Potential Triggers: Monetary decisions in the US and Japan. US and China industrial production and retail sales numbers. UK inflation data.

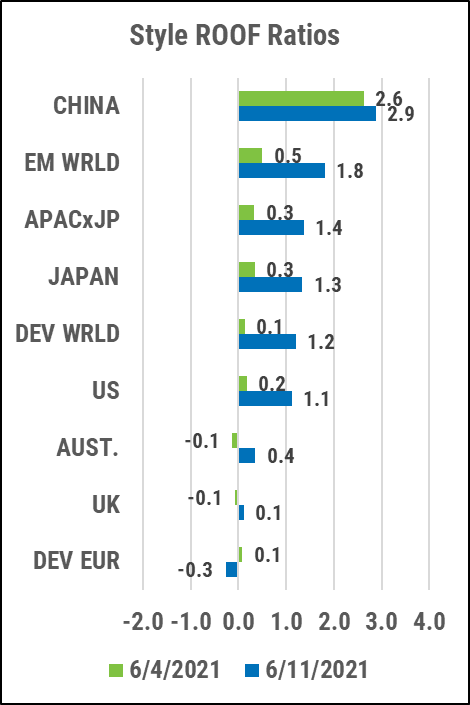

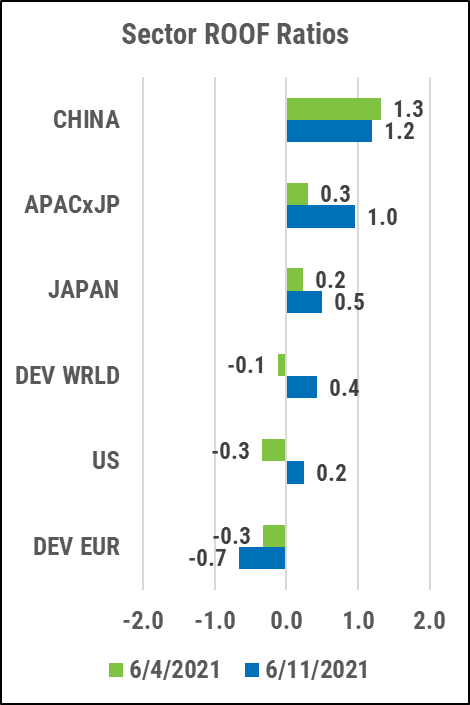

Summary: Investors globally breathed a big sigh of relief last week, proving once again that sentiment continues to be umbilically joined to Central Bank’s QE programs. Except Europe where sentiment declined, all other markets experienced a surge in positive sentiment bringing them closer to, and in some cases into, bullish territory. After weeks spent in the neutral zone worrying that higher interest rates could chew ravenously at the core of the US and global economic recoveries, investors are walking over the line of ambivalence accepting the Fed’s pitch that growth, and inflation can coexist, if you continue to have easy money. At these levels, sentiment is not yet bullish, but it is hopeful. Investors will be looking for excuses to buy with unquenchable naïveté on the inflation front, and are likely to downplay news that might cause a resurgent cynicism. The days of higher interest rates to fight inflation seemed so well-remembered two weeks ago, and so easily forgotten this week. Two decades of easy money has created a new generation of investors who believe there is a QE answer to everything, from recession to inflation.

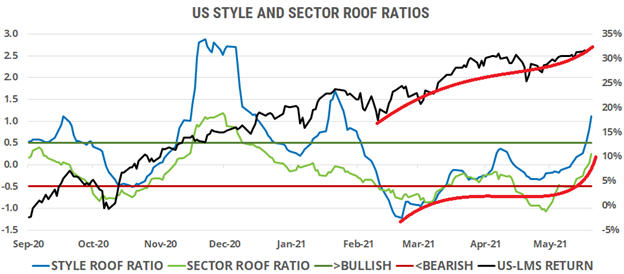

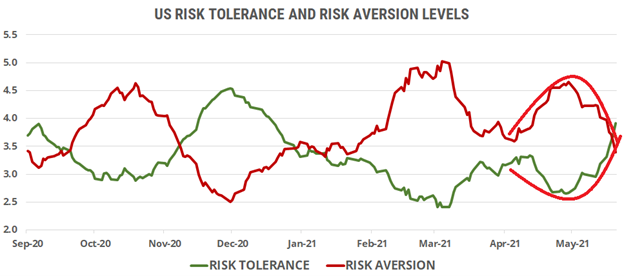

US investor sentiment surges towards the bullish zone ahead of the summer.

Both ROOF Ratios have surged towards the bullish zone in a hockey stick move (top chart). With this ascension towards a more optimistic outlook, markets may see wider swings on the upside, as investors look for excuses to buy rather than reasons to sell. If this optimism turns into a confident bullish sentiment over the next few weeks, markets will have strong sentimental support on the downside and could take multiple swings at new record highs over the summer months.

Risk aversion (red line) dove below its recent April lows, while risk tolerance (green line) rose to its highest YTD level (bottom chart). After three months of battle between inflation fears and central bank support, investors have come down on the side of the latter. They seem confident that the Fed will not let anything bad happen, certainly not in the short-term. Given the recent sentiment momentum, conditions are ripe for markets to rediscover their upside momentum as well.

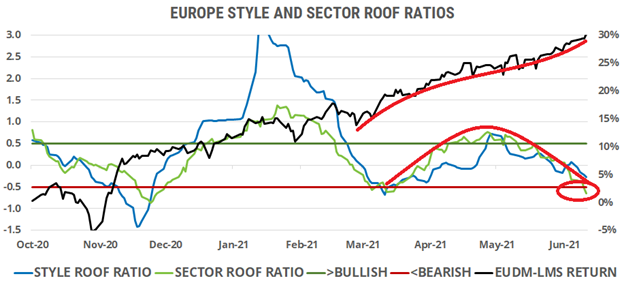

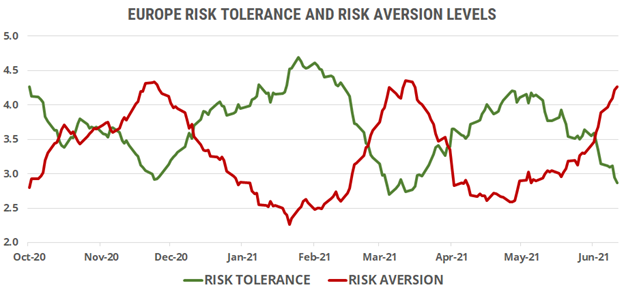

European markets are increasingly at odds with deteriorating investor sentiment.

European investor sentiment dipped a toe in the bearish zone, with the Sector ROOF Ratio (green line) dropping into below the Neutral zone (top chart). Sentiment among European investors has been deteriorating since mid-May and that accelerated last week. Markets have continuously ignored this worsening sentiment and are now dangerously out of sync with the mood of investors.

Risk aversion (red line) continued its upward path of the last few weeks and is now close to a YTD high. Conversely, risk tolerance (green line) ended sharply lower last week, headed for its YTD low (bottom chart). The supply and demand for risk is now firmly on the side of supply, meaning that any negative risk event could trigger a sharp selloff. Note that we have been here before, in March. Back then, no triggers came to induce the risk-averse investors to sell, and sentiment covered.

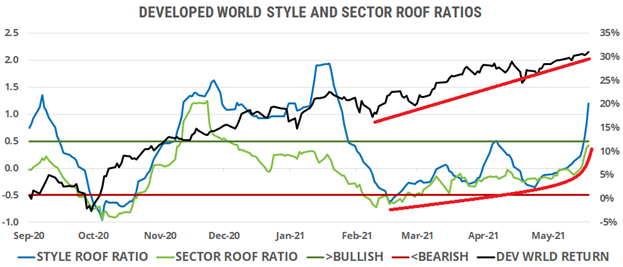

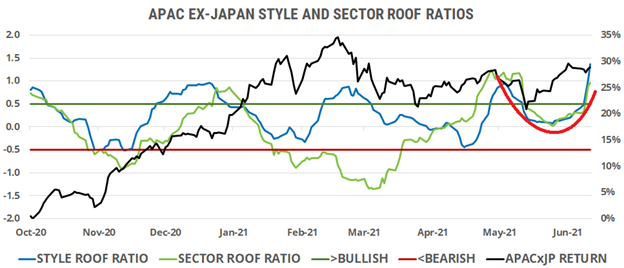

Sentiment of Global Developed and Asia ex-Japan investors turns bullish

After weeks of crawling higher but remaining in the neutral zone, sentiment for global developed market investors shot up last week, putting a foot in the bullish zone (top chart). The Style ROOF ratio broke above the neutral zone last week for the first time since January. The Sector ROOF ratio ended the week just below the border between neutral and bullish, but seems headed for a breakthrough this week for the first time since December 2020.

Asia ex-Japan sentiment broke out of the neutral zone and well into the bullish one for the first time since May (bottom chart). Investors in this market have been more positive about the global economic recovery, compared with those in other parts of the world, and are no stranger to the bullish zone this year. However, Asia ex-Japan markets have underperformed, as the bulk of the foreign funds flow that usually lifts these markets has preferred to remain at home, playing their respective domestic recovery stories instead of the one on global trade. Sentiment should again support an upside rally.

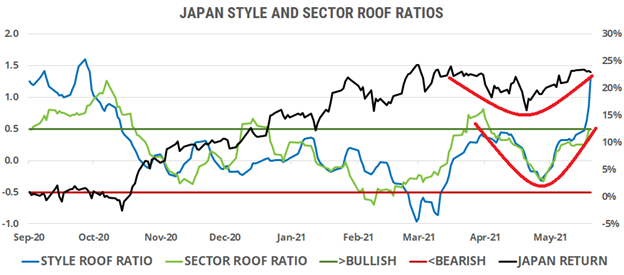

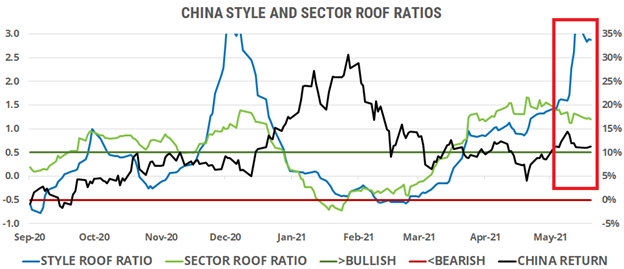

Sentiment turns bullish in Japan and continues to be positive in China.

After flattening out near the top of the neutral zone these past few weeks, sentiment in Japan made a last-ditch effort to break into the bullish zone late last week (top chart). This latest confident move could help markets return to their upward trend of Q4 2020, if the ROOF ratios continue their climb into bullish territory over the summer holidays. We note that the last two forays into bullish territory only lasted a few days and failed to push markets significantly higher.

Chinese investor sentiment, meanwhile, continues to linger near the bottom of the bullish zone, in search of confirmation that optimism is warranted (i.e., will be rewarded). Still, not much is known about the state of the US-China trade relationship and this past weekend’s G-7 effort to put up a united front against China (and Russia) could unravel sentiment if diplomacy gives way to more trade restrictions and a remake of the 2018-2019 disruptions to global trade. Markets there clearly seem to be expecting the latter and have not responded to the bullish sentiment for weeks.