Potential triggers for sentiment this week1 :

- US: November CPI, PMI, retail sales, and the Federal Reserve’s FOMC meeting.

- Europe: Policy meetings by the European Central Bank, Bank of England and Swiss National Bank; UK and Eurozone PMI.

- APAC: China November retail sales and industrial production.

- Global: Interest rate decision in the US, EU and UK this week will be accompanied by the latest inflation numbers for the US and Europe, and economic growth forecasts for 2023 by the ECB.

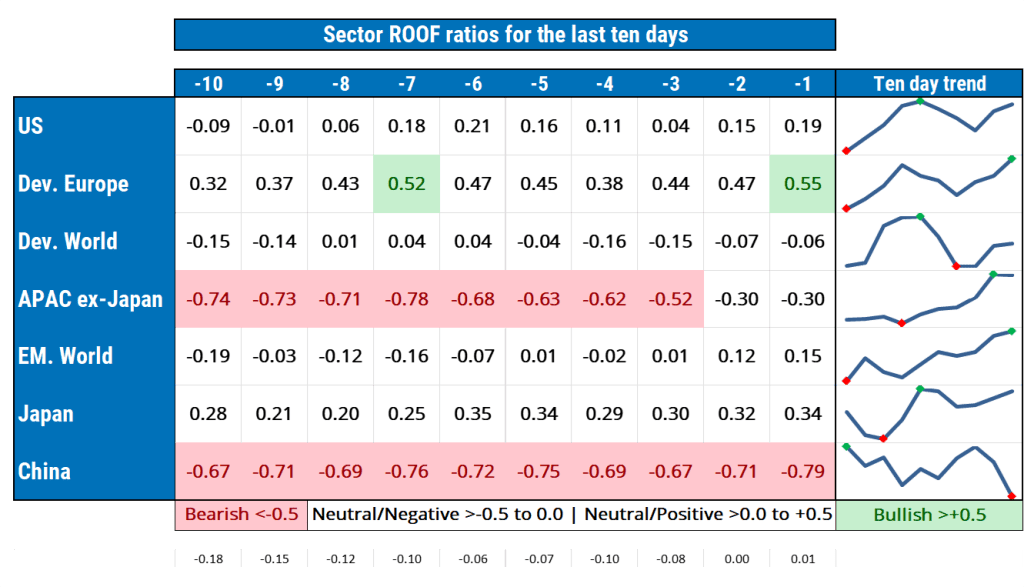

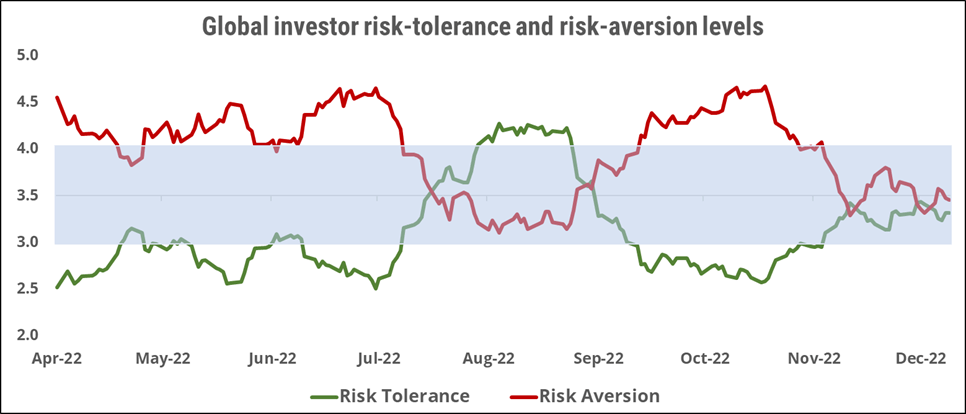

Summary of changes in investor sentiment from the previous week:

- Investor sentiment was little changed last week ahead of the key central bank meetings this week, remaining positive in Europe, Japan and the US; neutral in global developed and emerging markets; negative in Asia ex-Japan; and bearish in China. The direction of interest rates is at the very top of investors’ naughty list right now, and it isn’t clear what comes next, but it seems pretty obvious that whatever it is, it is a distant second.

- Sentiment matters. And if this sounds more like lazy philosophy than sound investment advice, consider that greed and fear represent both halves of the ‘fight-or-flight’ instinct that has been around for the totality of human existence, even if most investors choose to ignore it. And sometimes for markets, sentiment is what makes the difference between good news being bad news, or bad news being good news.

- Exactly when central banks will pivot to a more dovish monetary policy is the big question for risk-tolerant investors. It is also the hardest one to predict accurately, which we assume is not a coincidence. The lower volumes and neutral sentiment, indicates that having been bitten once in late August, investors have become twice shy on the pivot gamble.

- For the past two years, every attempt at forecasting good news on inflation or interest rates has failed to lead to a sustainable rally. As a result, risk-averse strategies have continuously outperformed both the broad market and risk-tolerant strategies. In an environment of high uncertainty, when it comes to risk taking, it’s not that less is more — it’s that less is everything.

Jump to a specific market

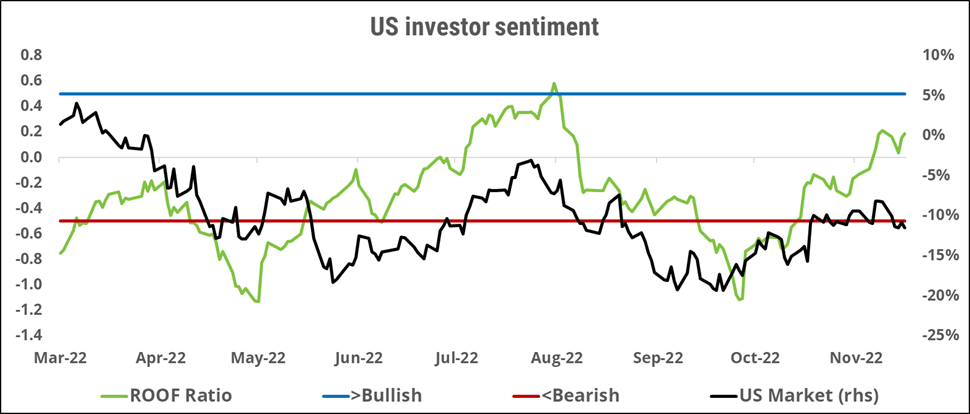

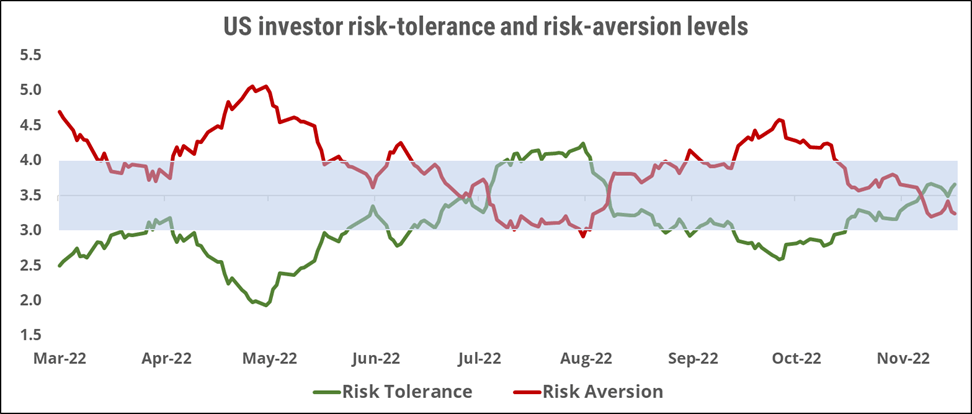

US investor sentiment

Sentiment among US investors (green line) improved slightly last week but failed to rise above its recent highs and remains well below the confident levels that preceded the August Federal Reserve meeting. Fed officials have been preparing markets for a more moderate pace of interest rate increases (50bps vs. 75bps) but have also told investors to expect them to keep raising interest rates for longer than previously thought. Nothing in this past month’s set of economic data will have weakened their argument. The current balance between risk aversion and risk tolerance indicates that investors are not anticipating any surprise with this week’s announcement. The last time they tried to second-guess the Fed, they ended up giving up all those gains in the following month. They seem a lot more cautious this time around.

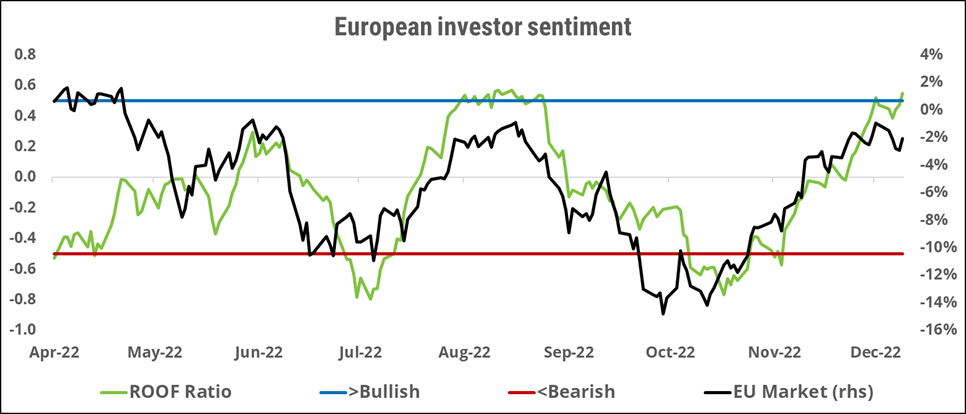

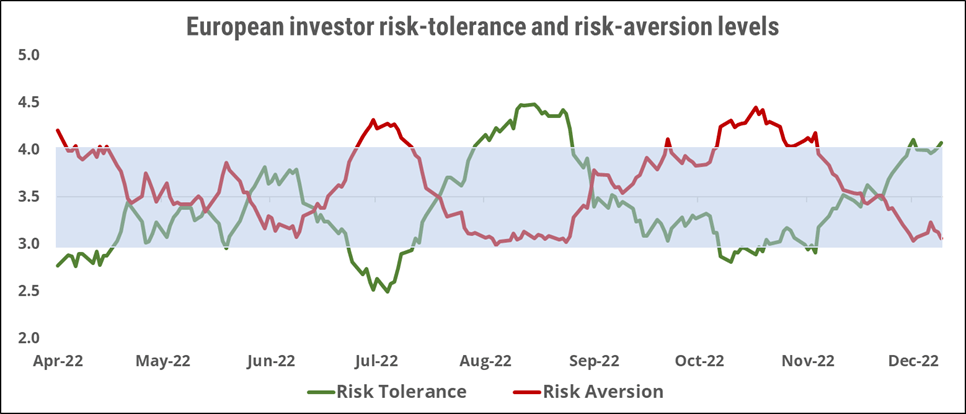

European investor sentiment

European investors’ sentiment (green line) rose again last week, ending bullish for the second time this month and mirroring the highs reached in August, ahead of the previous central bank meeting. Part of the rise in sentiment and markets can be explained by a growing consensus that Europe will be able to avoid an energy crisis this winter, which has led to some of the more bearish bets being unwound this month. Add to this a lower monthly inflation reading two weeks ago, as well as calmer currency markets from a growing consensus that this summer’s UK financial turmoil will not spillover into a broader European financial crisis. That Europe’s situation is not as bad as previously thought has helped drive risk-aversion levels down to their previous lows, but uncertainty remains too high for risk-tolerance levels to regain their previous highs. So, unless this week brings clarity back to markets, this two-months-old rally seems a little long in the sentimental tooth to be sustainable.

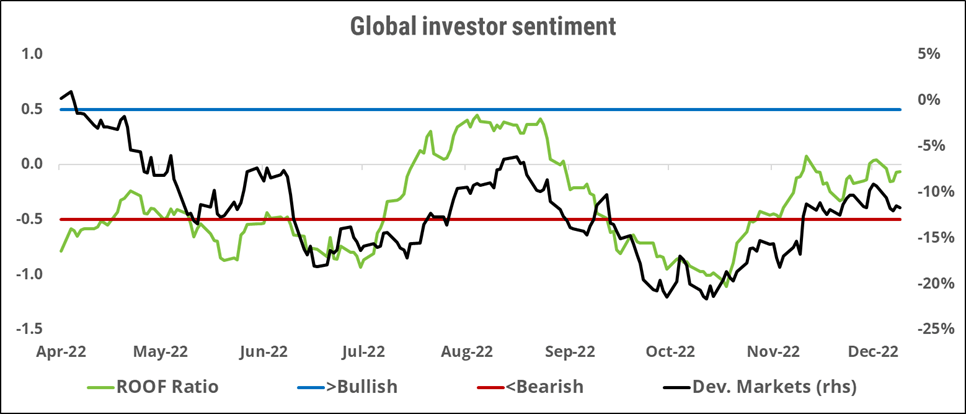

Global developed markets investor sentiment

Sentiment among global developed-markets investors (green line) has seen its recovery from bearish levels reached in late October stall, with risk tolerance unable to rise above risk aversion for the last four consecutive weeks. Neither calmer currency markets nor the abandonment of strict Zero-COVID-19 policies in China were enough to convince global investors to become more risk tolerant ahead of this week’s central bank meetings. This month-long sideways move in sentiment has been mirrored by market movements, with both remaining happily non-committal at this point. Given the lack of momentum in either risk aversion or risk tolerance, global investors seem poised to follow US and European investors this week rather than take the lead and point the way.

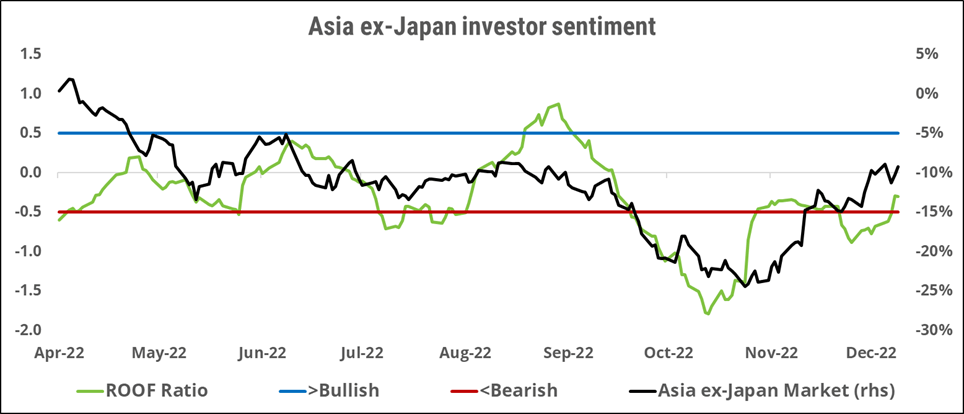

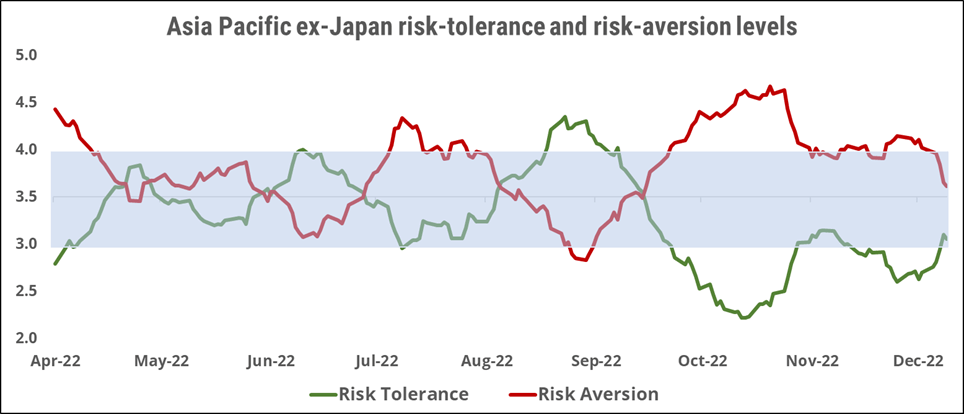

Asia ex-Japan markets investor sentiment

Sentiment among Asia ex-Japan investors (green line) recovered strongly last week, ending negative but no longer bearish. News that the Chinese authorities had lifted some of the more restrictive Zero-COVID-19 policies lifted both markets and sentiment during the week. Risk-tolerance levels remain well below their summer highs reached ahead of the August 26 FOMC meeting, and despite the decline in risk aversion from the COVID-19 news in China, risk appetite remains negative and sentiment fragile ahead of this week’s all-important central bank meetings.

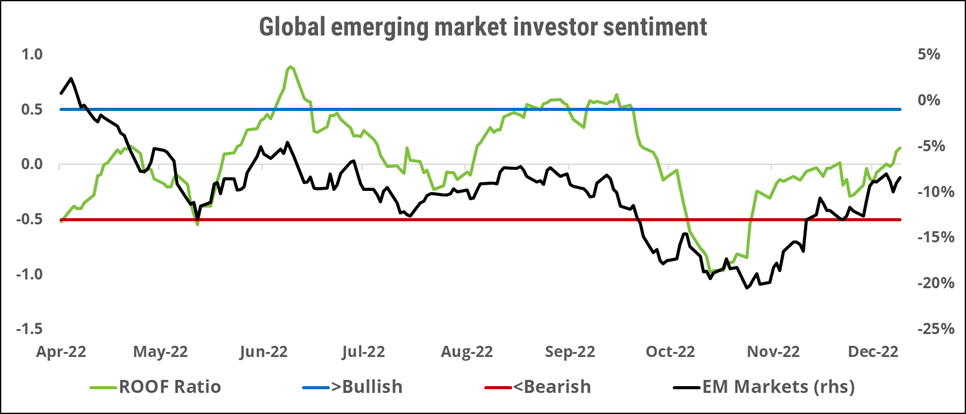

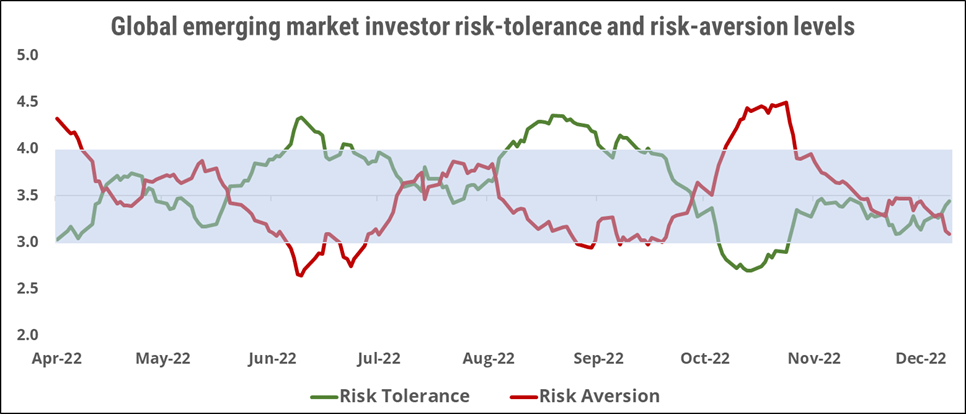

Global emerging markets investor sentiment

Sentiment among global emerging-markets investors (green line) rose last week, ending neutral but slightly positive for the first time since late September. The improvement in sentiment has been driven mostly by a fall in risk aversion, and risk tolerance remains well below its summer levels. Even the decline in risk aversion seems undecisive and driven more by relief from China’s COVID-19 situation not being as bad as feared after the latest policy shift, rather than confidence in improving fundamentals. This lack of risk tolerance momentum should prevent markets from rallying without just cause and in thin volume.

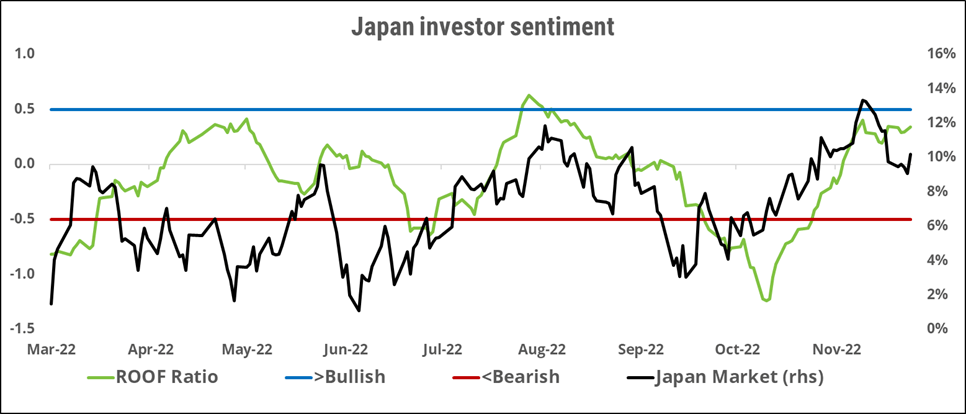

Japan market investor sentiment

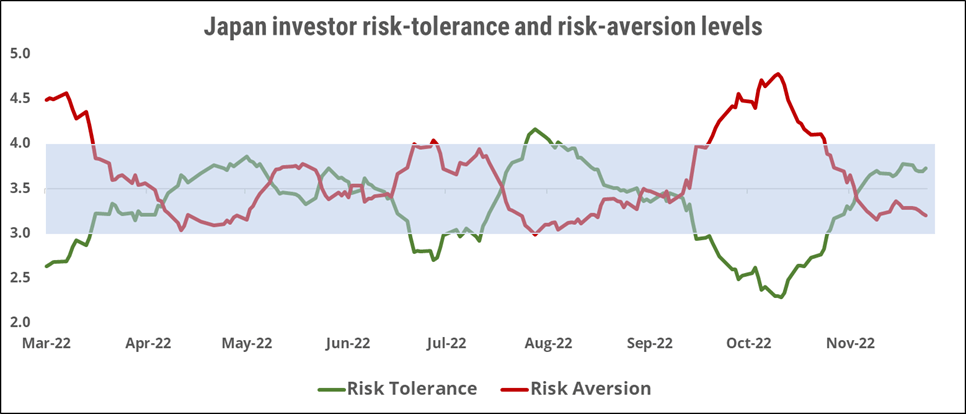

Sentiment among Japanese investors (green line) was unchanged last week, ending strongly positive but unable to progress higher from the previous week. This lack of progression in sentiment led to some profit-taking in markets after the latter reached fresh year-to-date highs. Risk tolerance is only slightly higher than risk aversion but remains below its August highs, indicating an unsustainable lack of conviction in the recent market rally. Net risk appetite is not sufficiently strong to drive a further market rise without new information corroborating investors’ improved outlook on the economy. Any renewed (upward) stress on the dollar-yen exchange rate from this week’s FOMC rate decision could encourage more profit-taking in the near term.

China (domestic) investor sentiment

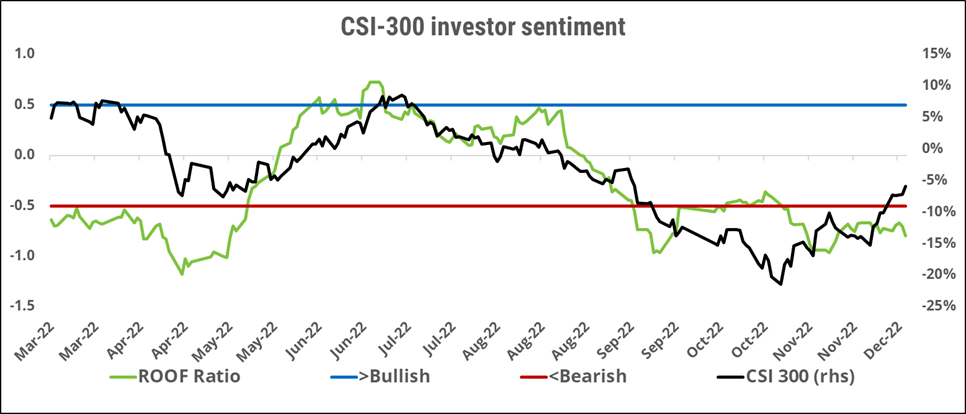

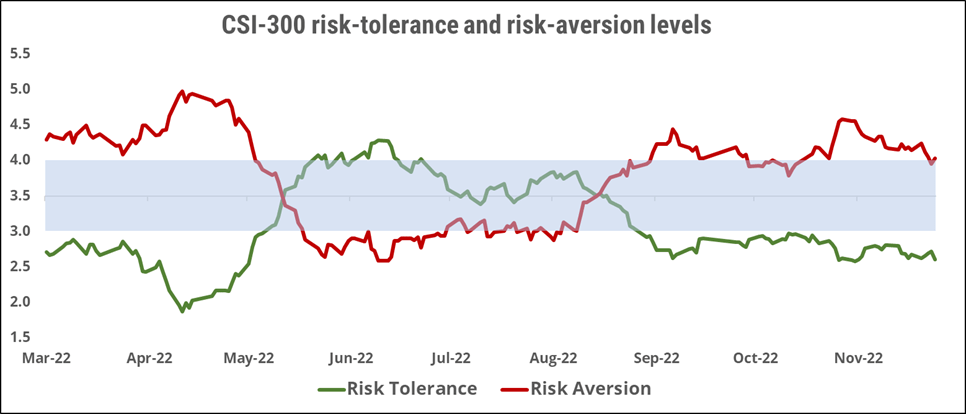

Sentiment (green line) among Chinese (A-shares) investors remained bearish last week, despite a rebound in markets from an improving COVID-19 situation. This suggests that market activity is driven more by the unwinding of overly bearish positions rather than the implementation of newly bullish ones. Risk aversion remains near its highs, while risk tolerance ended the week lower than the previous week. The large imbalance between the potential supply and demand for risk remains very negative and indicative of a lack of confidence that the worst for the economy has been avoided. Investors will be monitoring the COVID-19 developments, as well as the interest rate decisions in the US and Europe this week. Any negative news on either front could spark heavy selling in an overreaction from a still bearish sentiment.

1 If sentiment is bearish/bullish, a negative/positive surprise on these data releases could trigger an overreaction.