Potential Triggers: US CPI numbers, updated GDP figures for the Eurozone, the UK and Japan, and German industrial production numbers.

Summary: Investor sentiment continues to hoover within the neutral zone, held back by high valuations, and supported by a growing sense that inflation fears may have been just that, a temporary illusion caused by an abnormally low base. In this balanced state, news cannot easily sway the mind of investors who, free of strong cognitive bias in either direction, seem focused instead on rational thought – not their natural state. Thursday’s US CPI numbers is the next item on the agenda that could potentially breathe some vigor into the current tepid mood. If not, they might have to wait until June 17 for the next Fed move. But, with the summer months right around the corner, sentiment is likely to remain non-committal, protecting markets from false popular delusions and the madness of crowds. As for the (right) tail-end of the sentiment spectrum, the uber risk-tolerant investors chasing meme stocks ever higher up the gullibility pole, they would do well to remember that markets are notoriously tightfisted when it comes to dolling out happy endings to speculators. There is a time to sow and a time to reap. This seems a time to sleep.

US investor sentiment remains in the neutral zone ahead of the summer months.

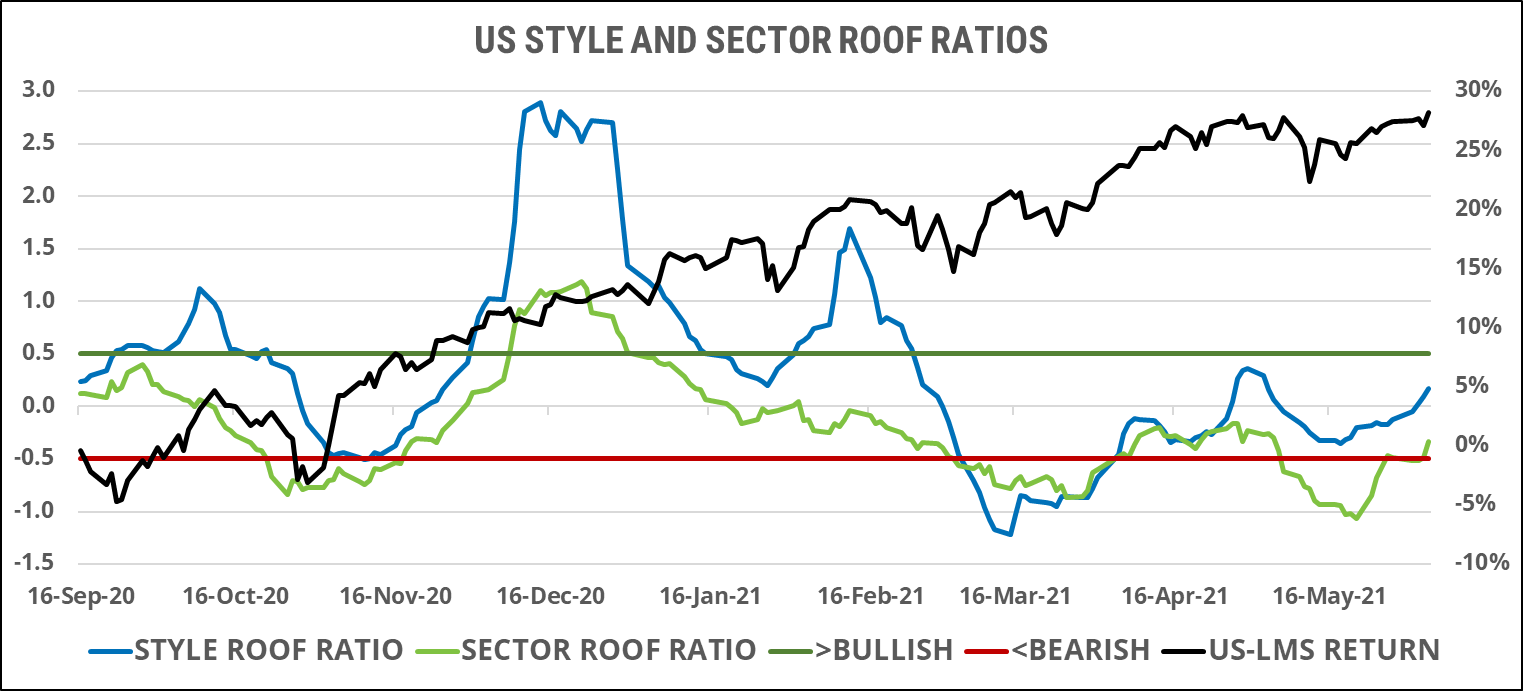

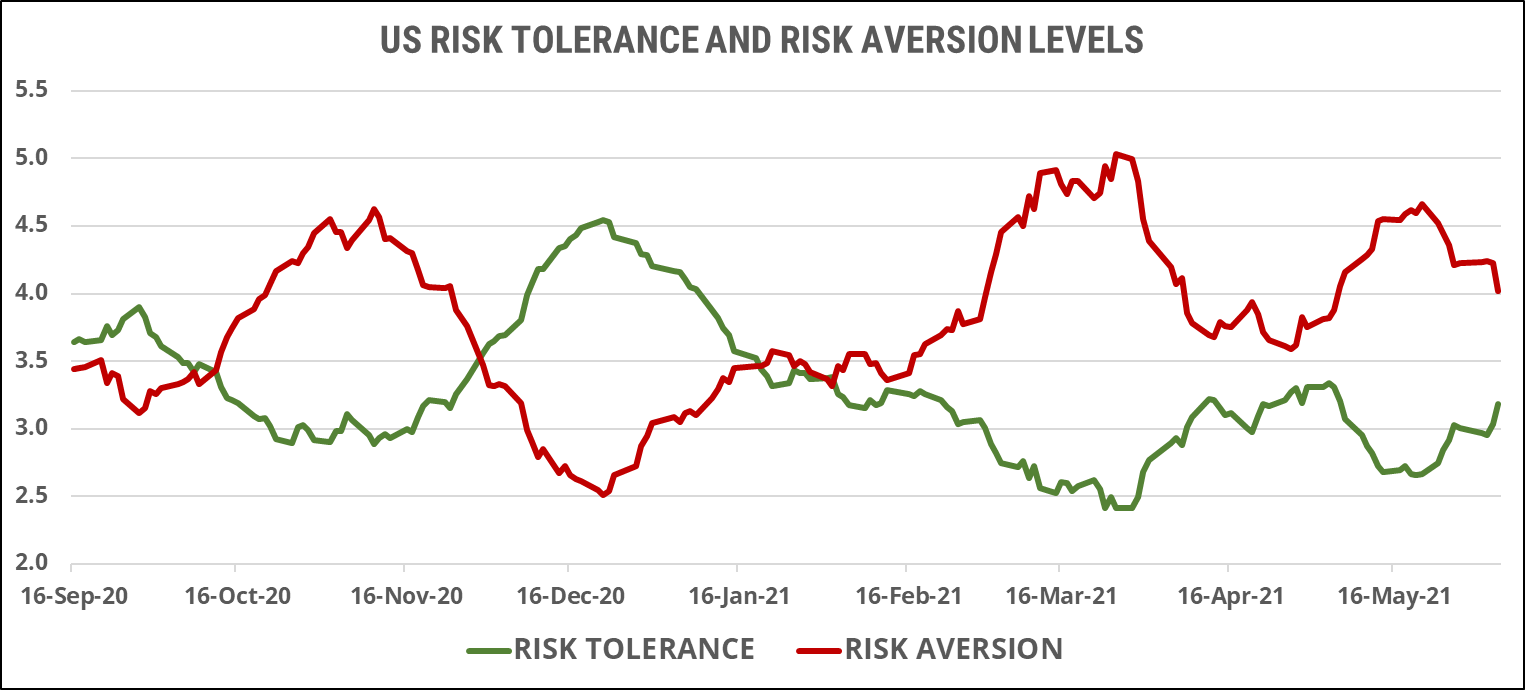

Both ROOF ratios have set up camp in the neutral zone, keeping markets in a tight range (top chart). Year-to-date, sentiment has spent two-thirds of the time in the neutral zone, and one-third in the bearish zone (sector ROOF). Get comfortable, we may be here a while.

A non-directional jobs report helped further bridge the gap between risk aversion (red line) and risk tolerance (green line) that had opened after the Yellen Put last month (bottom chart). With the supply and demand for risk this close to equilibrium, neither side can extract a large price concession from the other while selling or buying (i.e., why markets trade sideways). It will take an unexpected event to jolt investors out of their current doldrums and get them to strongly feel one way or the other. Until then, they will be working part-time, making plans for the summer break.

European markets continue to defy sentiment and rise to new highs.

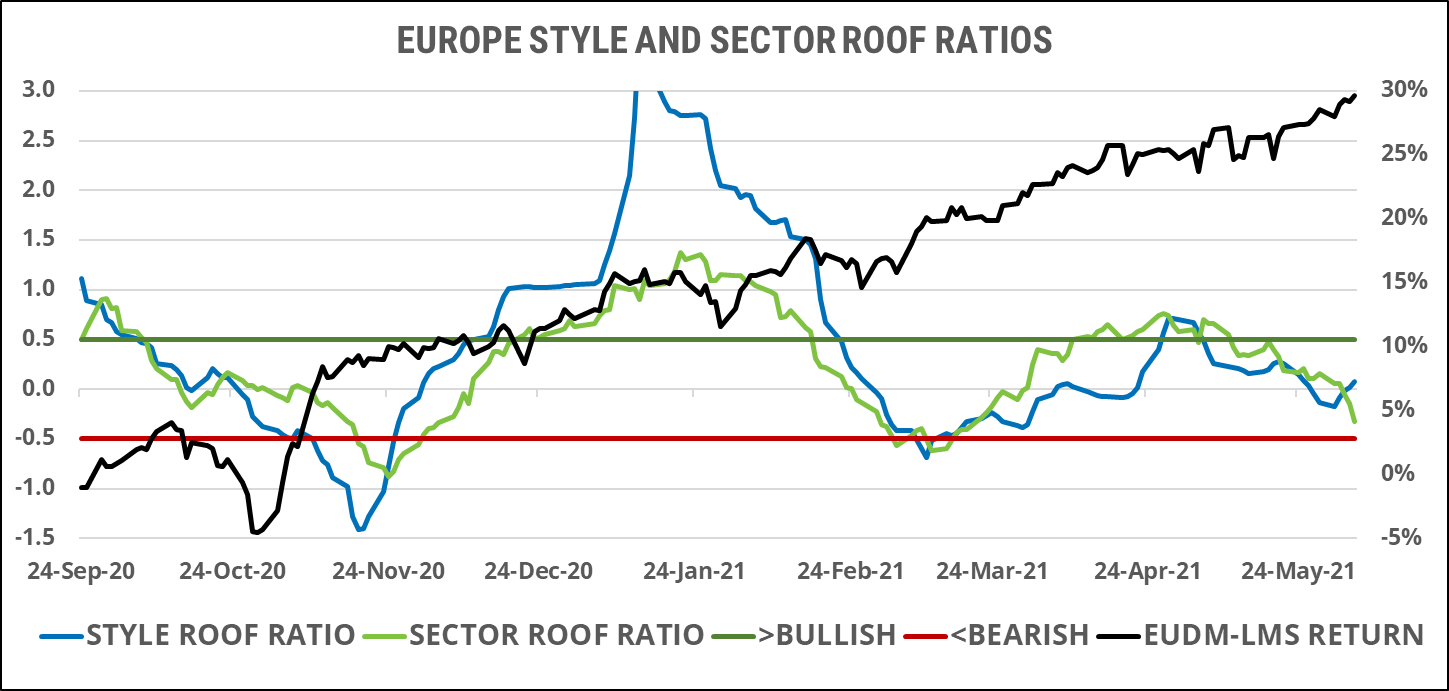

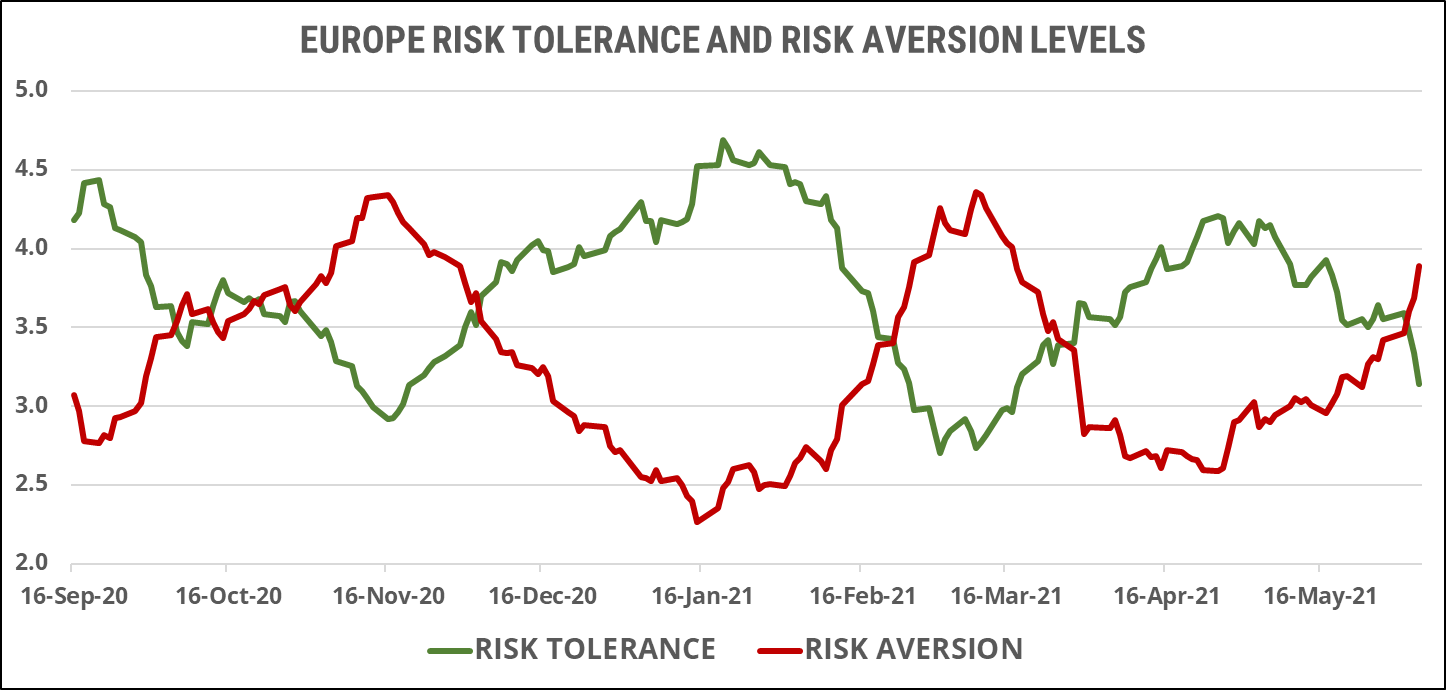

For the second time this year, European investors continues to treat the latest market rally as a spectator sport best watched from the safety of the neutral zone (top chart). Sentiment has now spent 48% of the time in either a neutral or bullish state year-to-date, but has been steadily declining since late April. Markets have again chosen to ignore the latest mood swing and keep rising.

After reaching equilibrium, risk aversion (red line) rose last week as risk tolerance (green line) declined, giving net risk appetite a slight negative momentum going into this week (bottom chart). The upcoming summer break may help explain the divergence between markets and sentiment with the latter being more focused on downside protection ahead of the holidays by increasing their exposure to risk-averse sectors instead of selling risk-tolerant ones altogether.

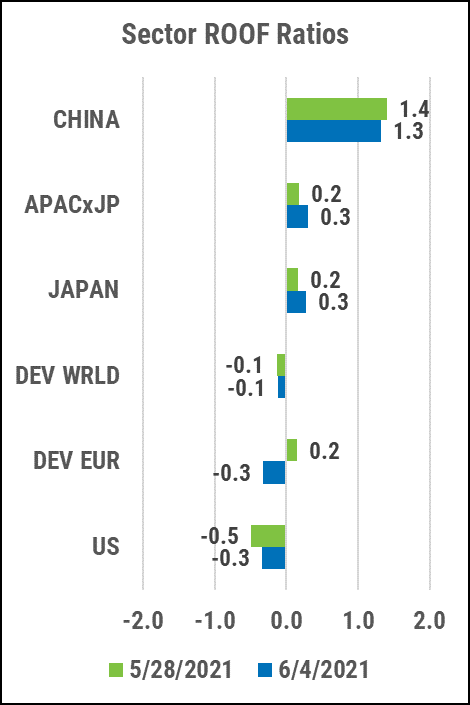

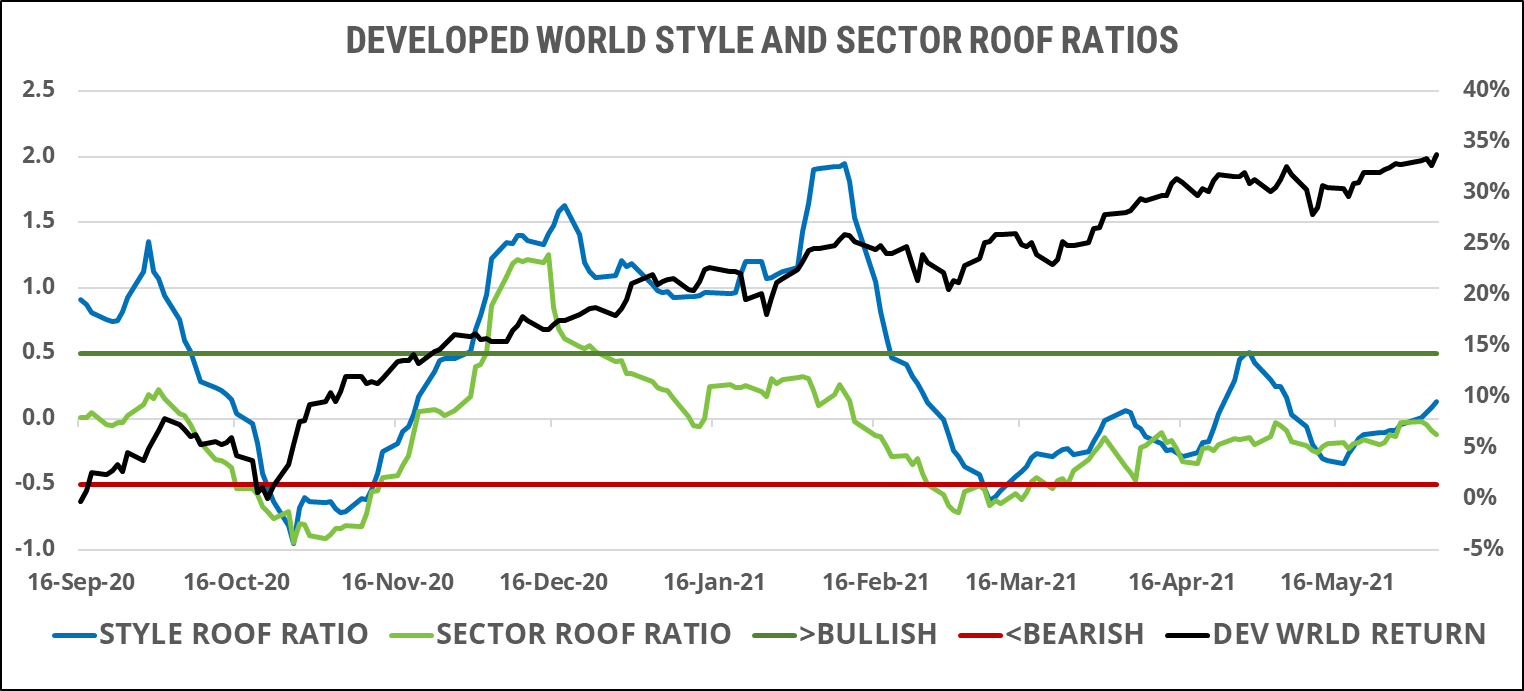

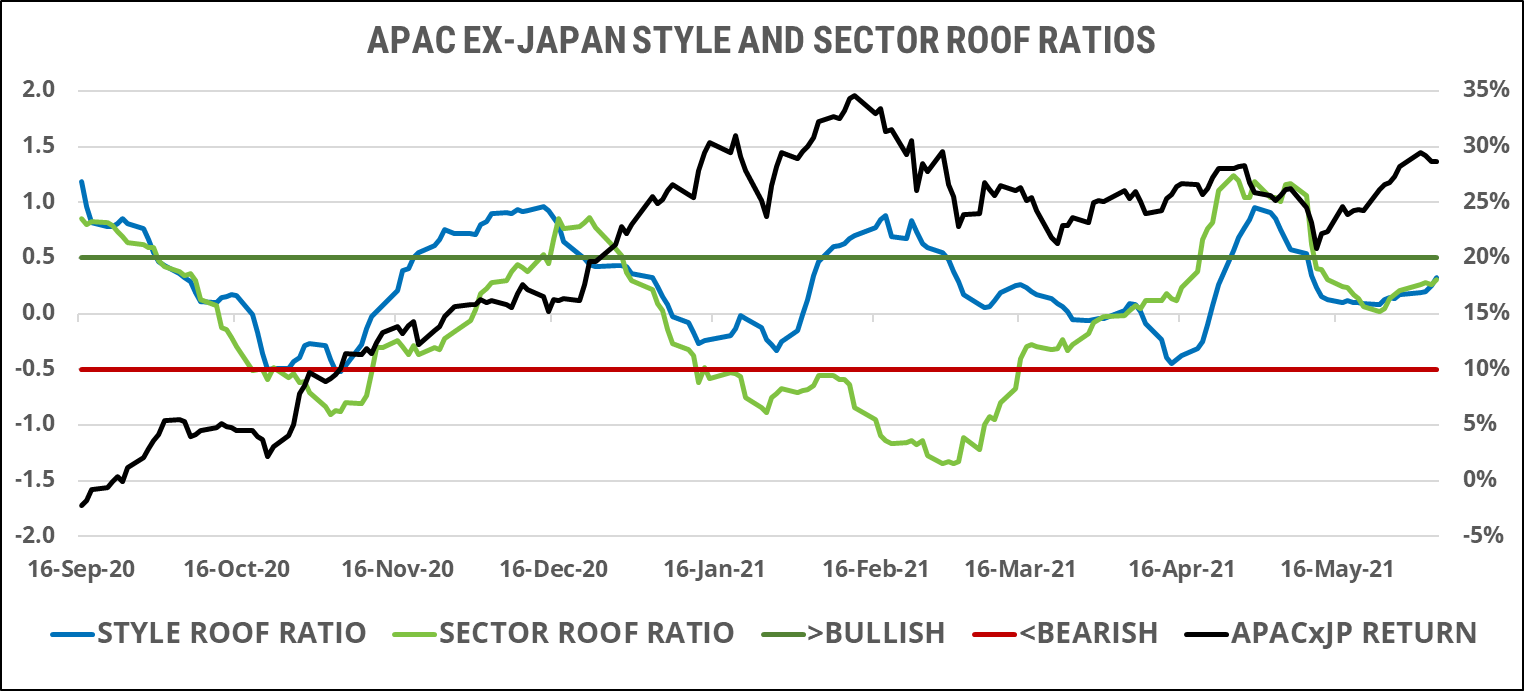

Sentiment among both Global Developed and Asia ex-Japan investors remains neutral.

Global investor sentiment continues its upward crawl started in late February and has now spent 85% of the time in the neutral zone year-to-date (top chart). Sentiment and markets remain in parallel for global investors, neither prone to any irrational exuberance, and it is any one’s guess what will turn it up or down from here given that summer is fast approaching.

Asia ex-Japan sentiment, meanwhile, has spent about half its year-to-date time in the neutral zone (46%) but seems more prone to bouts of bullishness than its peers having spent 37% of the time there, some recently (bottom chart). Low US interest rates and a weak USD are positives for the region and should continue to keep sentiment away from the bearish zone if nothing comes along to threaten the global economic recovery scenario.

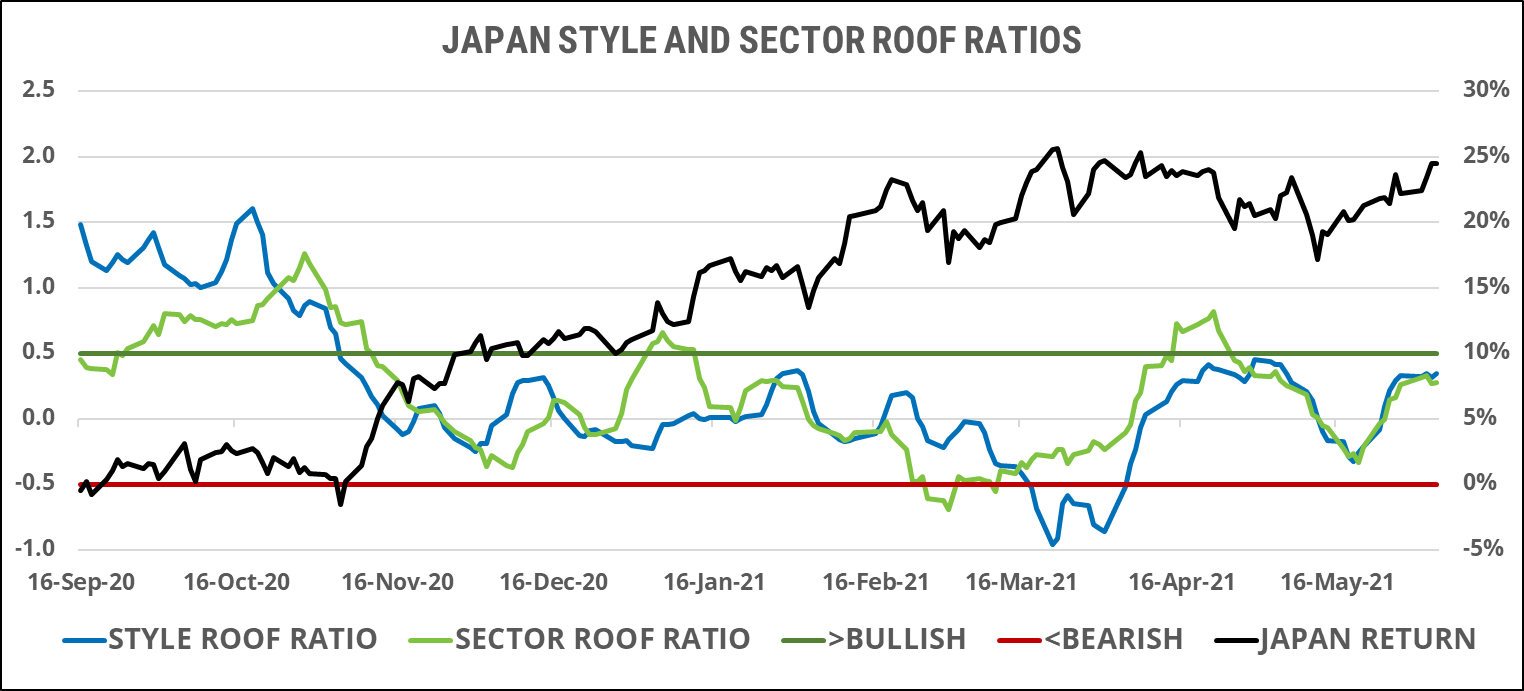

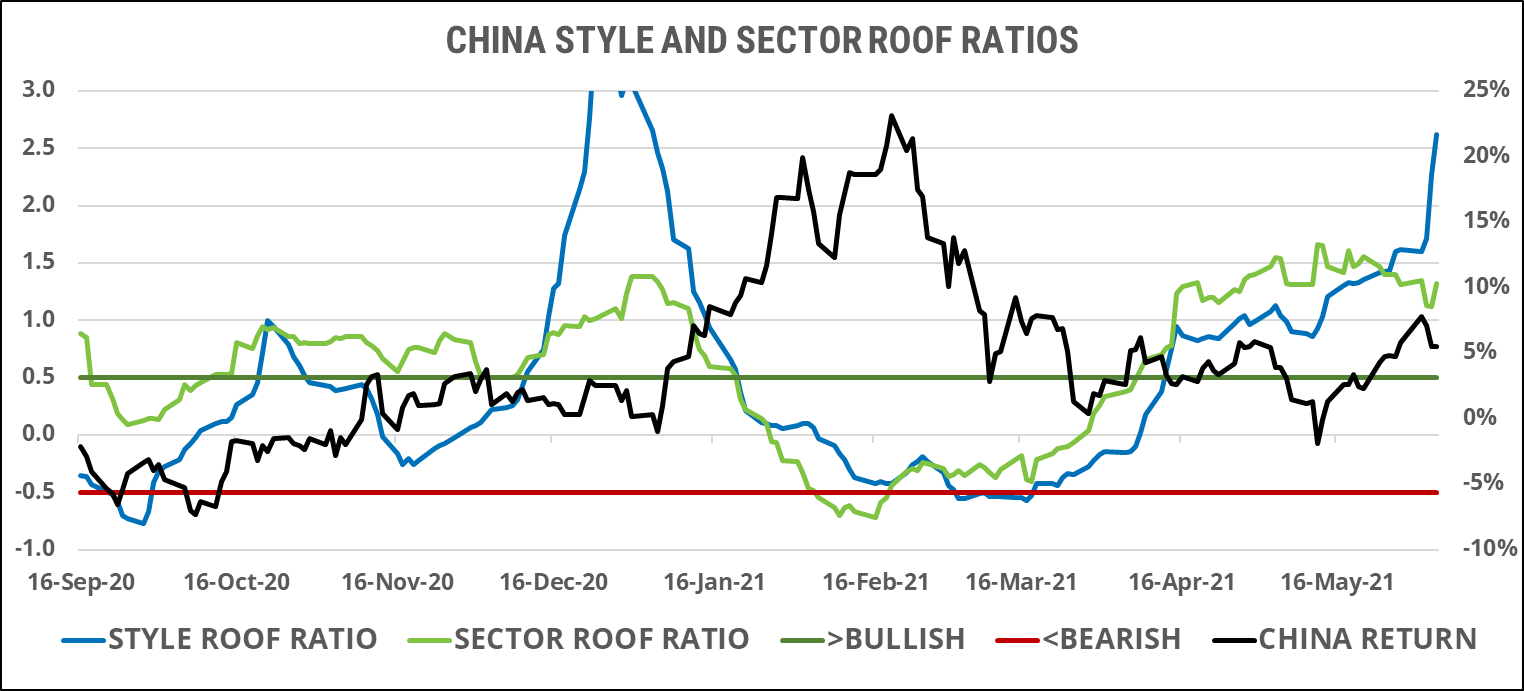

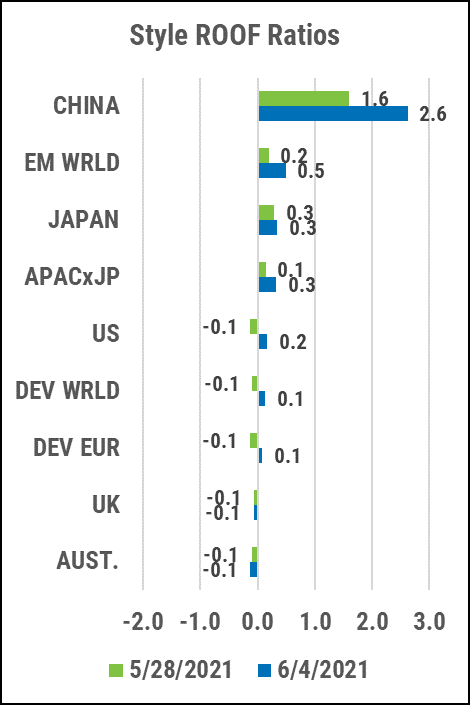

Sentiment remains neutral in Japan, and in search of confirmation in China.

The recovery in sentiment that started in mid-May has flattened out near the top of the neutral zone for Japanese investors (top chart). It seems that more factual data is needed to convince them to become bullish at these levels. Sentiment has now spent 70% of the time in the neutral zone since the start of the year, waiting for direction. Will it come before the summer break?

Chinese investor sentiment, meanwhile, has spent 47% of the time in the bullish zone and 43% in the neutral zone since the start of the year (bottom chart). Sentiment seems to be betting on the earnings boost form the global holiday revenge spending set to begin next months, while markets seem more concerned about recent regulatory crackdowns affecting the tech sector. This could help explain the divergence between the Style (blue line) and Sector (green line) ROOF ratios lately.