Potential triggers for sentiment this week1 :

- US Q2 earnings season kicks off with big banks reporting

- Fed Chair Powell’s testimony before congress

- US CPI and PPI, as well as retail sales data and industrial production

- China Q2 GDP growth, UK CPI and jobless numbers, BoJ interest rate decision

Summary of changes in investor sentiment from the previous week:

- Changes in investor sentiment continue to reflect the ongoing tradeoff between worries about the strength of the economic recovery on the one hand, and the limited downside risk from declining volatility on the other.

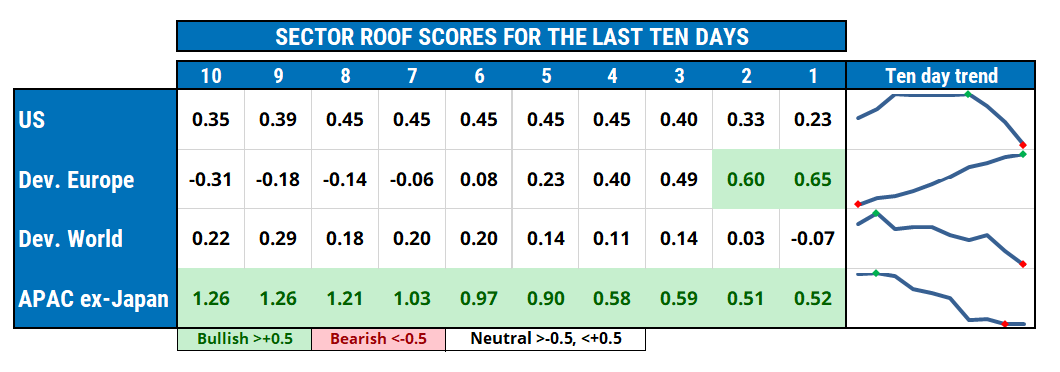

- Sentiment among US investors returned to a neutral position last week from a cautiously optimistic one at the end of the previous week. European investors, however, continued their strong sentiment recovery of the past few weeks and broke into the bullish zone last week, but the recovery in sentiment may not have been as voluntary as it seems.

- Global investor sentiment remains neutral and has stayed in a very tight range for two weeks now, seemingly lacking direction. Asia ex-Japan investors have pared some of their bullish sentiment ending last week just inside the bullish zone but with some downside momentum.

- The start of the Q2 earnings season in the US and new inflation readings for June may provide investors with some direction to counter lingering concerns about the pandemic situation and its ongoing impact on the economic recovery.

- We note that sentiment in three (US, Dev. World and APAC ex-Japan) of the four regions ended last week at their lows, despite a low volatility and low correlation regime, meaning that sentiment may become overly sensitive to a sudden change in volatility if it happens.

1 If sentiment is bearish/bullish, a negative/positive surprise on these data releases could trigger an overreaction.

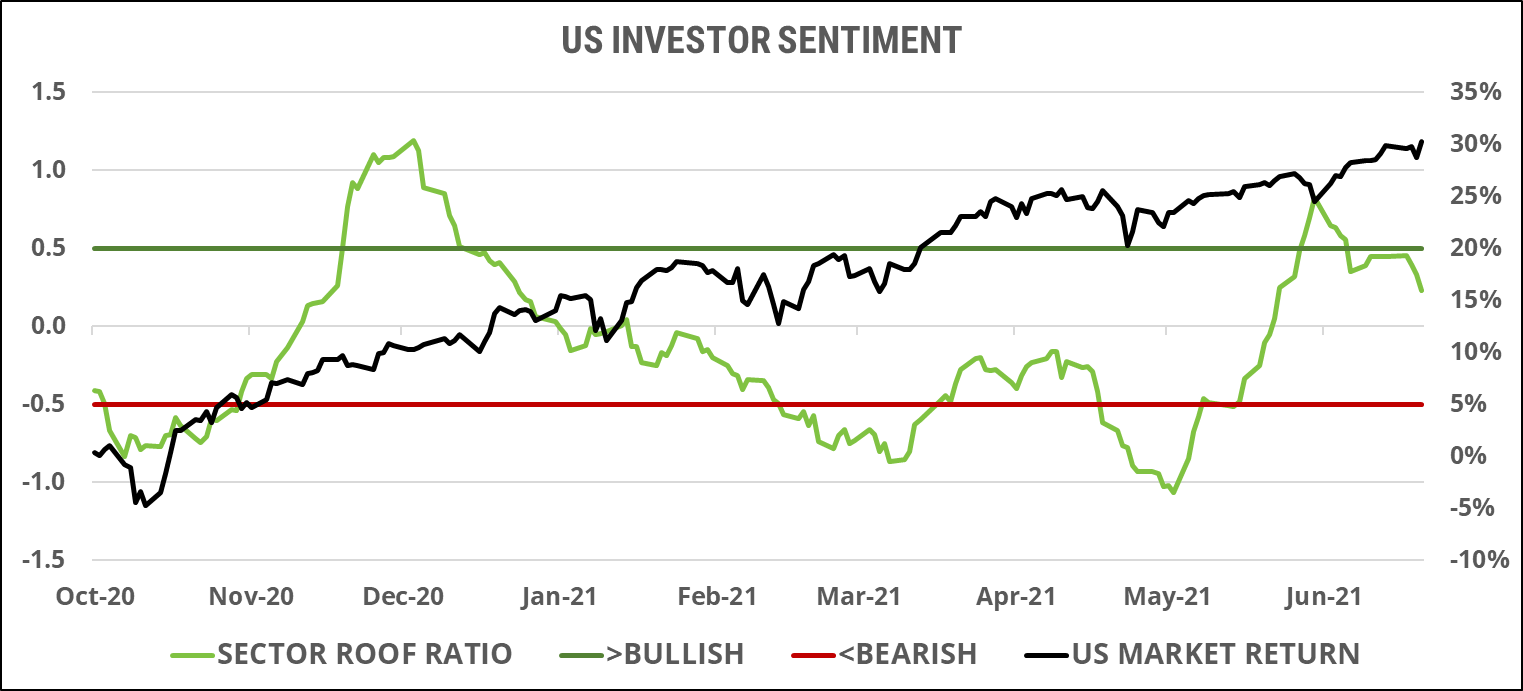

US investor sentiment:

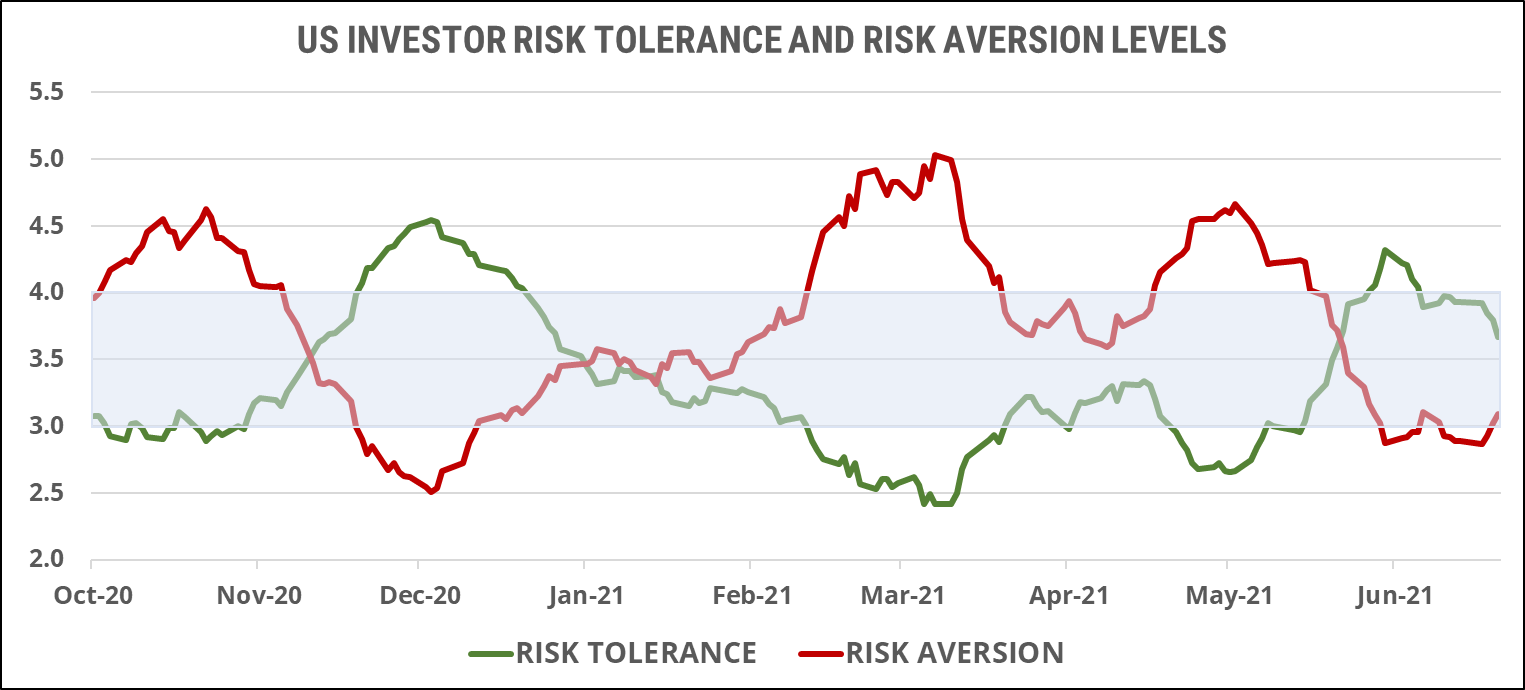

Sentiment among US investors ended last week slightly weaker than the previous week, ahead of the Q2 earnings reporting season that kicks off this week. The big question for them now seems to be whether the economic recovery is slowing down and whether current rich valuations are sustainable in a slow-growth environment. Volatility has flattened out at low levels, which means that sentiment is mostly being driven by sector allocation choices, instead of a need to respond to a changing risk situation. The concern for investors is that not every sector will have the kind of stellar earnings growth necessary to maintain current lofty valuations should the economy slow down from here. Their hope is that the earnings season and CEO guidance will provide clues as to which sectors are living up to their valuations and which ones are not.

Risk aversion (red line) rose while risk tolerance (green line) declined last week bringing the balance between the supply and demand for risk closer to equilibrium. Investors no longer seem to be worried that the Fed will be the one to derail the economic recovery, but rather that the rate of growth will slow down on its own as a result of supply chain issues and COVID-19-related pressures on demand. This week’s inflation releases for June might not provide much direction if investors are no longer worried about higher interest rates. From this week onwards, sentiment will take its cues from CEOs of reporting companies.

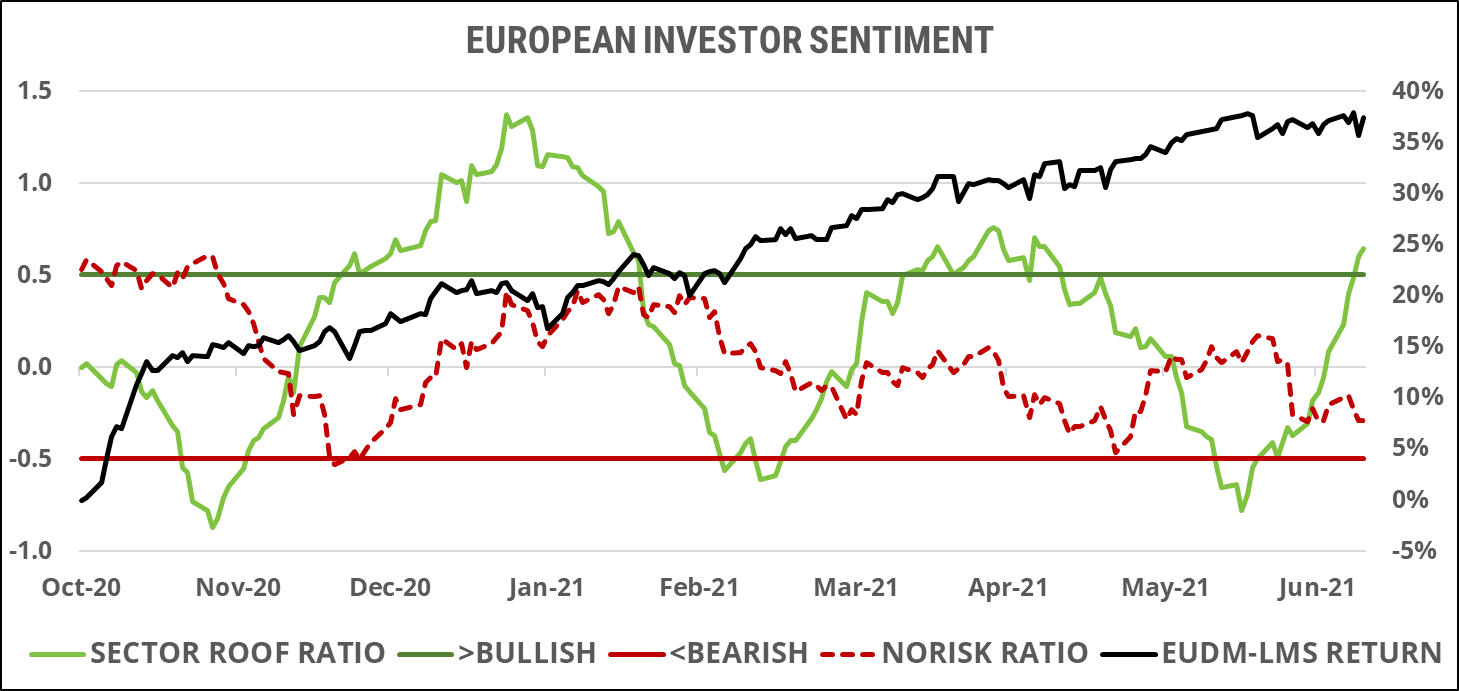

European investor sentiment:

European investor sentiment continued to surge, breaching into the bullish zone at the end of last week for the first time since April. It should be noted that a lot of this apparent rise in sentiment is related to the decline in predicted volatility for the European market these past three weeks. In the chart below the red dotted line shows where sentiment would be (-0.29) without the two risk metrics in our Sector ROOF Ratio methodology. So, while a lower risk regime allowed investors to take on more risk, they seem to have done so by increasing their bets more on risk-averse sectors than risk-tolerant ones. A sudden change in the direction of volatility will combine with this risk-averse sector preference to drive sentiment sharply in reverse and towards the bearish zone.

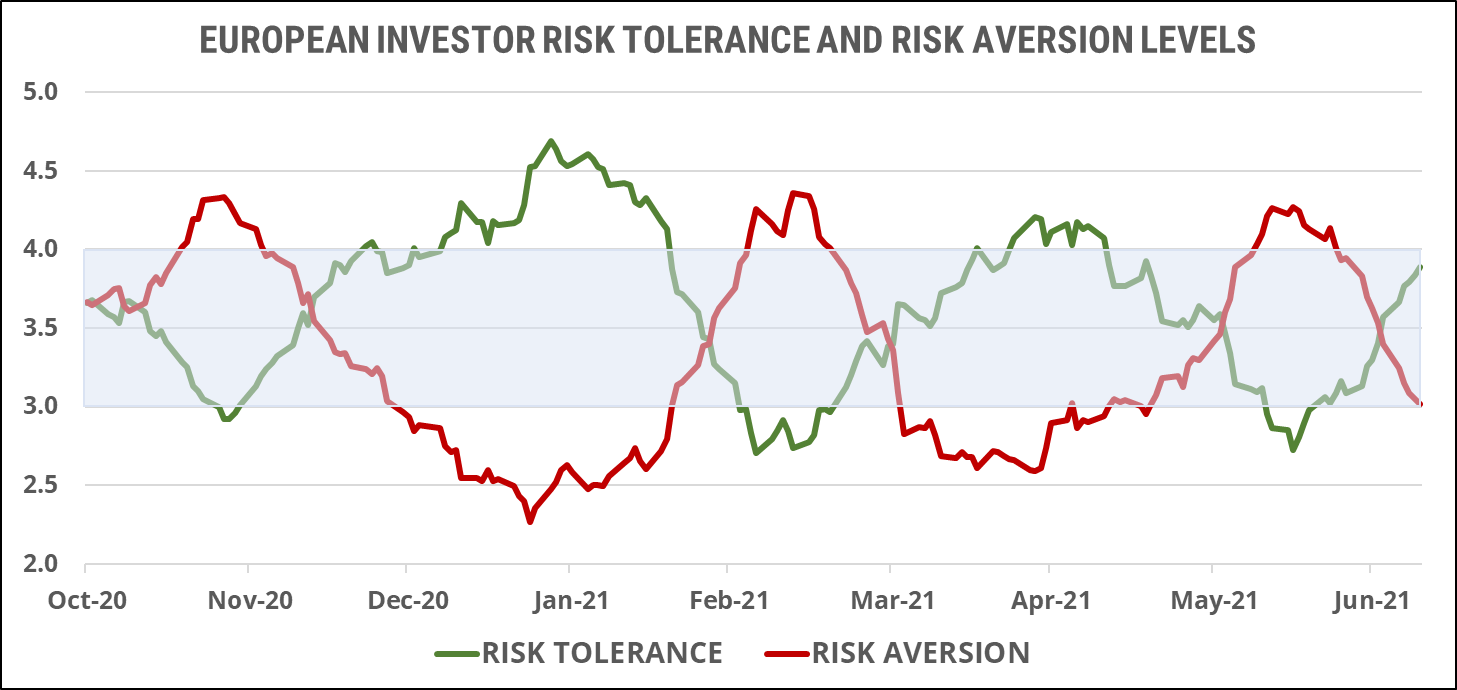

The supply and demand for risk seems now firmly on the side of demand with risk aversion (red line) continuing to decline last week while risk tolerance (green line) rose. As stated above, a large driver of this improved risk appetite is the continued declining volatility regime. With volatility now back to pre-pandemic levels, it is hard to see how this metric can further drive sentiment upwards unless investors also change their minds about which sectors they prefer. A simple flattening out of the volatility predictions, as is the case in the US market, will create a similar return to equilibrium between the supply and demand for risk.

Global developed markets investors sentiment:

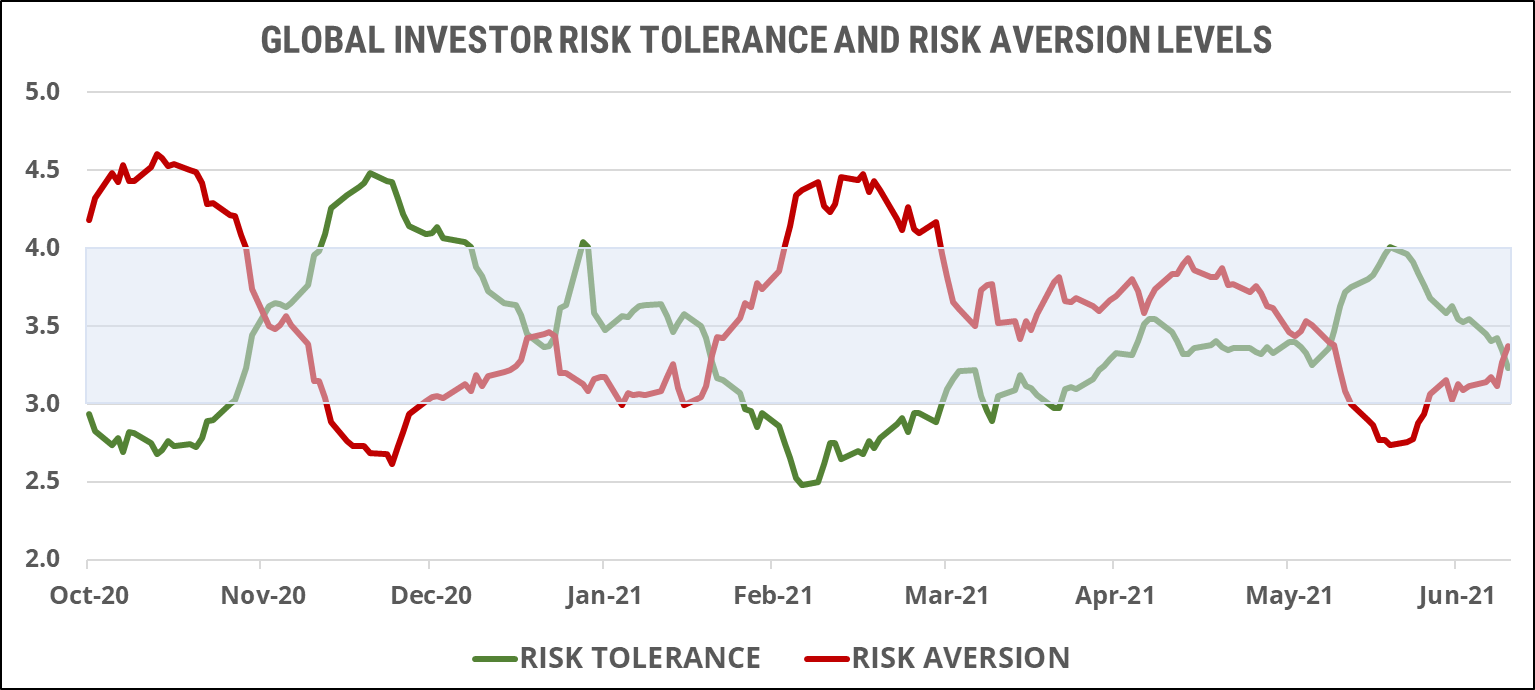

Global investor sentiment declined last week, giving up the cautious optimism it had retained the previous week. Responding equally to both the attraction of a low-risk environment and the fears of a slowing global economic recovery, sentiment is now dead neutral. Judging by the trend of the last month or so, momentum seems to be on the side of caution with investors needing a good reason to turn bullish again to reverse the trend. Second quarter year-on-year economic data remain skewed by the lockdowns in Q2 2020, so investors may choose to wait and see in the neutral zone until the start of Q3 data releases.

Risk tolerance (green line) and risk aversion (red line) levels are now at equilibrium, translating to a neutral risk appetite among global investors. Here, too, momentum seems to be on the side of rising risk aversion in the short term, especially with volatility levels having nowhere else to go but back up from these levels. If one takes the view that volatility will remain low and the Q2 earnings season will provide investors with the confidence they seek that the economic recovery remains intact, then the current supply-and-demand situation for risk offers an opportunity to add risk assets at a fair and reasonable price.

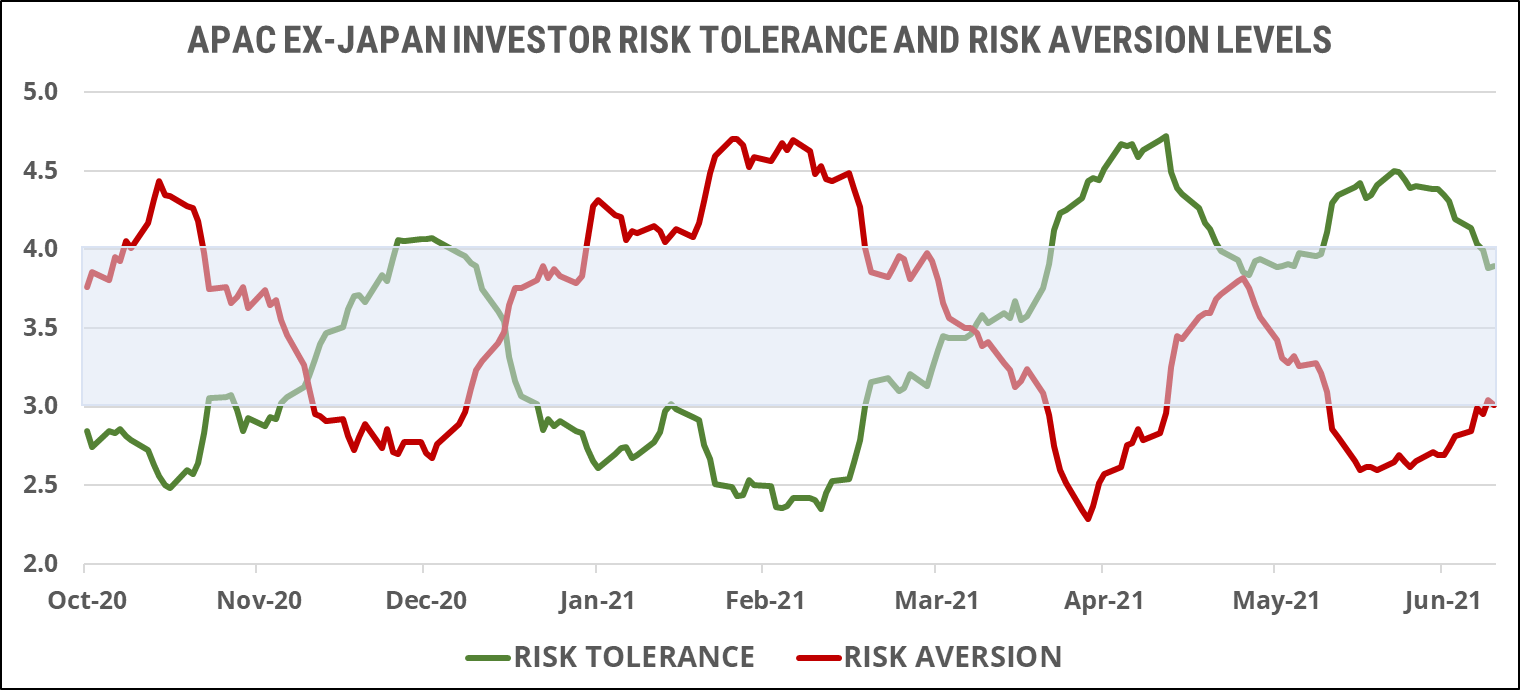

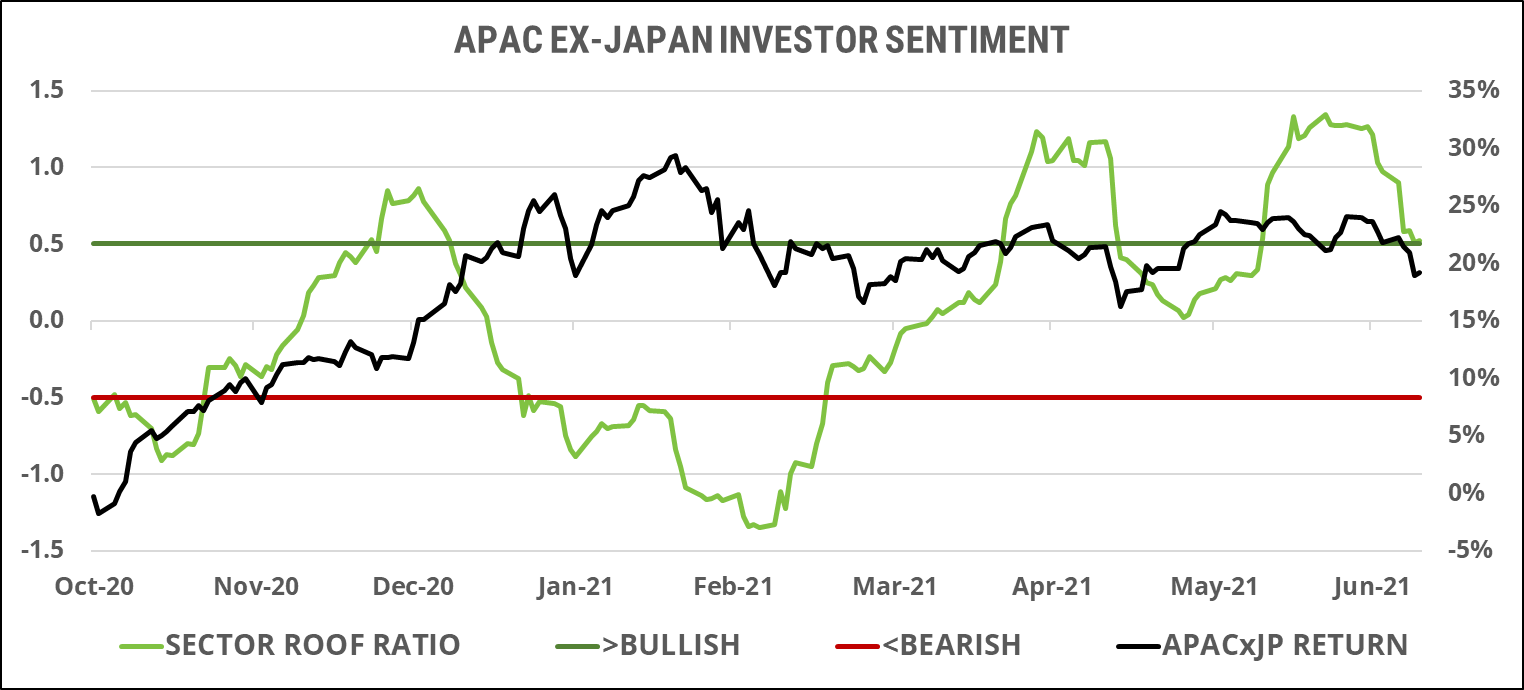

Asia ex-Japan investor sentiment:

Asia ex-Japan sentiment continues to respond to rising uncertainty about the rate of growth of the global economic recovery. Sentiment ended last week still in the bullish zone but just shy of the neutral zone as news headlines raise the prospect of a slowing recovery. Asia ex-Japan markets have likewise been unable to recover their previous highs, lacking confidence to push current valuations higher without further guidance. Despite the recent decline, sentiment remains cautiously optimistic in this part of the world, and barring negative earnings guidance from CEOs, it could easily return to a more bullish stance from here.

Risk tolerance (green line) continued to decline last week while risk aversion (red line) rose. The supply-and-demand balance for risk remains in favor of demand with a positive net risk appetite, but the gap between the two is no longer as wide as it was a month ago. Here, as well, momentum seems to be on the side of prudence rather than rashness, but there is quite a bit of downside room left before sentiment becomes bearish and it will take multiple negative news to turn investors into net sellers of risk again.