Potential triggers for sentiment this week1 :

- Minutes from the Federal Reserve and European Central Bank

- UK monthly GDP

- Germany factory orders and trade balance

- Worldwide services PMIs

Summary:

- Last week was uneventful from a sentiment point of view, with the July Fourth holiday in the US likely delaying any reaction to Friday’s strong employment report until later this week, when the release of the latest Federal Reserve minutes may add more context as to the direction of US interest rates.

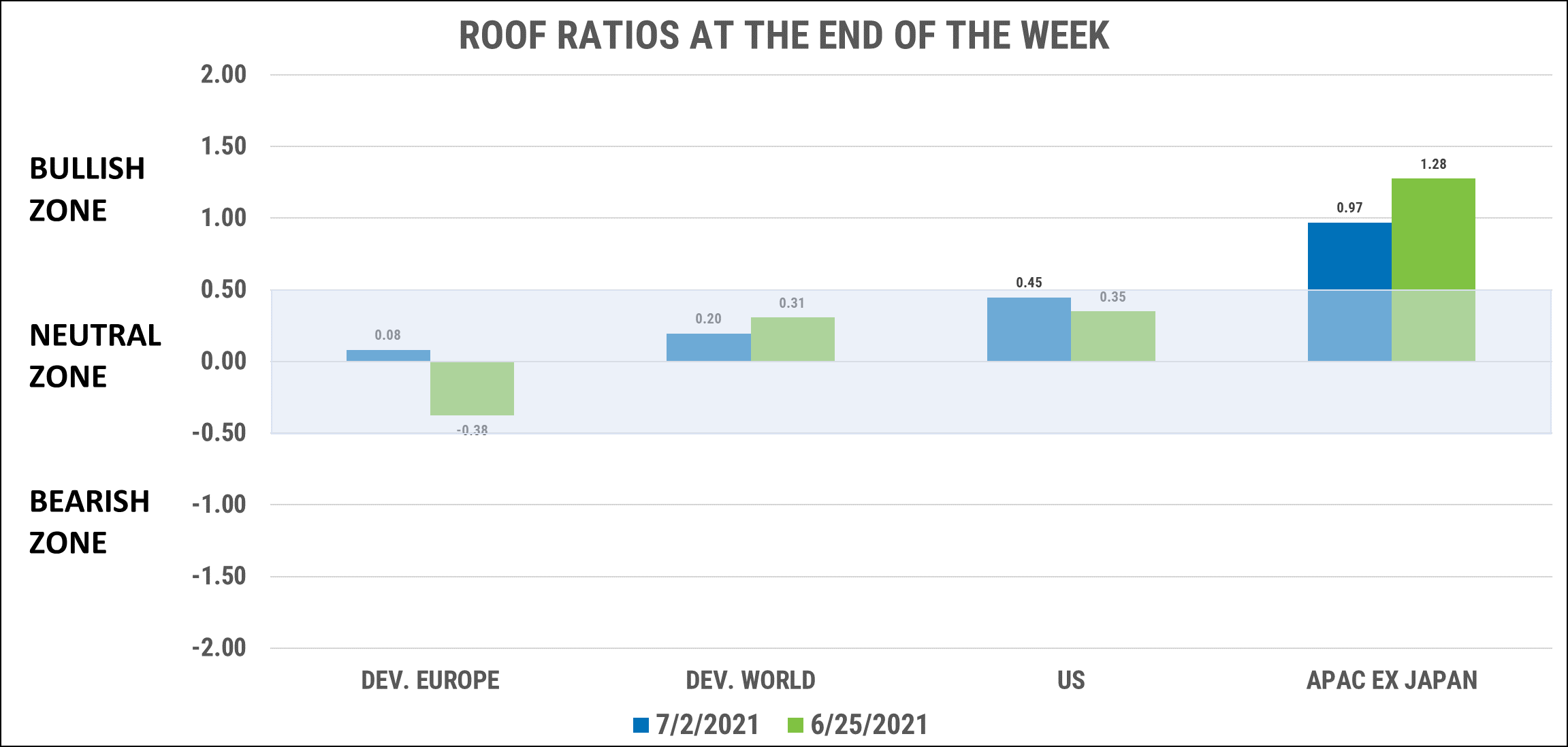

- Sentiment among US, European and global developed-market investors remained neutral, moving in a tight range from the previous week, while Asia ex-Japan investors pared their bullish sentiment to a somewhat less overly optimistic mood.

- A neutral sentiment means that the numbers of risk-tolerant and risk-averse investors in the market are evenly matched, giving neither side more pricing power over the other (i.e., it is neither a buyer’s nor a seller’s market). A neutral confirmation bias also means that investors are unlikely to overreact to negative or positive news while in this state, and markets are likely to continue to trade sideways in a tight range.

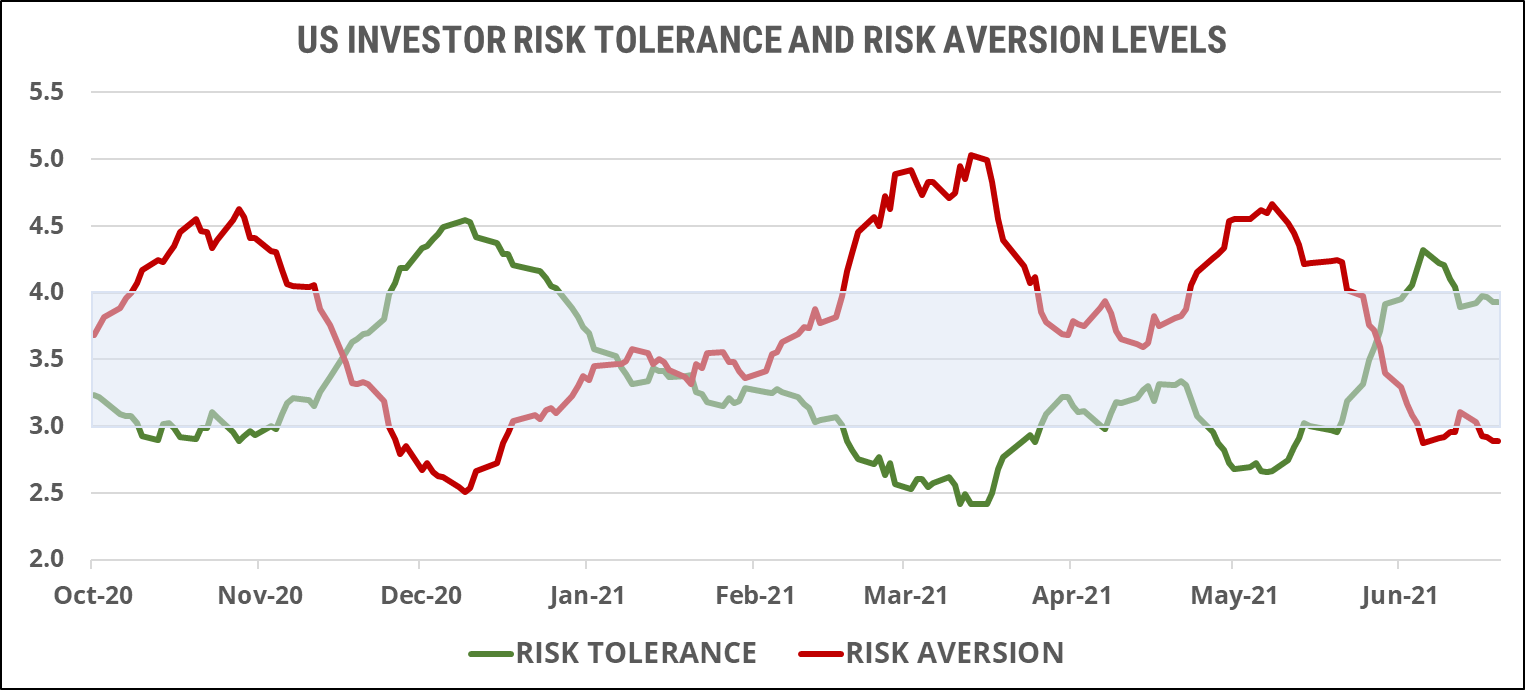

- We note that the ongoing decline in volatility across all the markets we track continues to be marginally supportive of higher risk tolerance, but even without this metric, risk tolerance would remain on par with risk aversion.

- A neutral sentiment also means that investors are not particularly bullish or bearish with regards to the upcoming Q2 2021 earnings season. The year-on-year data is expected to be noisy given Q2 2020’s lockdown situation, and the focus will be on CEOs’ guidance for the rest of the year, especially with regards to impact from inflation, supply-chain bottlenecks and the stronger USD.

1 If sentiment is bearish/bullish, a negative/positive surprise on these data releases could trigger an overreaction.

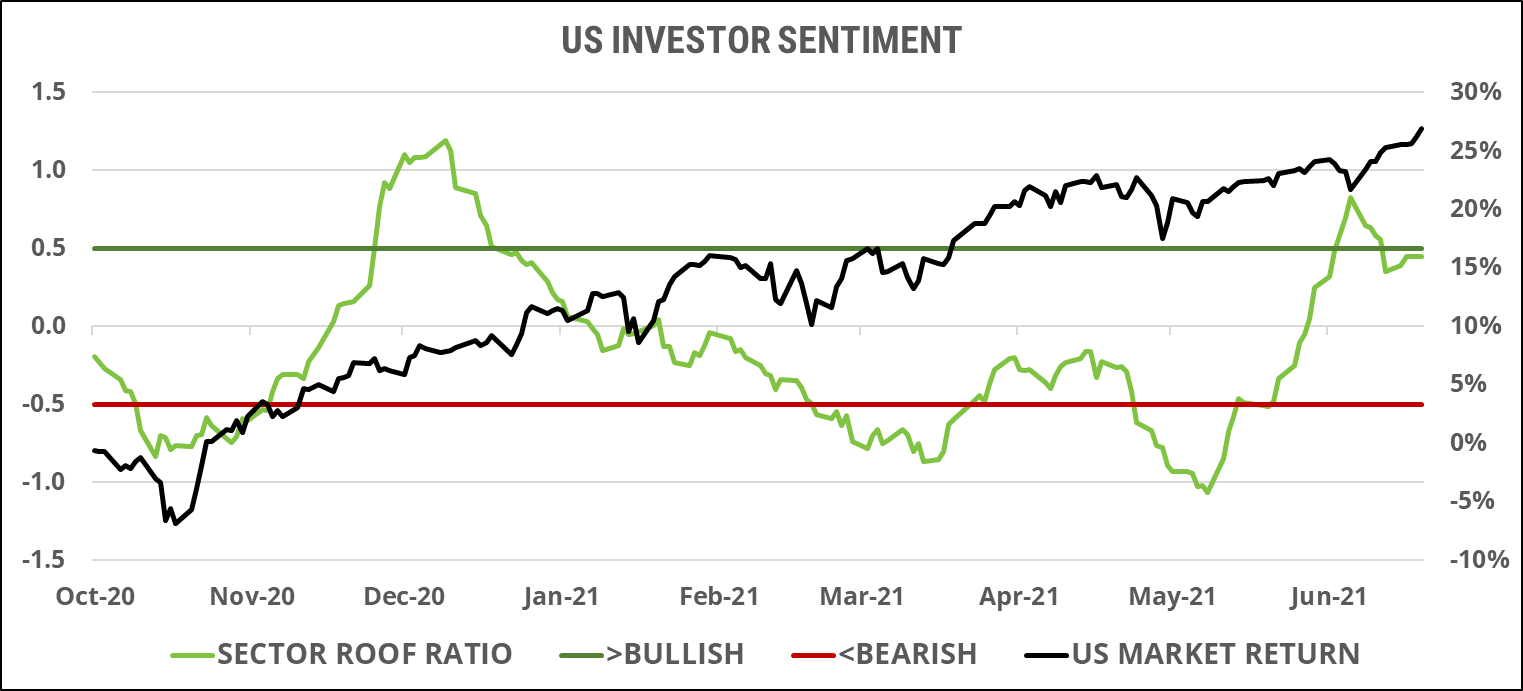

US investor sentiment:

Sentiment among US investors ended last week on the upper limit of the neutral zone, only marginally higher than the previous week. At these levels, sentiment is not yet bullish but is increasingly hopeful and signals a cautiously optimistic mood with regards to the upcoming earnings season. Expectations are high for headline earnings growth due to the year-on-year comparison, but current valuations are equally high translating into a requirement for longer-term growth potential for buyers at these levels. This will bring the focus for this earnings season on CEOs’ guidance for the rest of the year and beyond given the upcoming change in monetary policy as the economy and the employment situation continues to improve.

Both risk tolerance and risk aversion have remained flat these past few weeks, neither one being near their YTD highs or lows and resulting in an overall neutral risk appetite. With the potential supply and demand for risk close to equilibrium, risk assets are likely to trade at or around current values until information is released that could tip the balance one way or the other. As we enter the Q2 2021 earnings season, company-specific news will take over from macro and geopolitical news to dominate the headlines. As investors react to individual company results, stock dispersion will increase and correlation decrease, resulting in a more favorable risk diversification for portfolios. The only macro news that could reverse this trend is the serious threat of new lockdowns. Baring that, a successful Q2 earnings season and a still very accommodating Federal Reserve should continue to support risk tolerance among investors.

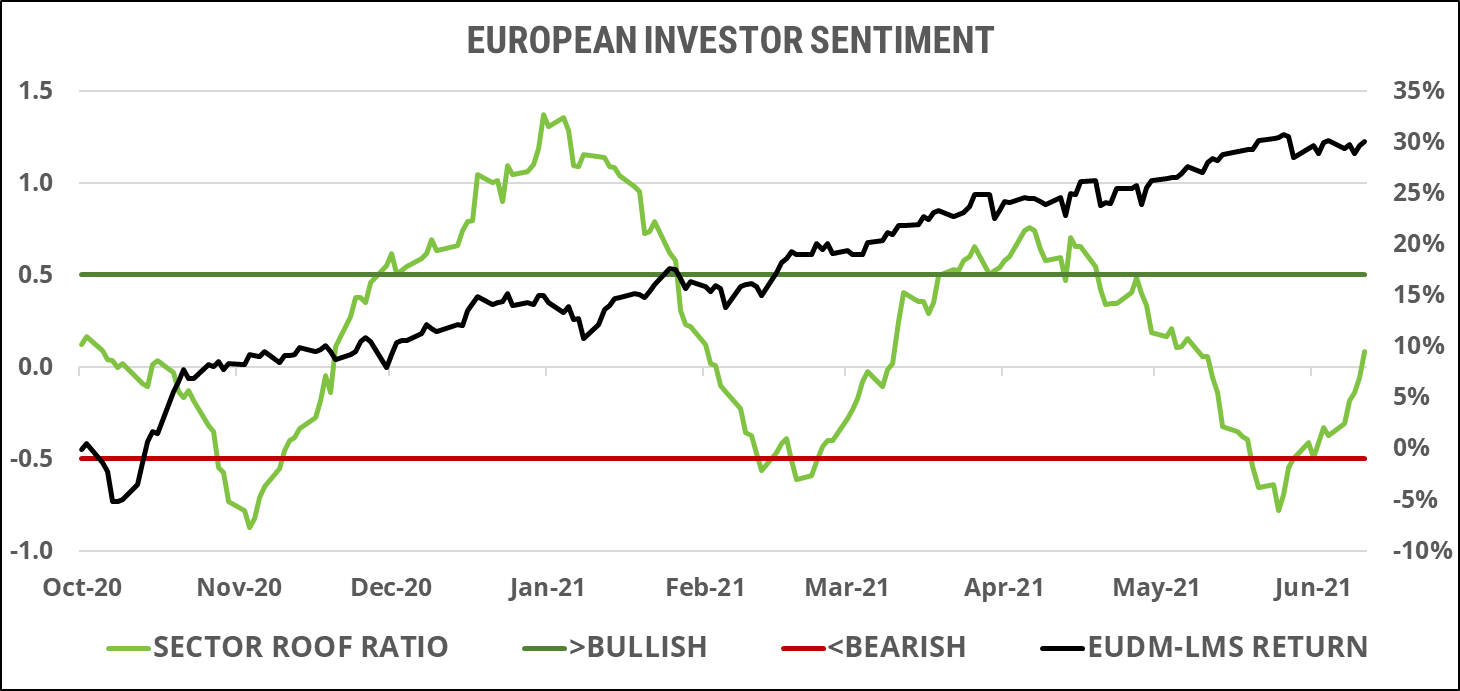

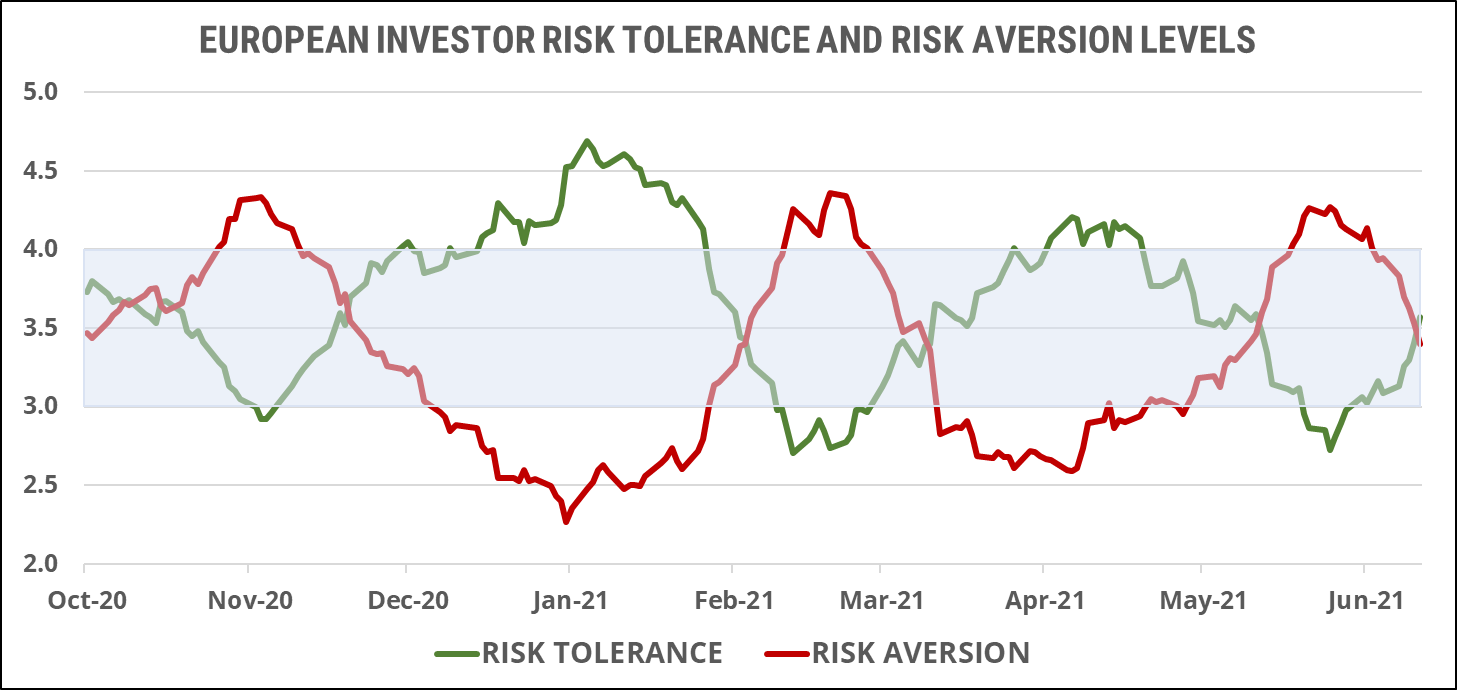

European investor sentiment:

European investor sentiment continued to recover from its short stint in the bearish zone in early June. After returning to the neutral zone the previous week, it continued to improve last week and seems headed for the border with the bullish zone. In the last three weeks, European investor sentiment has gone from pessimistic and doubtful last month, to no longer pessimistic but not yet hopeful the previous week, to hopeful but not yet optimistic at the end of last week. The pace of this recovery is reminiscent of the one seen in November 2020 after the multiple vaccine news, and last March after the reopening following the devastating second wave of COVID-19 infections over the winter. European markets have been rather flat since mid-June and could now get a boost from improving sentiment.

The negative supply and demand balance of the past few weeks has now returned to equilibrium with risk aversion levels falling and risk tolerance levels rising for the past three consecutive weeks. At equilibrium, investors will exchange stocks with each other at fair value and sentiment will not play a role in the pricing of risk assets. In other words, every risk-averse investor will be able to find a risk-tolerant one to trade with and will not have to offer large price discounts to sell their risk assets should they wish to do so. Conversely, every risk-tolerant investor will find a risk-averse investor willing to trade with them without having to offer them a large price premium for their risk assets to acquire them. With the earning season upon us, trading will be based on individual company news instead of geopolitics and given the balanced situation we are in, should remain very disciplined.

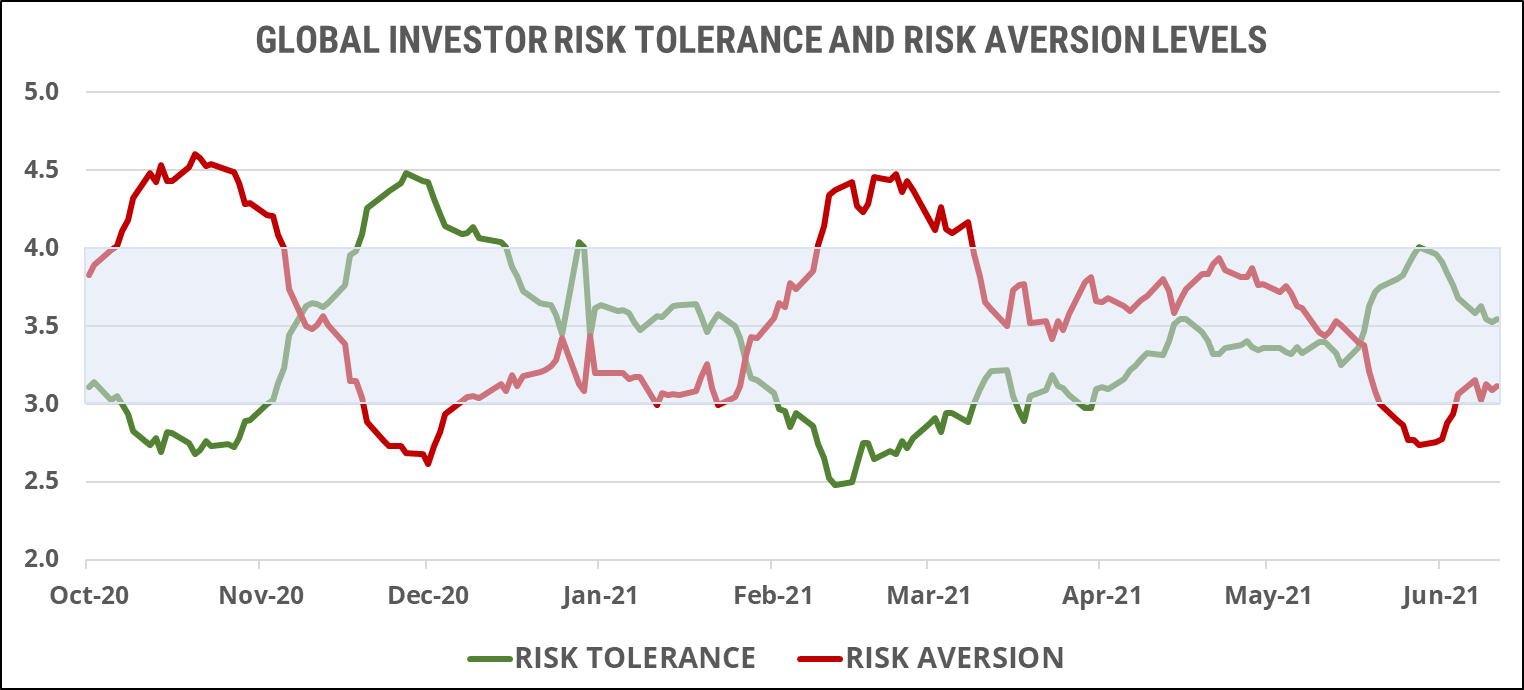

Global developed markets investors sentiment:

Global investors briefly ventured into the bullish zone during the second half of June only to retrace their steps by the end of the month. Since then, sentiment has remained flat near the upper levels of the neutral zone, keeping alive the uptrend in sentiment started in early March. Despite assurances from the major central banks that they will continue to give investors a negative penny for their thoughts, remnants of social distancing measures across the world, uncertain political leadership changes in both Germany and France, continued disruption of global supply chains across emerging markets, and a brewing potential standoff between the G7 and China, still weigh on sentiment.

Global investors briefly ventured into the bullish zone during the second half of June only to retrace their steps by the end of the month. Since then, sentiment has remained flat near the upper levels of the neutral zone, keeping alive the uptrend in sentiment started in early March. Despite assurances from the major central banks that they will continue to give investors a negative penny for their thoughts, remnants of social distancing measures across the world, uncertain political leadership changes in both Germany and France, continued disruption of global supply chains across emerging markets, and a brewing potential standoff between the G7 and China, still weigh on sentiment.

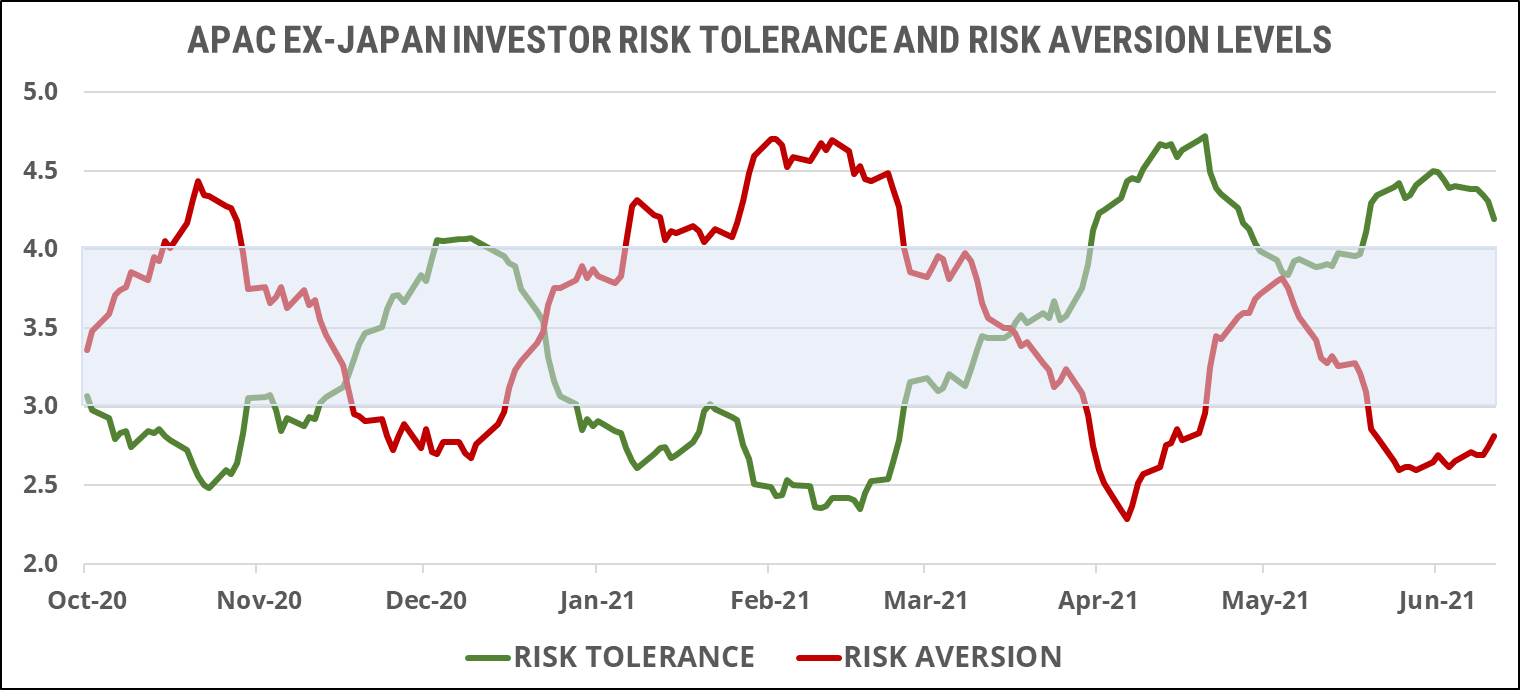

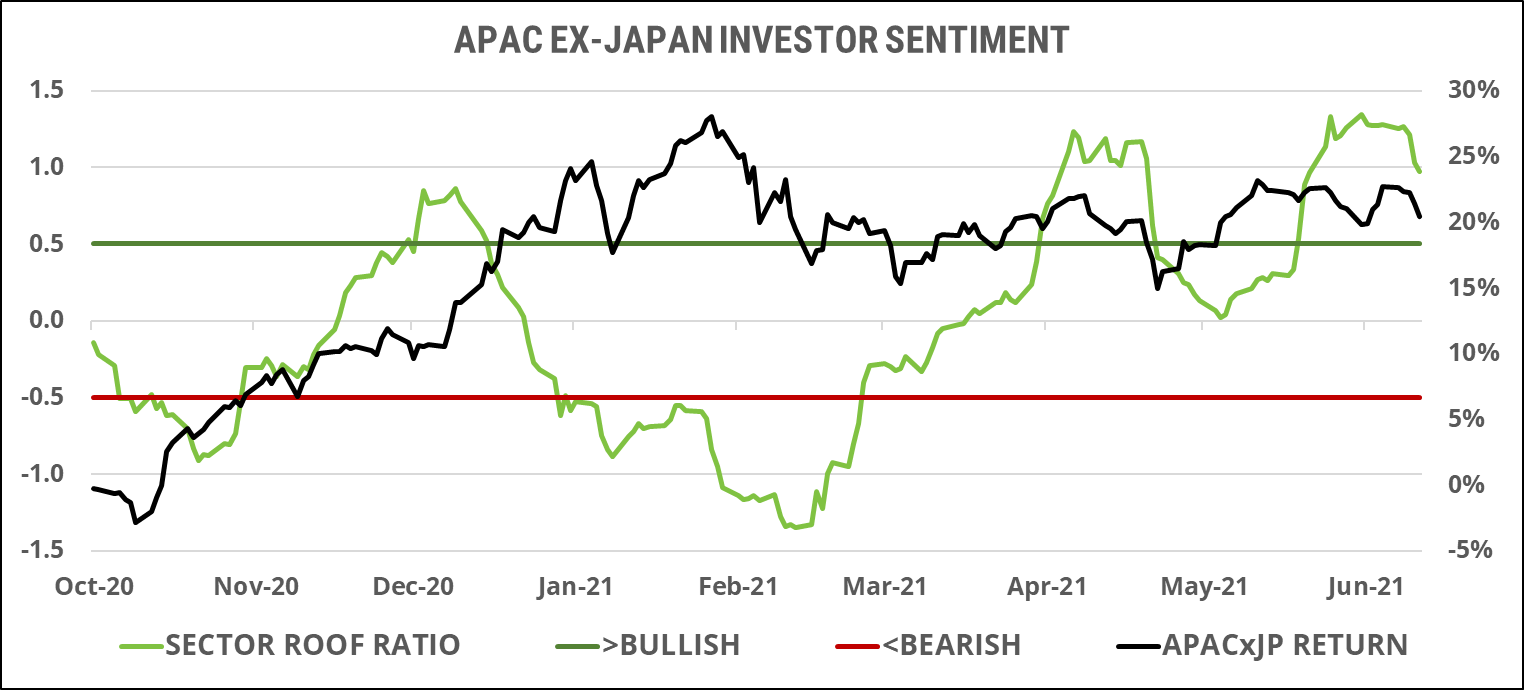

Asia ex-Japan investor sentiment:

As the most economically sensitive region, Asia ex-Japan investor sentiment has been the highest since the end of the second wave of COVID-19 infections that hit the US and Europe this past winter. The improving economic outlook from the vaccination drive across western economies has raised global economic growth forecast, which is seen to benefit Asia ex-Japan. However, the region is also sensitive to higher US interest rates and a stronger USD. Add to this a larger impact from higher commodity prices on regional PMI data and supply chains, as well as relatively high valuations and an unresolved US/G7 – China relationship, and we can understand why markets have not kept up with the Joneses when it comes to their enthusiasm. So, investors in Asia ex-Japan are generally bullish, but they need some good news on the macro and geopolitical front to chase markets higher.

Risk tolerance has now been much higher than risk aversion for over a month, a situation that usually leads to much higher market returns than what we have seen during that time. When risk appetite is that high, any positive news leads to an overreaction on the upside, however, we have not had any positive news in the last month on either the inflation, US interest rates or geopolitical fronts. This means that even though there are many more risk-tolerant investors than risk-averse ones in the market, without a reason to start buying risk assets, risk-tolerant investors have no need to offer price premiums to acquire them. As we have noted before, the behavior of buying at a premium and selling at a discount follows separate concepts of behavioral psychology. Even when risk-tolerant investors dominate, they still require a motive to start offering premiums, but when risk-averse investors dominate, they will usually sell first, then find out why. Without a clear buying signal, markets may suffer from sentiment fatigue and return to the neutral zone.