Potential triggers this week: Fed and ECB minutes, PMI data for the US, UK, Japan, and Eurozone, US retail sales and industrial production, as well as Q4 GDP data for Japan and the Eurozone. The tail end of the earnings season and ongoing developments on the US fiscal stimulus package.

Summary: Admit it, last week was boring. An interval almost breathtaking in its sentimental unsexiness. The earnings season is about 80% of the way through and provided no surprises, the stimulus package is still being haggled over in congress, vaccinations are proceeding at a snail pace, and former President Trump was acquitted by the Senate, again (did anyone not see that one coming?). This lack of emotional direction has left most investors feeling neutral, except for Europeans which continue to slowly curb their bullishness, and global developed investors who are timidly becoming bullish. For the past few weeks, markets have been ignoring sentiment’s gradual pull-back and rallied, confident in their belief that neither central banks’ easy credit nor their massive asset purchasing programs will come to an end any time soon. In short, sentiment has been giving all the sense that something was wrong with none of the bearishness. Absent negative news to validate a weaker sentiment, investors’ mood may simply follow markets higher.

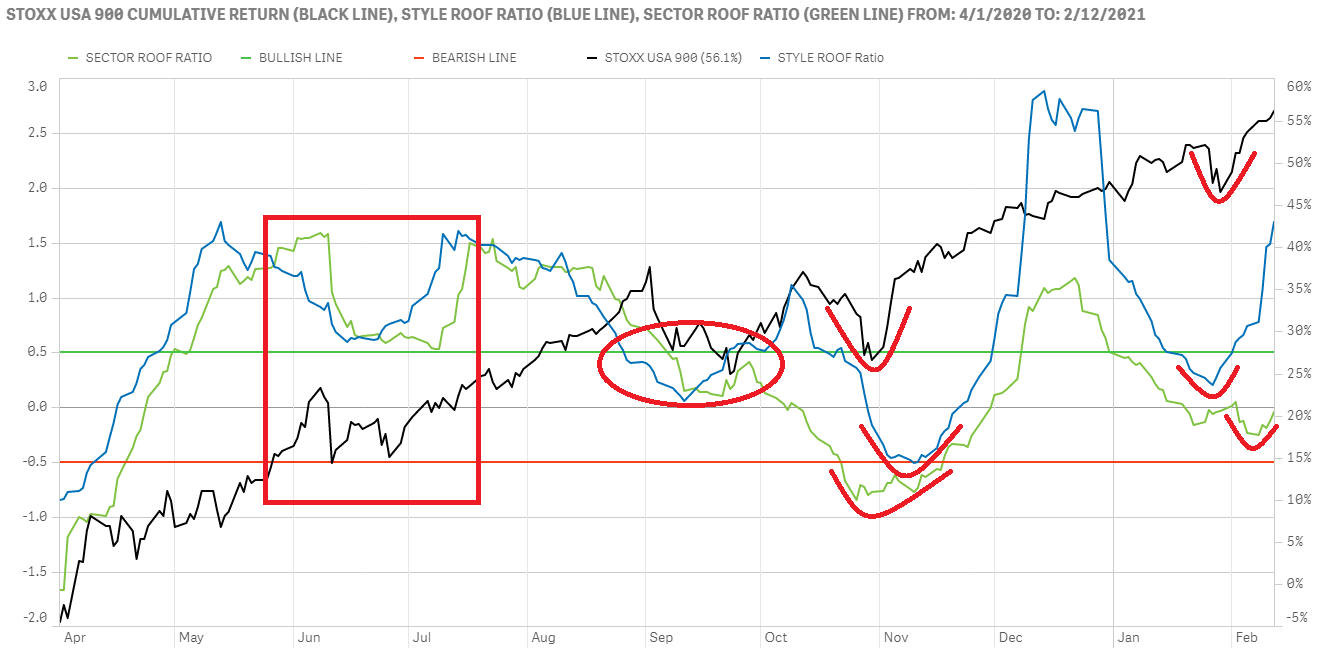

Sector ROOF makes a U-turn and follows Style ROOF and Markets upwards.

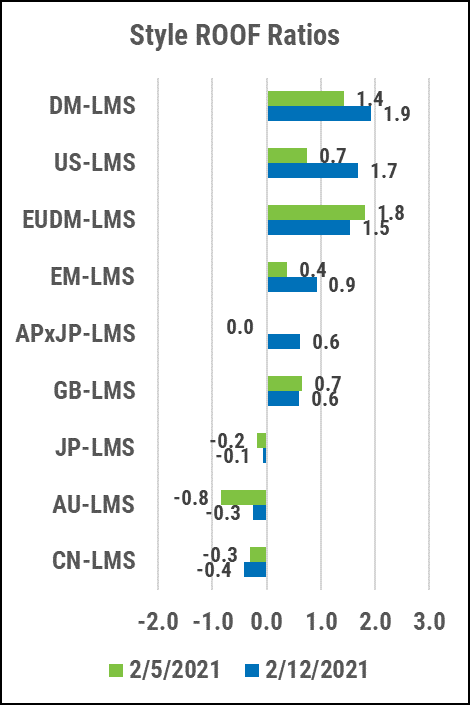

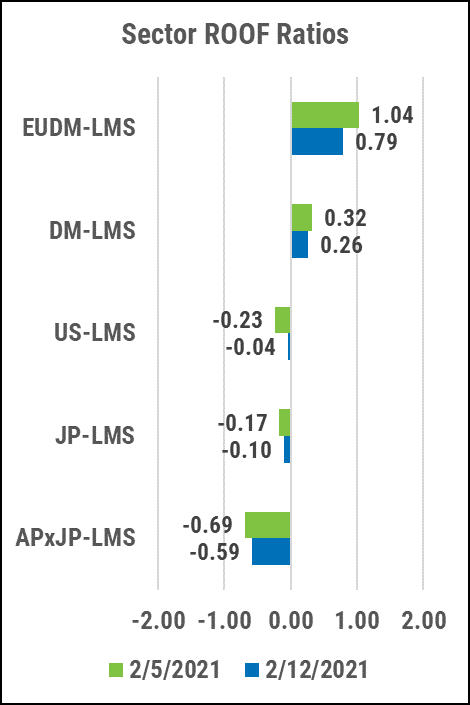

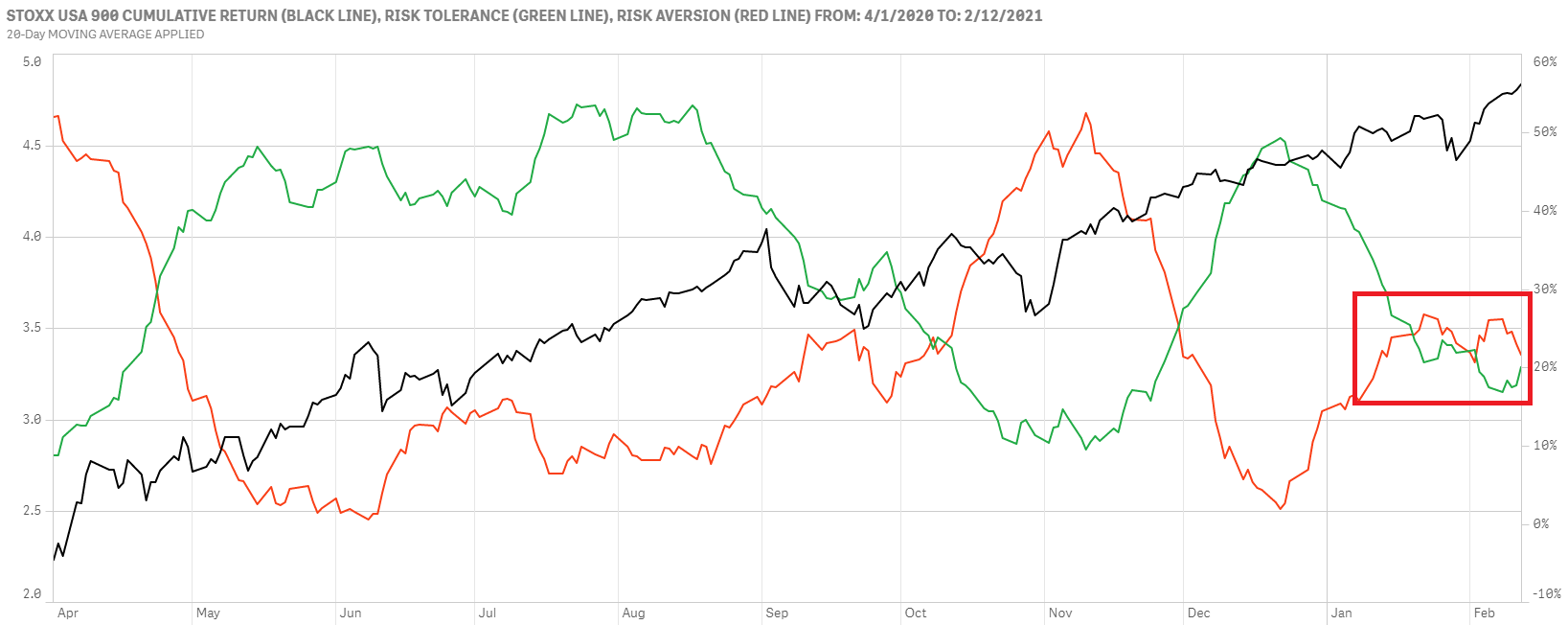

This past week has provided US investors with very little to get excited about. The FAANGs and other pandemic profiteers had a great Q4, Tom Brady won another Superbowl (except now he’s 56 years old), and another President was acquitted by the Senate for doing something which elsewhere would have gotten you the guillotine. Two weeks ago, we saw the Style ROOF Ratio break from its Sector counterpart and follow markets upward. This week it was the Sector ROOF’s turn. It is the fourth time in the last nine months that markets and investor sentiment bottomed out after a very short correction only to head for new highs (top chart). With risk tolerance and risk aversion so close to each other, the supply and balance for risk is at equilibrium and it will take some more than an impeachment acquittal to pull markets higher (bottom chart). The Fed is doing all it can, congress is trying to pass the second stimulus bill, but more may be needed as both may have already been priced at these valuations (i.e., 12M forward PE of 22.2 versus 5Y AVG of 17.7 and 10Y AVG of 15.8).

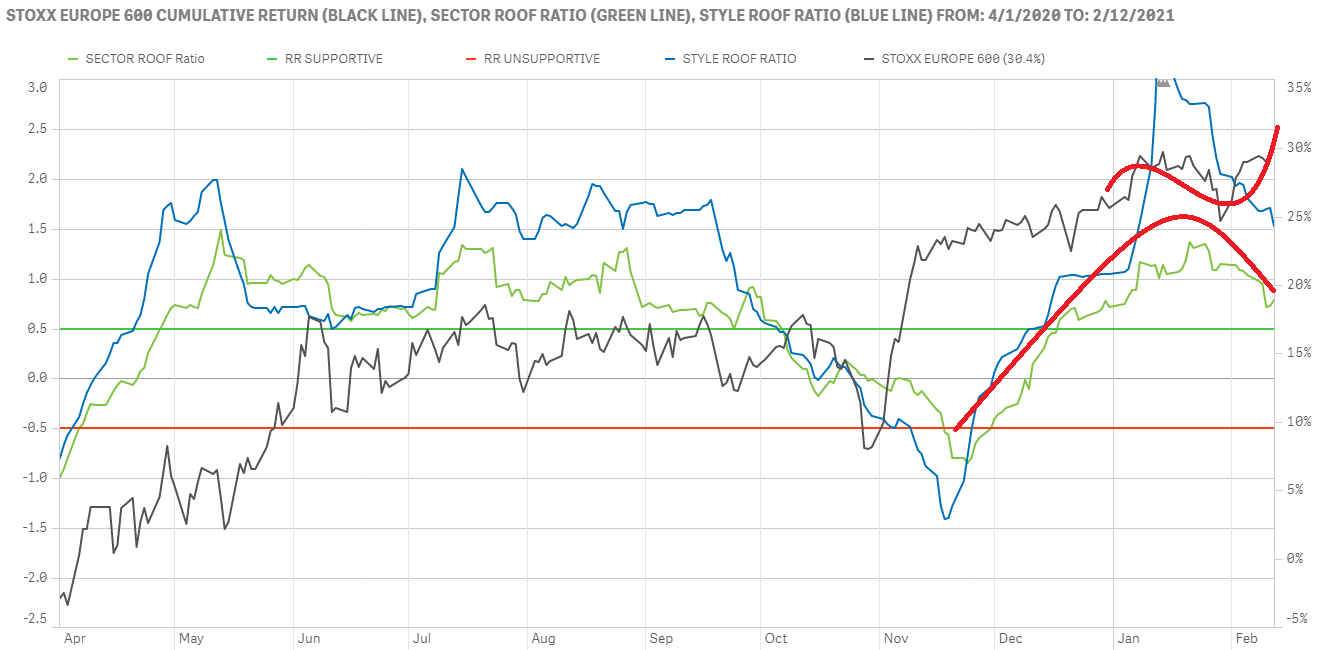

Sentiment in Europe continues to weaken but remains in the bullish zone.

Sentiment among European investors continues to gently roll down the bullish hill it climbed post Brexit trade deal and post COVID-19 vaccine news (top chart). Since the start of the year the STOXX Europe 600 index had followed sentiment’s lead but last week decided to rebound ‘sans’ emotional reasons. Both ROOF Ratios are still in the bullish zone despite recent declines and investors’ positive cognitive bias may simply not need a reason for markets to rebound.

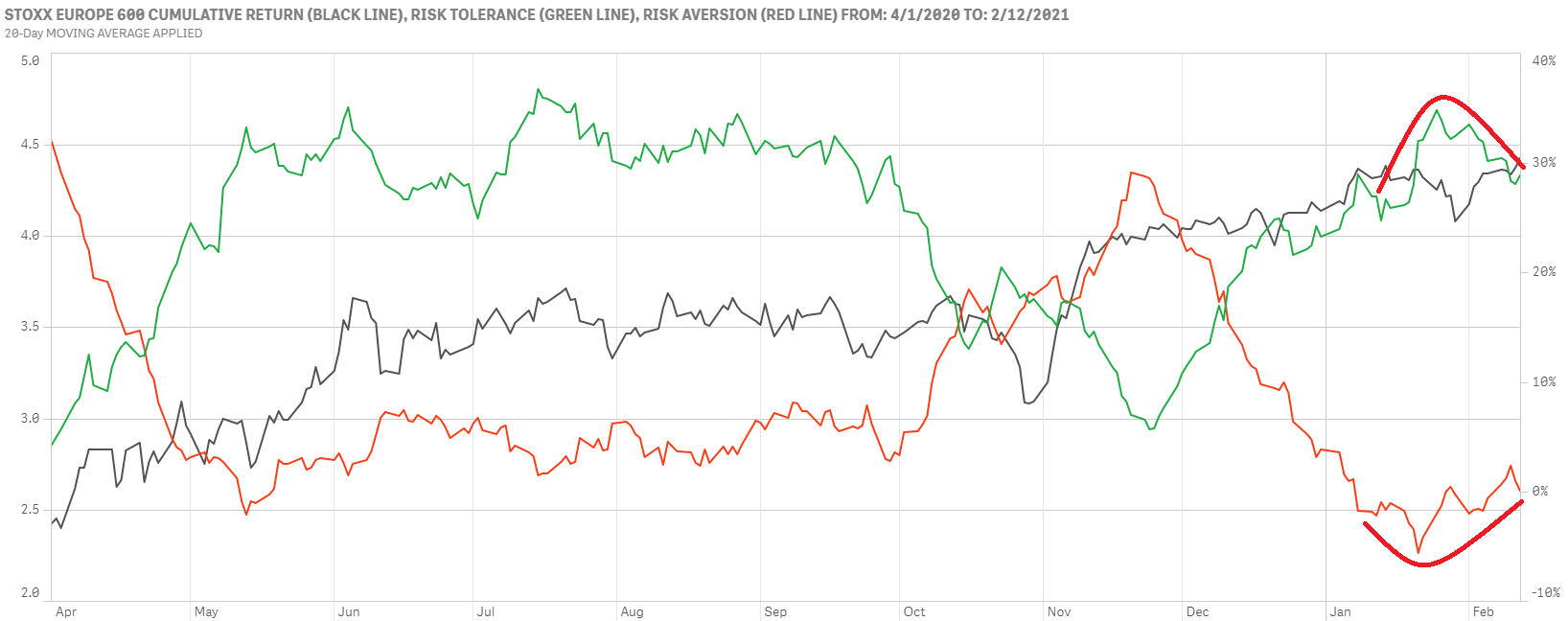

The supply and demand for risk remains firmly in demand’s favor (bottom chart), creating a need for risk-tolerant investors to offer a premium to acquire more risk assets from their less numerous risk-averse peers. In this situation, sellers of risky assets find willing buyers at an advantageous price but buyers may have to balance price and tracking error when trying to acquire them. It will take a strongly negative news to reverse the current risk appetite.

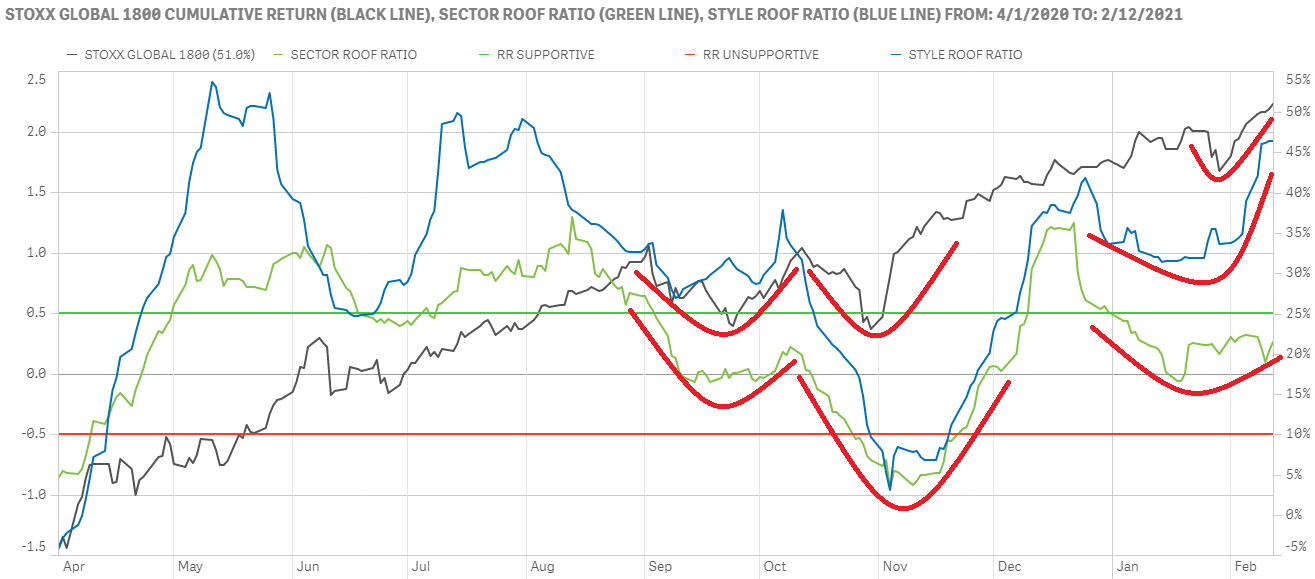

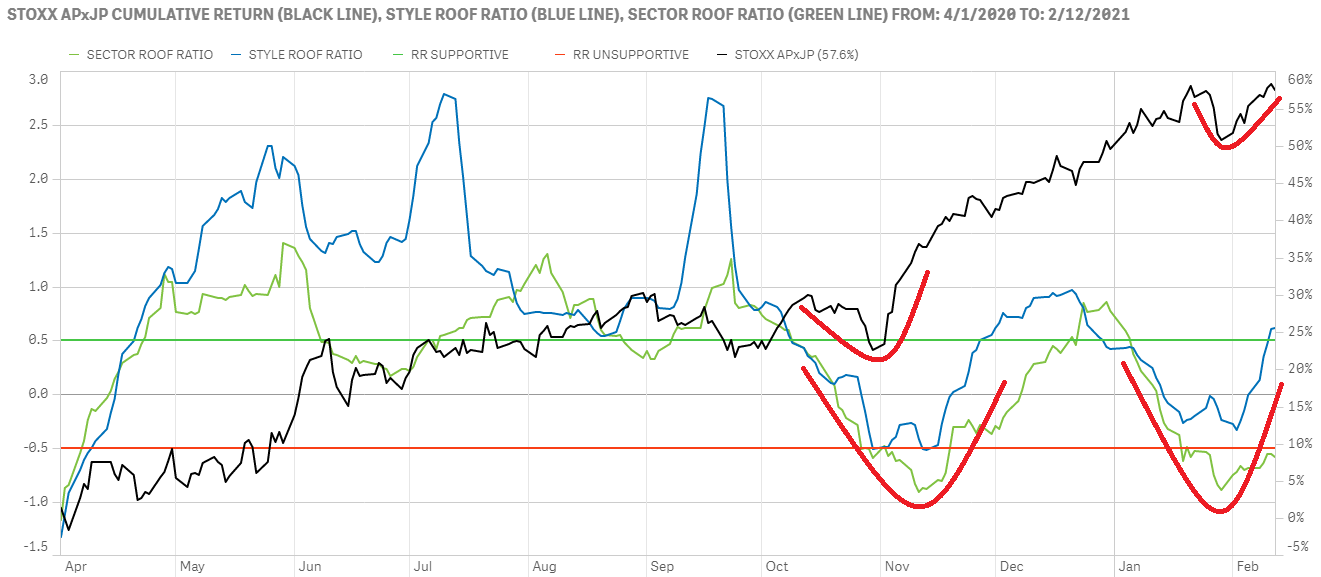

Sentiment remains in sync with global markets and defiance in Asia falls back in line for now.

The STOXX Global 1800 continues to closely track changes in investor sentiment (top chart). For the third time since the summer, dips in sentiment have caused a slight profit taking on the STOXX Global 1800 index, but a subsequent recovering risk appetite brings about a new assault on new highs. Both sentiment indicators (Style and Sector ROOF Ratios) as well as the index have staged a recovery from their January lows last week. It would appear as though this cycle is likely to continue.

Likewise, markets and sentiment in Asia ex-Japan recovered from their January lows but from a much lower base (bottom chart). The Sector ROOF Ratio is still in bearish territory while the Style ROOF Ratio has raced ahead into the bullish zone. This divergence in sentiment across our two methodologies signifies a much more fragile recovery in risk appetite than the one seen among global investors. Markets in Asia ex-Japan had been more bullish than sentiment indicated since the start of the year and so may have more downside risk than upside potential.