Potential triggers this week: Flash PMI surveys for the US, UK, Eurozone, and Japan. US final Q4 GDP, durable goods orders, existing home sales, Powell testimony, and personal income and outlays; UK unemployment, retail trade and inflation data; and Eurozone consumer morale.

Summary: Fed Chairman Powell has reiterated his insouciance about inflationary pressures and the Biden administration is already working on its next fiscal stimulus package. Alas both these hooks seem to have lost their worm, and investor sentiment remained bearish last week except in the UK. Why are markets being so kumbaya while investors are growing increasingly pessimistic about the future? Could it be that having made so much profit over the past twelve months, they have become cavalier about the possibility of losing some of it? Or perhaps, a herd mentality has taken hold, and no one wants to risk being exposed to that humiliating feeling of having been ’othered’ by not participating. Both hypotheses would reveal ‘profit’ as the new fundamental lens through which every trade is made in another clear sign of a bubble forming (or inflating further). Markets’ failure to clock daily consecutive new highs without swift profit taking does indicate some hesitation as a growing number of investors seem to be patiently waiting for risk-free yield to be reinvented.

Despite three consecutive months of deteriorating sentiment, markets continue to rise.

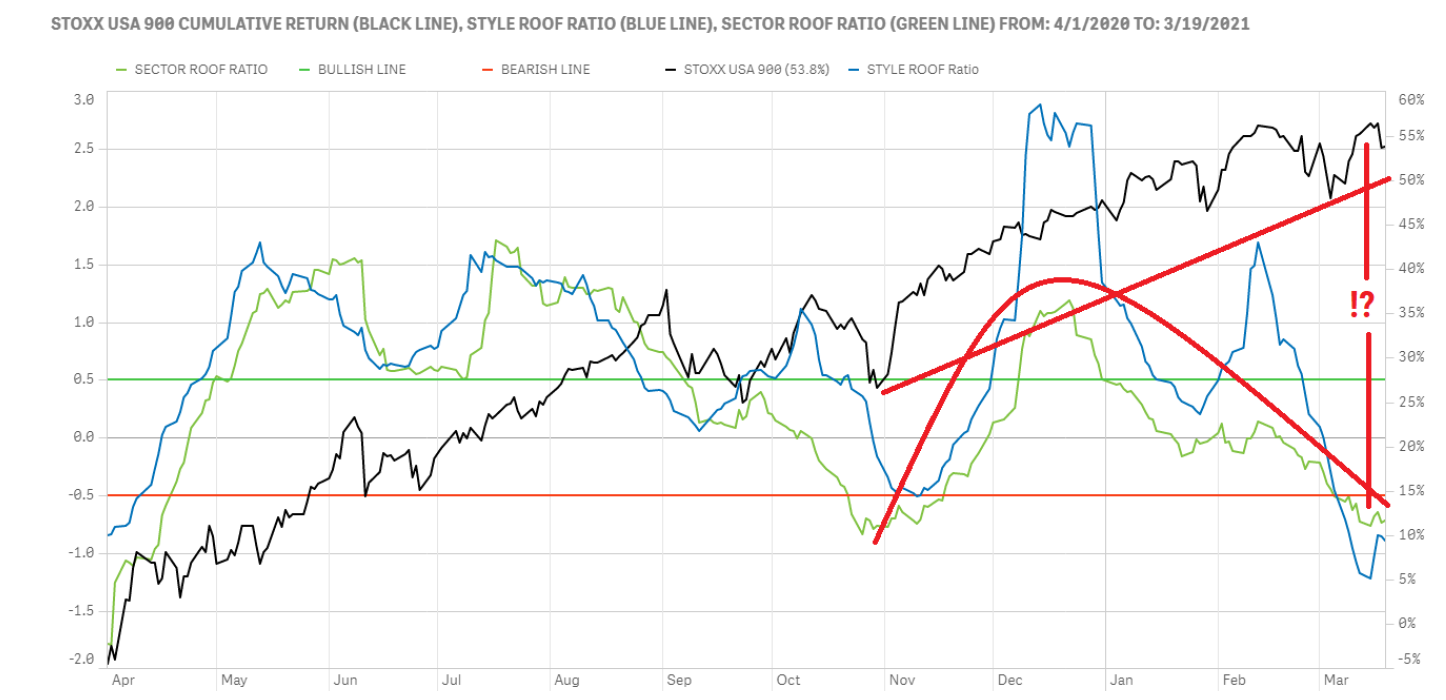

US markets do not seem worried about the general lack of yeast in investor sentiment. Both ROOF Ratios have now been declining since late December but the STOXX USA 900 index notched five new highs since then (top chart). The divergence between market returns and sentiment is now as wide as it was prior to the COVID-19 crash. This does not mean that a crash is imminent once again, but simply that were a risk event to happen, investors would over-react and cause a large correction.

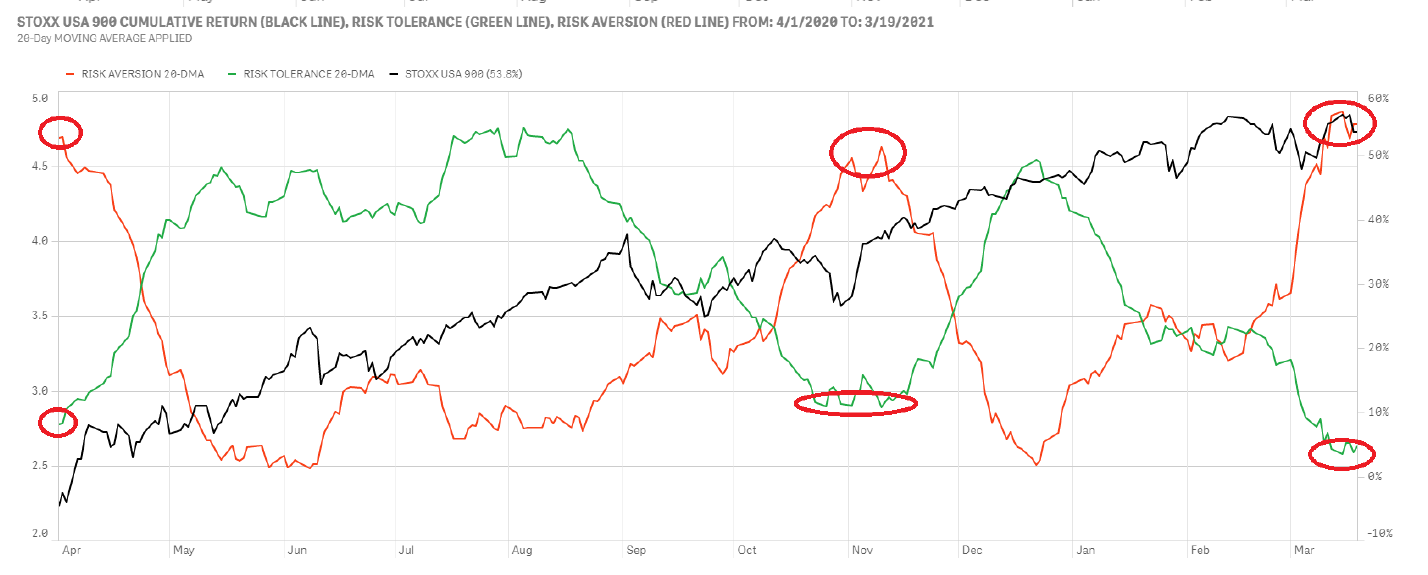

The supply-demand for risk is now firmly on the side of supply with risk tolerance (green line) at a new 12-months low and risk aversion (red line) at a 12-months high (bottom chart). This means that in the event of a negative news, the few risk-tolerant investors left in the market will be able to extract large price discount from the many risk-averse investors wanting to de-risk their portfolios by selling them their risk assets (i.e., why markets fall).

European markets continue to defy a deteriorating investor sentiment, hoping for stimulus.

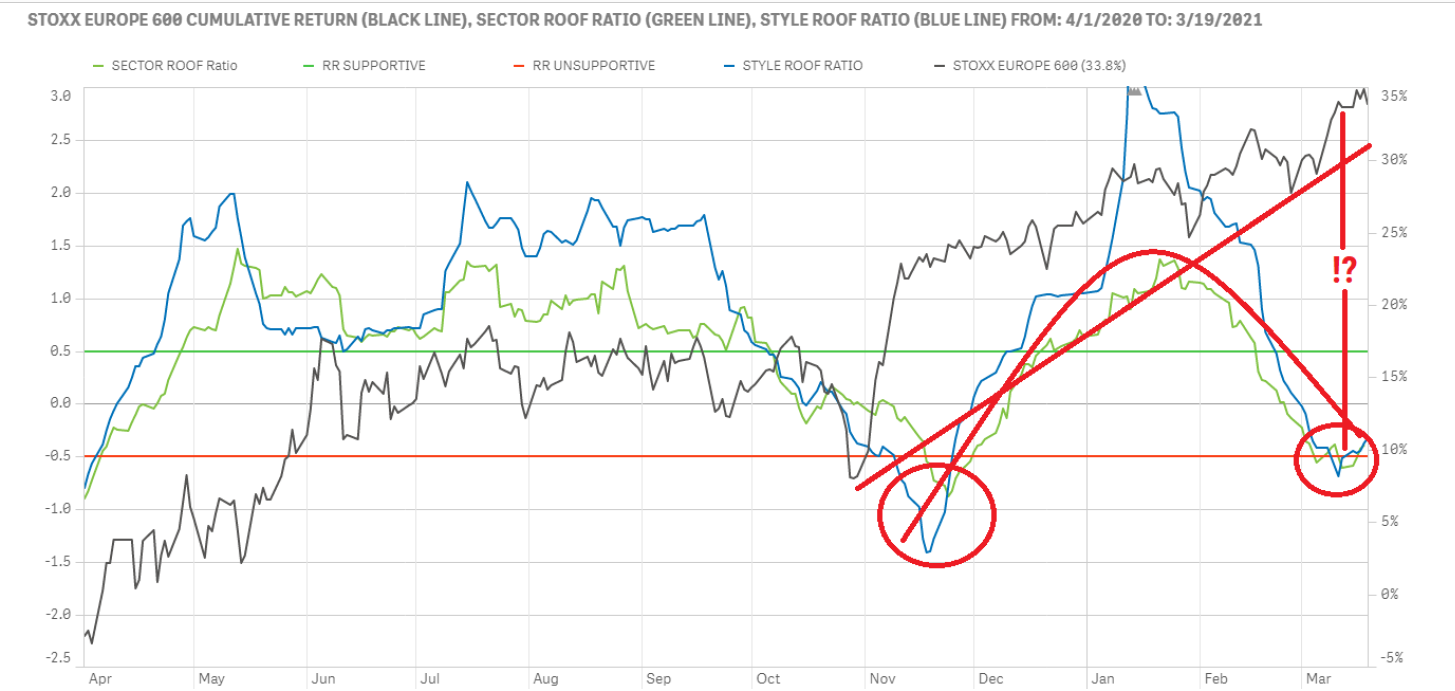

Sentiment in developed Europe stabilized just inside the bearish zone for both of our ROOF variants (top chart). Despite this deteriorating sentiment, the STOXX Europe 600 index continued to rise this past two weeks, ignoring both sentiment and COVID data pointing to a growing third wave and its associated economically disruptive social distancing measures. Last October, the mere mention of the possibility of a second wave and new lockdown measures sent investors packing.

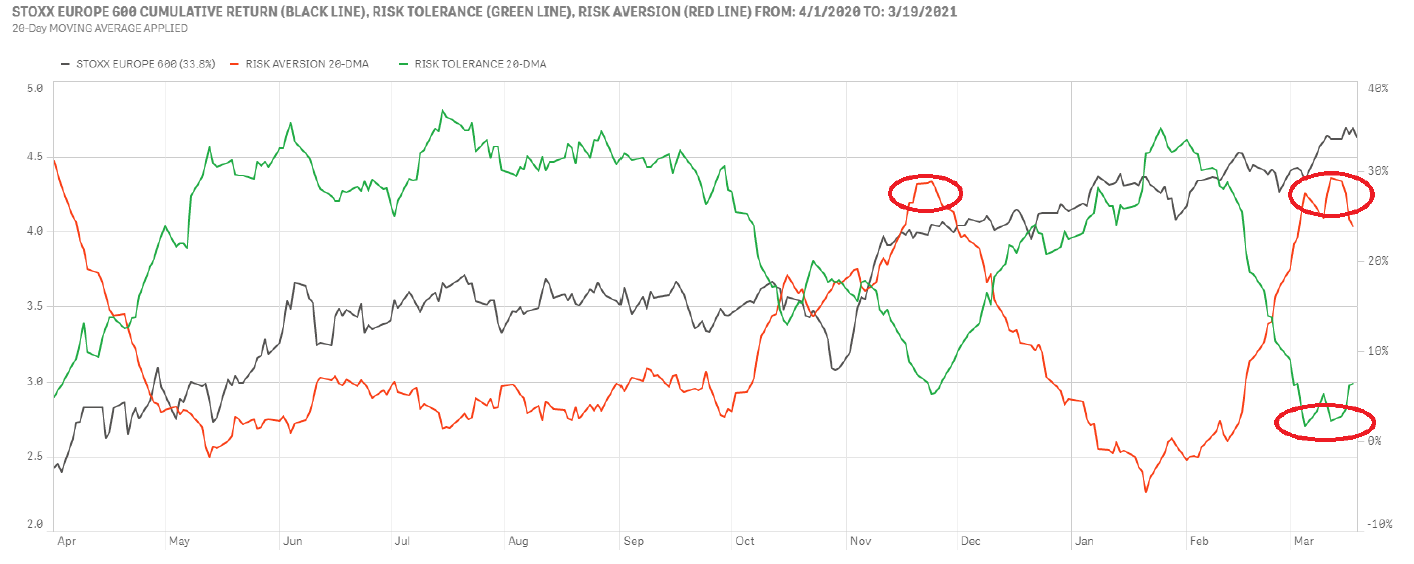

After hitting a 12-months low in January, risk aversion (red line) rebounded sharply and sits now near its 12-month high level (bottom chart). Risk tolerance (green line), meanwhile, is at a 12-months low. The supply and demand balance for risk is now almost as negative as it was pre COVID-19 crash last year and signals a very fragile risk appetite maintained only by the promise of further stimulus measures and an absence of investment alternatives.

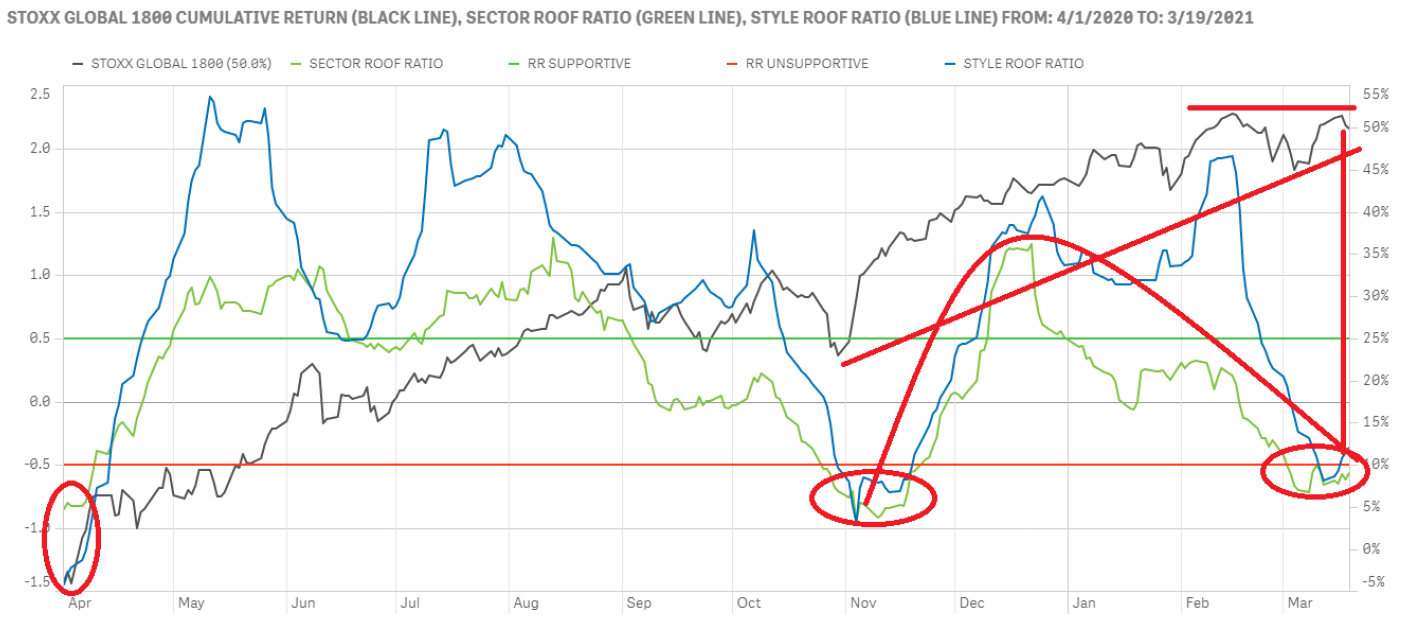

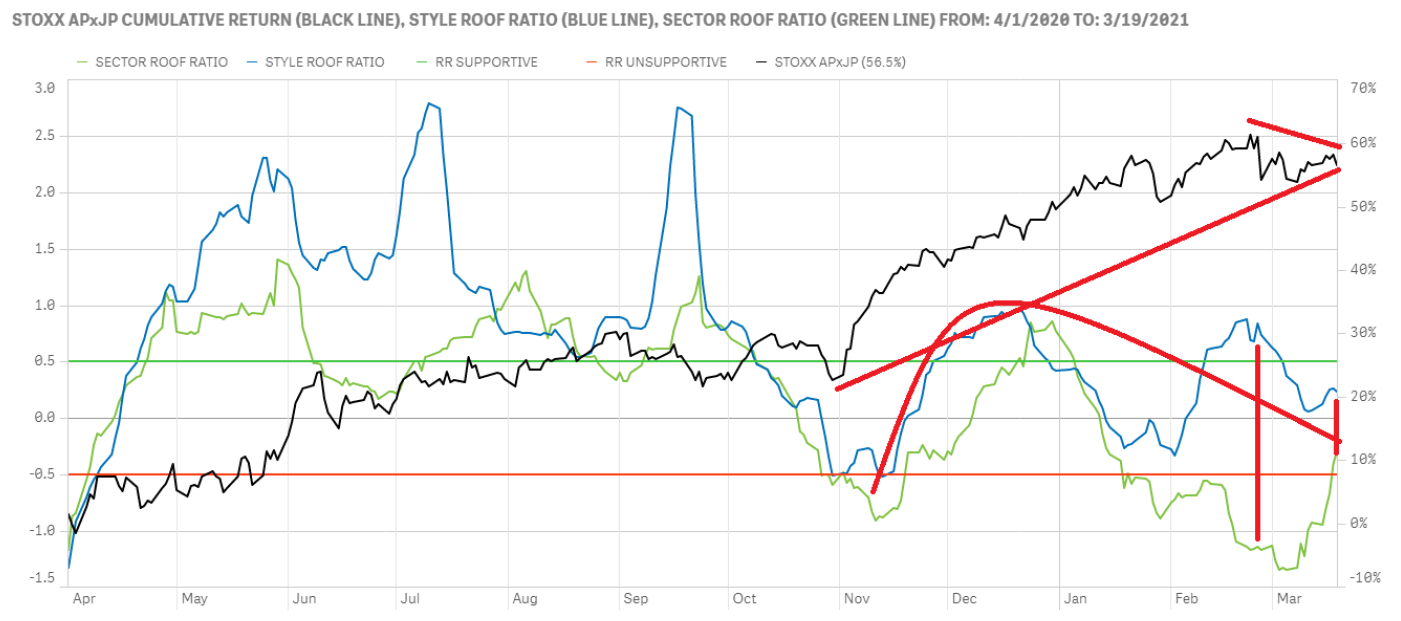

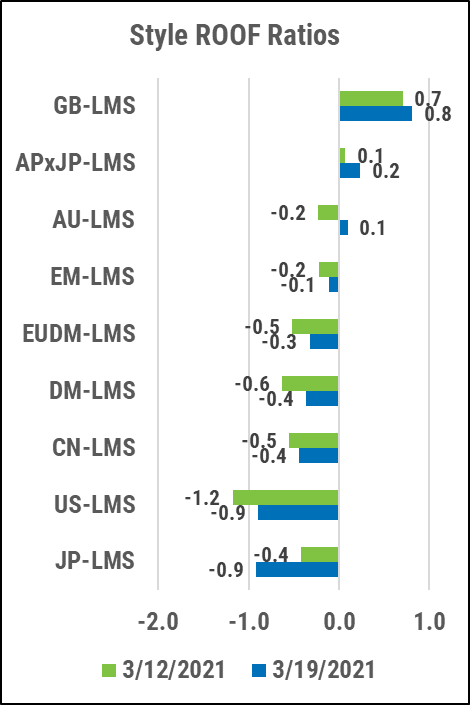

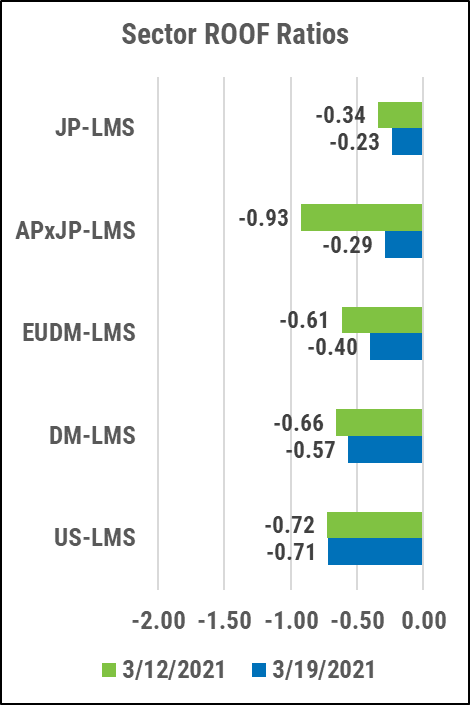

Global investor sentiment remains bearish while Asia ex-Japan returns to neutral.

The STOXX Global 1800 has traded sideways for the last few weeks, stubbornly defiant of a deteriorating sentiment (top chart). The latter has now stabilized just inside the bearish zone (<=0.5) but the gap between markets and investor sentiment betrays a courage to push markets higher that simply isn’t there. Were a risk event to happen, panic selling is more likely than orderly profit taking.

In Asia ex-Japan, the divergence between our two ROOF ratios has narrowed with both giving in to the other and meeting halfway in the neutral zone (bottom chart). Markets, meanwhile, have also paused their recent defiance of sentiment and seem to be awaiting further direction from geopolitics. A clear picture will be long in the making as domestic concerns take center stage for the Biden administration and leaders globally focus on their domestic vaccination rollout. The recent move from bearish to neutral in this region seems to indicate a willingness to wait-and-see on the part of Asia ex-Japan investors.