Potential Triggers: US Q1 GDP (2nd est.), durable goods orders, personal income, PCE price index, and Biden’s FY 2022 budget. Eurozone business survey and GDP updates from France and Germany.

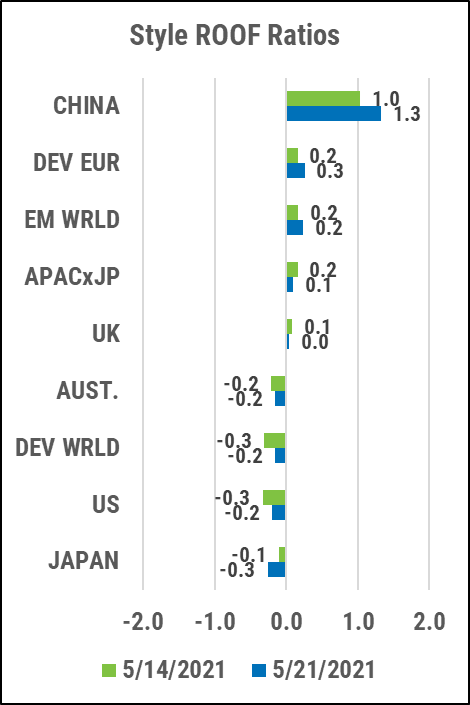

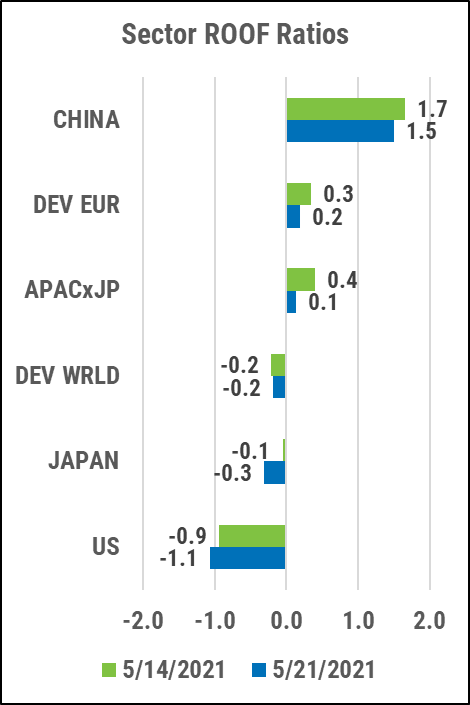

Summary: Sentiment continues to be swayed by inflation. As many think it will last, as think it will be temporary. Half of them will be right. Investors seem unable to agree when Central Banks will have to raise interest rates, but have for now decided it is likely further away than next Wednesday at 9am. Sentiment remains adrift in the ambiguity of the neutral zone for most markets we track except the US where the Yellen Put has left it with one foot in the bearish zone, one (still) in the neutral one, and China where investors seem to be voting more with their feet than their portfolios. In terms of market impact, hopes for continued easy money and fears of higher interest rates are not symmetrical; hope leads to voluntary responses, fear, involuntary ones; the latter usually uncontrolled. Big potential triggers (May jobs report and CPI) on inflation are not due until early next month, so, if politicians and administration officials can keep their mouths shut on that sensitive topic until hard data is released on June 4th and 10th, then it seems likely that both sentiment and markets will remain non-committal until then. Onward and sideways.

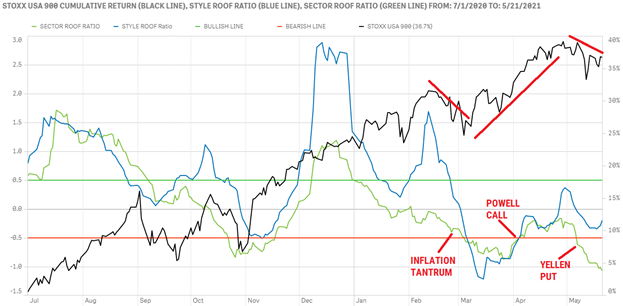

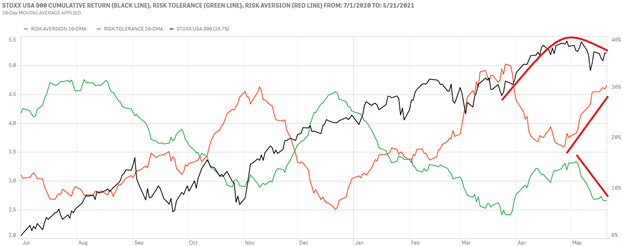

US investor sentiment remains under pressure from the Yellen Put.

US investors remain decidedly nervous about prospects for higher interest rates, but seem to gradually become used to the idea. The Style ROOF (blue line) ratio paused at the lower end of the neutral zone while its Sector ROOF (green line) counterpart dropped deeper into bearish territory (top chart). This split decision on the issue of inflation is unlikely to be resolved this week, but bias remains on the downside for now.

Risk aversion (red line) continued to rise last week breaking above its pre-election (Nov 2020) jitters (bottom chart). Risk tolerance (green line) meanwhile, flattened out just below its October 2020 levels, but above its recent inflation tantrum lows (bottom chart). Demand for risk remains net negative in these circumstances, and a weak sentiment should continue to be a drag on markets at these levels, especially with no data points to jolt it one way or the other until two weeks from now.

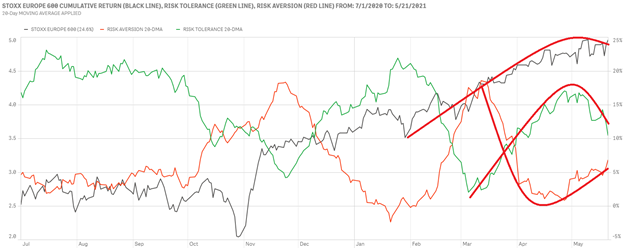

European investors sentiment weaker than markets would suggest.

Both European ROOF Ratios continued to retreat in the neutral zone last week while markets made one last defiant attempt at new highs (top chart). In a repeat of the March divergence between market return and sentiment, markets are once again ignoring a dip in sentiment but have become choppier in a sign that investor confidence is lacking for a sustained push to higher levels.

Risk aversion (red line) among European investors continued to rise last week, as risk tolerance (green line) retreated lower (bottom chart). The supply and demand for risk is still slightly in favor of demand but the downward-trending net risk appetite is no longer strong enough for a sustainable rally. In this zone of cynical optimism, markets may try and break higher, supported only by the belief that downside risk is limited. Further deterioration in sentiment could easily reverse this perception and after the long rally since November 2020, there is plenty of profit-taking to be had.

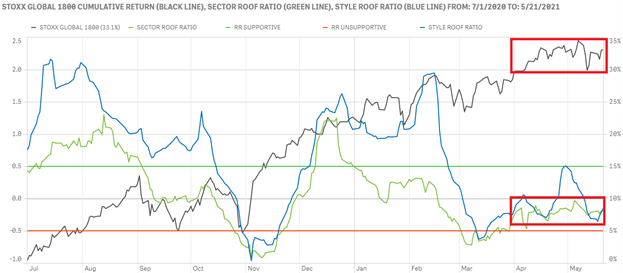

Sentiment among both Global Developed and Asia ex-Japan investors remains neutral.

Global investors’ sentiment flattened in the bottom half of the neutral zone last week, capping market returns after their long post-vaccine run (top chart). These investors usually take their cures from their US counterparts; last week, none were given, leaving both sentiment and markets directionless for the second month in a row. Sentiment is on the low side YTD, markets on the high side, signaling more downside risk than upside potential from these levels. Fingers crossed.

Asian markets managed to resist a downward pull from a deteriorating sentiment in Q1, trading sideways for February and March until sentiment improved again in April (bottom chart), can they do again? A declining sentiment is starting to weigh on markets, but the downward pull is not yet as strong as it was in Q1. The market’s consolidation during February and March has provided it with a strong base from which to rebound should a declining sentiment force it to test those levels again.

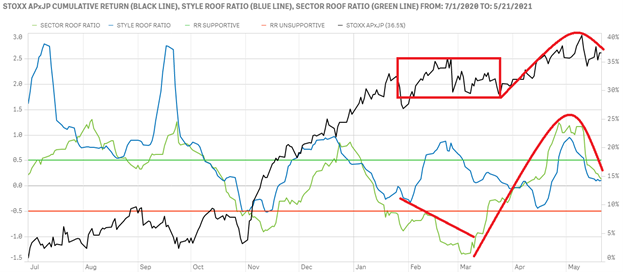

Sentiment drags Japanese markets lower but pulls Chinese markets higher.

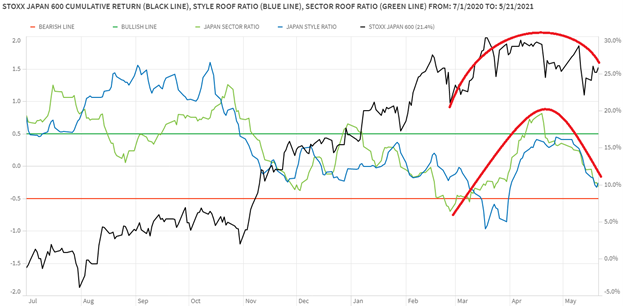

Japanese investors’ sentiment continued to decline from its April highs last week dipping into the lower half of the neutral zone for both ROOF ratios (top chart). As sentiment heads lower, it acts as a drag on markets and pulling the STOXX Japan 600 index lower via several very choppy sessions.

A continued rise in sentiment to new highs in China is slowly pulling markets back up from their March lows (bottom chart). The positive impact from rising sentiment has been slow to take effect. Given that sentiment does not have a lot of upside left from these levels, it will need to remain high to allow markets to catch-up. A drop in sentiment now might, instead, act as a deflator for markets.