolerance was last at the 3.5 level and risk appetite was neutral.