Potential triggers this week: FOMC minutes, partisan legislative haggling over President Biden’s $2 trillion infrastructure spending plan, and escalating third infection wave and lockdowns in Europe.

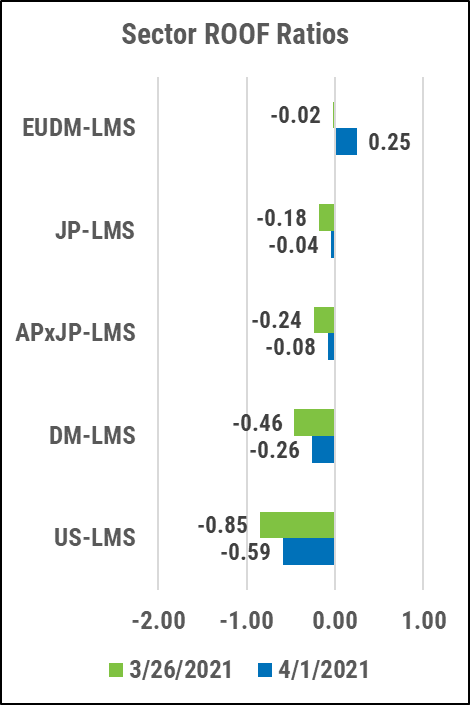

Summary: Over the last twelve months, a successful investment strategy could have been designed by a ten-year-old with a decent Wi-Fi connection – buy everything that can be consumed online, sell everything that cannot. You can almost hear the CIO in the bedroom next door saying “Okay, I’m done. Can I go play outside now?”. In Q1 2021, this internet connection has been spotty at best. Investor sentiment gradually sank, battered by a second wave of infections, then rose again lifted by growing evidence of a strong economic recovery. The beginnings of a third wave pushed sentiment down again, but promises of continued fiscal and monetary stimulus lifted it back up. As of April 1st, most markets ended in the neutral zone with the UK and the US providing the two barbells of bullish and bearish, respectively (albeit both seemingly on their way to the neutral zone too). Given that both new lockdowns and a strong economic recovery are known unknowns canceling each other out, sentimentally speaking, it seems that only an unknown unknown will be able to break this deadlock and provide sentiment and markets with a clear direction in Q2.

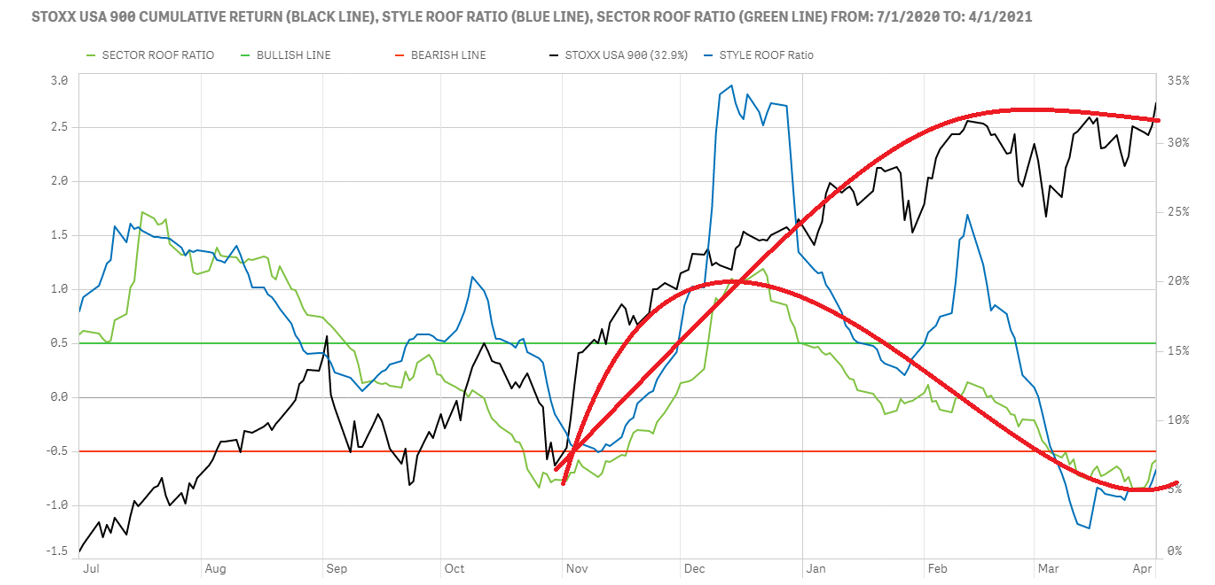

US markets reached new record highs pulling sentiment higher in the process.

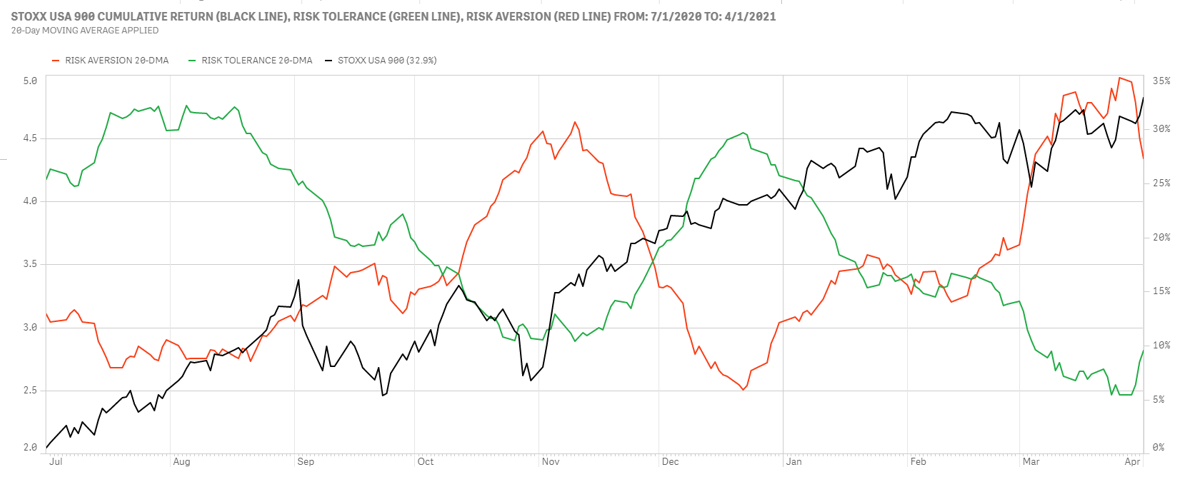

Helped by the repeated promise of continuous stimulus from the Fed and the Biden administration, US investor sentiment began to stage a rebound from deep in bearish territory, to the edge of the neutral zone (top chart). In recent weeks, a deteriorating sentiment had capped market’s advances, but that downward pull seems to weaken last week with both ROOF ratios recovering some ground, ending just shy of the neutral zone.

Risk aversion (red line) receded last week from its 52-week high, while risk tolerance (green line) rebounded off its 52-week lows (bottom chart). The supply and demand balance for risk remains firmly in favor of supply, leaving markets vulnerable to an event that could trigger this bearish sentiment into action. Given the divergence between market returns and risk appetite, it seems that investors’ risk aversion may be more of a valuation-aversion rather than an outright bearish feeling.

European investor sentiment recovers helping markets reach new highs.

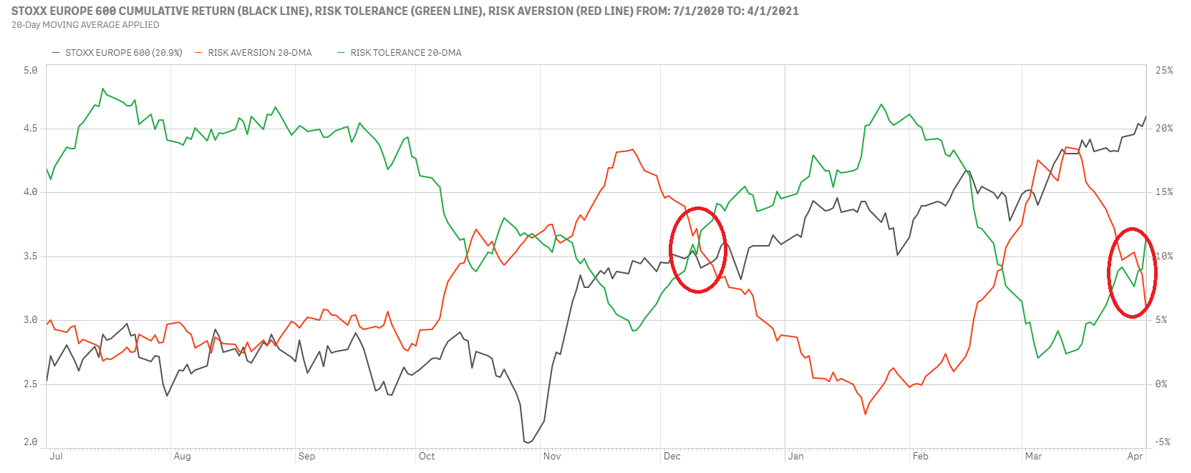

Both European ROOF Ratios ricocheted off the bearish zone and continued their recovery last week (top chart). It seems tightening lockdown measures in response to a third wave of infection is having the opposite effect on markets and investors than during the first or second wave. Sentiment is now back to neutral with a recent positive momentum which could help markets continue to ignore the pandemic situation on the ground and focus on the promise of more stimulus from the ECB.

Risk aversion (red Line) continued its sharp decline from its mid-March highs, and risk tolerance (green line) rose further on continued anticipation of further monetary stimulus (bottom chart). The supply and demand curves for risk ended last week with a slight positive, giving markets some downside risk protection as the ranks of risk-averse investors continues to decline. In this situation risk-averse investors wanting to get out should not have to give a discount to find willing buyers.

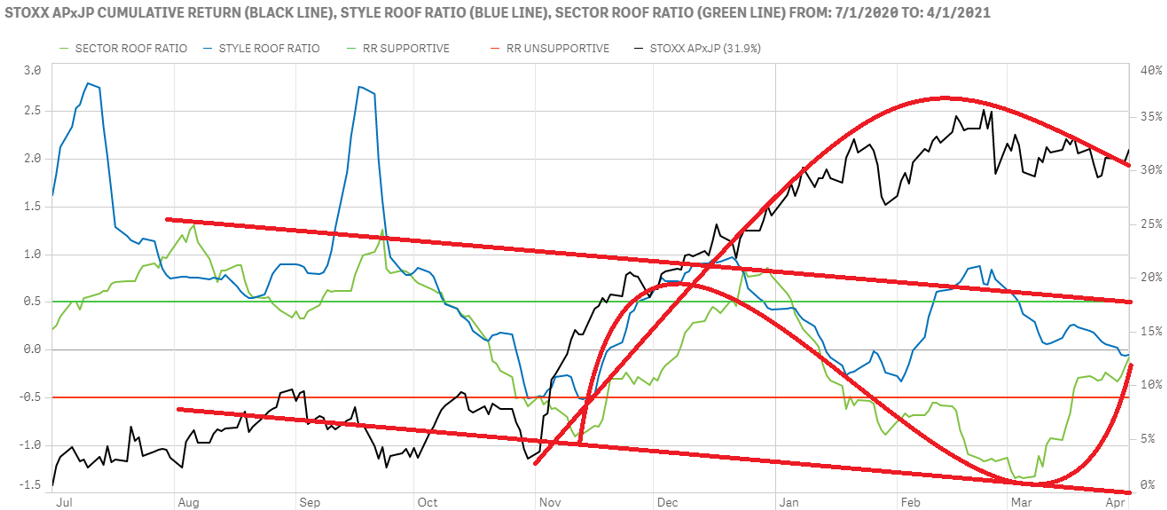

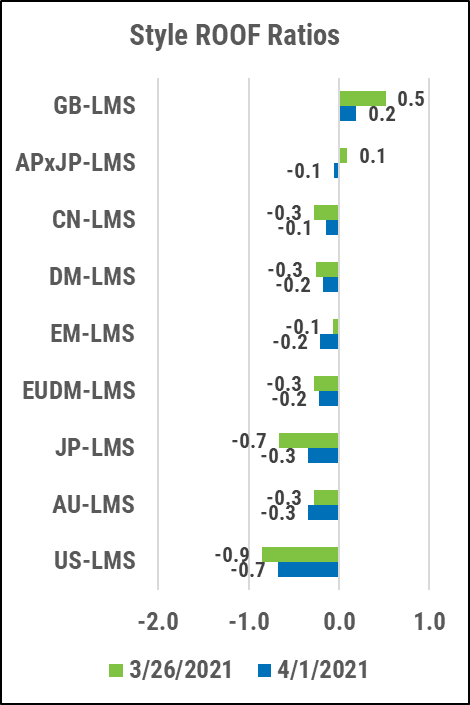

Global and Asia ex-Japan investor sentiment continues to recover.

Global investor sentiment continued to recover last week with both ROOF Ratios now in the neutral zone (top chart). The imbalance between risk-averse and risk-tolerant investors is closing fast and if this positive sentiment momentum continues, it could turn into a supportive factor for markets to climb even higher. Still, the gap between markets and sentiment highlights investor’s unease about the source of the current valuation being stimulus rather than organic economic growth.

In Asia ex-Japan, the divergence between our two ROOF ratios has now closed with both ROOF Ratios converging in the neutral zone (bottom chart). The Sector ROOF’s (green line) strong upward momentum recently may provide markets with the sentimental support it needs to resume its upward path. We note, however, that the medium-term trend for sentiment in this region remains down from the highs seen (and never since repeated) in July 2020. With the relationship between China and the US still an open question, this is likely to continue to weigh on sentiment.