Potential triggers for sentiment this week1 :

- US: CPI data, consumer confidence.

- Europe: UK October GDP data, German investor morale and factory orders.

- APAC: China CPI data, Japan current account and producer prices.

1 If sentiment is bearish/bullish, a negative/positive surprise on these data releases could trigger an overreaction.

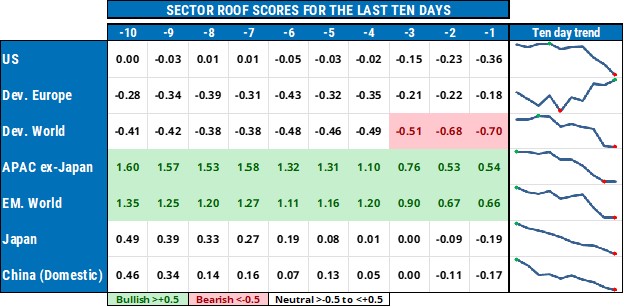

Summary of changes in investor sentiment from the previous week:

- Investor sentiment weakened further last week across all markets we track, except developed Europe. The latter narrowly avoided falling into the bearish zone at the start of the week and was rescued by assurances from the ECB that it will remain accommodative and supportive for all of 2022.

- Among developed-market investors, the bulls are hoping for continued support from central banks and see the recent Omicron selloff as just the price of the omelette. The increasingly negative sentiment among their peers, however, suggests we may get just more broken eggs in the weeks ahead.

- Global emerging-market investors may be mistaking the neurosis among their developed-market counterparts for positive energy that will eventually drive fund flows towards them. Despite the evidence from negative year-to-date market returns, they seem to have become experts at self-persuasion. Hope, they say, is God’s apology for reality.

- Over the next few weeks, science will battle incredulity and central banks will face off with inflationary pressures. Nothing short of an unequivocal position from regulators and politicians – an occurrence as rare as rocking-horse droppings – on both inflation and the pandemic response will convince investors that a return to risk-taking has any chance of being rewarded by markets.

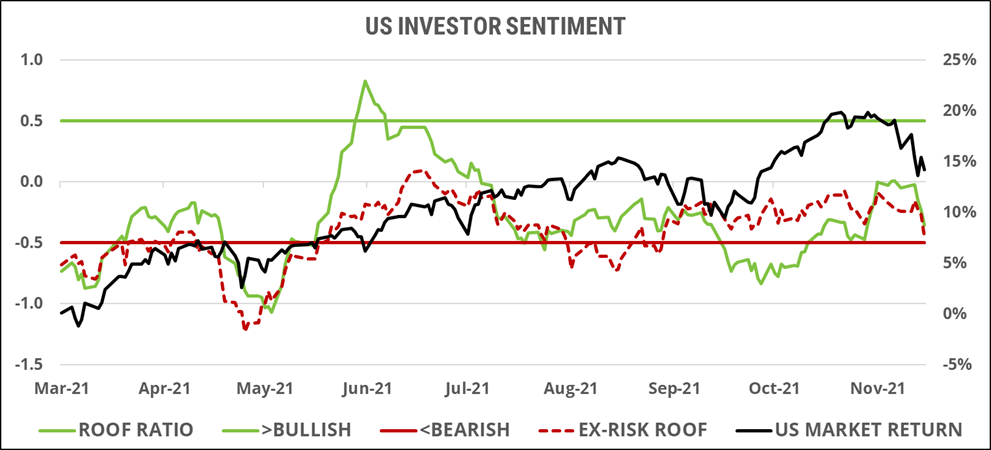

US investor sentiment:

US investor sentiment (green line) plunged last week, ending at the edge of the neutral zone. The volatility spike from the Omicron news, as well as continued high inflation readings and a softer-than-expected jobs report, triggered a wave of portfolio de-risking. Sector allocation (red dotted line) confirms the risk-aversion consensus as most investors rushed to implement risk-averse strategies, seeking to both lock in year-to-date gains as well as protect their portfolios from further downside risks. This is likely to be the situation for the remainder of the calendar year as a weakening sentiment seems too negative to support a successful market rally. That is not to say that bargain hunting won’t result in isolated up-days, but with sentiment this negative, it will take a higher-than- normal amount of clarity to get them back into a risk-taking mood this close to year-end.

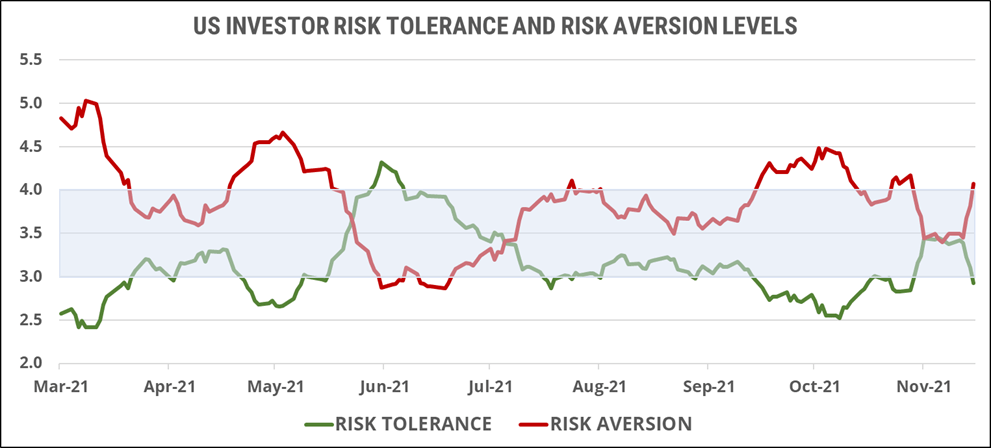

Risk aversion (red line) shot up last week while risk tolerance (green line) declined sharply, creating a negative imbalance between the two for the first time since October. In this situation, the potential supply of risk assets is higher than the potential demand, resulting in downside vulnerability for markets in the event of continued negative news flow. Until recently, US investors did not feel that inflation or the threat of higher interest rates could derail either the earnings or the economic recovery. The Omicron news, however, has the potential to change their conclusion on both fronts, and has already shaken their confidence in the initial forecasts. As we enter the home stretch of the calendar year, the time window for one last bullish rally is rapidly closing, and without the support of positive sentiment, risk tolerance is unlikely to regain the upper hand in the short term.

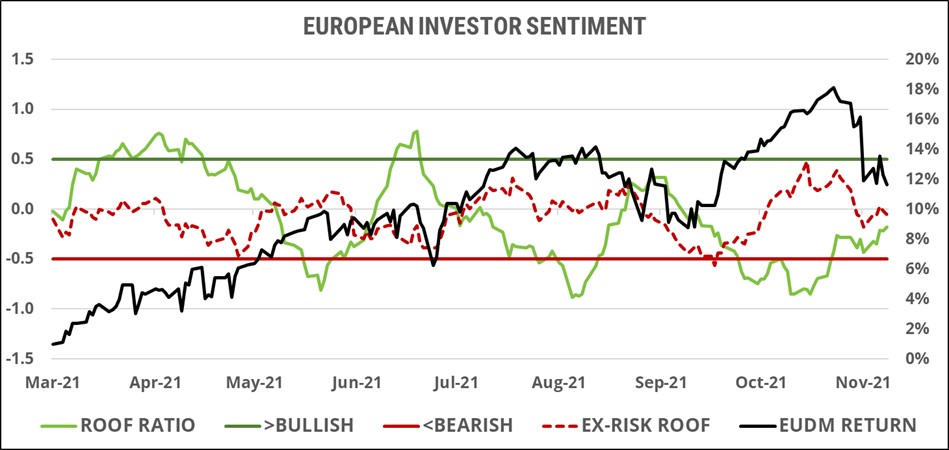

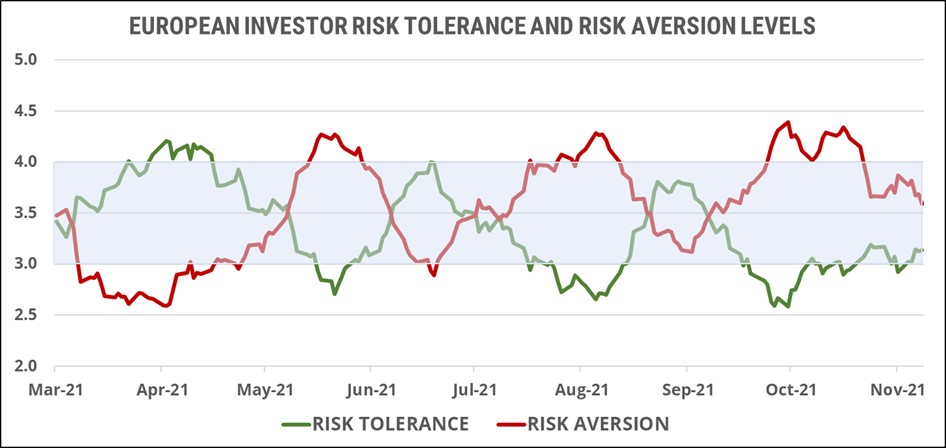

European investor sentiment:

European investor sentiment (green line), seemingly headed for the bearish zone at the start of the week, rebounded after strong assurances from the ECB that monetary policy would remain unchanged in its current accommodative stance for all of 2022. Of course, ‘accommodative’ may be a euphemism for ‘deeply worried about the fate of the global economic recovery’, but for now at least, European investors seem to be appreciative of the promise for continued easy money, although they seem to be the only ones. With less than 12% of cumulative returns on the STOXX Europe 600 index left to protect for the calendar year, they may become increasingly sensitive to negative news and require additional stimulus, in addition to the status quo on monetary policy, to consider becoming bullish again.

Risk aversion (red line) and risk tolerance (green line) converged last week after the ECB announcement, but the balance remains in favor of risk aversion. The negative gap between the supply and demand for risk assets is a danger for markets, but at this level, is not yet dangerous. European investors are in the enviable position of having had their monetary policy question answered, but the question on the policy response to the Omicron health threat remains open. The slight advantage for risk aversion over risk tolerance can therefore be understood in the context of this remaining ambiguity. With history as guide, investors should not expect a unified answer from the European Union.

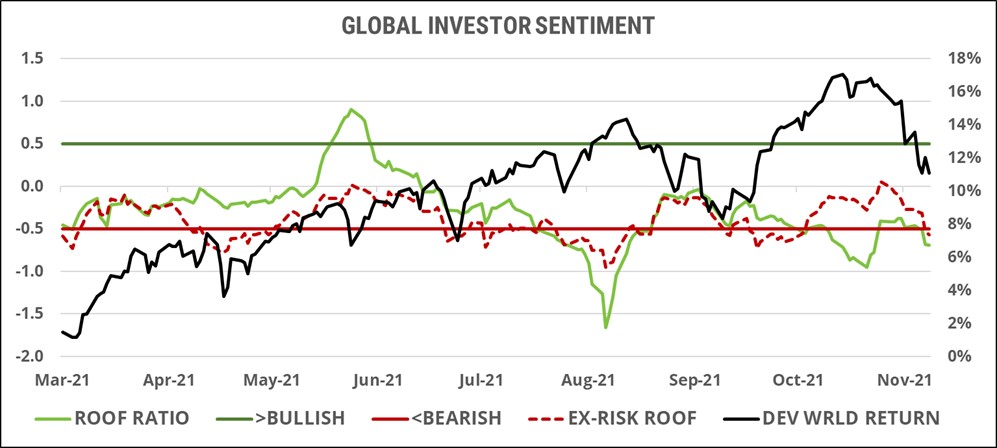

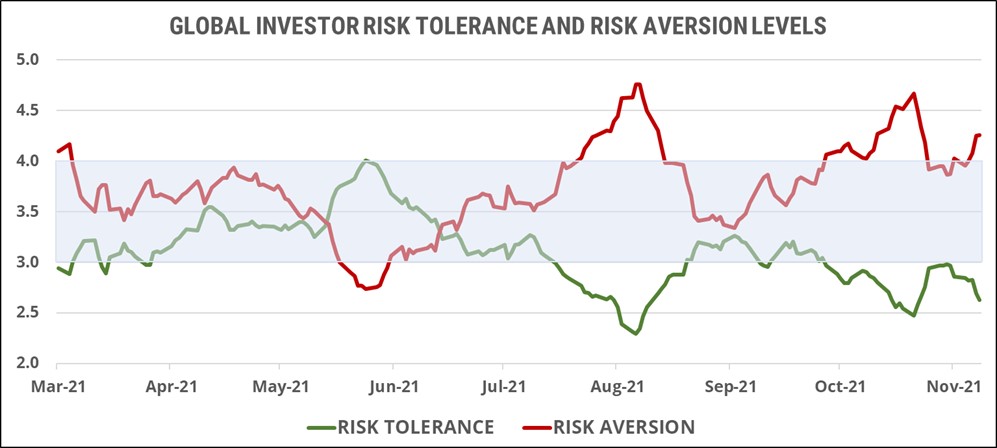

Global developed markets investors sentiment:

Sentiment among global developed markets investors (green line) dropped below the neutral zone, ending the week in bearish territory. Sector allocations also pointed to the implementation of more risk-averse strategies (red dotted line), indicating that there was more to the decline in sentiment than just the volatility spike. Other than for a three-week period during the month of June, global developed market investor sentiment has been negative all year, and bearish three times within the last four months – this despite the ongoing injection of monetary and fiscal stimulus. Global markets seem to have resisted the downward pull when sentiment was only mildly negative, staying positive year to date, but it remains to be seen if they can avoid being dragged into negative territory now that sentiment has taken a decidedly bearish undertone.

Risk tolerance (green line) and risk aversion (red line) continued to diverge last week, increasing the negative gap between them. As the potential supply of risk assets from rising risk aversion outweighs the potential demand from a declining risk tolerance, markets are becoming more at risk of an overreaction on the downside. Should the key narratives on monetary tightening, new COVID-19 infections or social distancing measures turn negative, given the increasingly bearish sentiment bias, markets would come under severe pressure in the short term.

Asia ex-Japan markets investor sentiment:

Sentiment (green line) among Asia ex-Japan investors declined sharply last week, in sympathy with global markets, but managed to close the week just inside the bullish zone. Investors’ positive sentiment has been at odds with markets since the start of September, with the latter increasing its negative year-to-date losses last week. It almost seems as though markets will not recover until this contrarian sentiment acknowledges that not all is entirely well in Shangri-La, and that in fact, it could all get rapidly worse. In other words, the longer sentiment remains in denial about the dangers to the global economic recovery, the longer it will take for markets to bottom out.

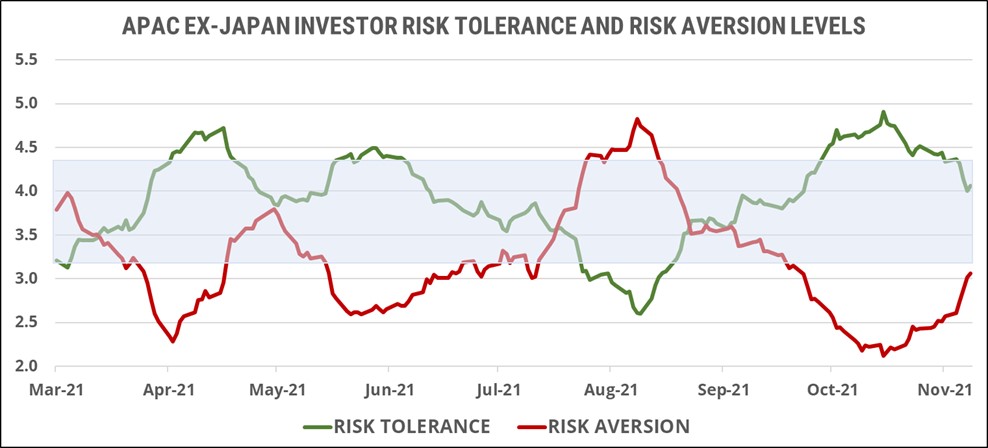

Risk tolerance (green line) and risk aversion (red line) continued their recent convergence last week but retained their contrarian positive risk appetite. Asia’s heavily fragmented response to the pandemic in terms of social distancing and travel measures continues to affect the global supply chain and slow the pace of economic recovery. These headwinds have been reflected in market performance but not in investor sentiment, which continues to bet on an earnings recovery and incoming fund flows from developed-market investors. Eventually, investors will need to accept that the longer and harder they must try to persuade themselves of something, the more likely it is that they are already inclined to doubt and distrust it.

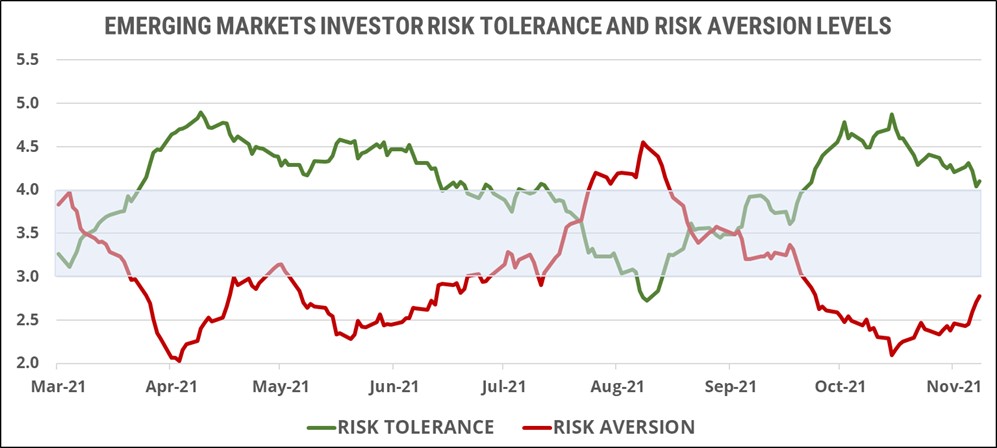

Global emerging markets investor sentiment:

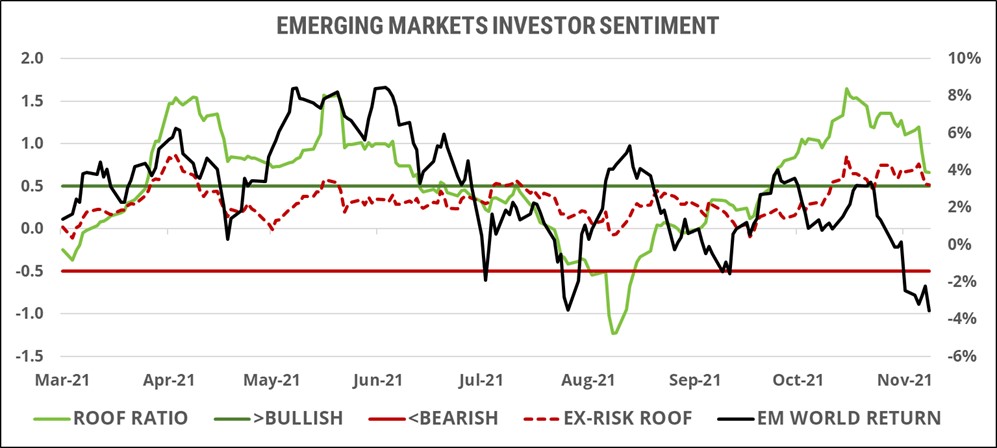

Sentiment among global emerging-markets investors (green line) has been slowly declining from its inflated levels reached at the end of October. That decline accelerated last week with sentiment ending just inside the bullish zone but with a strong downward momentum going into this week. Unlike Asia ex-Japan investors, emerging-market investors seem to have accepted that markets are not headed their way and that the last two months or so may have been a case of the tail trying to wag the dog instead of the other way around. The volatility premium over developed markets, and the negative year-to-date cumulative returns, means fund flows are unlikely to come given the negative reward for risk-taking that emerging markets have offered investors this year. In the short term, investor sentiment is likely to continue to be driven by market performance and should not offer much guidance as to the direction of asset prices.

The positive gap between risk aversion (red line) and risk tolerance (green line) narrowed sharply last week but remains positive, in favor of risk tolerance. Risk appetite has been positive for most of the year, except briefly in August, but markets have yet to really reciprocate with positive returns for risk-taking. The increase in market volatility raises the stakes for being wrong (i.e., higher Value-at-risk), and now, with no positive year-to-date returns to protect in the final inning, risk appetite seems to be returning to a more neutral position, awaiting direction from policy makers.