Potential Triggers: Fed policy meeting minutes, Eurozone Q1 GDP update, flash PMI updates for US, UK, Europe, China, and Japan.

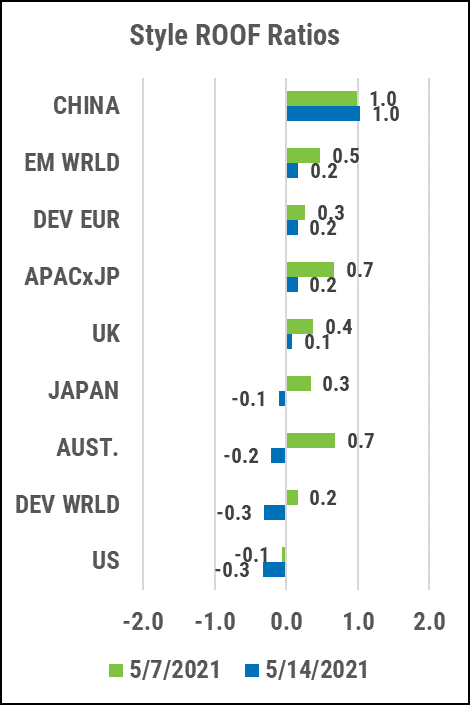

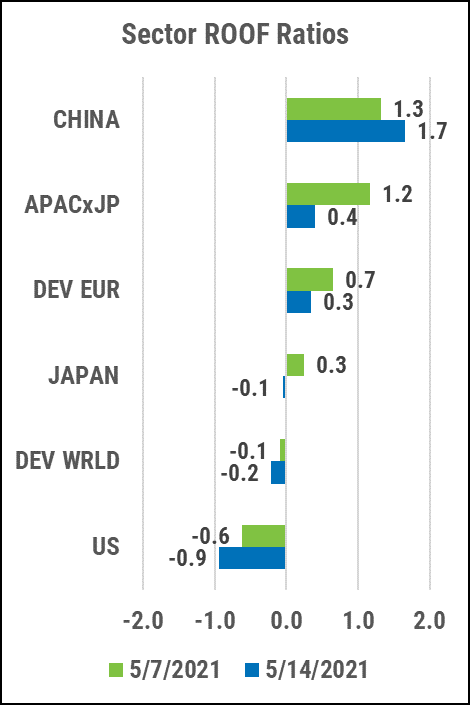

Summary: I don’t mean to go all Harlan Ellison on you but what was Janet Yellen thinking shouting “higher interest rates are coming” in a crowded market filled with hordes of QE faithful praying at the altar of easy money?! The impact on investor sentiment was swift, and (almost) global. Investor sentiment declined sharply again last week in all markets we track except China. US investors regained their leadership role as the most negative investors with sentiment there falling deeper into bearish territory. Sentiment in global developed markets, Japan, Europe, Asia ex-Japan, and the UK also declined albeit from much higher starting point, and ended last week in the neutral zone. The question unnerving investors isn’t about inflation per se, inflation is already here and rising, but for how long and how high it will have to go to force the Fed into raising interest rates. Add to this a few geopolitical and pandemic flare-ups and the negative confirmation bias takes over, making investors over-react to negative news and under-react to positive ones. To be fair, only US investors seem in this bearish situation, the rest of the world is still in a neutral wait-and-see mode right now.

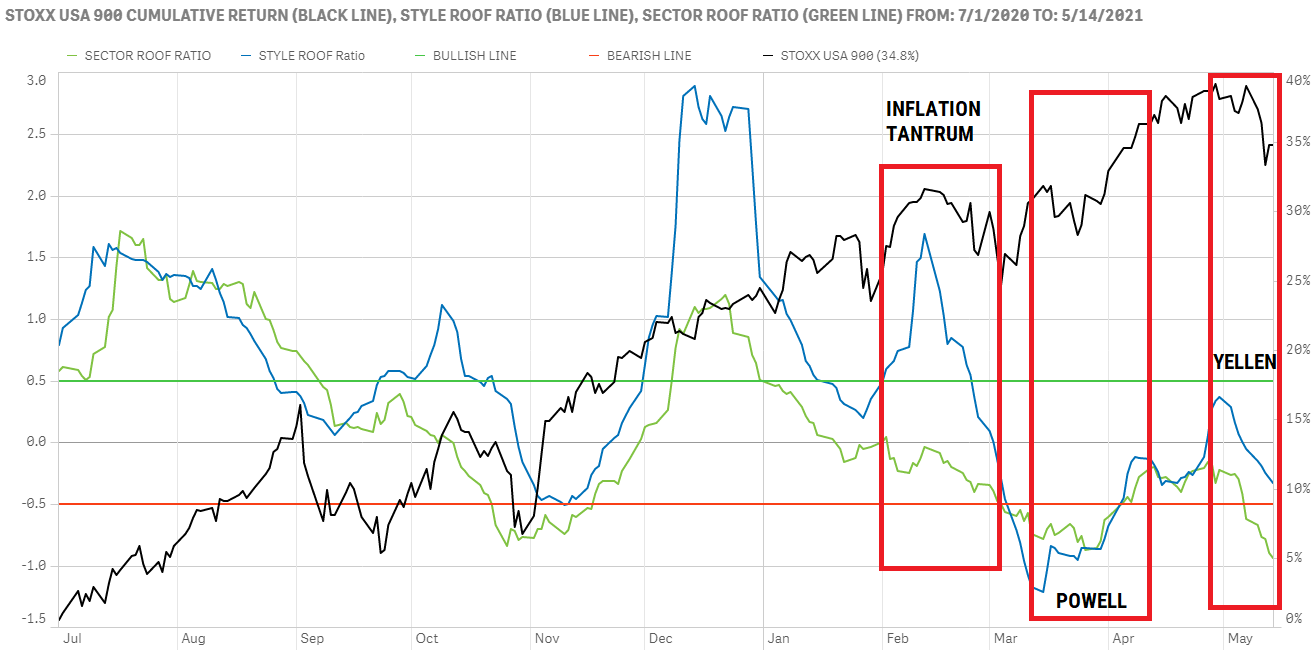

US investor sentiment dips further into bearish territory on continued inflation fears.

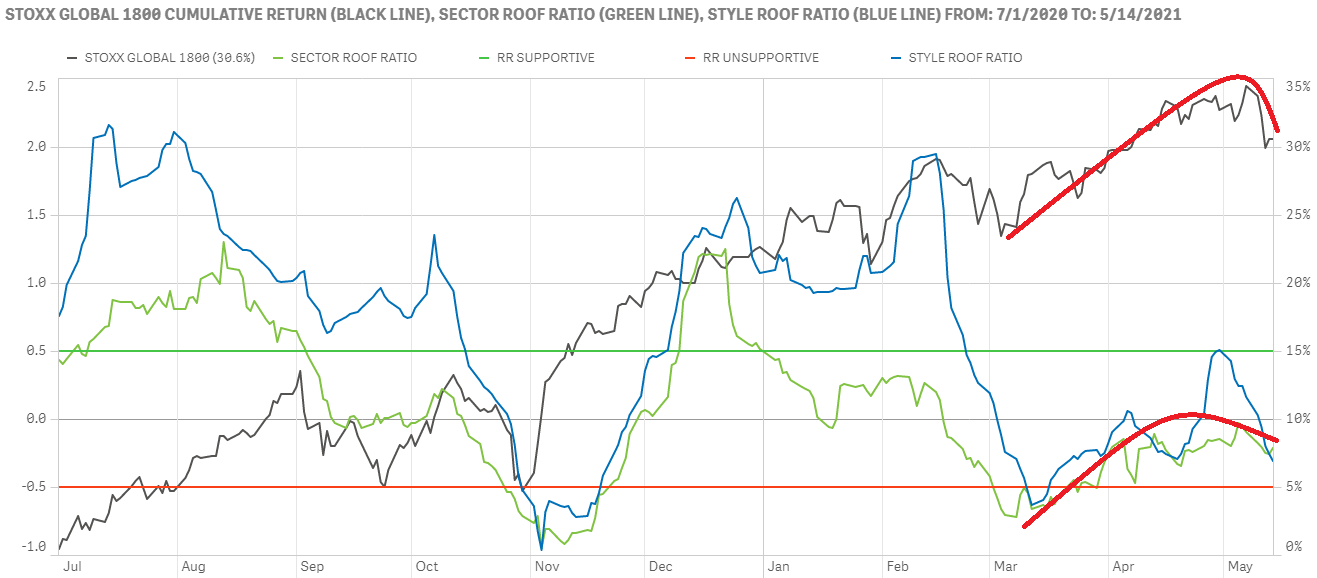

US investors reacted to treasury secretary Yellen’s non-apology apology by becoming more, not less, concerned about inflation. The Sector ROOF ratio (green line) is now deep in bearish territory with the Style ROOF ratio (blue line) in tow behind it (top chart). The last time sentiment fell this low on inflation worries, Fed Chair Powell was able to talk investors off the ledge by pledging low interest rates until at least 2023. Let’s see if he can do it again and help his former boss walk back her gaffe.

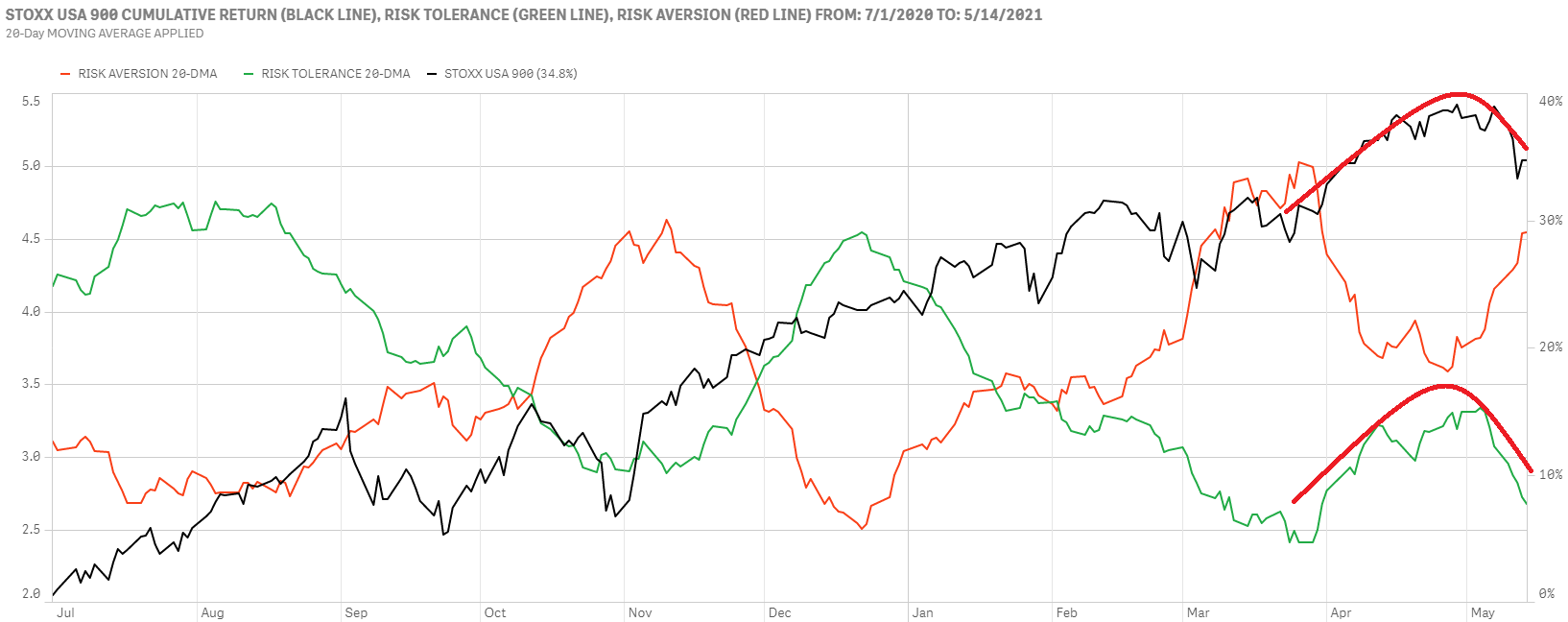

Risk aversion (red line) continued to rise last week but remains below its February inflation tantrum highs (bottom chart). Likewise, risk tolerance (green line) despite falling below its October 2020 levels, is still above its February 2021 lows (bottom chart). The net negative supply-demand balance for risk helps explain the recent market correction. Investors will be combing through the Fed meeting notes to be released this week, for clues to just how worried it is about inflation.

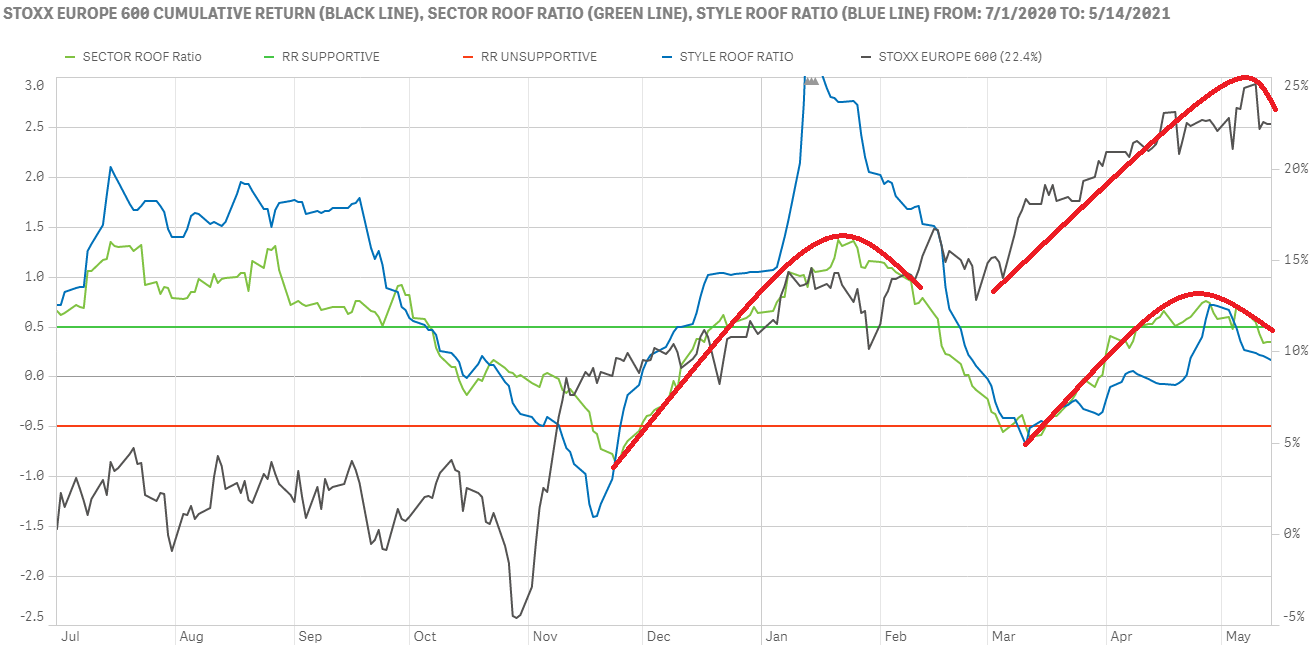

European investors sentiment retraces its recent steps for the safety the neutral zone.

Both ROOF Ratios have now retreated to the neutral zone after a short foray into the bullish one last month (top chart). The latest run in market performance was supported by improving sentiment but as the latter declines, markets will need other reasons to keep climbing.

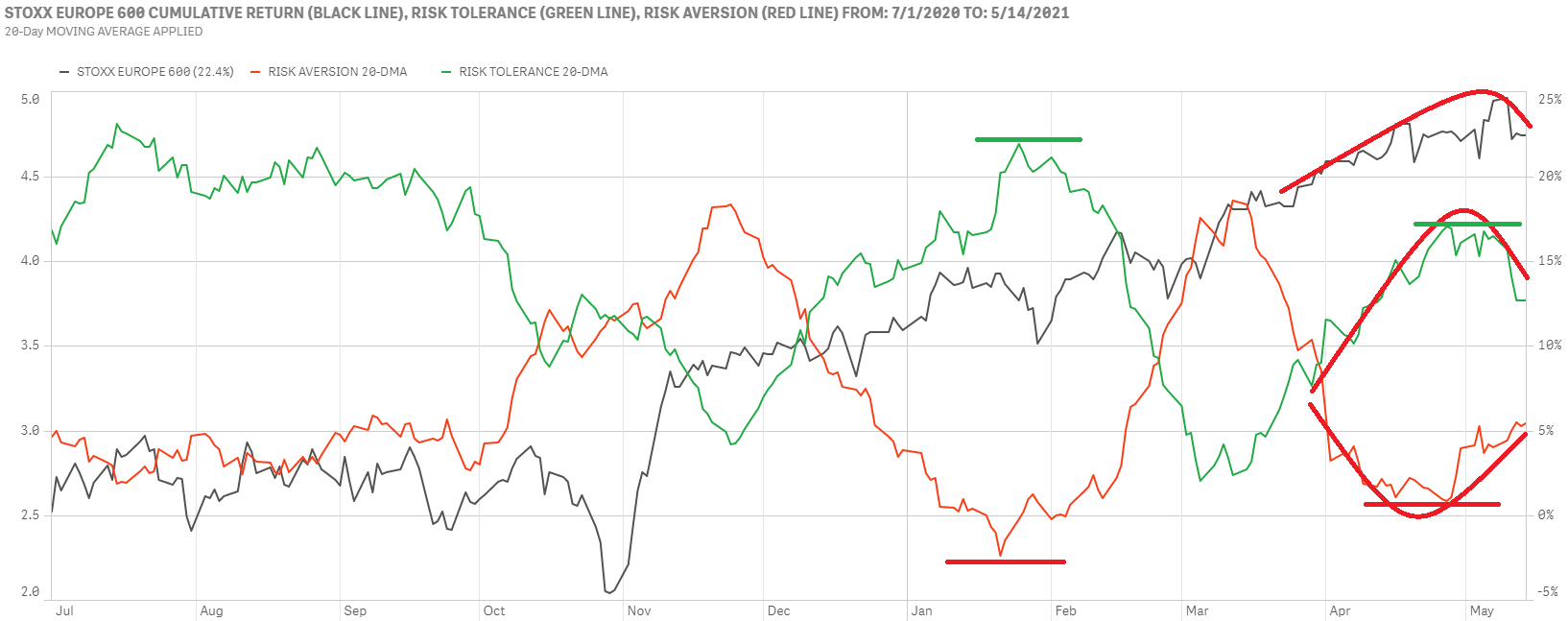

Markets had successfully shrugged off a rise in risk aversion (red line) back in May and continued to advance on improving sentiment thereafter (bottom chart). But, the clouds of higher interest rates in the US, and domestic political worries in France and Germany ahead of their elections was reason enough for investors risk tolerance (green line) to decline. We note that the recent highs in risk tolerance were nowhere as high as at the start of the year while risk aversion levels remained higher than their start-of-the-year lows indicating that there is some cumulative risk aversion that simply won’t go away, and net risk appetite might be lower than the recent market run may suggest.

Spooked by inflation worries, both Global and Asia ex-Japan investor sentiment declines.

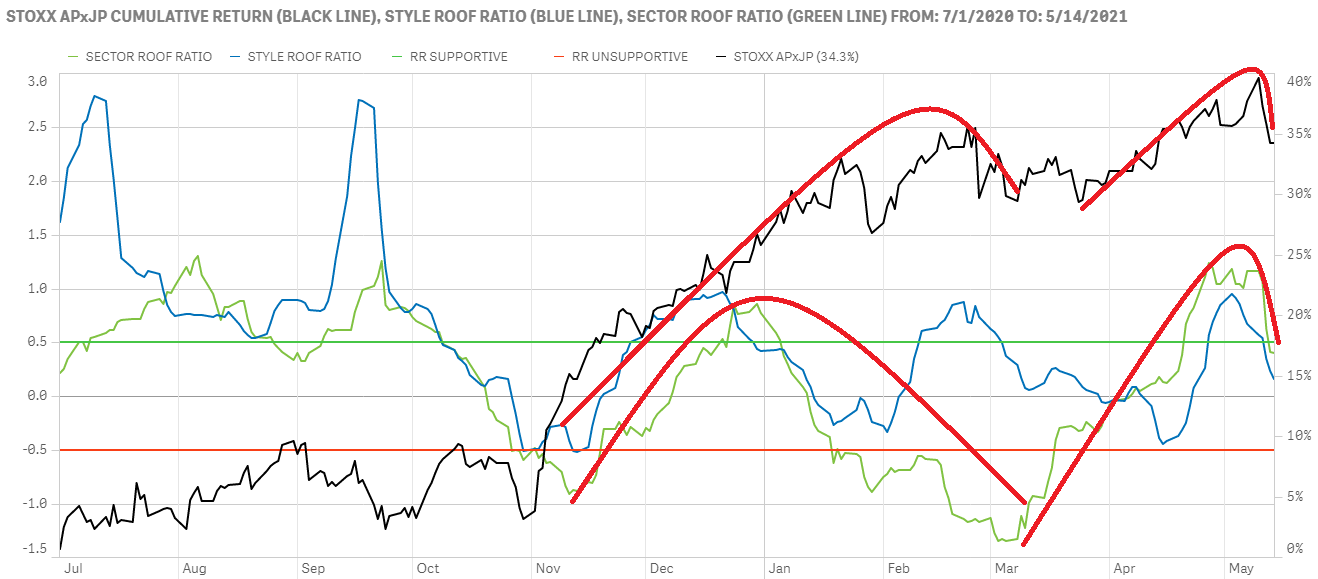

Global investors’ sentiment declined last week for both of our ROOF variants but remained in the bottom half of the neutral zone (top chart). After a recent strong run, markets also retreated under a bout of profit-taking. In the neutral zone sentiment bias is neither positive nor negative and it will take actual negative news instead of anticipation of one to reverse the recent upward trend in risk appetite for global investors who are still focused on the global economic recovery story.

Asian markets resisted a downward pull from a deteriorating sentiment in Q1, it remains to be seen if it can do it again in Q2 (bottom chart). Back in Q1 sentiment fell from bullish to bearish but markets only flattened in response. We may be seeing the start of a similar decline in sentiment from both US inflation worries and Asian pandemic flare-ups, if so it will be interesting to see if markets can withstand a declining investor sentiment two quarters in a row. The decline in sentiment is only starting and we are still in the upper half of the Neutral zone, for now.