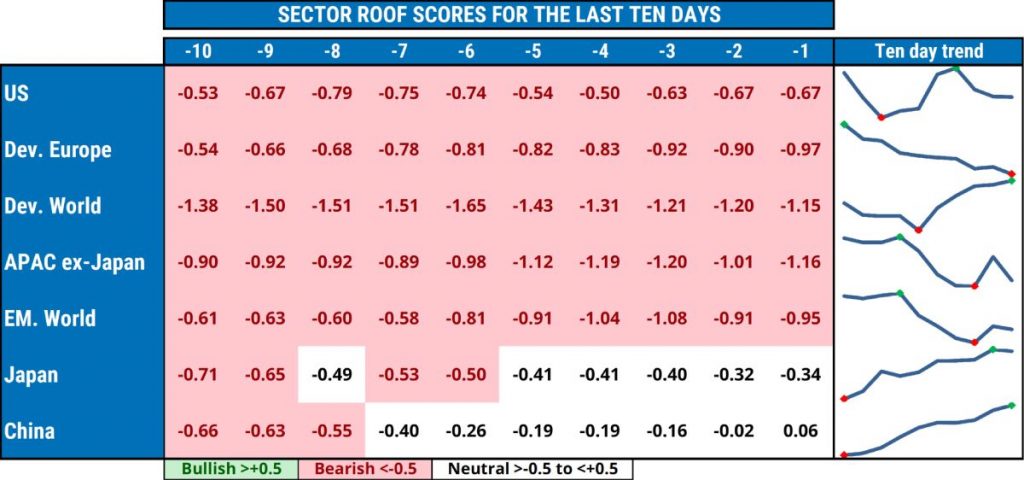

Notes to our readers. As we start 2022, we have made one small adjustment to our Sector ROOF Score methodology. The cap-weighted sector portfolios will now be constructed using the same free-float adjustment factor used across all our indices. This has had some minor, non-directional effects on our history, but we believe this change will better capture investor behavior by focusing solely on the assets they can use to implement their strategies.

Potential triggers for sentiment this week1 :

- US: Inflation data, retail sales, consumer confidence and factory production data.

- Europe: Eurozone factory production data.

- APAC: Japan current account and producer prices.

1 If sentiment is bearish/bullish, a negative/positive surprise on these data releases could trigger an overreaction.

Summary of changes in investor sentiment from the previous week:

- Investor sentiment remains very negative in most markets we track, recovering only slightly in Japan and China last week. Uncertainty levels will likely remain elevated until both inflation and Omicron infection numbers have peaked, and the immediate geopolitical worries are lifted.

- In their 2022 forecasts, investors must deal with the desynchronization of monetary policy response to inflation among major central banks. On the side of the faux naïf are the Fed and the BoE, with their finger already on the interest rate trigger. Meanwhile, the ECB and the BoJ present themselves as the picture of irenic innocence (“Inflation? What inflation?”).

- The upcoming earnings season (starting this week) should provide investors with a bit more clarity as to the impact of inflation on corporate profits. At the very least, it should offer a welcome distraction from the murky macro situation, forcing investors to focus on individual stock selection and increasing dispersion as well as portfolio diversification. The wild card in this scenario is geopolitics (i.e., Ukraine in the short term).

- Sentiment started its decline back in late November, falling into bearish territory for most markets in December. At current levels, there is a sense that we are nearing peak bearishness and that investors are waiting for a reason to abandon their worst-case scenarios and focus on the more positive ones. But, at current valuation levels, the latter will need to be confirmed by CEOs in the next couple of weeks.

- 2021 saw markets reward risk-averse strategies more than risk-tolerant ones all year, resulting in lofty valuations for the former. Valuations on assets commonly found in more risk-tolerant strategies are now more attractive than those found in risk-averse ones. The latter will also have to compete with rising Treasury yields for investors’ attention (i.e., risk-averse isn’t risk-free, and risk-free is looking more and more attractive). Strong earnings and positive guidance for 2022 out of this reporting season might just be the trigger for a rotation trade to start.

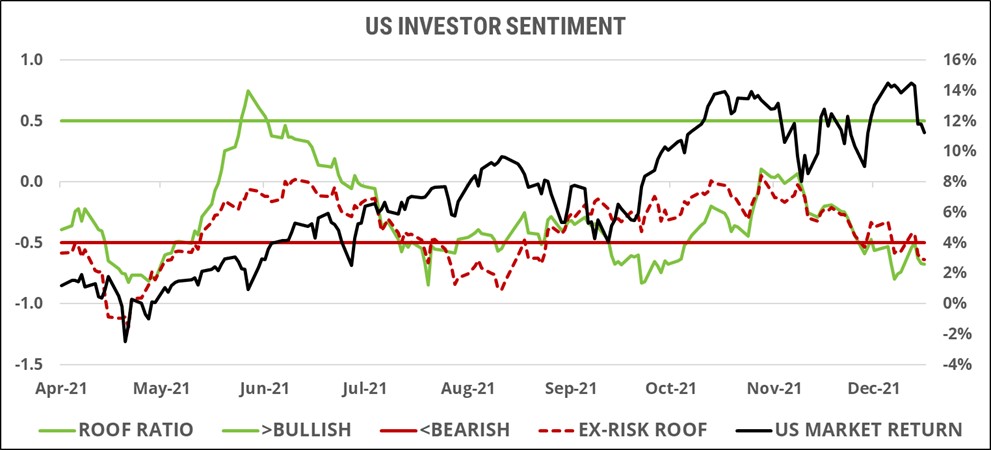

US investor sentiment:

US investor sentiment (green line) was bearish for the third week in a row, forcing markets to retrace some of their recent (sentimentally) ill-gotten gains. Rising inflation remains the top worry ahead of the December reading this week, and has already pushed US 10Y Treasury yields back to their highest level since the pandemic started. The Fed has indicated that it (now) shares investors’ worry but has yet to act, prompting speculation as to when the first rate hike will take place. Expectations have moved forward to March of this year and since November, US investors have been implementing risk-averse strategies via their sector allocation (red dotted line). For now, sentiment is bearish, so a worse-than expected inflation reading could trigger further downside in the short term. The medium-term outlook will depend on whether investors feel that the Fed has fallen behind the curve and missed the chance to get inflation under control in the early stages. Conversely, a mild reading followed by clear signs the Fed is already engaged in countering inflation, should trigger a recovery in sentiment and lend support to an earnings-driven rally in the coming weeks if CEOs confirm the benign impact of inflation on the corporate earnings outlook.

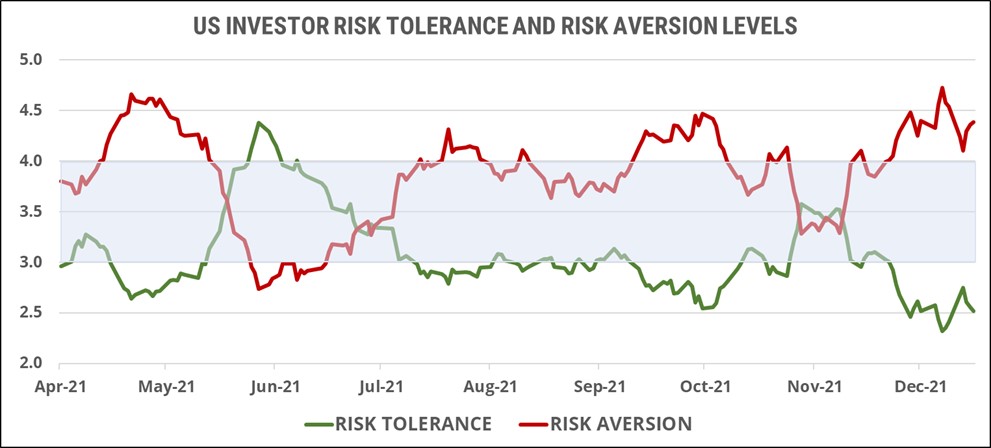

Risk aversion (red line) and risk tolerance (green line) remained far apart from each other last week, creating a very negative net risk appetite among investors (i.e., there are far more investors that are bearish than are bullish). A negative inflation report this week could trigger a rapid market correction as the many risk-averse investors offer large price discounts to offload their risk assets to the few risk-tolerant investors left in the market. Conversely, a positive news, supported by both Fed and CEO commentary on the situation, could make them rush to buy back some of the risk assets they have been selling since November.

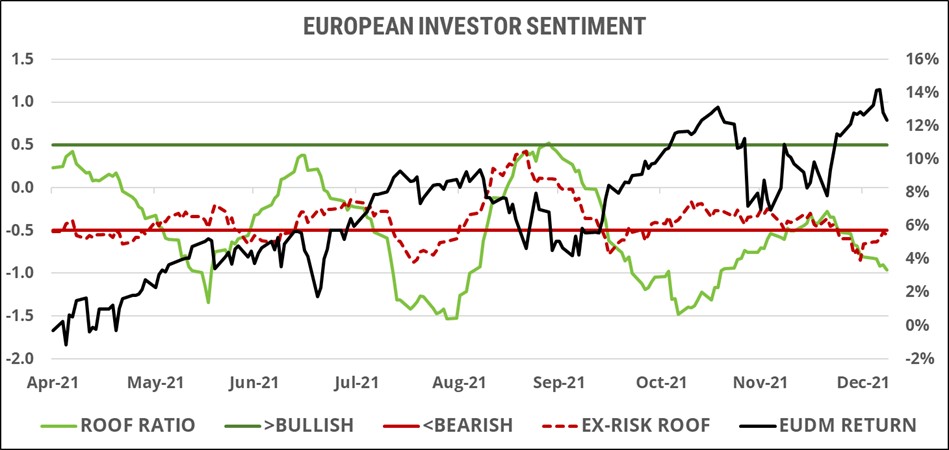

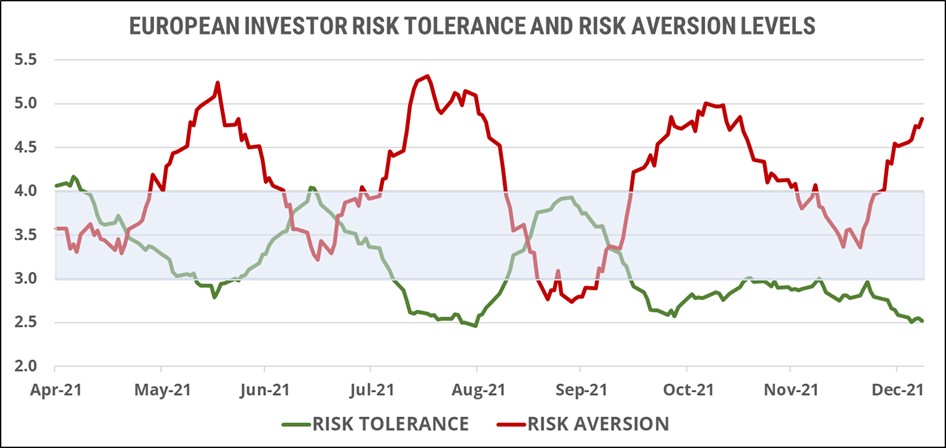

European investor sentiment:

European investor sentiment (green line) declined further last week, pulling markets down with it. On the positive side, investors seem to be implementing less risk-averse strategies via their sector allocation decisions (red dotted line) given the ECB’s assurances that they will not raise interest rates, yet. The ongoing pandemic situation seems to be the main factor influencing sentiment at this point. The outcome of the upcoming French presidential election in April and May is made more uncertain by the failure of the incumbent, and lead contender in the polls, to confirm his candidacy. Short-term, sentiment remains negative and susceptible to over-reaction on negative news (i.e., from Omicron, Ukraine, or French politics). If none of these worries are triggered during January, sentiment should gradually recover as investors focus on corporate earnings and the economic outlook for 2022.

Risk aversion (red line) continued to rise last week, while risk tolerance (green line) trickled further down to reach 52-week lows last seen in August 2021. Investors will need to see a sustained decline in new infection numbers, a warming of relations between Russia and the West, and more clarity on the inflation picture, to become less risk-averse in the short-term. Negative developments on all three fronts could trigger a sharp market correction as the net negative risk appetite converts risk-averse investors into net sellers of risk assets.

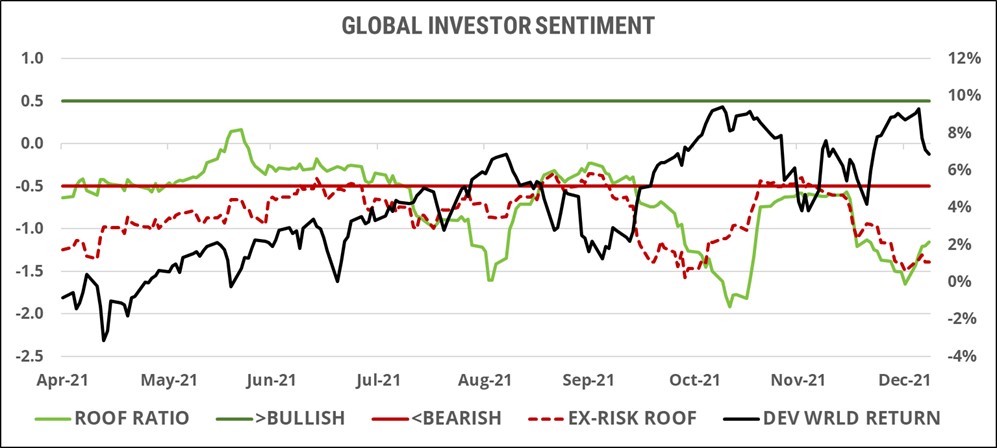

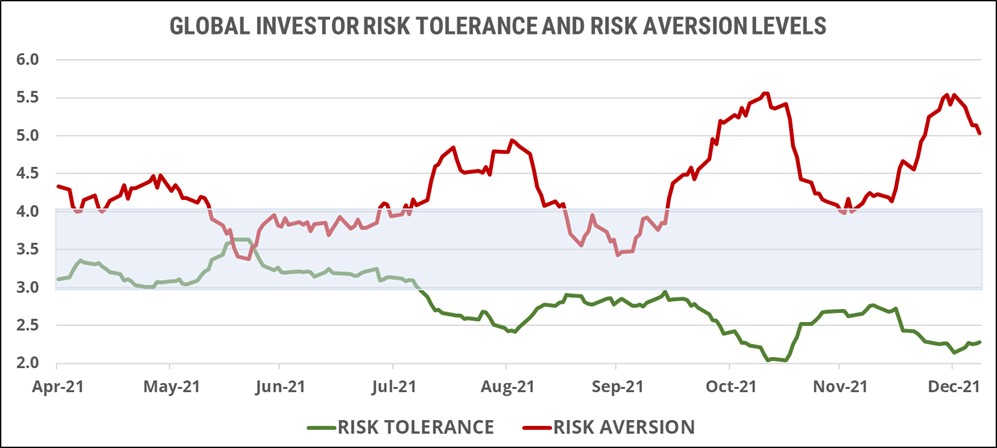

Global developed markets investors sentiment:

Sentiment among global developed-markets investors (green line) recovered slightly last week but remains deep in bearish territory. Markets and sentiment seemed dislocated in 2021 and year-to-date in 2022, as risk-averse strategies continue to earn higher returns than risk-tolerant ones. Investors seem to have returned to their 2020 pandemic playbook, preparing for the worst while hoping for the best and having to deal with monetary policy dislocation. Geopolitics is also weighing on sentiment as investors ponder how many enemies the US (60% of the global index) can make (Russia, China, Iran…) ahead of its own mid-term elections in November. For global investor sentiment to recover, these factors need to be removed from the negative side of the scale one by one. First Ukraine, then Omicron, then US-China trade relations…

Risk tolerance (green line) remains near its 52-week low, while risk aversion (red line) retreated from its recent highs albeit remaining elevated. In the event of negative developments on the Omicron, Ukraine or inflation front, the overwhelmingly net negative risk appetite will cause an over-reaction on the downside, forcing a market correction. Conversely, resolution on these three issues could trigger a rotation from risk-averse to risk-tolerant strategies by investors, supporting a market rally to new highs. In the short-term, this choice seems to be in Vladimir Putin’s hands, which is probably what is keeping investors on edge.

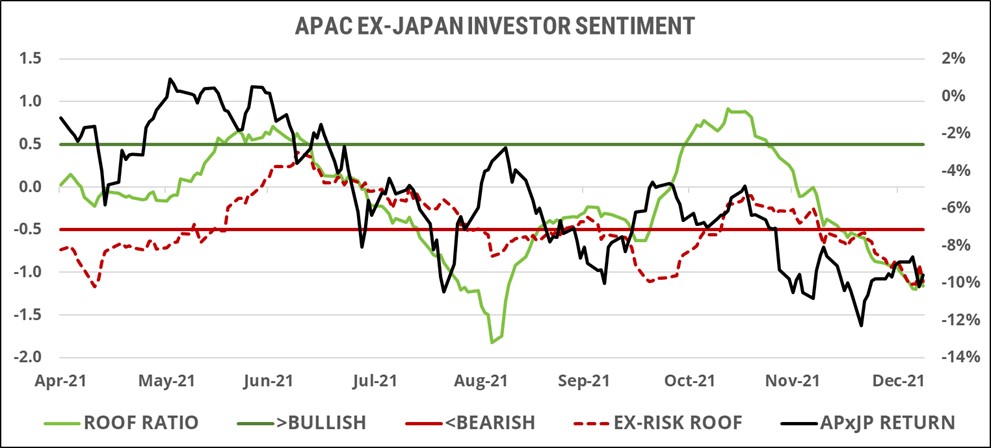

Asia ex-Japan markets investor sentiment:

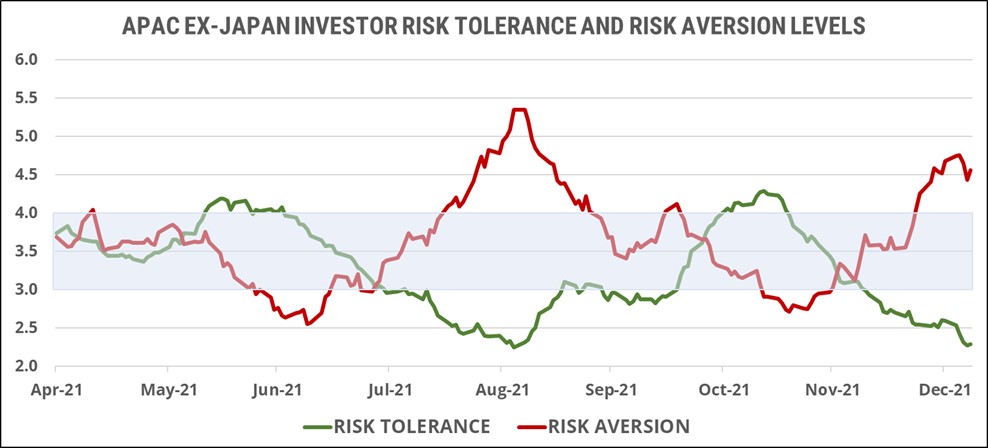

Sentiment (green line) among Asia ex-Japan investors continues to weaken and turn increasingly bearish, taking markets down with it. Asian ex-Japan investors ended the week as the most bearish ones among the markets we track. Omicron continues to disrupt the region’s supply chain, especially in the areas of transportation and tourism, and the US-China relationship remains adversarial on multiple fronts. Looking ahead, energy prices are expected to remain high, raising costs for many of the region’s economies, and US interest rates are set to rise, increasing the debt burden for both regional governments and corporate borrowers alike. As we saw during all of 2021, it will take nothing short of a return to pre-pandemic normalcy for regional investor sentiment to become positive again. In the meantime, investors continue to implement risk-averse strategies.

Risk tolerance (green line) declined further last week, while risk aversion (red line) gave up some of its recent gains. The net risk appetite remains very negative, however, and conducive to further market downside in the event of negative news. This may come as early as this week with the US inflation picture and its impact on US treasury yields, which are already back to pre-pandemic levels. Conversely, valuations in this part of the world are nowhere near developed market levels.

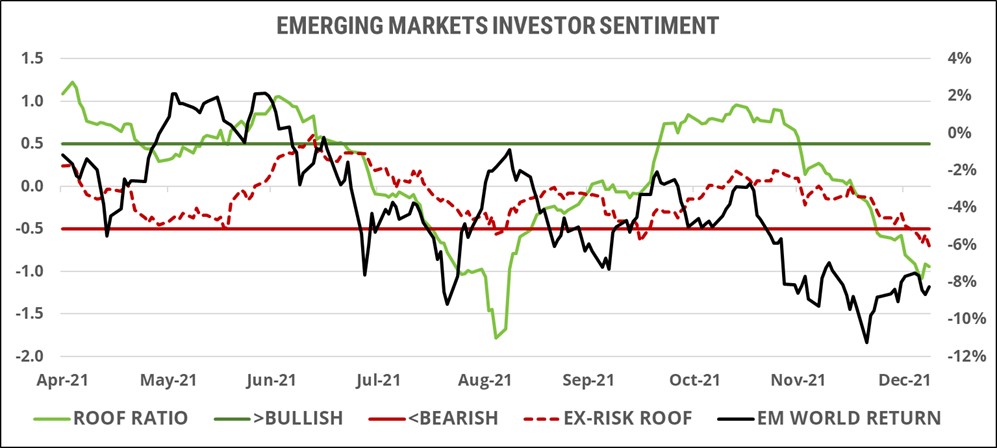

Global emerging markets investor sentiment:

Sentiment among global emerging-markets investors (green line) remained bearish, preventing a market rebound that started in December to continue any further last week. Emerging markets failed to profit from the global economic recovery last year and investors are now looking at rising inflation, high energy prices and an ongoing pandemic for 2022. A trifecta of macroeconomic, geopolitical and health (pandemic) factors will keep fund flows out of emerging markets in the near term. Valuations of both risk-averse and risk-tolerant assets remain low given the market’s one-year negative returns, but investors simply do not seem to believe in any reasons to turn positive in the short term.

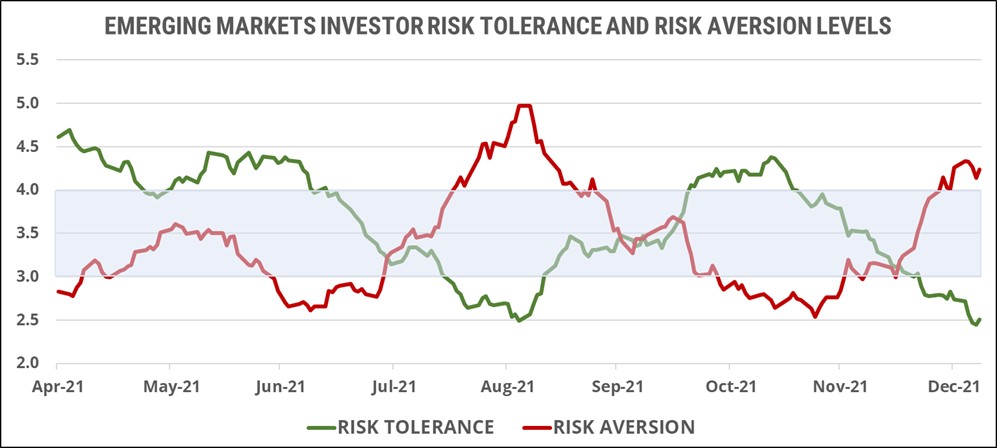

The negative gap between risk aversion (red line) and risk tolerance (green line) remains too large for a sustainable market rally. Interestingly, while risk tolerance is at its 52-week low, risk aversion is not at its high, implying a kind of risk-aversion fatigue on the part of investors. They are not actively negative but seem to have become indifferent, reflecting a state where they are simply no longer hopeful (for the time being).