Potential Triggers: Earnings from Pfizer and GM, US jobs report Friday, and worldwide PMI data.

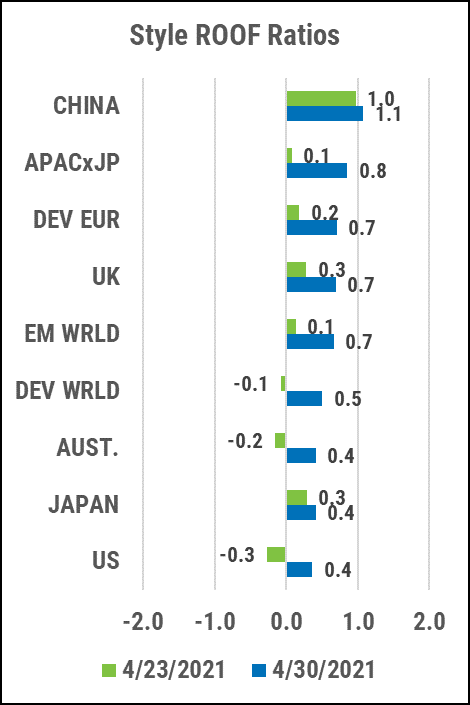

Summary: Changes in the risk environment too often come with preassigned emotional responses. As volatility and correlation declined across major markets last week, investors reacted to this potential for smaller drawdowns and lower predicted active risk by taking on more risk. This, however, does not mean that they have become more risk tolerant. Decomposition of the ROOF Ratios (both Style and Sector variants) show that the main driver of this past week’s increase in sentiment was declining volatility and not a penchant for more risk-tolerant styles or sectors (removing the two risk metrics show a decline in sentiment last week). Be wary of risk-driven changes in sentiment as volatility is, by nature, fleeting. Correlation has a longer half-life than volatility, but it’s still not a distance runner. The two can easily change course and investors’ preference for risk aversion lately signals that they could be easily spooked by, say, a stronger-than expected jobs report Friday, and over-react. So, think of last week’s apparent rise in risk appetite by investors as you would of a gentile on Wall Street who has no interest in converting to Judaism but still celebrates most Jewish holidays and occasionally (mis-)uses Yiddish expressions.

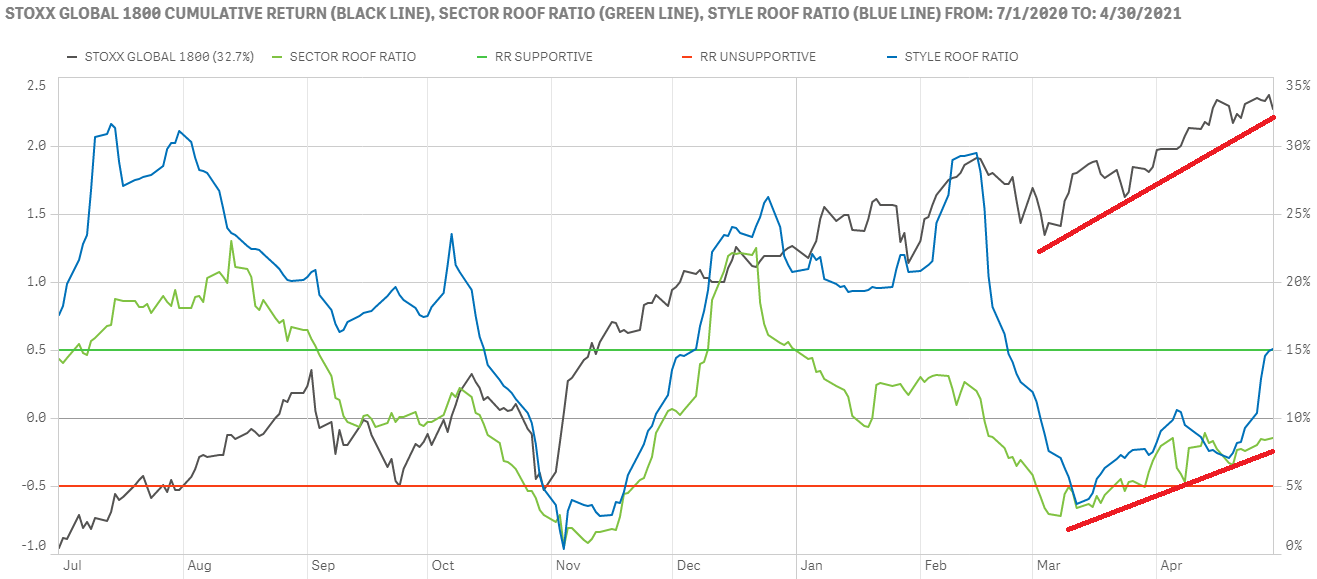

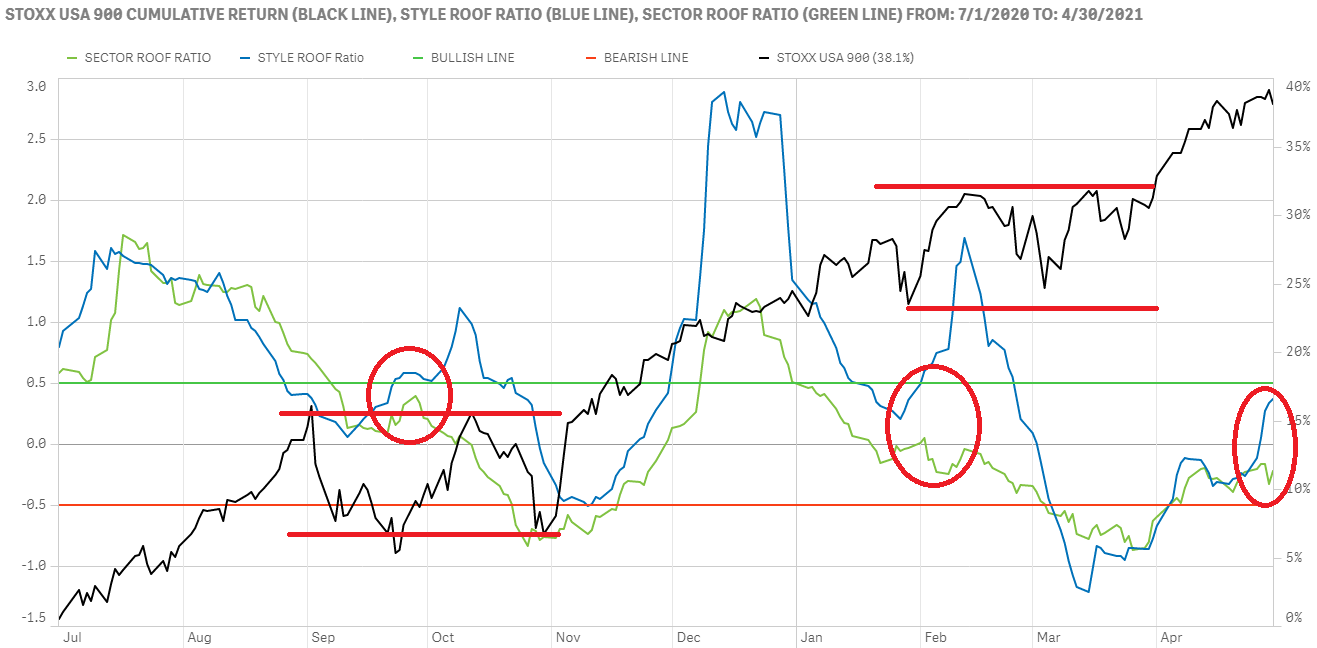

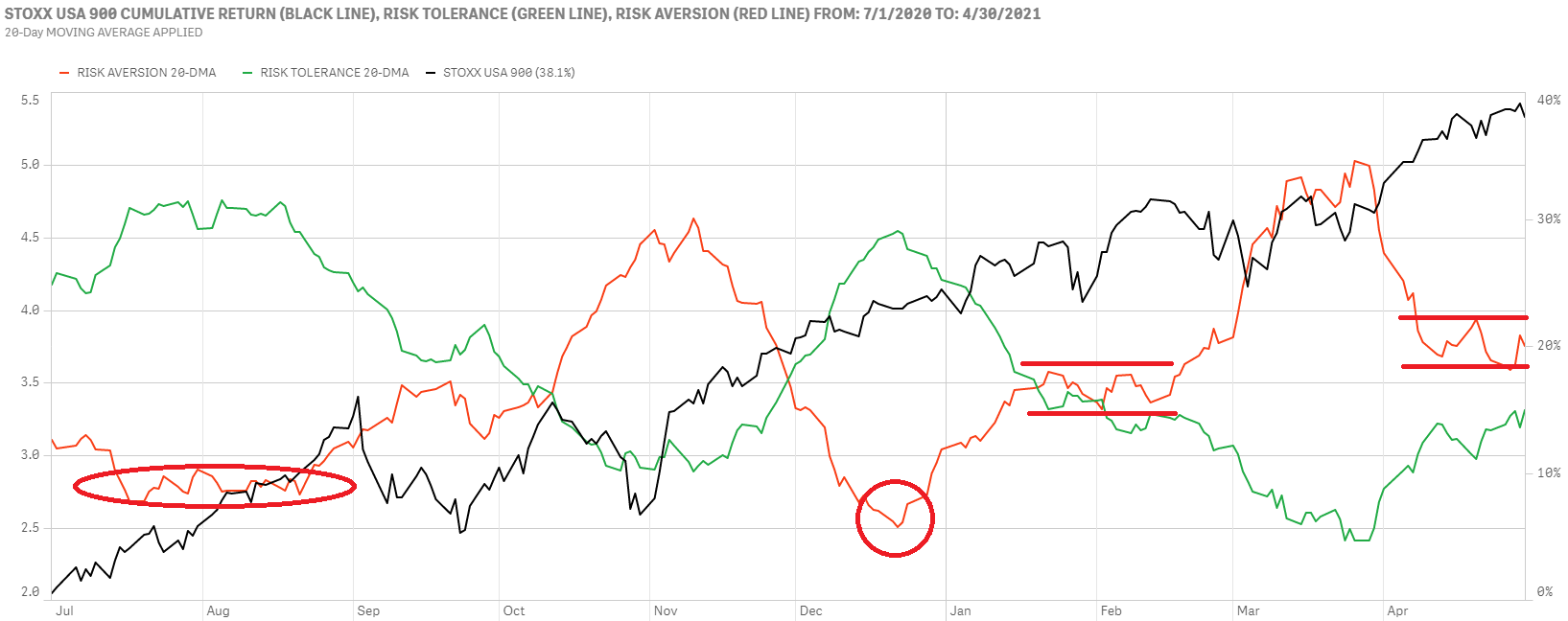

US investor sentiment split by recent decline in volatility and correlation levels.

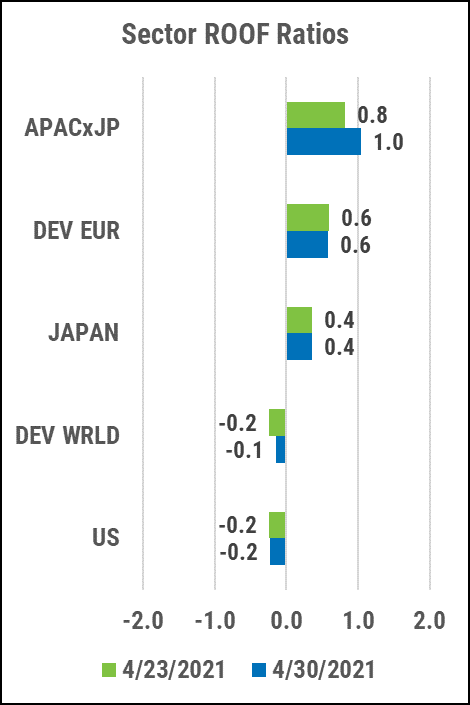

The stalled ROOF ratios of the past few weeks have given way to a split decision this week with the Style ROOF making an attempt at the bullish zone while the Sector ROOF remains anchored in the lower half of the neutral zone (top chart). Both ratios benefitted from a decline in volatility but investors’ continued preference for risk averse sectors outweighed their need to take on more risk. The Style ROOF has made a false start twice in the recent past only to retrace its seps later.

The supply and demand for risk continue to be near equilibrium with a slight edge for supply (bottom chart). If we remove the two risk metrics and only focus on the eleven sector choices, the remaining demand for risk is much lower than the supply, indicating that investors do not seem to have higher return expectations for risk-tolerant sectors and are just going through the motions. This lack of confidence could keep them in the neutral zone in the short-term.

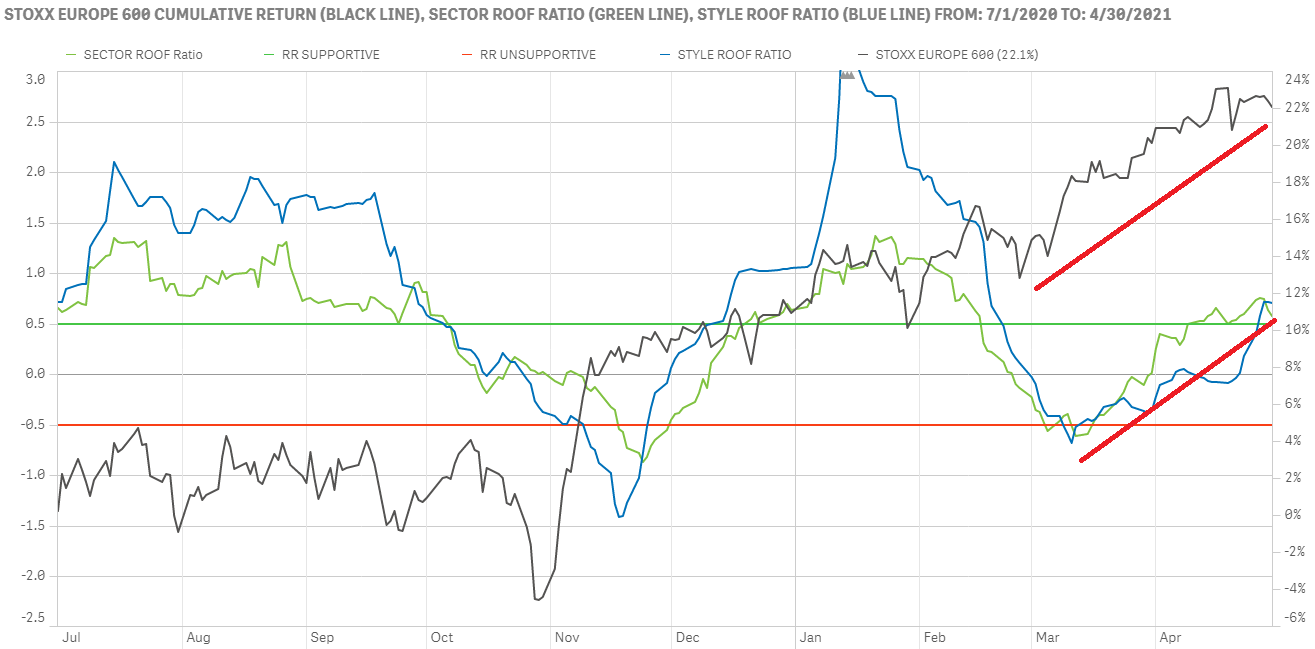

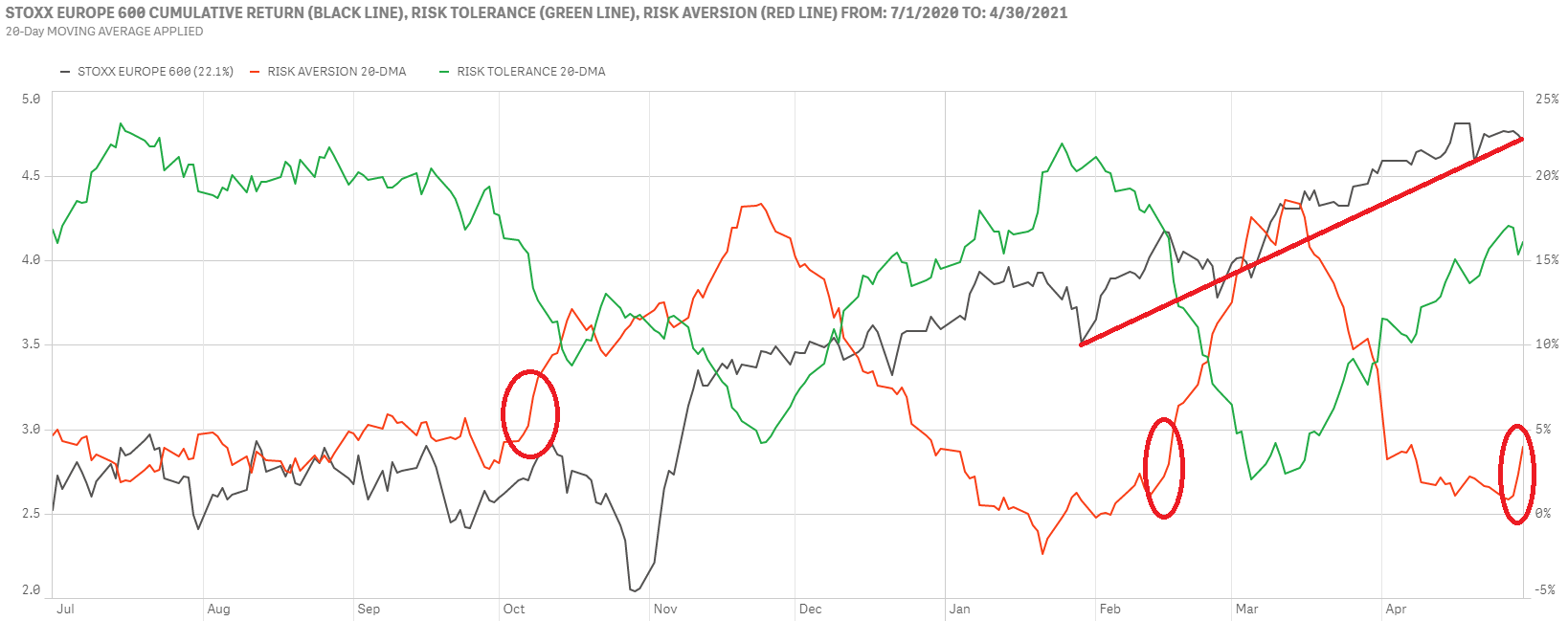

European investors sentiment remains positive but for how long?

Both ROOF Ratios have returned to the bullish zone but seem to question why they are there (top chart). Both sentiment and markets have run in parallel since mid-March and both seem to hesitate at these levels, requiring more confidence than investors may have to give. Momentum behind markets and the economy remains positive, growing social unrest, upcoming elections, and a slow vaccination drive is causing them to question whether the economy can go it alone.

The Sector risk aversion (red line) has seen a spike upward last week (bottom chart). This kind of reversal has been seen before and in both previous instances, risk tolerance (green line) was higher than where it is today indicating that the supply and demand for risk in Europe isn’t as much in favor of demand as in the past and may return to equilibrium in short notice if the volatility situation changes. Like their US counterparts, they are not chasing risk tolerant sectors or styles.

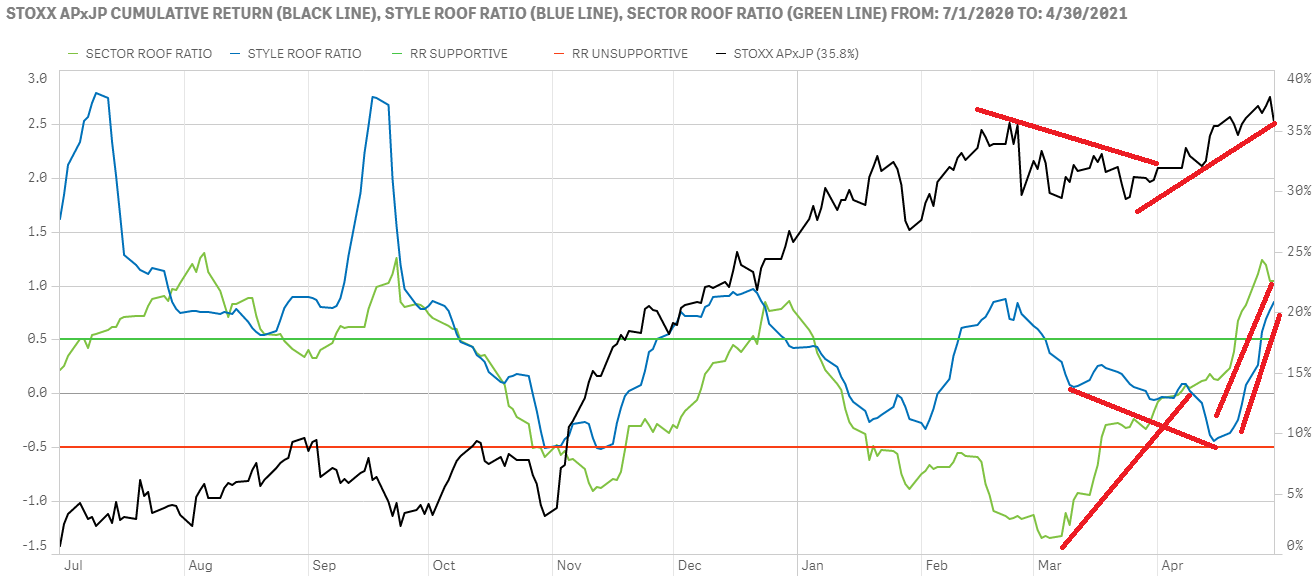

Global investors’ sentiment regains strength as Asian investors reach consensus.

Global investors seem to have regained some confidence last week with the Style ROOF (blue line) making a run for the bullish zone (top chart). Lower market risk and correlation are helping to lift sentiment but without this improving volatility regime, investors’ risk appetite isn’t as pronounced as it seems with risk aversion levels still slightly ahead of risk tolerance ones, signaling a greater potential for supply than demand for risk assets.

Asia ex-Japan has returned to consensus last week with both ROOF Ratios rising sharply to cross into the bullish zone (bottom chart). As with other regions, the lower risk environment of late is the main driver behind the improving sentiment but there seems to be more than that at play in Asia as even without the two risk metrics, demand for risk remains ahead of potential supply lending support to the current market rally.