Note to readers: We’ll be taking a break for the next four weeks (September 6 to October 4), during which the ROOF report will not be published

Potential triggers for sentiment this week1 :

- US: August factory orders, construction spending and jobs report

- Global: Worldwide manufacturing and services PMI data

- Europe: August inflation, retail sales, business survey and unemployment numbers

1 If sentiment is bearish/bullish, a negative/positive surprise on these data releases could trigger an overreaction.

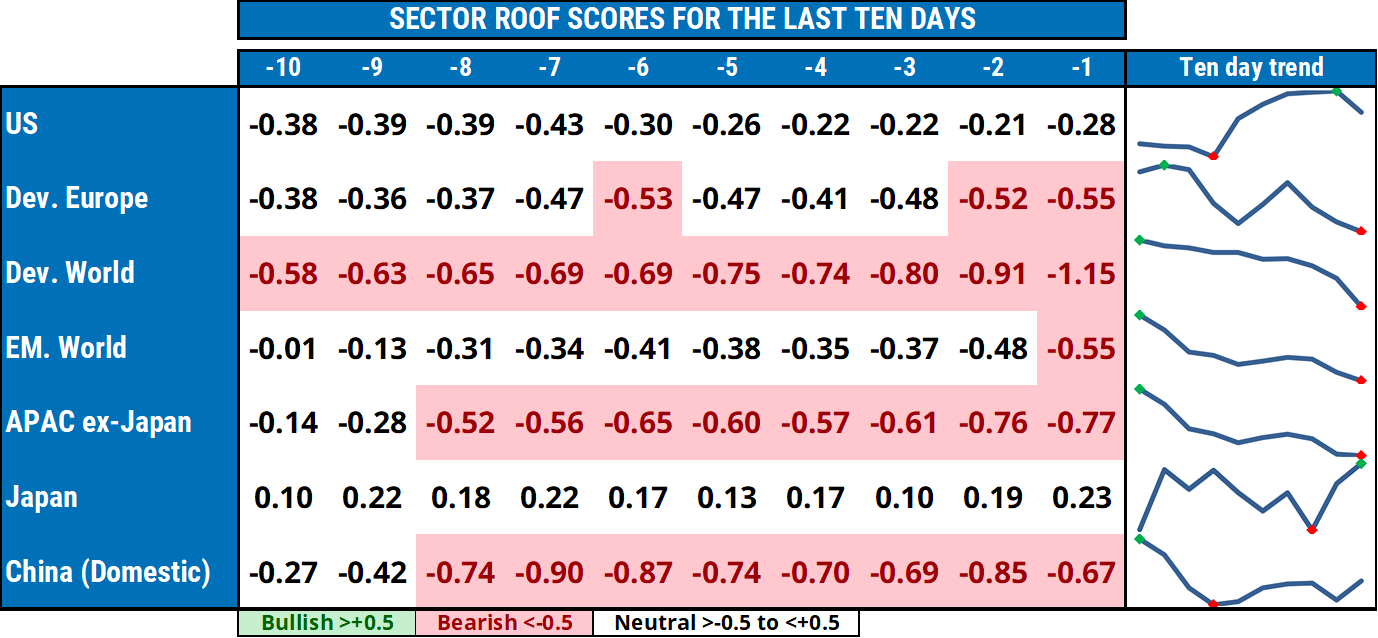

Summary of changes in investor sentiment from the previous week:

- Sentiment in five of the seven markets we track has fallen into the bearish zone, and were it not for a decline in volatility, the US market would also show a bearish mood. Only Japan seems to not have gotten the memo and is bucking the trend with cautious optimism.

- Markets continue to defy sentiment and seem to be trying to teach investors a lesson about the futility of being bearish in a QE world; the lack of cosmic support for it.

- Investor sentiment continues to point to an uneasy awareness that the current market rally could turn on a dime and that a correction, long presaged yet unrealized, is overdue.

- Markets have been rising on the back of bearish bets (albeit with new inflows), in a public display of the same-bed-different-dreams story. Their estrangement with sentiment is so wide now that we will soon be talking about different beds altogether. What’s next, different rooms?

- All the liquidity seems collected in the stock market right now, as if global capital markets had been tilted sideways (by central banks) and every dollar that wasn’t bolted down in other asset classes has slid into equities. What happens when the tilting reverses?

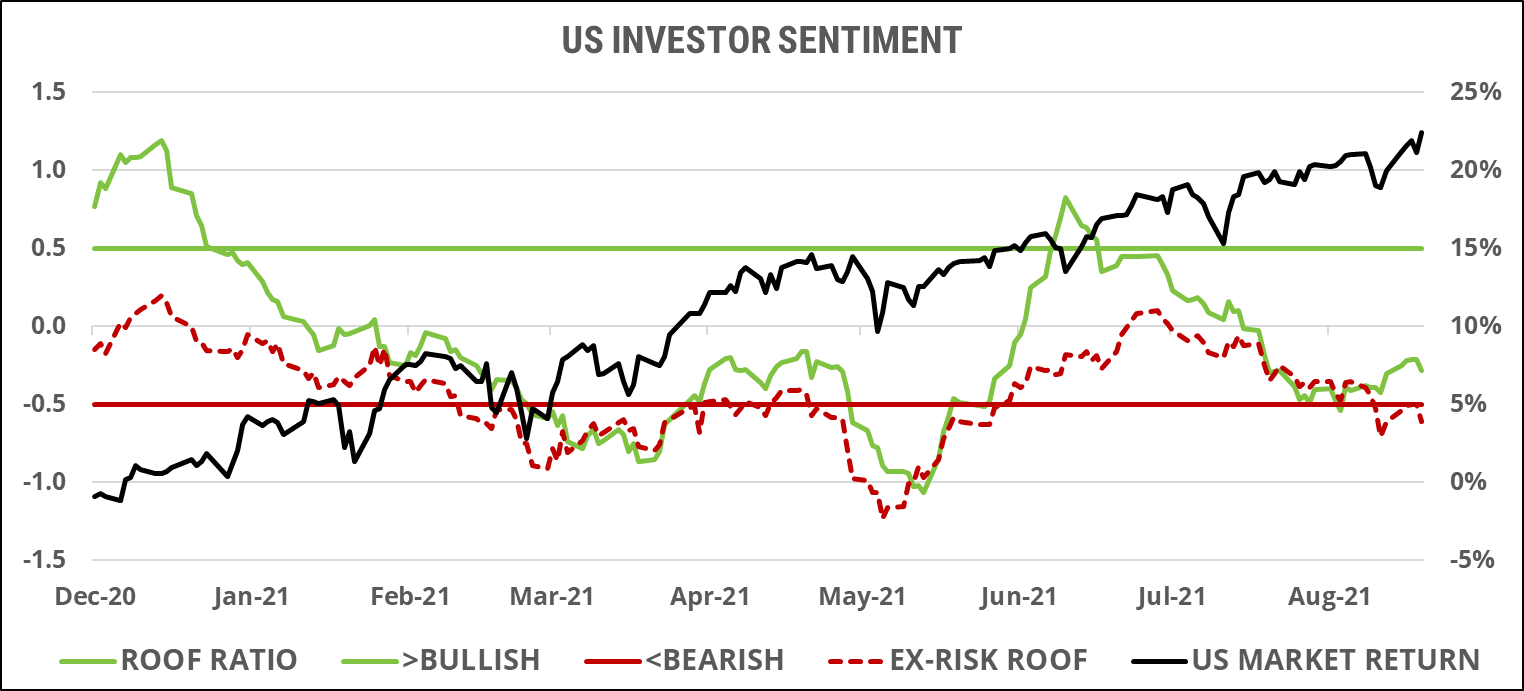

US investor sentiment:

A decline in volatility allowed markets to end the week on a higher note, but sentiment among investors remains negative. The US market is up some 20% YTD, has hit 50-plus record new highs, and yet sentiment has been negative or bearish during most of that time as new inflows shore up markets via increasingly risk-averse strategies. Absent the recent fall in market volatility, sentiment turned bearish ten days ago and has remained there ever since (red dotted line), indicative of a negative risk appetite. At these levels, investors will be quite sensitive to negative news which, ironically, could come in the form of a strong positive surprise at this Friday’s jobs report.

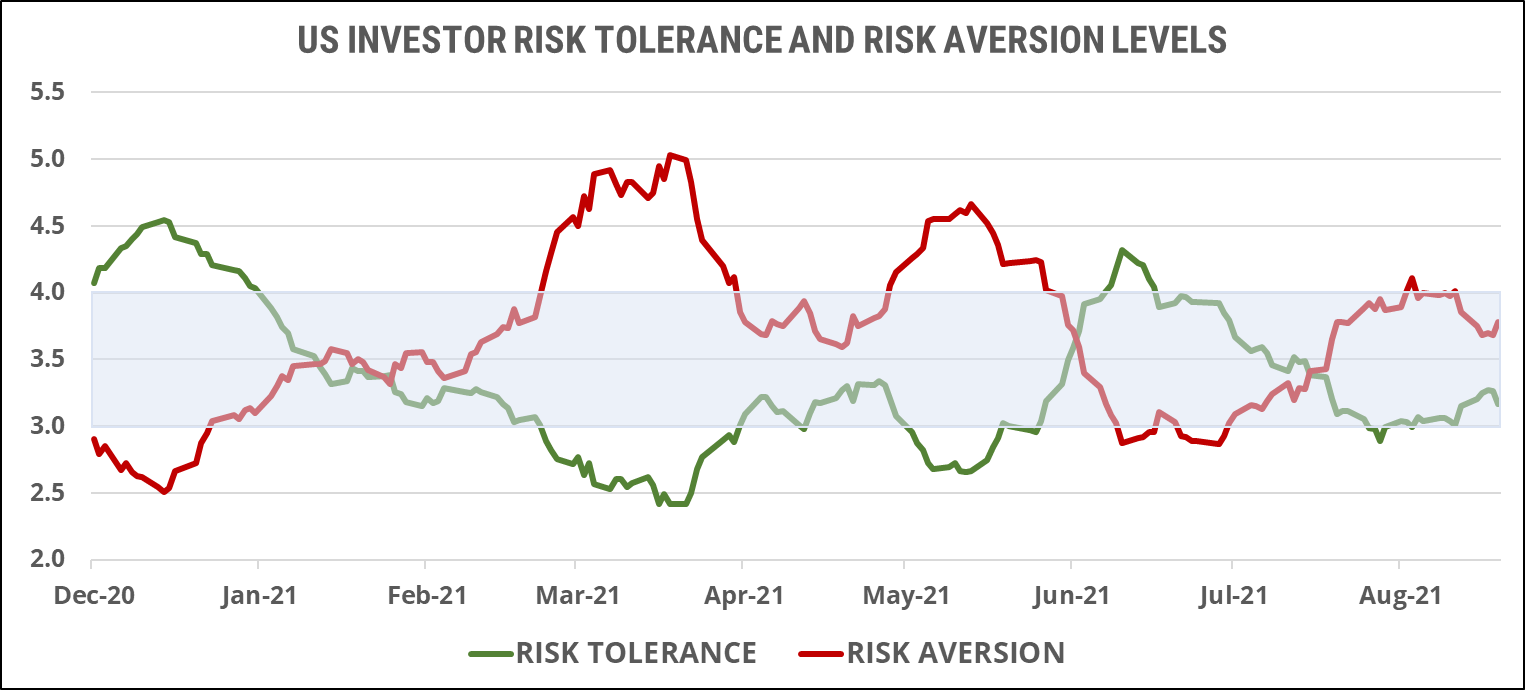

The imbalance between risk aversion (red line), and risk tolerance (green line) has narrowed last week on the back of declining market volatility but remains in favor of supply, translating into a moderately negative risk appetite. We note that the level of risk aversion is not as high as it was earlier in the year and the imbalance with risk tolerance is much smaller than in March or May of this year. This and the declining volumes are indicative of uncertainty being the key driver of sentiment rather than an outright bearish stance (i.e., investors lack the confidence to be bearish but remain skeptical of forecasts for further upside potential).

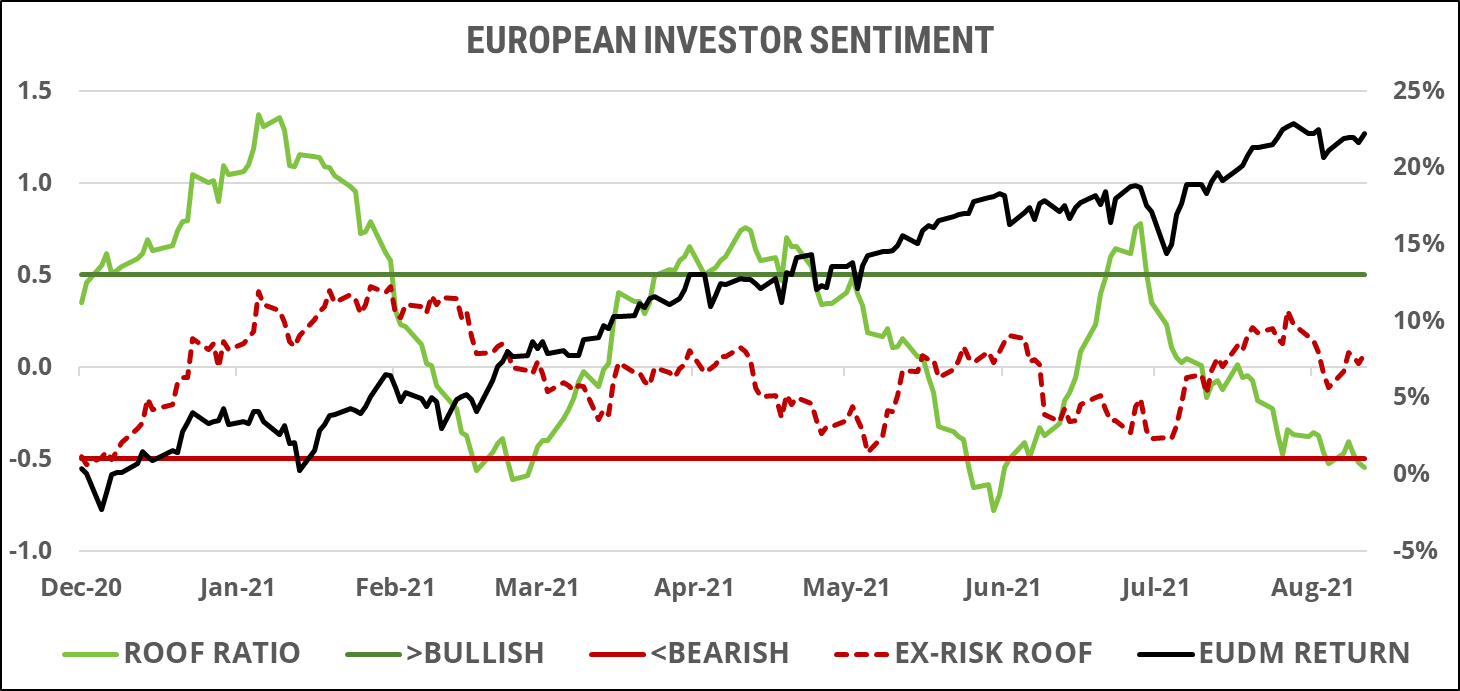

European investor sentiment:

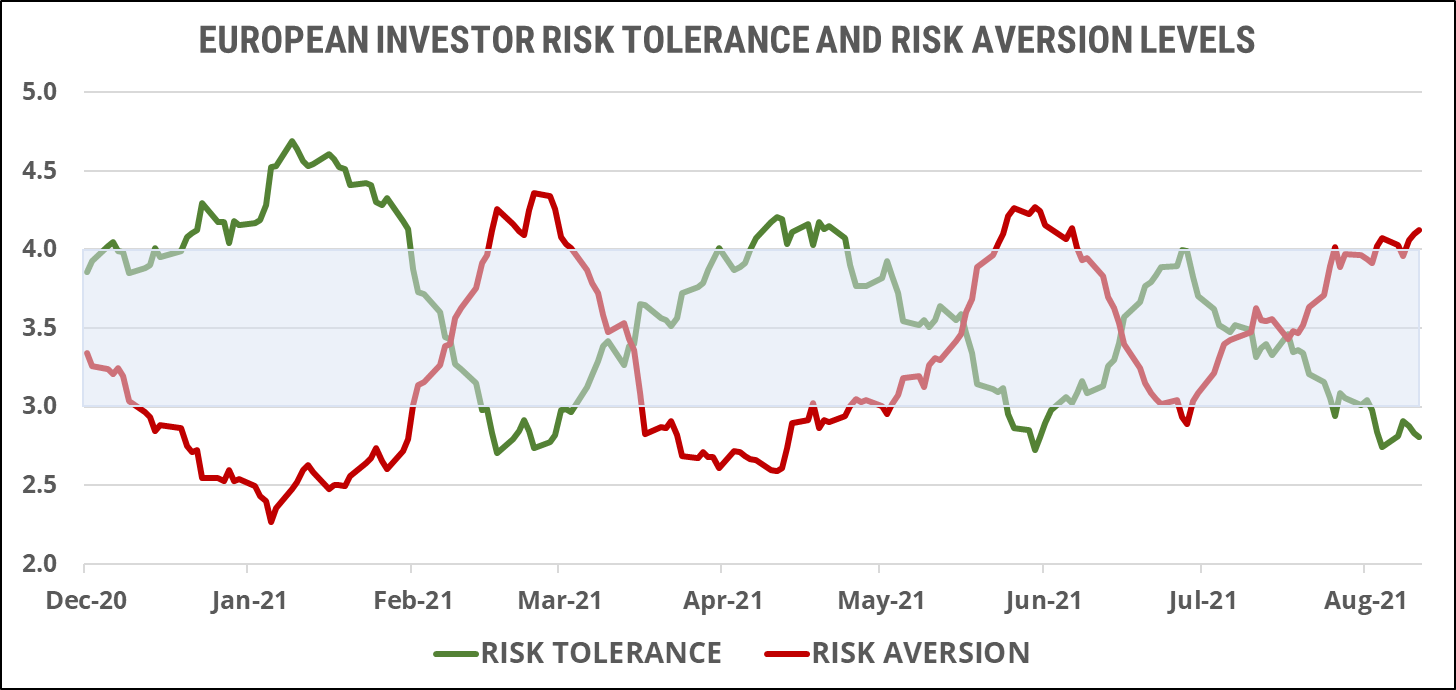

European investor sentiment dipped into the bearish zone last week, temporarily capping further market advances. On a purely sector allocation basis (red dotted line), sentiment is still in the neutral zone. This indicates that investors in Europe are not as bearish as they seem and remain hopeful of an improving outlook as a high vaccination rate shows to be limiting the surge of new infections in that part of the world. The ECB remains highly accommodative but political uncertainty linked to upcoming elections in Germany next month and, further away, hard-to-call elections in France in May next year, will add to investors’ uncertainty in the coming weeks and months. Market volatility has been on a steady decline all month and is now back to pre-pandemic levels. Any uptick in market risk, like the July spike, will add to investors’ negative mood and could send them to the sidelines with plenty of profit-taking along the way.

Risk aversion (red line) continued to rise last week as risk tolerance (green line) declined further. The imbalance between the supply and demand for risk is now dangerously negative. The many risk-averse investors will offer large discounts for their risk assets to the remaining (fewer) risk-tolerant ones if a risk event triggers their bearish sentiment into (i.e., the gun appears loaded). This trigger could take the form of a sudden fourth wave of infections, a less accommodative ECB, or a (negative) surprise result in the German elections. If none of these triggers materialize, then sentiment could return to a more neutral stance as investors focus on the strength of the economic recovery.

Global developed markets investors sentiment:

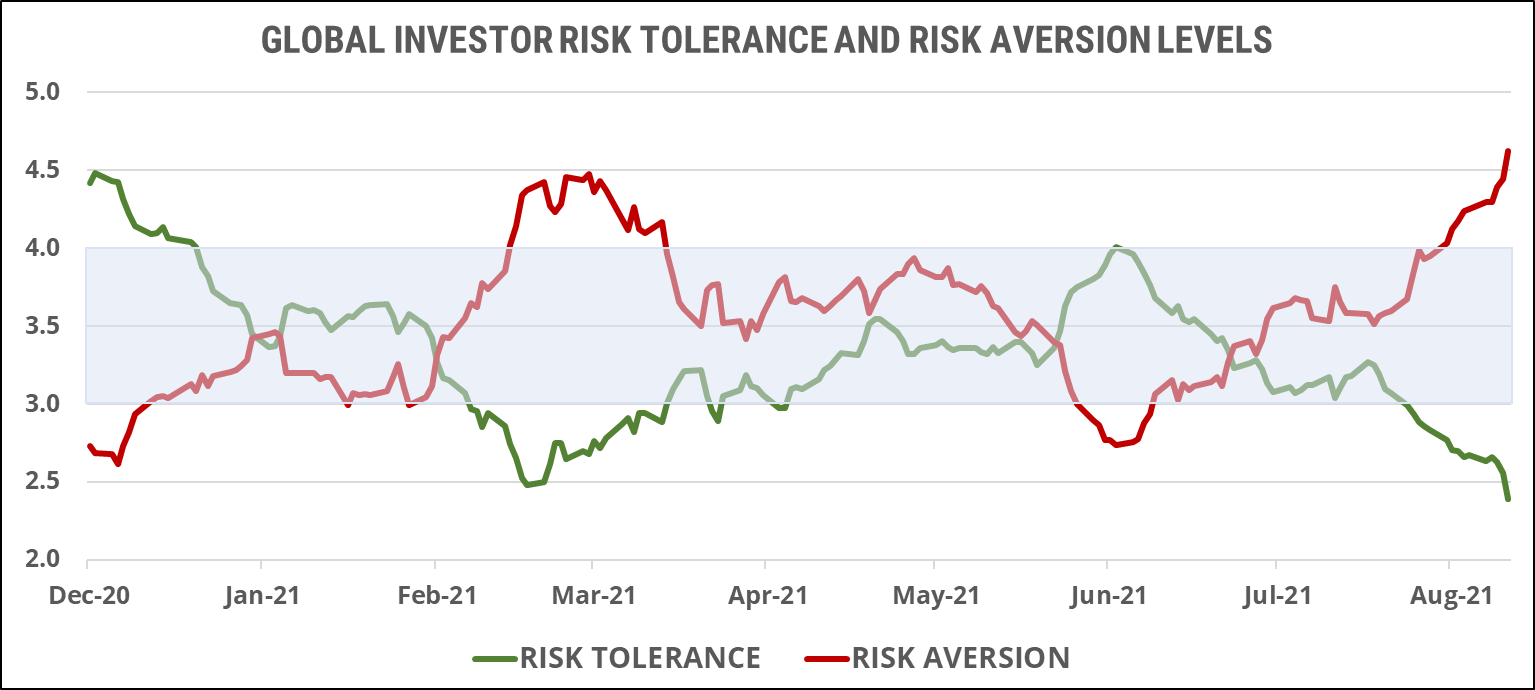

Global developed markets investors’ sentiment fell further into bearish territory last week, seemingly taking the worst fears of US, European, and Asian investors with them. This deterioration in sentiment occurred despite an improving market risk, indicating a more determined negative stance on the part of global investors who feel that regional problems compound rather than diversify away at the global level. This is reflective of a focus on the global supply chain issues that do not seem to be going away, regardless of monetary or fiscal stimuli, and which may impact this year’s Christmas shopping season (there are already headline news to that effect).

Risk tolerance (green line) plunged to new YTD lows last week, and risk aversion (red line) surged to new YTD highs. This imbalance indicates a large oversupply of risk-averse investors versus risk-tolerant ones in the market. Any risk event at these levels could trigger a large market correction as risk-averse investors offer sharply lower prices for their risk assets in their attempt to de-risk portfolios. Depending on the durability of the risk event that would trigger this selling response, a continued rise in market volatility will feed further needs for de-risking and boost the ranks of the risk-averse investors, adding further momentum to the downside.

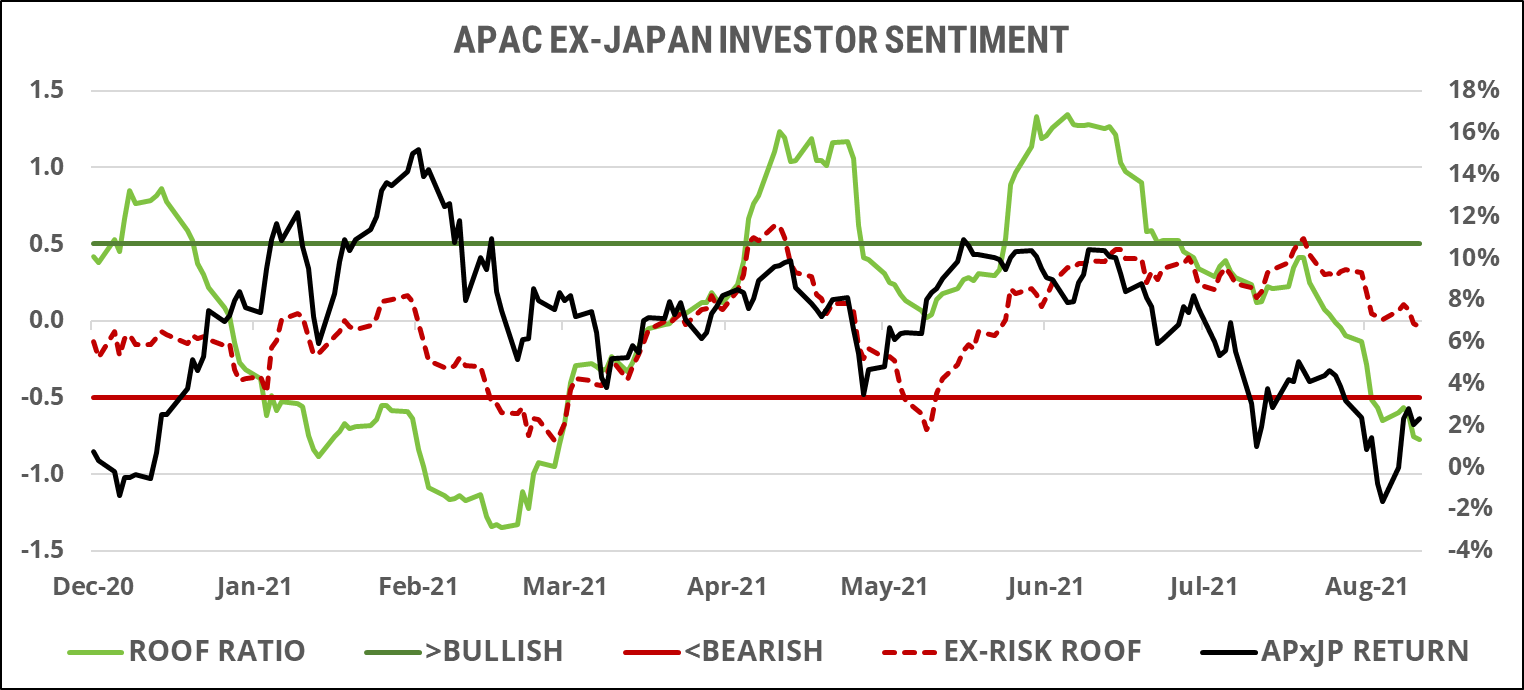

Asia ex-Japan markets investor sentiment:

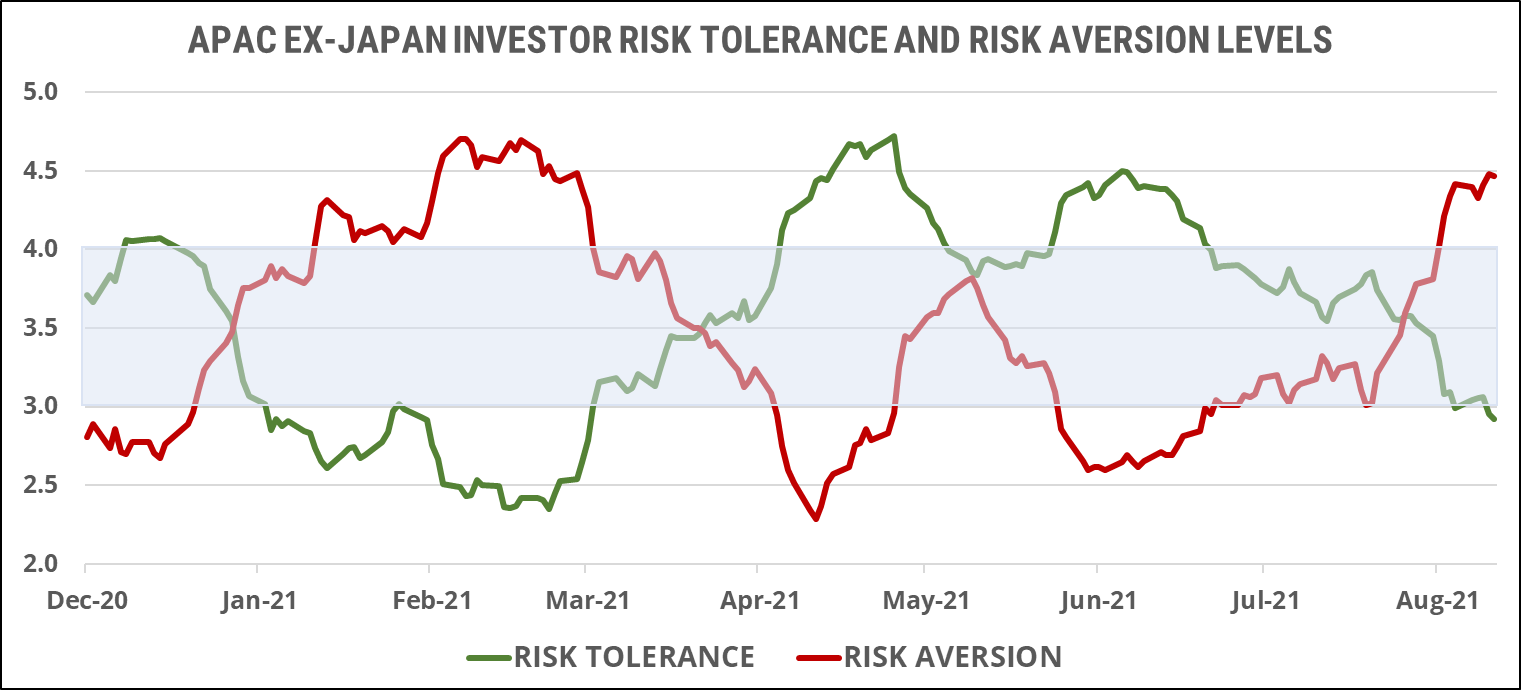

Sentiment among Asia ex-Japan investors remained in the bearish zone last week despite a small recovery in markets from recent lows. Markets in Asia are now essentially flat YTD, but sentiment is increasingly negative, capping the upside potential of any rallies in the short term. Supply chain bottlenecks and a fluid and uncertain COVID-19 situation aggravated by persistently low vaccination rates in populous countries, continues to weigh on sentiment. Markets have been under pressure from sentiment since the end of May and will remain so in the short term despite low valuations.

Risk tolerance (green line) ended last week lower, and risk aversion (red line) rose to near YTD high, translating into a continued negative risk appetite for the region. Markets, however, are flat YTD so there may not be a lot of profit-taking to be had and it will take strong downside conviction for investors to start selling from these levels. In the short term, we expect this negative risk appetite to keep investors at bay during any rally attempts unless those are based on convincing improvements in the COVID-19 situation in the region.

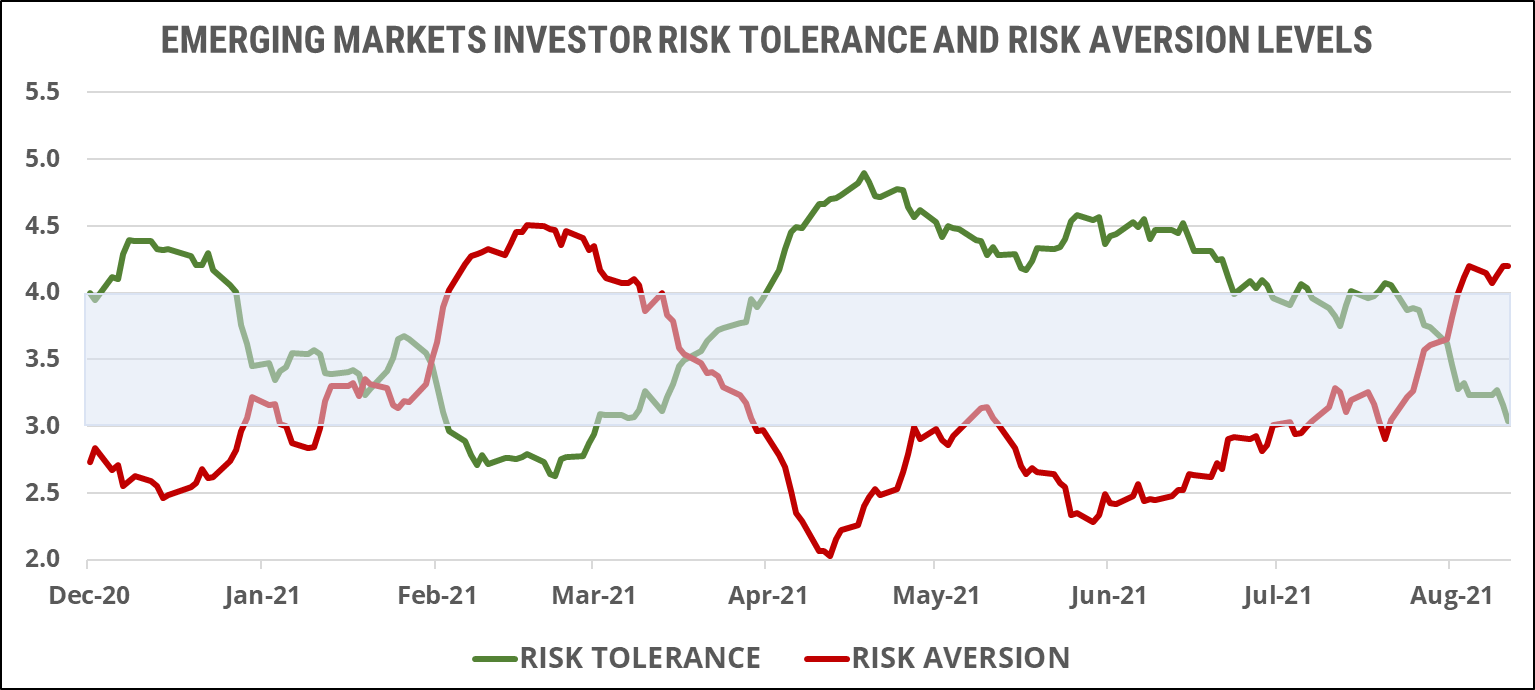

Global emerging markets investor sentiment:

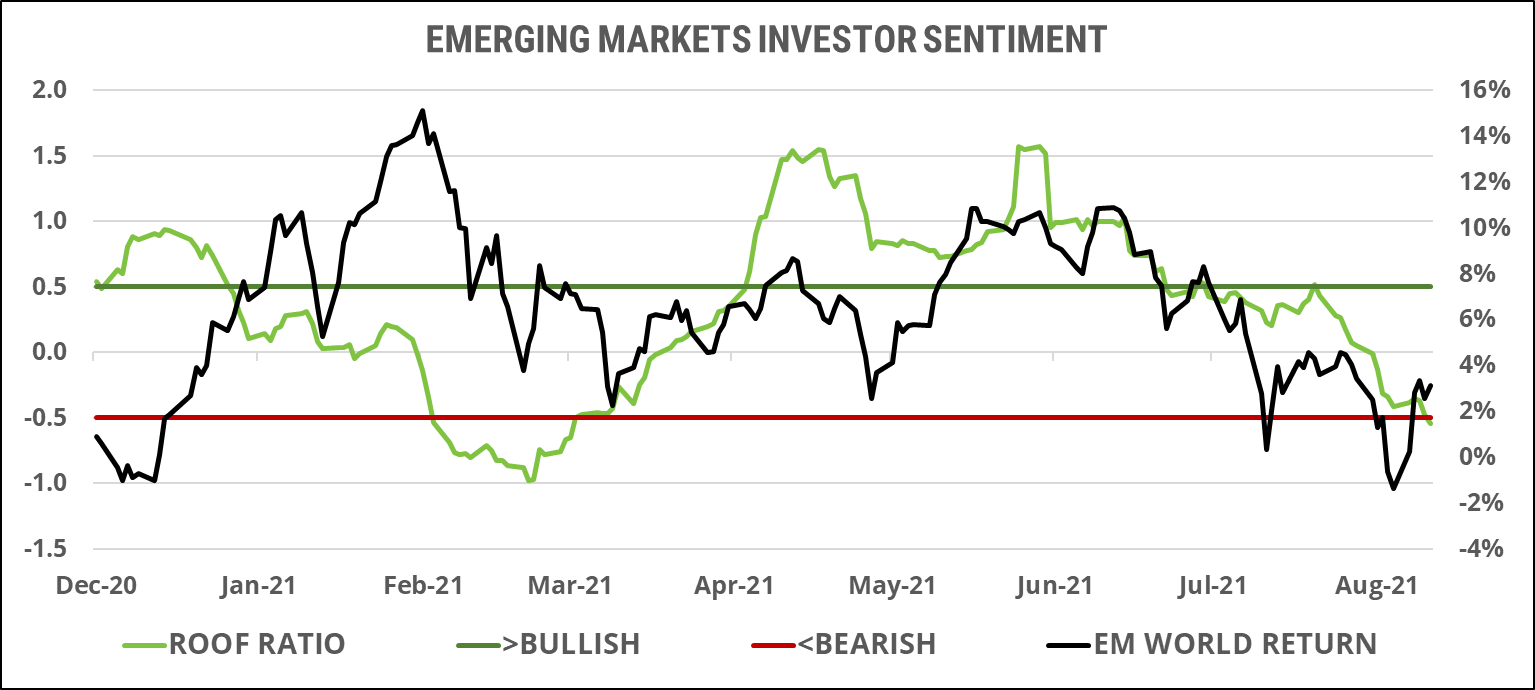

Global emerging market investors are following in the footsteps of their developed peers in compounding regional woes into seemingly bigger global ones instead of seeing any diversification across them (i.e. we’re talking about the same problem across regions: COVID-19). Sentiment there weakened further and ended the week in the bearish zone for the first time since February. Investors have been feeling increasingly negative for three consecutive months now, in line with the deteriorating COVID-19 narrative in that part of the world. Markets are mostly flat YTD after rebounding off new lows last week so the downside from negative sentiment may be limited in the short term, but, likewise, is any upside potential until sentiment recovers.

Risk aversion (red line) peaked last week while risk tolerance (green line) continued to decline, increasing the net negative risk appetite for global emerging markets. The imbalance between the supply and demand for risk isn’t as high as it was last February but is becoming increasingly negative. Unlike in February, when markets had risen some 15% on the vaccination news in November 2020, markets now are near their YTD lows and probably offer little in the way of profit taking from here. It will take a recovery in sentiment, however, for them to even attempt a recovery of their recent highs.