Potential triggers this week: US Fed minutes and US Jobs report. Covid-19 vaccination status – success and failures. UK monetary indicators, Eurozone retail sales, industrial output, and inflation rate, China Caixin PMI surveys; Japan consumer confidence, and worldwide services PMI numbers.

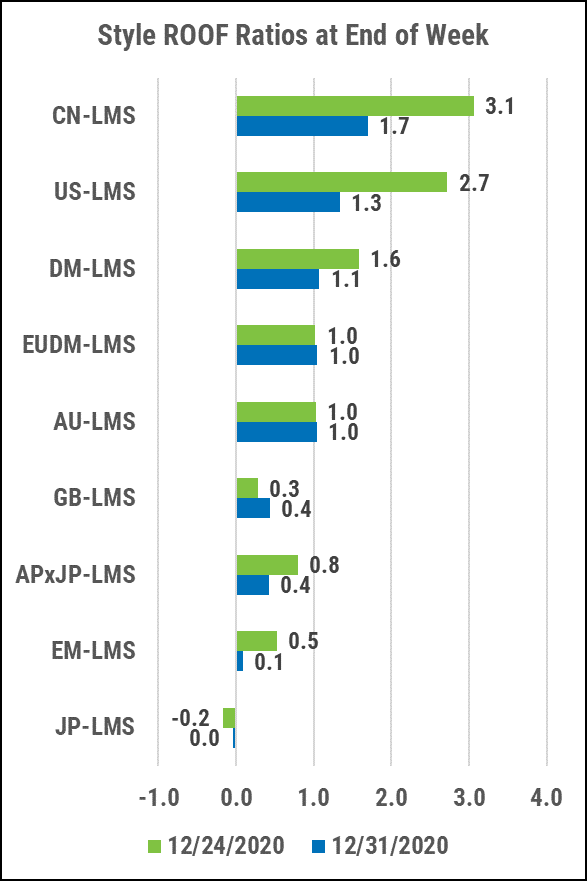

Summary: Sentiment continued to improve in December on the back of growing optimism surrounding the vaccine news, until the last week of the year where it weakened for US, China, and Global Developed investors, triggering sell signals in those markets. To be fair, investors there only experienced a change in sentiment from strongly bullish to only mildly so, and their ROOF Ratios ended the year still above the Neutral zone but more than 0.5 points below their recent highs. Q4 2020 economic data is likely to confirm a slowing down of the recovery but the continued monetary and fiscal stimuli should provide downside risk protection. It will be up to the vaccine narrative to give investors a sense of how soon economic activity will return to normal. In the meantime, news on the US leadership transition and the post-Brexit developments for Europe and the UK will likely dictate short-term mood swings.

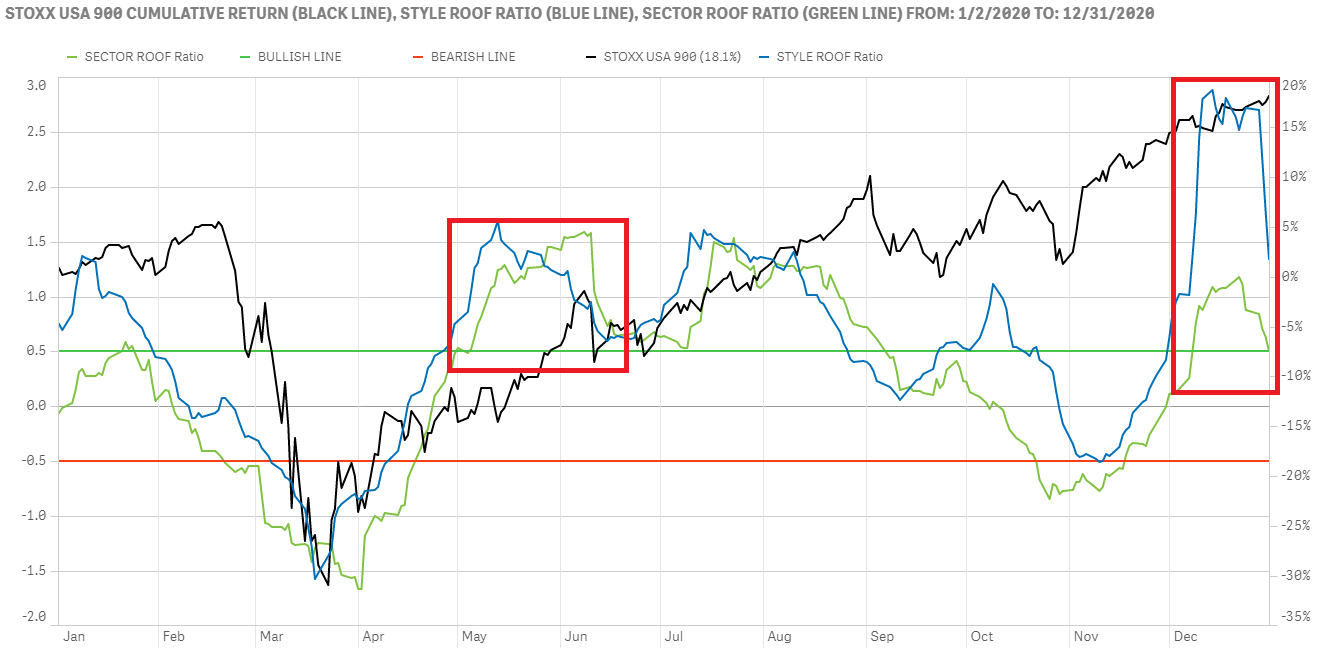

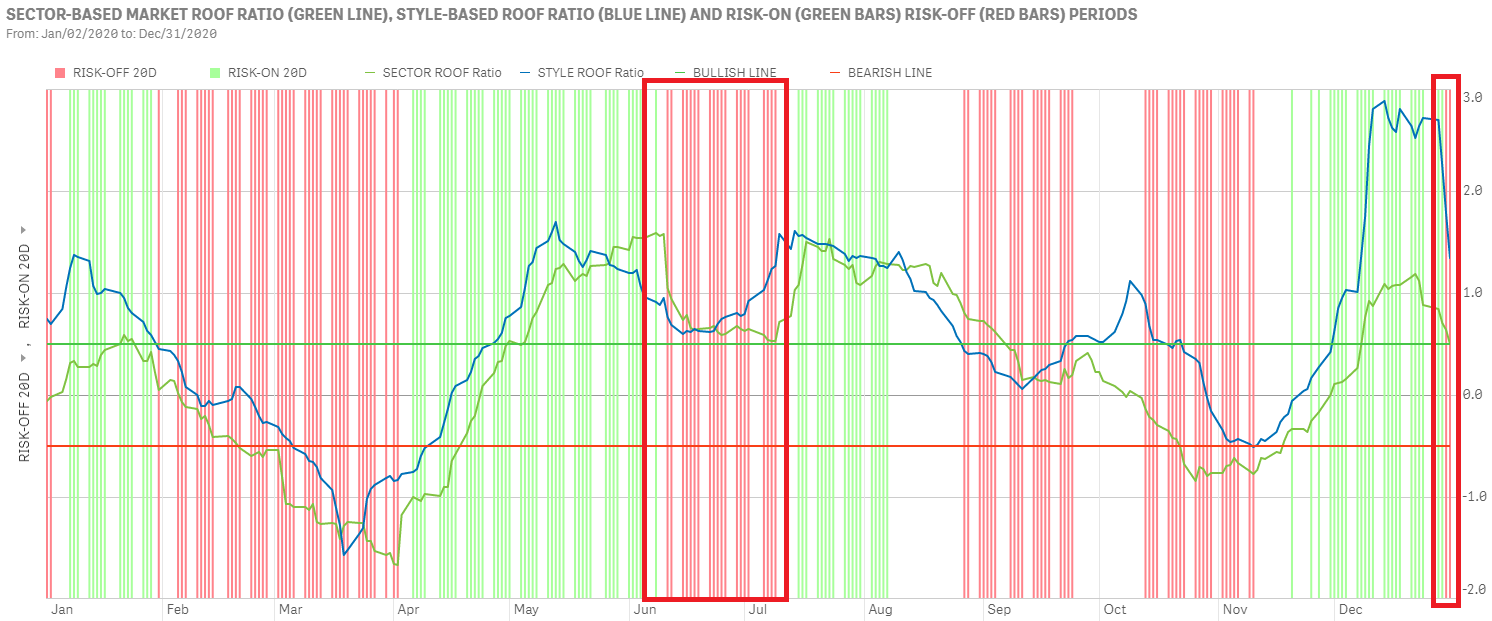

US investors curb their enthusiasm in the last week of the year triggering a sell signal.

Both ROOF Ratios made a sharp U-turn in the last (holiday-shortened) week of the year (top chart). Both fell by more than 0.5 from their recent highs (within the last 20-days) signaling a change in sentiment and triggering a sell (profit taking) signal in the process (bottom chart). The abruptness of the change in sentiment was similar to what we experienced in June 2020. Back then, sentiment recovered shortly thereafter, returning to its upward trend in July.

To be clear, sentiment remains positive, just no longer euphoric. The news of the vaccine in November is now giving way to the roll-out success stories, which are not off to a great start. Meanwhile the negative COVID-19 narrative (i.e., deaths) keeps hitting daily new highs and unnerving investors. It is another sixteen days until the Biden administration takes over and transparency returns to the daily briefings, until then, sentiment may remain directionless.

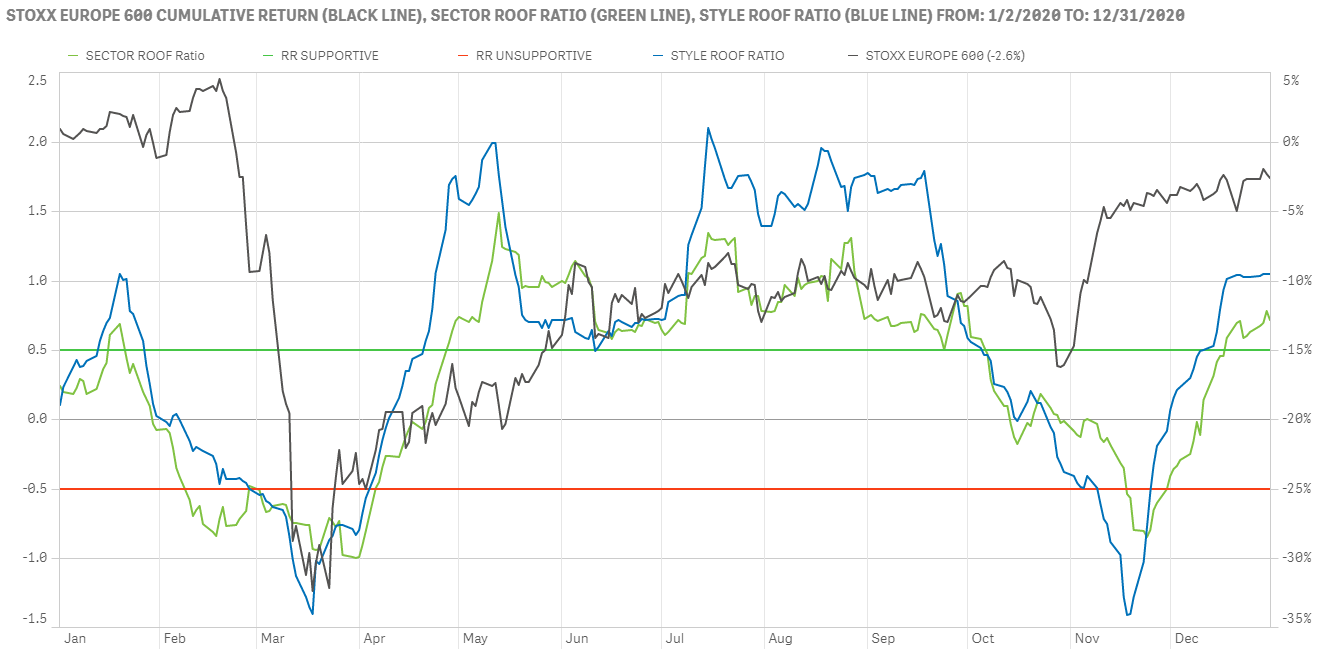

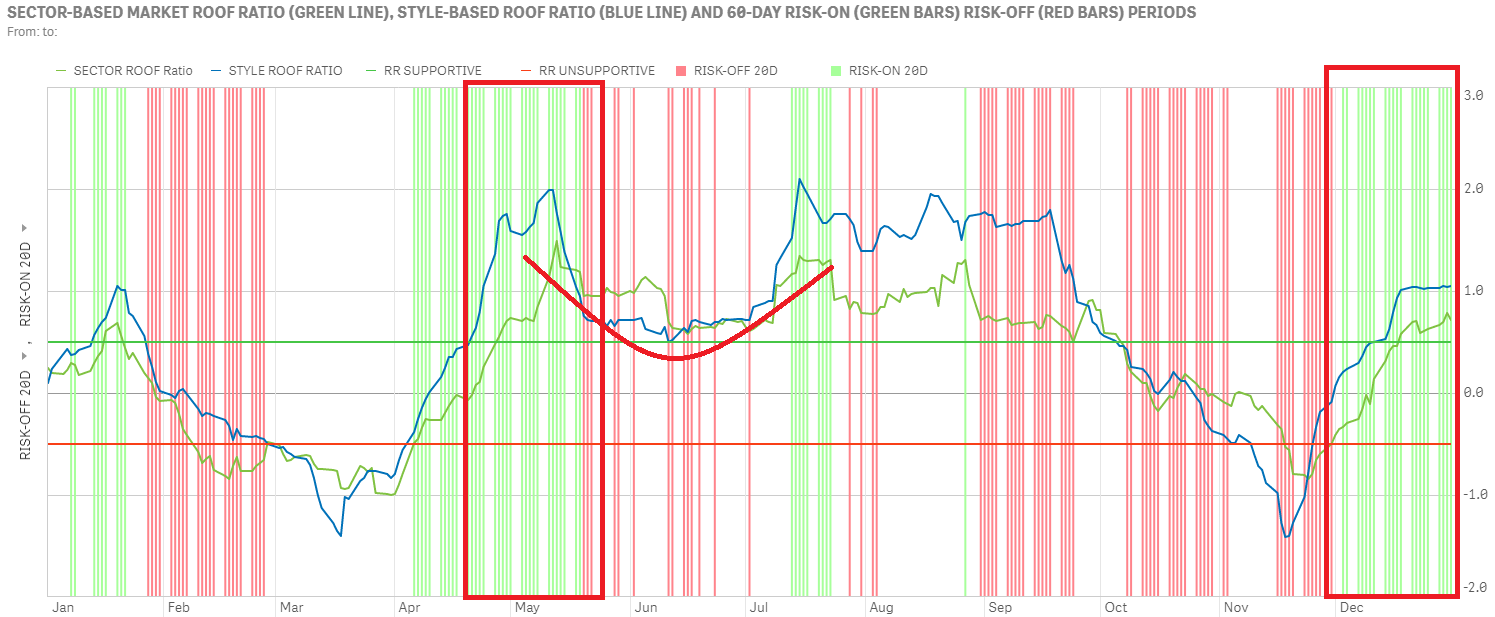

Sentiment in Europe recovered its bullish stance but remains restrained by Brexit.

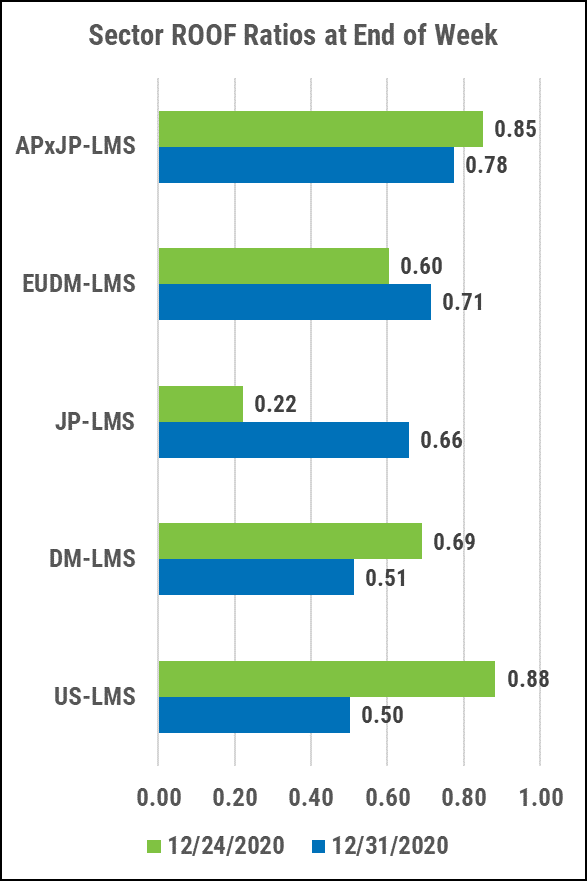

Sentiment in Developed Europe continued its assent into the bullish zone but was held back by the daily will-they-won’t-they Brexit trade negotiations (top chart). Unlike in June 2020, the pause in sentiment was not strong enough to erase the BUY signal triggered in early December which remains in place (bottom chart). Now that Brexit has come and gone, without the UK crashing out of the EU without a deal, perhaps sentiment will return to its upward trend lifting market back to their previous (February 2020) highs.

As with US investors, sentiment is likely to be driven by the success and failures of the COVID-19 vaccination narrative in the short term. At these (ROOF) levels sentiment seems positive enough to withstand some bad news and carry on, limiting the downside risk for markets.

Sentiment takes a break for both Global and Asia ex-Japan investors.

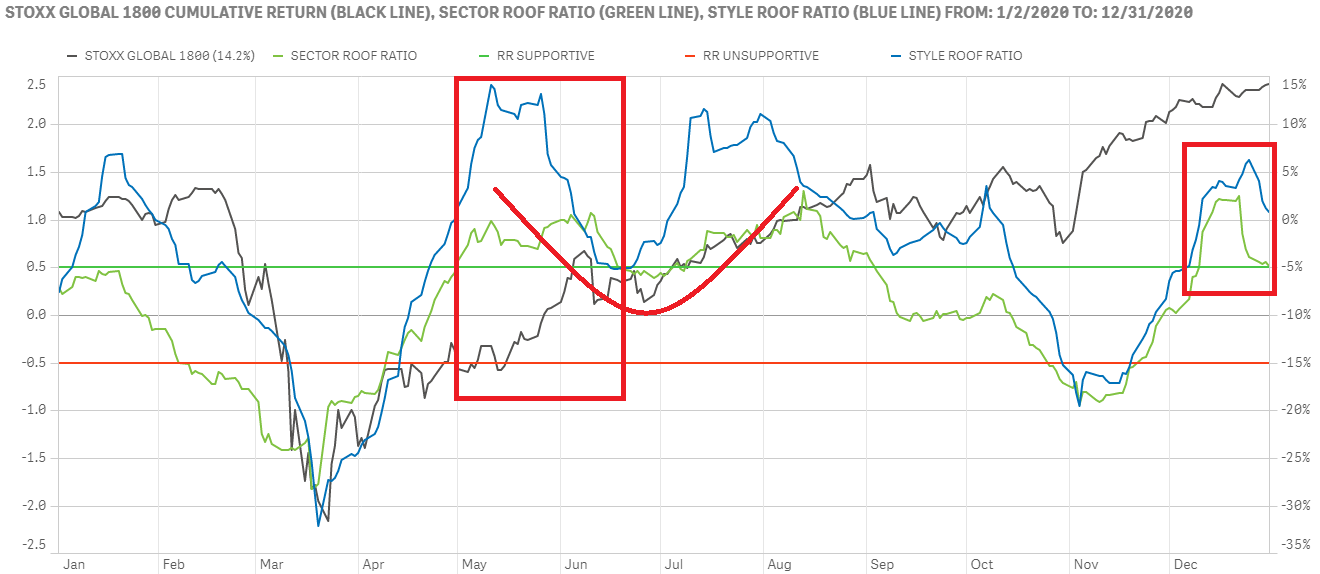

Investor sentiment for the STOXX Global 1800 has followed its US counterpart in a retracement of recent highs while remaining just inside the bullish zone (top chart). As it did in the US, this greater than 0.5 retracement in the last 20-days triggered a sell/profit-taking signal. As in the US we have been there before, in June 2020, only to see sentiment and markets recover in July.

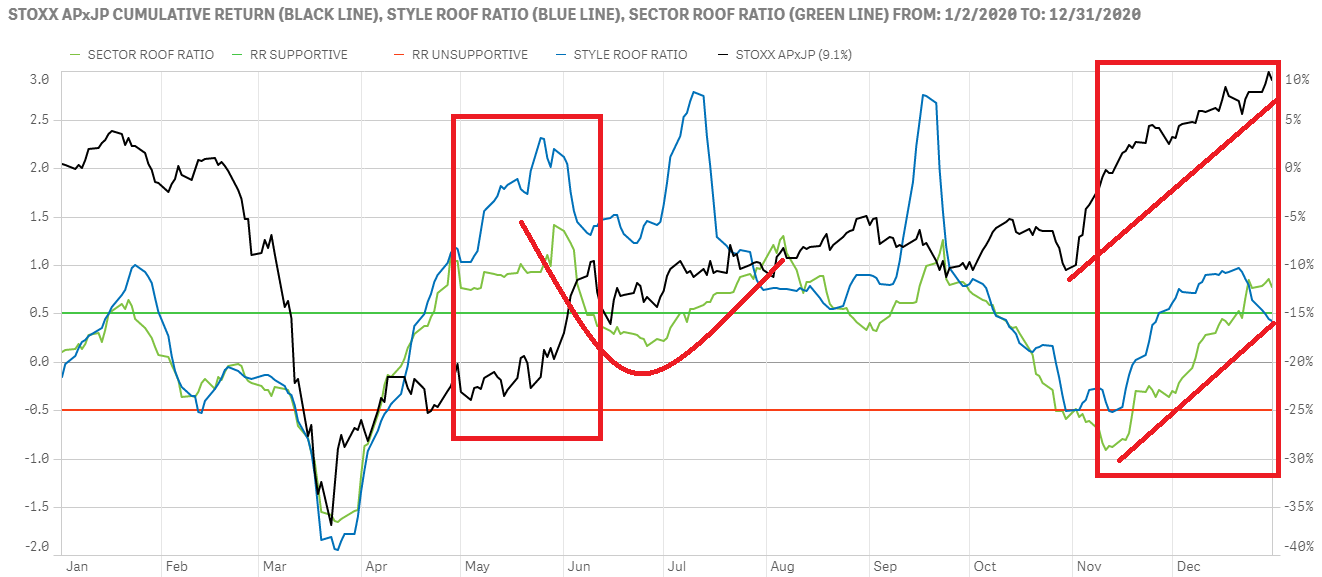

Sentiment in Asia ex-Japan has likewise retraced some of its recent rise but remains at or above the neutral zone. Of all the markets we cover, however, the gap between the recent rise in the STOXX Asia Pacific ex-Japan 600 and sentiment is now the widest, signally that market prices may have gotten ahead of sentiment. The recovery in both markets and sentiment has run in parallel until last week but the recent drop in the ROOF ratios may endanger this relationship. A further drop in sentiment from these levels would leave markets vulnerable to a growingly negative cognitive bias.