Potential triggers for sentiment this week1 :

- US Q2 earnings season continues with Berkshire Hathaway, General Motors and Uber

- US July jobs report due out Friday, expected to show continued acceleration in the recovery

- Worldwide PMI data

- Bank of England’s Monetary Policy Summary

1 If sentiment is bearish/bullish, a negative/positive surprise on these data releases could trigger an overreaction.

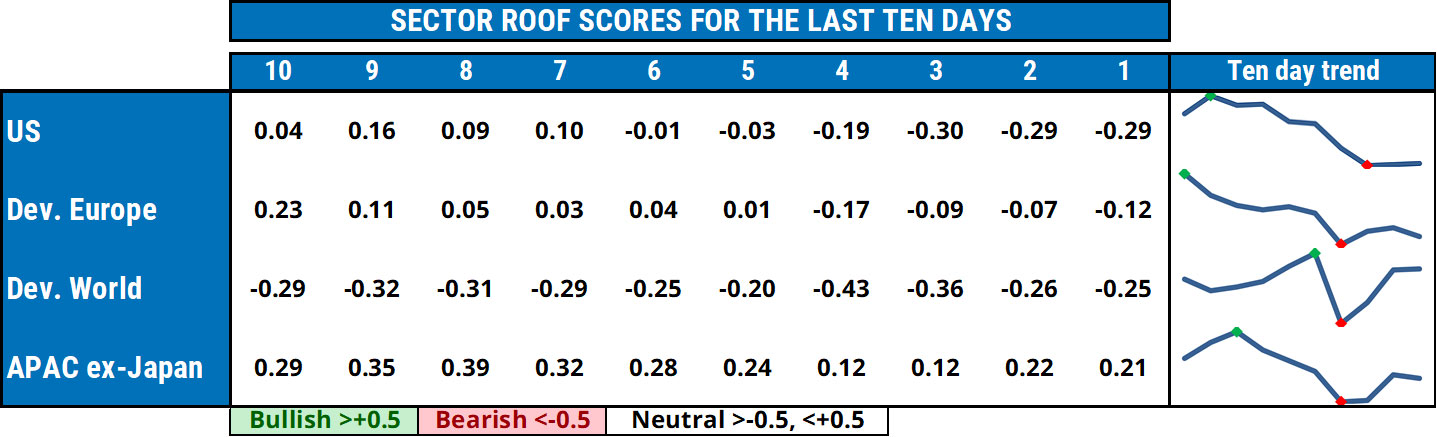

Summary of changes in investor sentiment from the previous week:

- Investors remain trapped at the intersection of rising inflation and slowing economic growth – two worries that when combined at their extreme, makes them think of stagflation. And while no-one is using the s-word yet, this lack of clarity continues to negatively affect the collective unconscious.

- Investor sentiment continued to drift aimlessly across the lower half (between -0.5 and 0) of the neutral zone for all markets we track except Asia ex-Japan, which remains, timidly, cautiously optimistic.

- High valuations, successive new record highs, and oversubscribed IPOs do a lot to perpetuate the image of a hot market on the verge of a continued bull run. But are valuations high because investors think stronger earnings are coming, or do they need to believe stronger earnings are coming because valuations are so high?

- An increasing number of investors feel that at these levels, the rewards for risk-taking may be slim. The bull trap looks inviting. It is well lit by the ongoing Q2 earnings season. It welcomes them with the lack of alternatives, but something seems amiss, even if they can’t quite put their finger on it.

- Investors seem caught in the hamster-wheel where higher valuations simply generate a higher want for earnings growth, necessitating in turn a higher level of economic growth to be delivered. They fear renewed threat to both supply and demand from rising COVID-19 infections may apply the break on this wheel, at least temporarily, causing the hamster to fall.

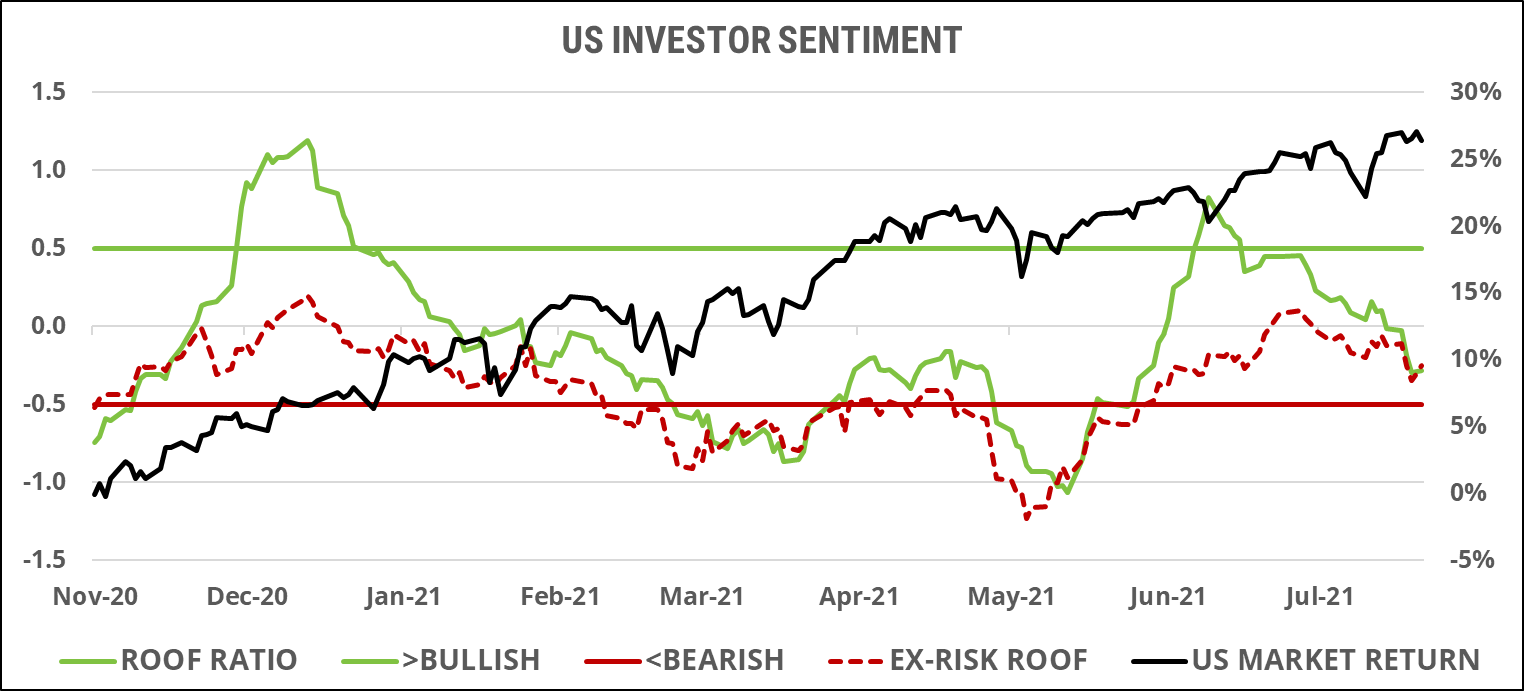

US investor sentiment:

US investor sentiment continued to drift lower within the neutral zone last week, ending three-quarters of the way down, but stopping short of the bearish zone. Continued strong earnings reports and guidance from bellwether stocks wasn’t enough to halt the decline in sentiment as deeper concerns about economic growth overshadowed positive earnings growth. Still, sentiment stopped short of breaking into the bearish zone and rebounded on Friday to end the week off its low. The question on investors’ mind now is whether the recent V-shape recovery in stock prices represents a bull trap.

Risk aversion (red line) continued to rise last week while risk tolerance (green line) headed lower, creating a small imbalance in the supply and demand for risk in favor of supply. The gap between the two isn’t large enough to cause a big dislocation in prices, and baring a negative risk event to swell the ranks of risk-averse investors, the market should remain range-bound around current levels.

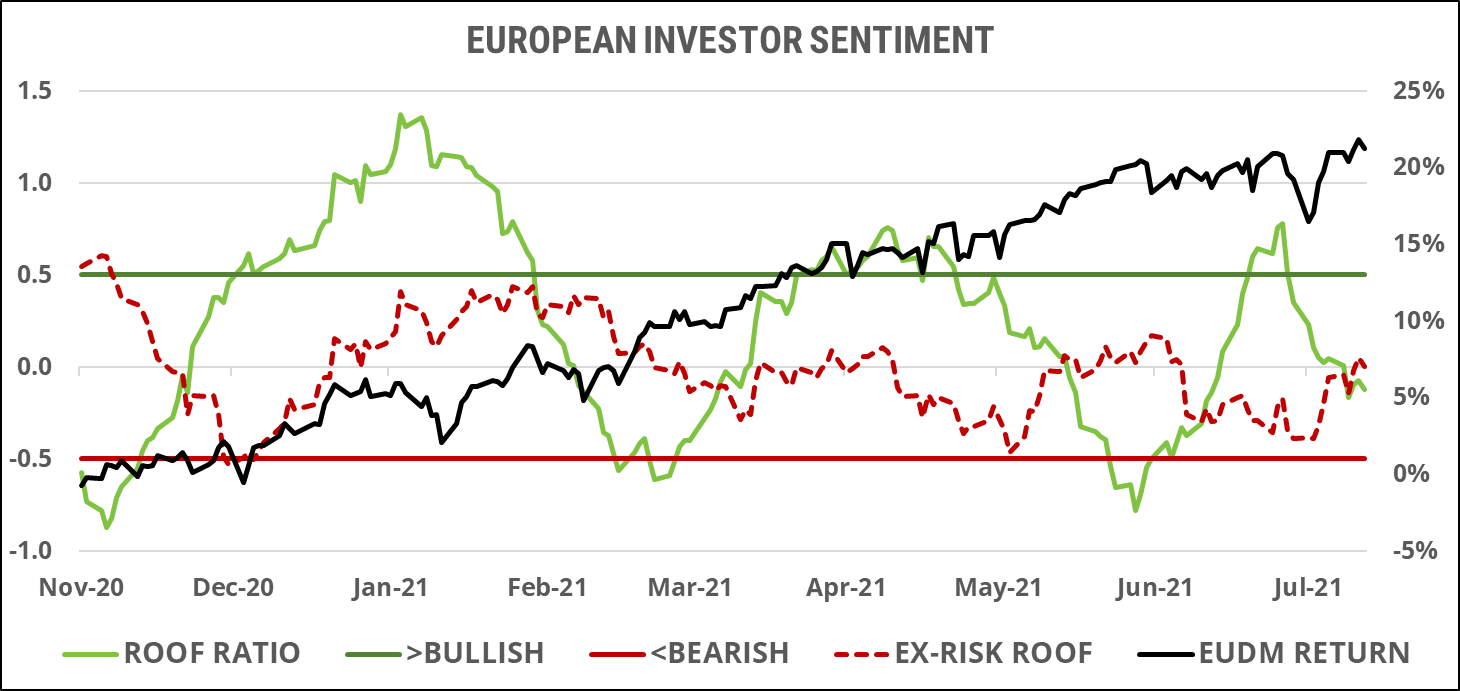

European investor sentiment:

The leveraging impact of changing market volatility seems to have run its course, with investor sentiment both with (green line) and net of volatility (red dotted line) ending last week in the middle of the neutral zone. At this level, sentiment is unable to influence markets as the collective confirmation bias lacks direction either way. Investors remain unsure if at these levels there is any more good news to price in. Central banks remain accommodative but the twin headwinds of rising inflation and a stubbornly high level of new infection cases from the Delta variant of the COVID-19 virus is keeping them on edge. The fear is that if we cannot control the spread of this new variant during the summer months by reaching a high-enough vaccination level, how will we fare if a new, more virulent, variant emerges just ahead of the winter months?

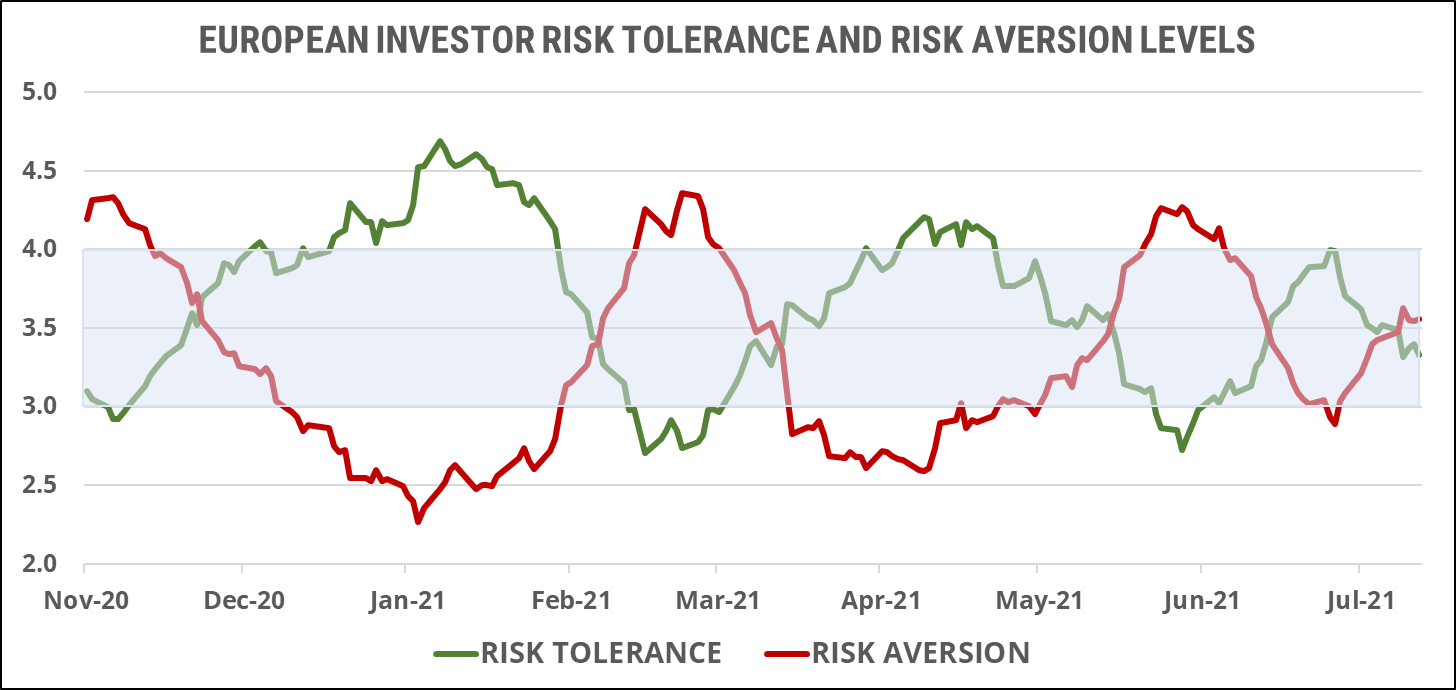

Risk aversion (red line) and risk tolerance (green line) remained at equilibrium last week, representing a balanced supply-and-demand situation and a neutral risk appetite. As in the US, investors seem to have entered a phase where they have stopped rewarding companies for what they have done and instead focus on what they need to deliver to maintain current valuations. Now that the V-shape recovery sparked by the multiple vaccine news last November has run its course, the year-on-year comparison with Q3 2020 paints a mixed economic picture. Any threat to the economic recovery from either inflation or the ongoing pandemic will increase the ranks of risk-averse investors and deplete the risk-tolerant side, turning the current neutral risk appetite into a bearish one. Conversely, positive signs from the UK’s re-opening experiment that the virus is something highly vaccinated economies can live with may spark a return to risk tolerance.

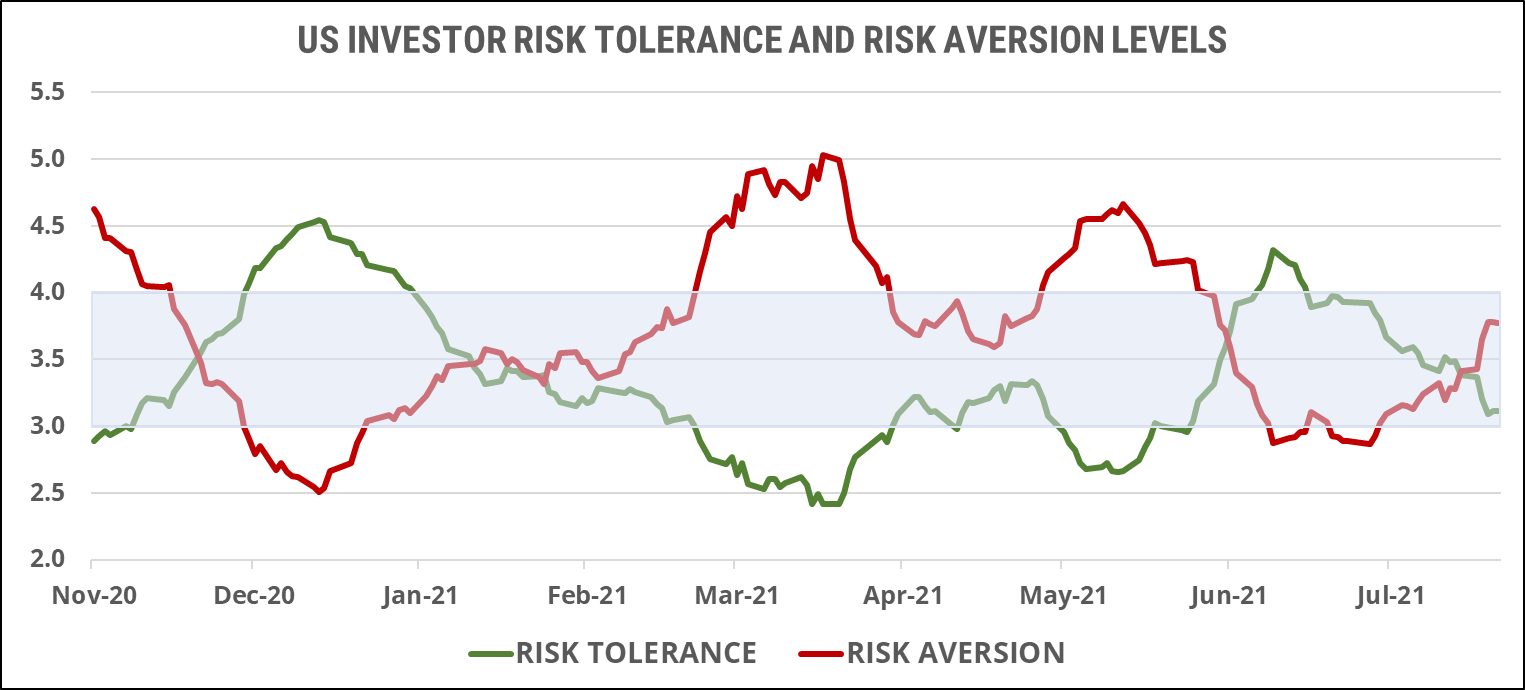

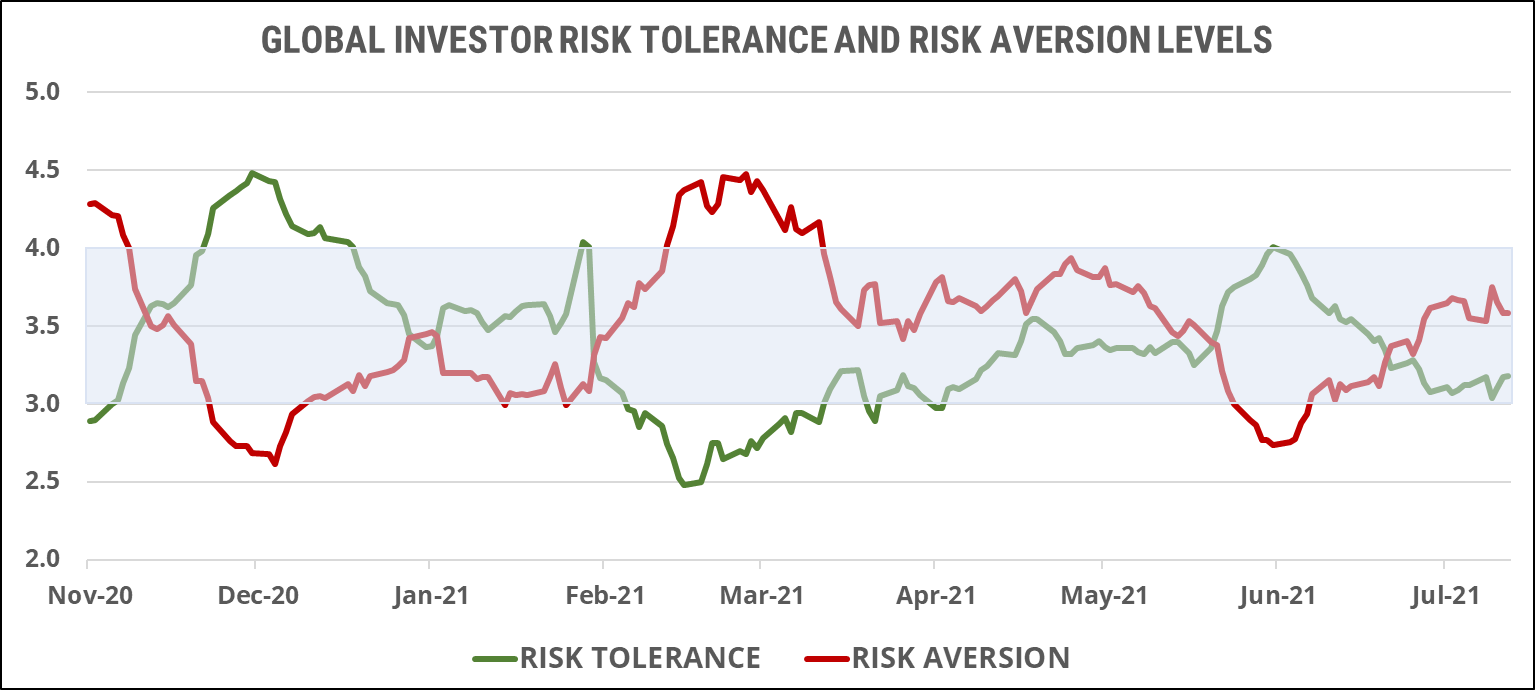

Global developed markets investors sentiment:

Global investor sentiment remained in the neutral zone last week, reverting a downward move towards the bearish zone in the last two days. Sentiment excluding the two risk metrics in the ROOF methodology (red dotted line) has been moving in parallel with the standard ROOF ratio (green line) for three consecutive weeks now, signaling that market volatility has stabilized at current levels and is no longer impacting sentiment either way. Investor sentiment remains weaker than multiple market rallies might suggest, with the latter being driven by a strong preference for sectors with a risk-averse characteristic. This also suggests that if strongly positive news hits markets and turns sentiment around, there is quite a lot of upside for sectors with a risk-tolerant profile, as those have underperformed since the start of the year and would have quite a lot of catching up to do (e.g., consumer discretionary and industrials).

Risk tolerance (green line) and risk aversion (red line) continued their parallel run last week with the gap between the two remaining virtually constant. Investors seem happy to remain in this state of ambivalence with a slight preference for risk aversion until the economic situation becomes clearer. Here too, the imbalance between the supply and demand for risk isn’t wide enough to start a major market rally or reversal. Without direction from risk appetite, markets are likely to remain in a tight range until investors get clarity on the economic recovery. The bias remains slightly negative though, so negative news is likely to affect markets more than positive ones for the time being.

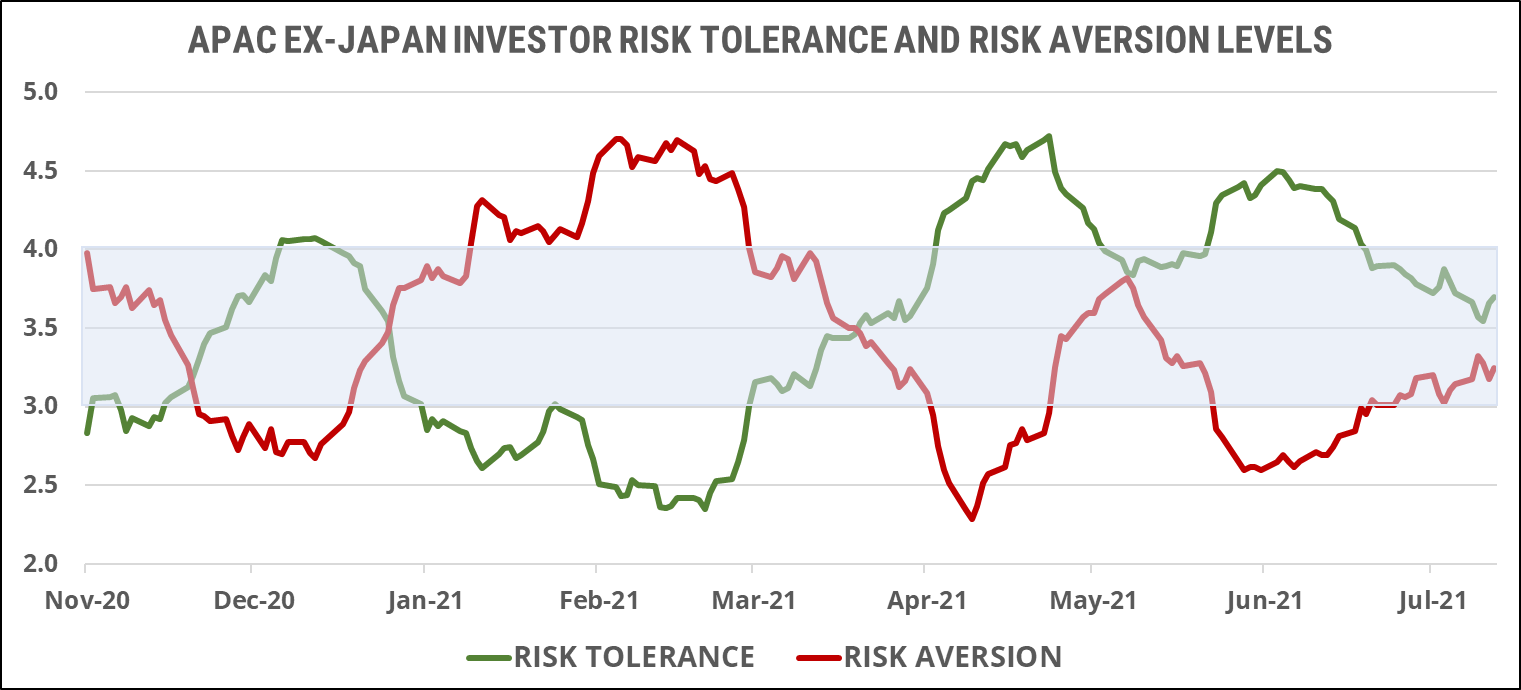

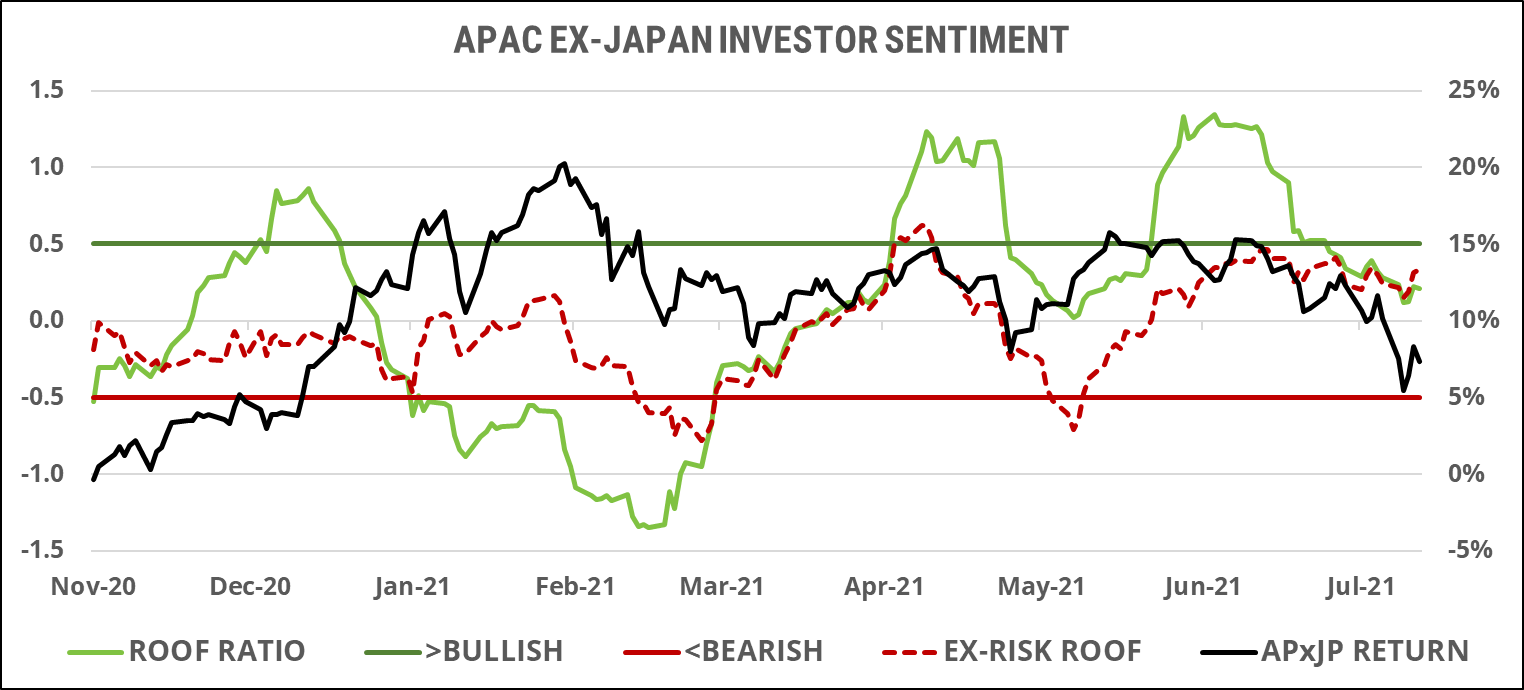

Asia ex-Japan investor sentiment:

Investor sentiment in Asia ex-Japan has flattened out in the upper part of the neutral zone. At this level, investors remain cautiously optimistic and positive news is likely to have a greater impact than negative ones. Changing market volatility is no longer a factor and both of our sentiment indicators (one with and one without market volatility included) have been moving in tandem for the last two weeks. This reinforces our trust in current sentiment levels and confirms the observation that Asia ex-Japan investors remain more positive / less negative than their global peers. Unlike other markets, valuations here remain lower than they were earlier in the year, which also reduces the need for investors to be more risk averse.

The gap between risk tolerance (green line) and risk aversion (red line) narrowed further last week before widening again on the last day. At these levels, the supply and demand for risk can be said to be at equilibrium, removing any large impact sentiment could have on market movements. The market decline since June has been faster than the rise in investors’ risk aversion, signaling a greater confirmation bias towards positive news in this region than in others. This could be a function of the lower valuations in Asia ex-Japan than elsewhere. When valuations were high back in January and investors turned skittish, risk aversion rose much faster and higher then than it is doing now. So, the pause in the decline in sentiment in this region may simply be reflecting the fact that investors feel the market has reached fair valuation, rather than a latent bullish sentiment.