Potential triggers:

- US job report Friday, and worldwide PMI data throughout the week

- UK Q1 GDP and current account updates

- Eurozone inflation and business morale

- US job report Friday, and worldwide PMI data throughout the week

- UK Q1 GDP and current account updates

- Eurozone inflation and business morale

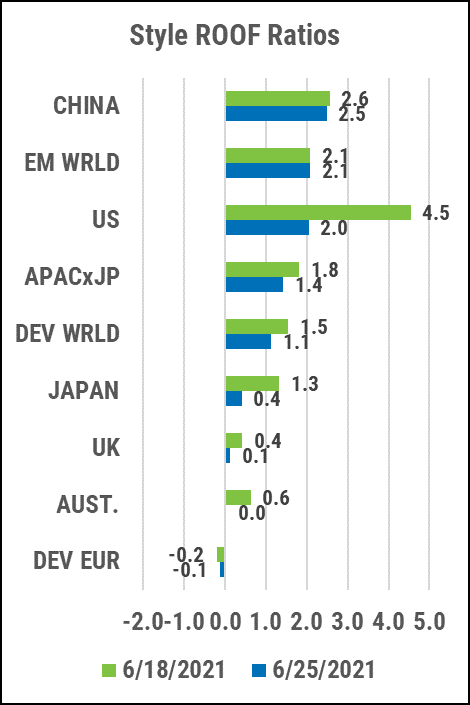

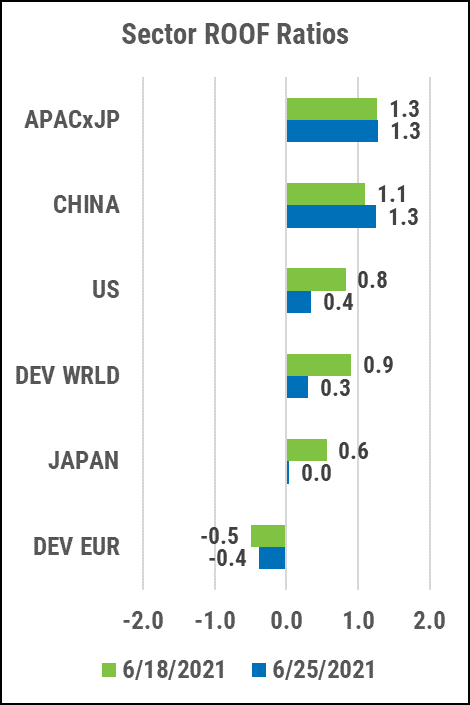

Summary: For the past few weeks, declining volatility has been the main driver of improvement in sentiment. With volatility now back to pre-pandemic levels in most markets we track, there does not seem much downside potential from here, especially with the seasonally more emotional summer months ahead. Any uptick in volatility, however, will translate into a direct increase in risk aversion, and with most developed markets back in the neutral zone, this could push sentiment into bearish territory. Note that we have been there before but as no negative news came to trigger a bearish sentiment into action, markets remained on their upward path and sentiment eventually recovered. Macroeconomic and geopolitical news remain in the driver’s seat for the next few weeks until the start of the Q2 2021 earning season when company-specific news will take over as main headlines, driving up dispersion and lowering the risk of a correlation spike. Until then, markets and sentiment remain vulnerable to a volatility event, especially given the lower volumes of the summer months.

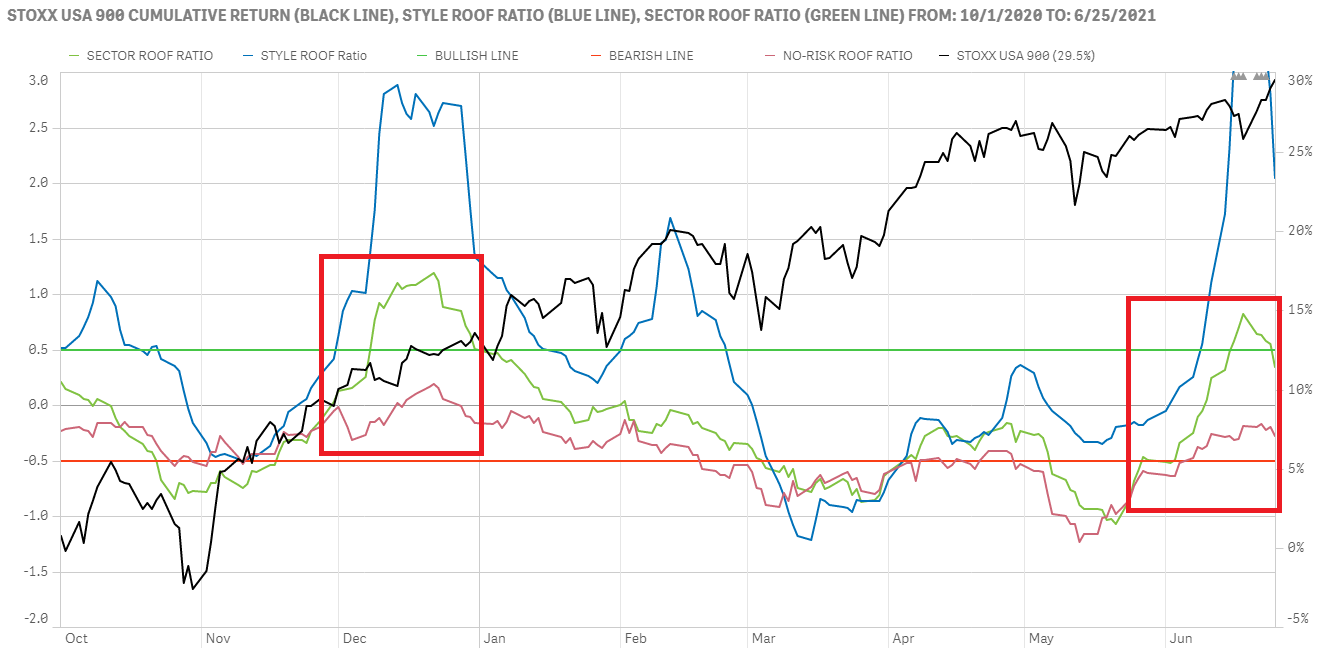

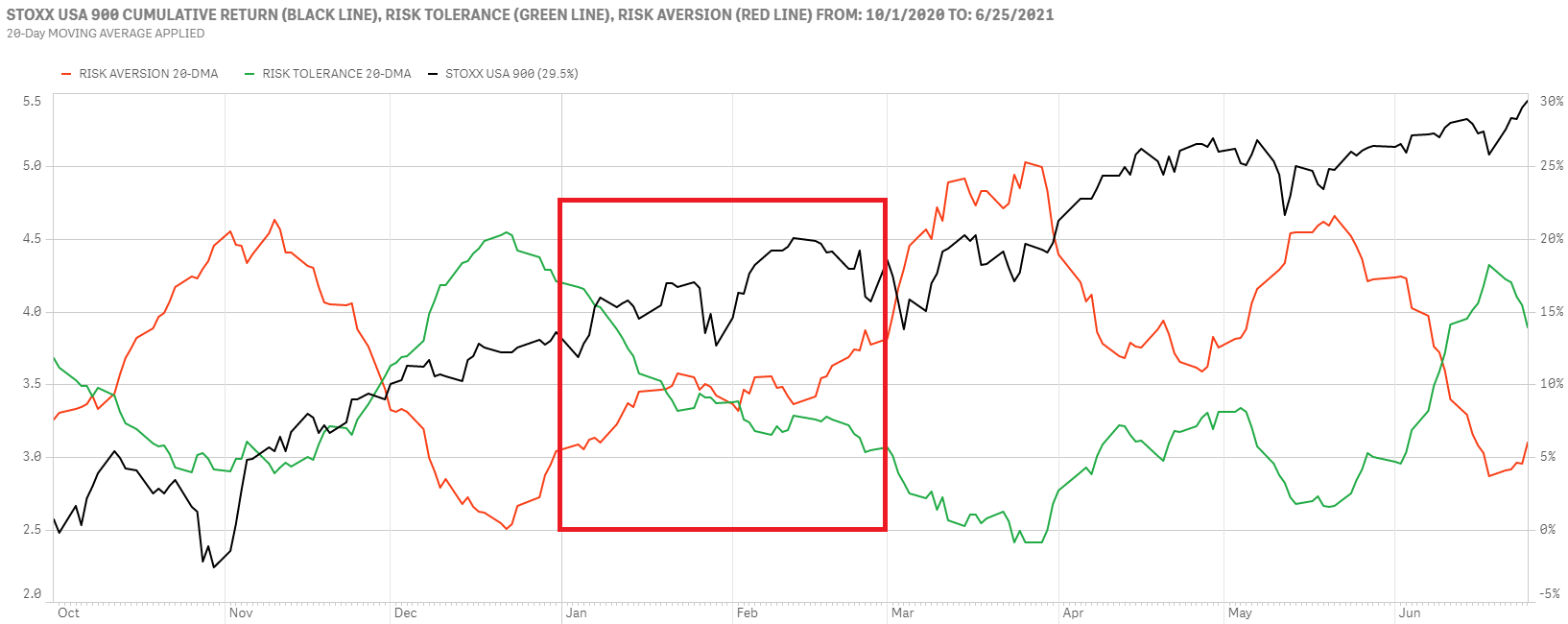

US investor sentiment retreats to the neutral zone as volatility flattens

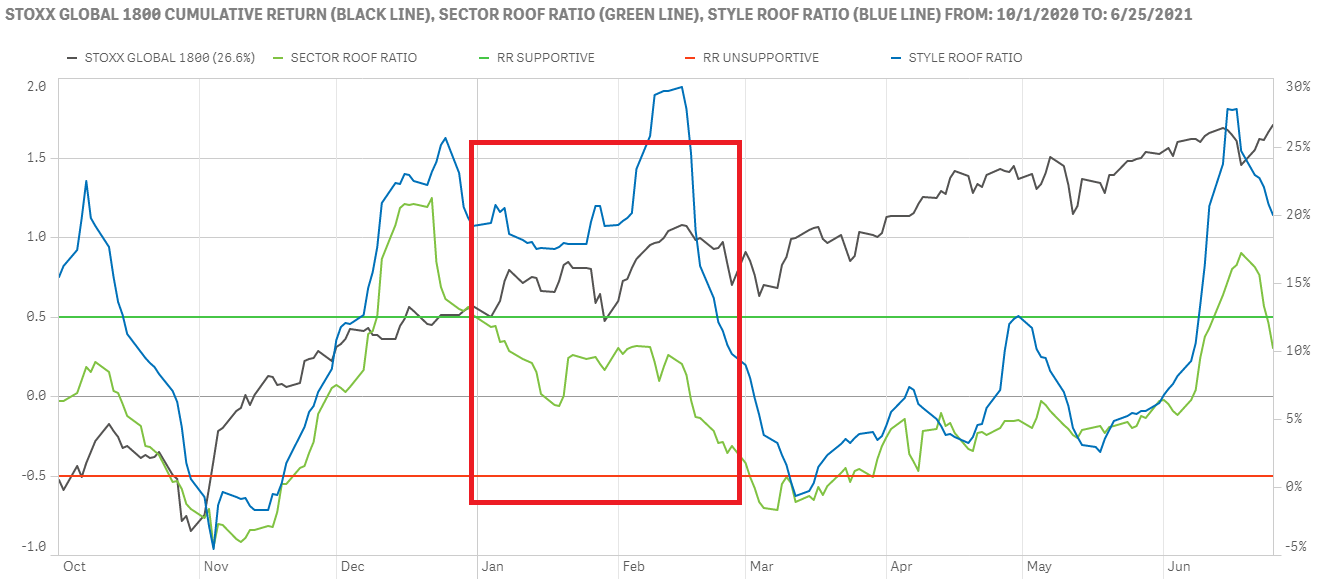

A slight uptick in one of our two risk metrics (the risk spread between our SH and MH models), pared the risk-tolerance sub-score last week and pulled both our ROOF ratios back from their highs the previous week (top chart). The additional red line in the top chart shows what the Sector ROOF Ratio would be without the two risk metrics in it. As we saw back in December, declining volatility allowed sentiment to improve beyond sector allocation preferences and, if volatility flattens out, we may be headed for a market environment like the January-February period during July and August.

Risk tolerance (green line) declined after the loss of one of its two risk metrics, but remains higher than risk aversion (red line). Nevertheless, the spread between the two is narrowing fast (bottom chart). A quiet summer and a directionless volatility regime could return us to equilibrium as in most of January and February of this year.

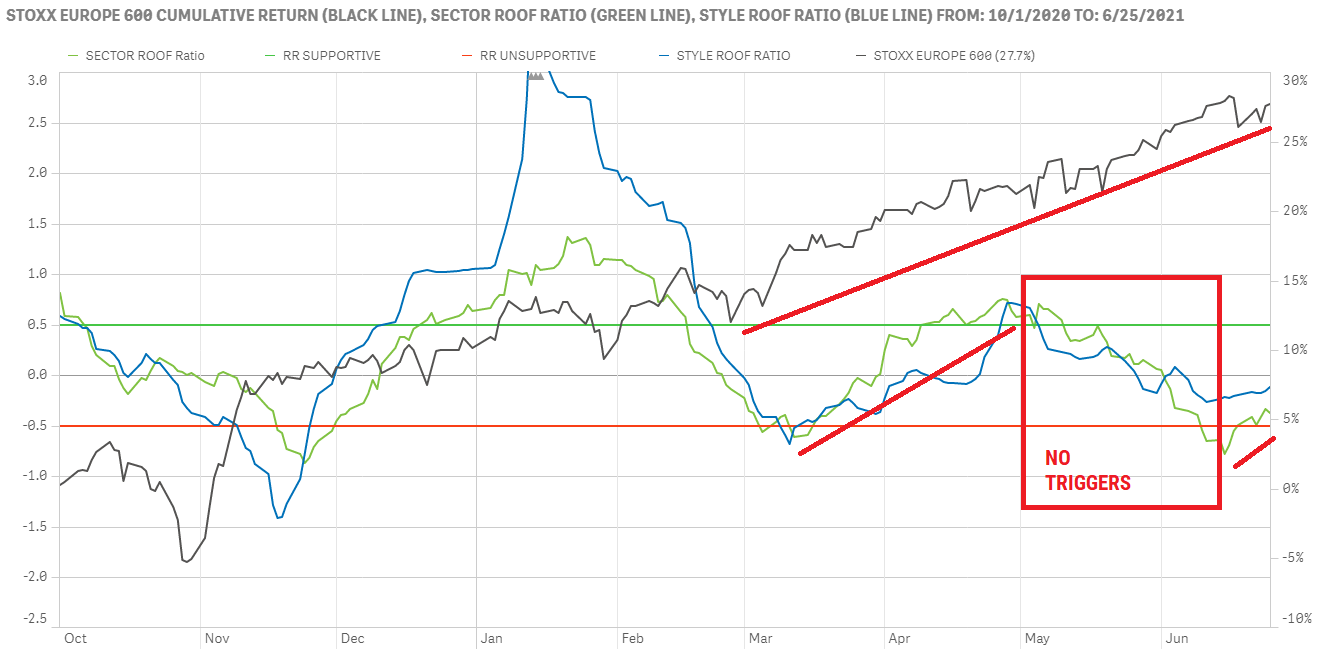

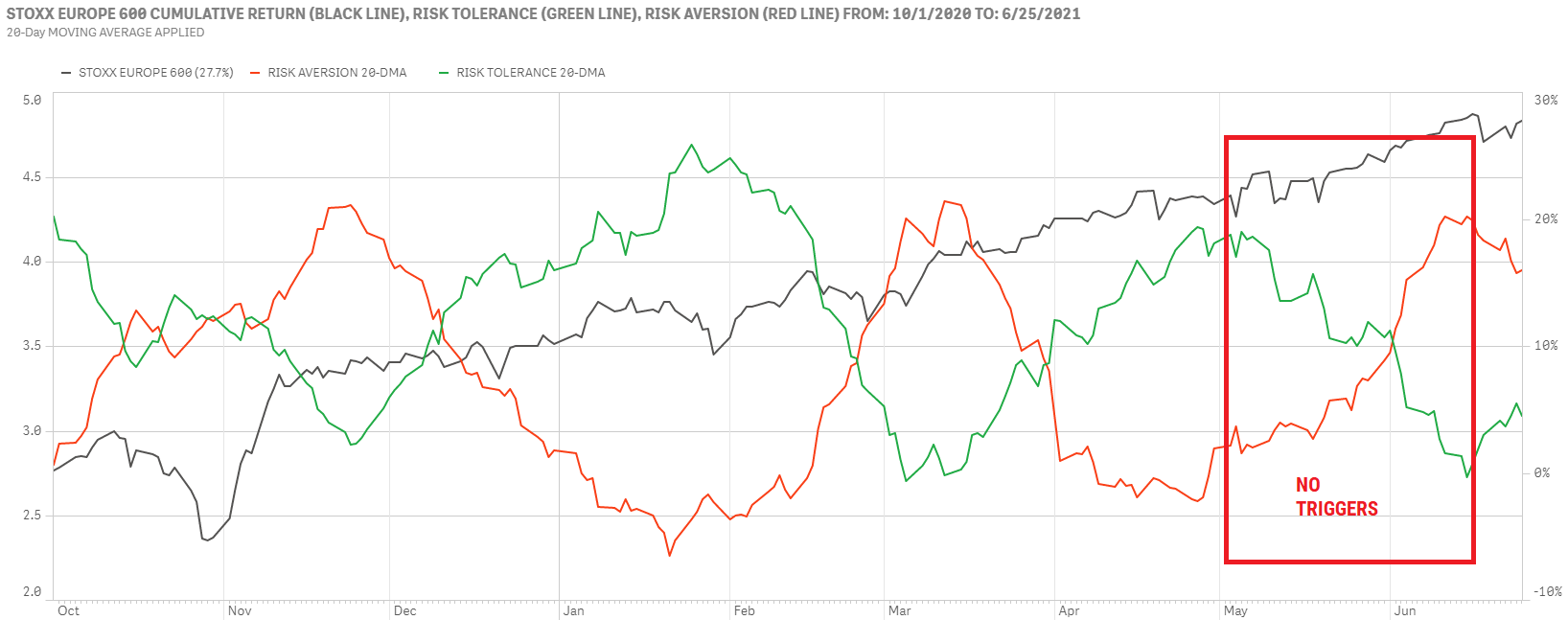

European investor sentiment recovers to reclaims the neutral zone on lower volatility

European investor sentiment recovered last week and is now back in the neutral zone for both our ROOF Ratios (top chart). The past five weeks saw a growing divergence between market returns and investor sentiment. A lack of negative news, however, prevented the negative sentiment from being triggered into a selling frenzy and although the cognitive bias was increasingly negative, investors held their nerve. A declining volatility regime has recently lifted sentiment off its lows and back into neutral territory where it is no longer a drag on markets, but not yet supportive either.

The sharply negative risk appetite of the past few weeks has eased somewhat with risk aversion (red line) declining for two consecutive weeks now and risk tolerance (green line) rising, but net risk appetite remains negative for the time being (bottom chart). A volatility spike could reverse this recovery and send risk appetite back down into very negative territory.

Sentiment of Global Developed investors retreats while Asia ex-Japan’s remains bullish

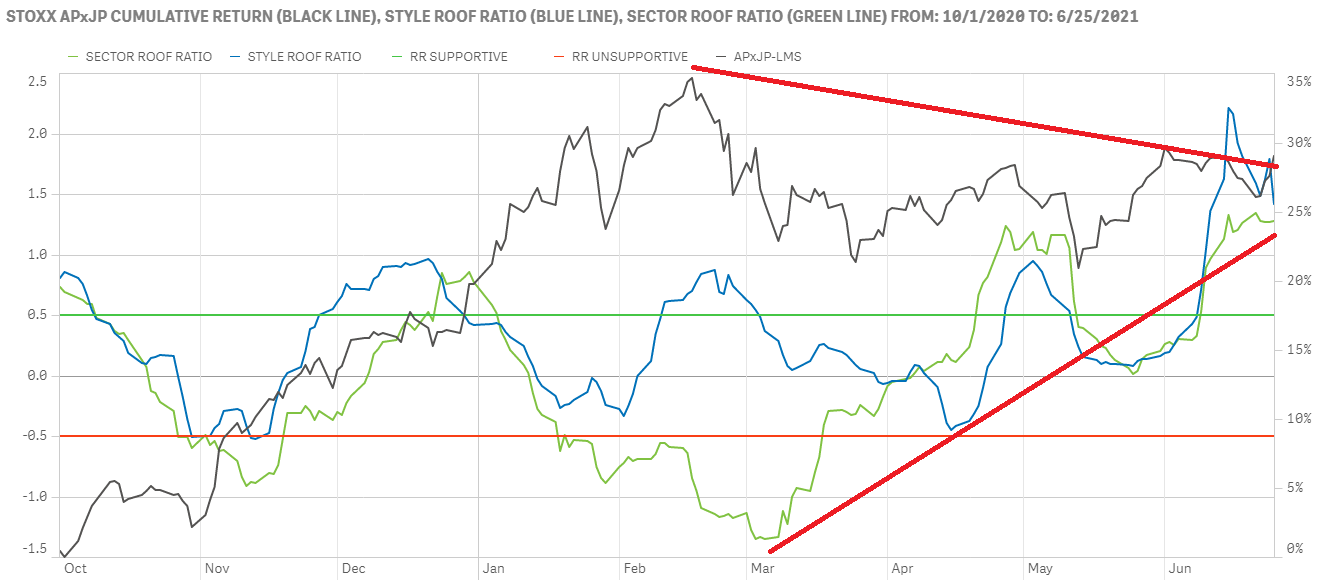

Global investors pared their enthusiasm last week but remain more positive than their US or European peers (top chart). The choice of being positive seems more linked to the global economic recovery than falling volatility for these investors and unless geopolitics weighs in on global trade or the strength of the global economic recovery, their continued preference for risk-tolerant sectors should keep sentiment in the positive range and supportive of higher market levels.

Asia ex-Japan investors continue to favor risk-tolerant sectors, keeping sentiment in the bullish zone (bottom chart). Asian markets have been reacting to the threat of higher US interest rates but have remained near their YTD highs supported by positive investor sentiment. The best-case scenario for markets here is that the global economic recovery boosts earnings faster than the increase in the debt burden caused by a stronger USD or higher US interest rates.

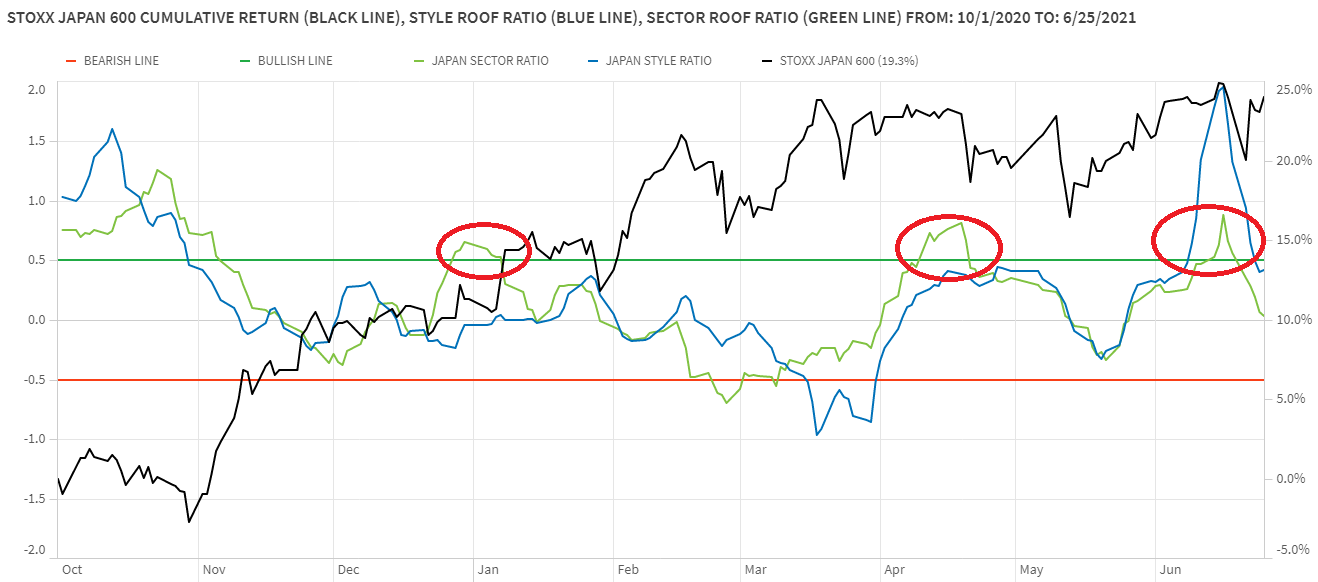

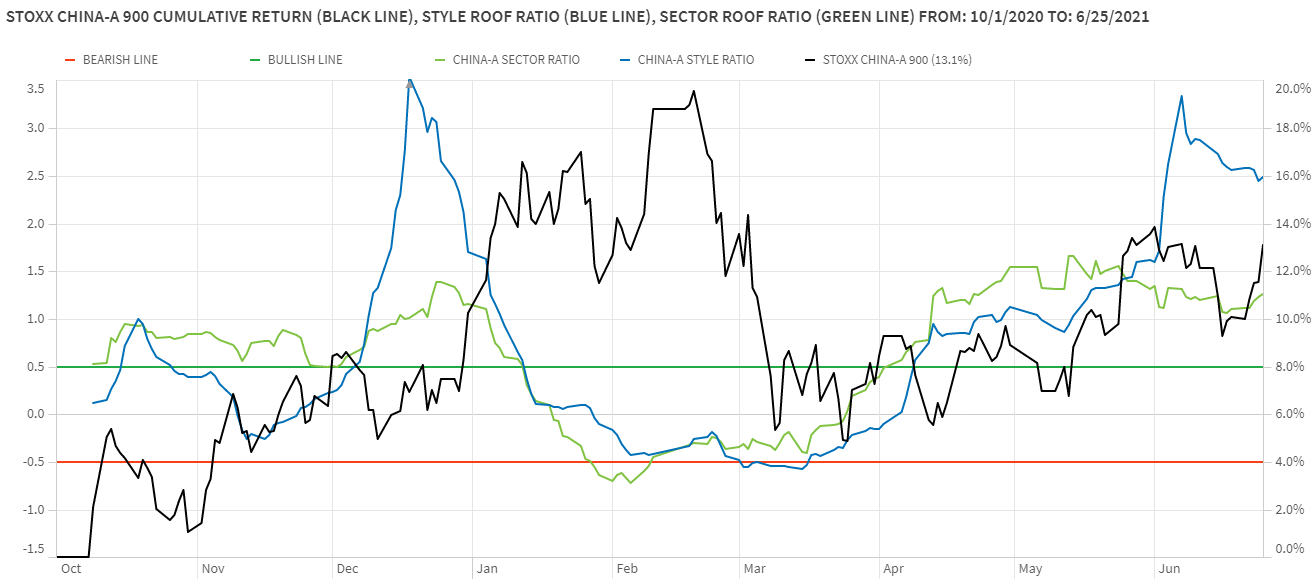

Sentiment in Japan retreats to the neutral zone while Chinese investors remain bullish

Sentiment among Japanese investors retreated for a second consecutive week to end in the middle of the neutral zone (top chart). This is now the third failed attempt this year at holding on to a bullish sentiment. Each of the preceding retracements to the neutral zone was followed by a volatile market correction to the previous support levels (circa 5%). With the Olympics just around the corner and the vaccination drive well behind other developed nations, sentiment is likely to remain nervous.

Sentiment among Chinese investors remains bullish, but a lack of positive news has not allowed positive cognitive bias to turn into a strong buying spree, leaving markets still well below their YTD high. Geopolitics and regulatory risks still govern the mood of Chinese investors. Add to those unresolved concerns rising commodity prices and their impact on PMI data, and you get a subdued response to positive sentiment. The mood has been positive for three consecutive months now, and markets have been so for two of those, but more positive news is needed to trigger buying at these levels.