Potential triggers for sentiment this week1 :

- US: Retail sales, producer prices and housing data. Earnings reports from big retailers will be on focus, as will the state of the crypto market after the FTX bankruptcy.

- Europe: UK inflation data and budget statement.

- APAC: Japan Q3 GDP; Chinese industrial production and retail sales, as well as any new development in the country’s Zero-COVID policy.

- Global: Any further lockdown measures in China affecting the global supply chain, and any retaliation by Russia for the loss of the city of Kherson in the war in Ukraine.

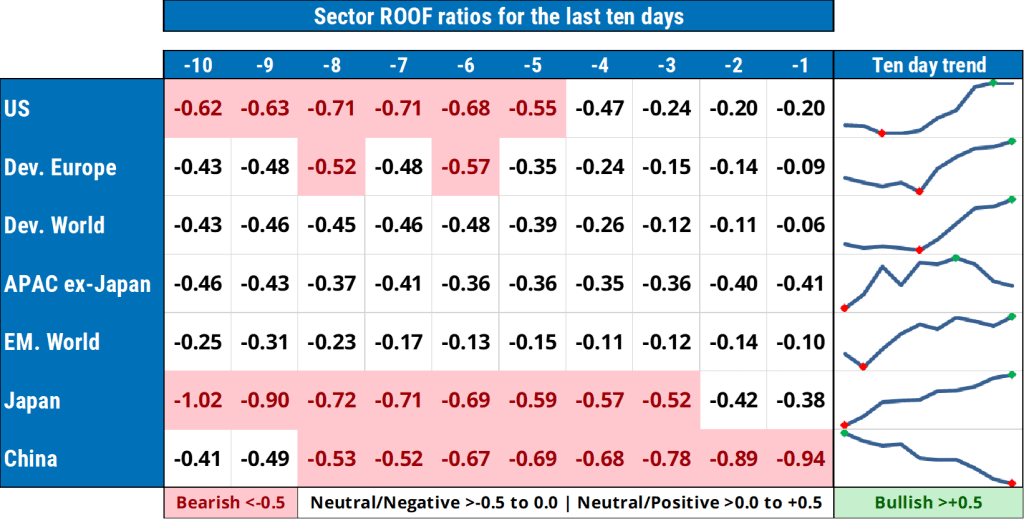

Summary of changes in investor sentiment from the previous week:

- Investor sentiment continued to improve across all markets we follow, driven higher by a trifecta of ‘better-than-feared’ news on corporate earnings, lower inflation and the US midterm election results. The only exception was among Chinese investors, who remain strongly bearish after authorities reaffirmed their Zero-COVID policy and reimposed lockdown measures in key cities as new infection cases rise.

- This earnings reporting season was a bit of a mixed bag, and CEOs told investors nothing of what may come next. Perhaps they felt that it was not their job to steal an instant of the future and deprive market participants of the joy of discovery. Absent clear guidance, however, investors’ focus will return on how well the wall holds up the roof instead of carefully selecting each brick. As of now, the roof is holding up fine, despite the macroeconomic and geopolitical storms.

- In and of itself, inflation is not the problem. The problem is that inflation is never in and of itself. It does not matter if the Federal Reserve will pivot from its current monetary tightening path or not — it matters only that enough investors believe this to be true. The real question, therefore, evolves not on the authenticity of that theory, but only on its verisimilitude. The latter scores well with risk-tolerant investors, who are currently dominant in this low-volume period.

- The 2022 midterm election results are in, and predictions of a ‘red wave’ turned out to be a cautionary tale with a downbeat ending for Republicans — one Republican in particular. We now have a divided government, and for the next two years, investors will enjoy the legislative equivalent of Gerald Ford’s presidency, when nothing of consequence happens. This result should further fan the flames of risk tolerance among investors.

- Last week was a case of investor sentiment expecting bad news and none happening. The potential for downside overreaction from a bearish sentiment was therefore not triggered. Even news from the war in Ukraine was positive. The big question, however, remains unanswered: Will the global economy face a short and shallow recession (small r), or a prolonged and deep Recession (big R)?

Jump to a specific market

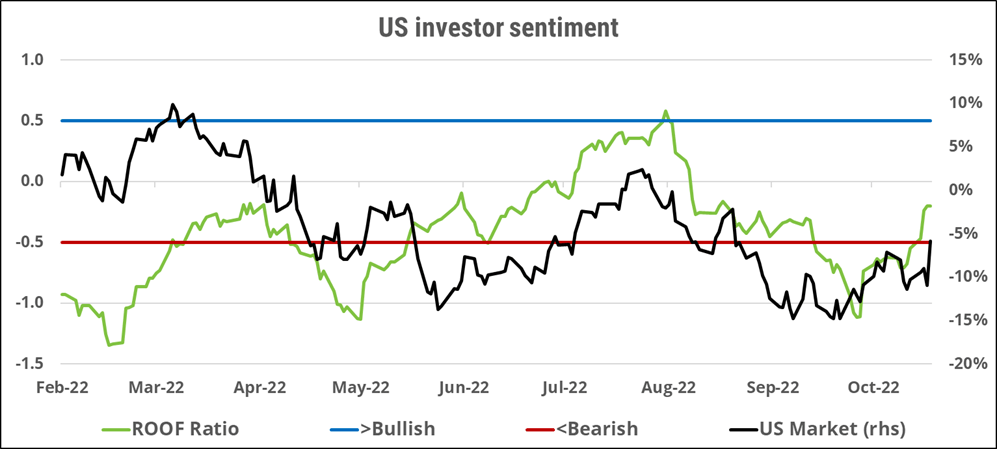

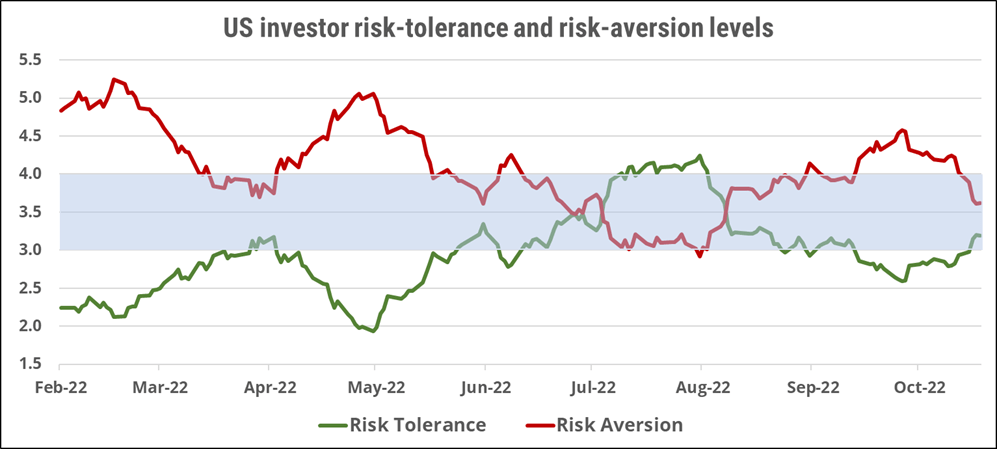

US investor sentiment

Sentiment among US investors (green line) continued to rise, convincingly, last week, ending neutral for the first time since mid-September. On the plus side for investors, were the continued resilience of corporate earnings and the economy, lower-than-forecast inflation data, and better-than expected midterm election results that delivered a divided government — a preferred scenario for markets. Even the news out of Ukraine was positive. The only negative for now is the open question on the economic cost of fighting inflation. For now, risk-tolerant investors seem willing to kick that can down the road and worry about it next year. The lower market volatility is also inducing a rebound in net risk appetite as fewer investors need to de-risk their portfolios for compliance reasons. Average traded volumes remain well below those in the first half of 2022, accentuating any price movements, and as sentiment turns more positive, the upward market momentum should continue in the short term.

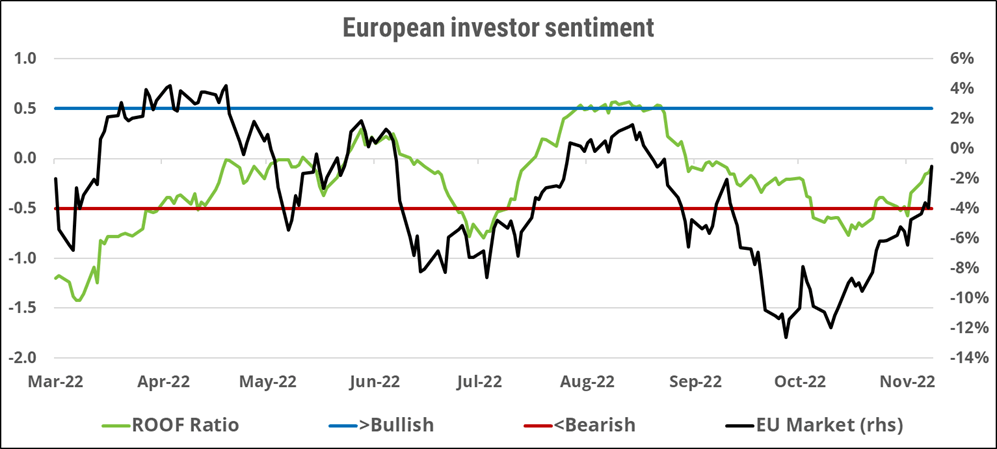

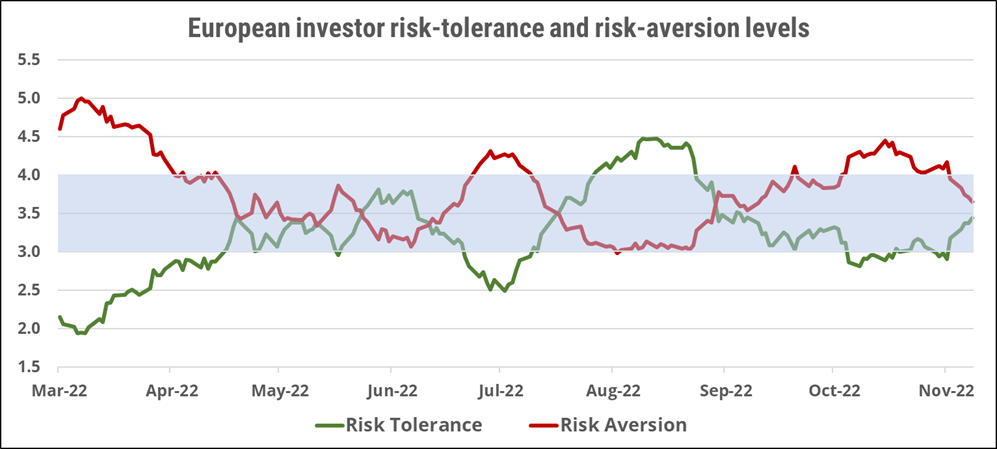

European investor sentiment

European investors’ sentiment (green line) improved further last week, ending neutral and at the highest level since late September. The magnitude of the current market rebound is now bigger than either the July or May bear market rallies. Sentiment is still lower than in those two priors, however, despite its recent recovery. If nothing comes along to dampen investors’ risk appetite, sentiment and markets could rise further in the near term, with the August highs as a near-term target. As with other developed markets, the question surrounding the health of the global economy remains unanswered. The impact on Europe’s industrial production capacity without Russian energy through the winter and with potential disruptions in China’s manufacturing capabilities remains unknown. Risk-averse investors will want to have this final piece of the puzzle solved before returning to markets.

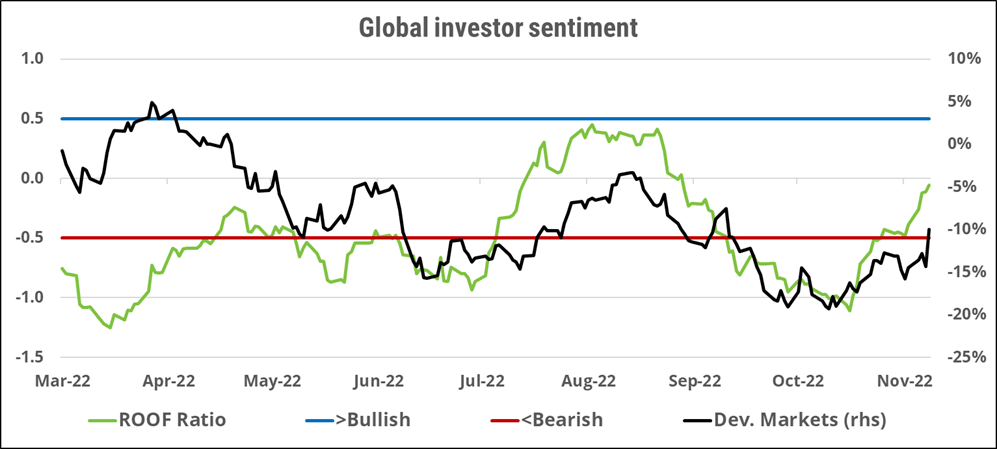

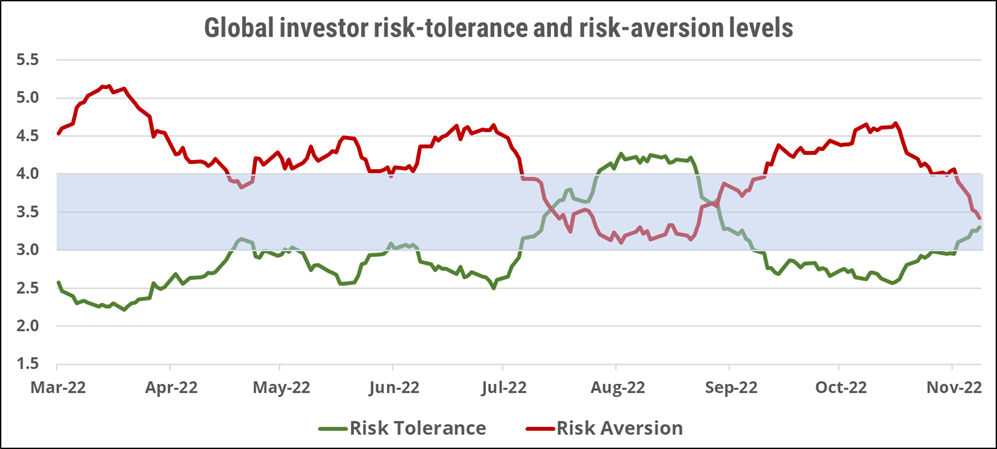

Global developed markets investor sentiment

Sentiment among global developed-markets investors (green line) jumped last week, ending neutral. Global investors had been the most bearish across all markets we follow during October, but calmer currency markets, a weaker US dollar, and a rapid decline in market volatility this month have raised overall risk appetite and put a temporary halt to de-risking by risk-averse investors. Global markets have now recovered more than half of their September and October decline, and with sentiment becoming increasingly more supportive of a market rally, prices could return to their August highs by the end of the month, especially if the macroeconomic and geopolitical news remains benign.

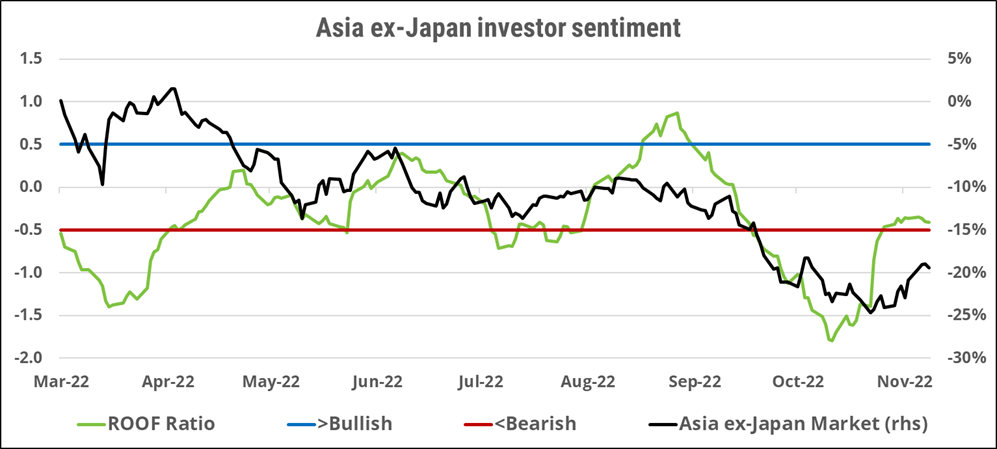

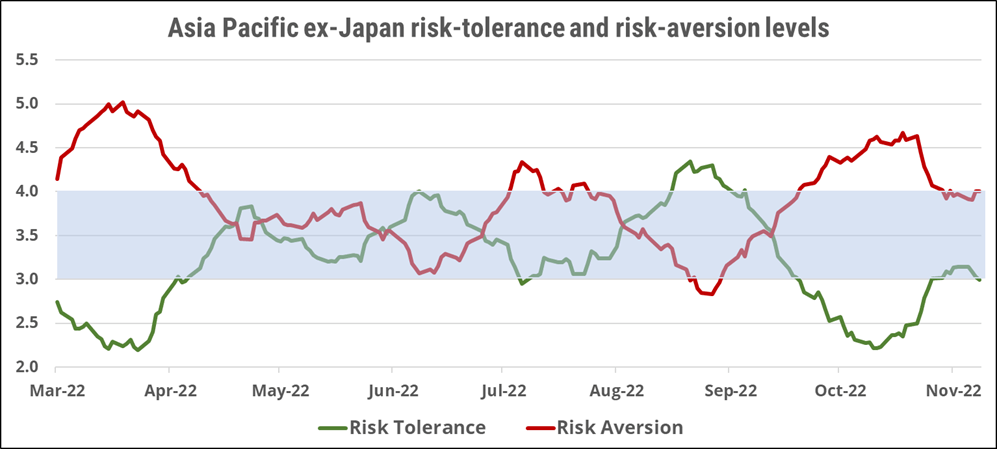

Asia ex-Japan markets investor sentiment

Sentiment among Asia ex-Japan investors (green line) ended unchanged from the previous week, failing to build on the prior month’s recovery. Investors remain very sensitive to the fluid COVID situation in China as local new infection cases continue to rise and authorities there reaffirm their commitment to the Zero-COVID policy ahead of the winter. This issue is crucial for markets and kept investor sentiment from focusing on the positives of lower-than-expected US inflation data as well as a softer US dollar. If sentiment fails to recover, it will continue to weigh on any market rally and prevent a return to even the recent August highs.

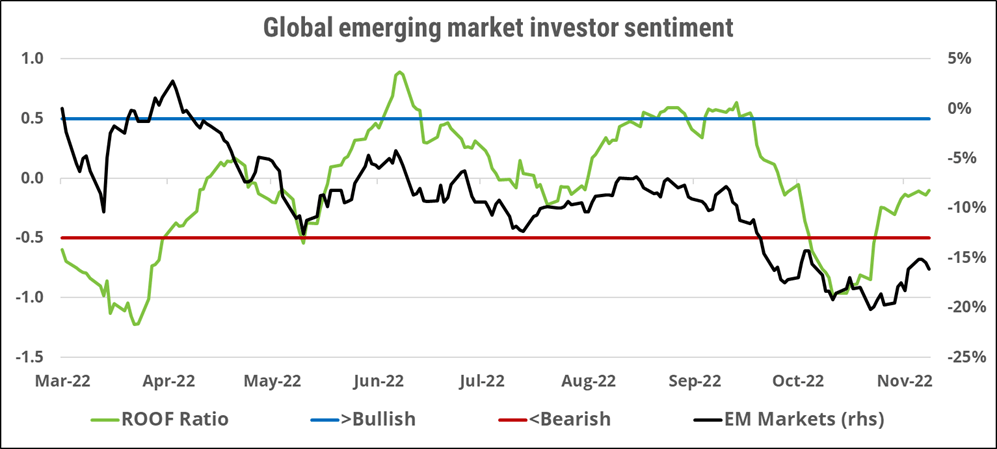

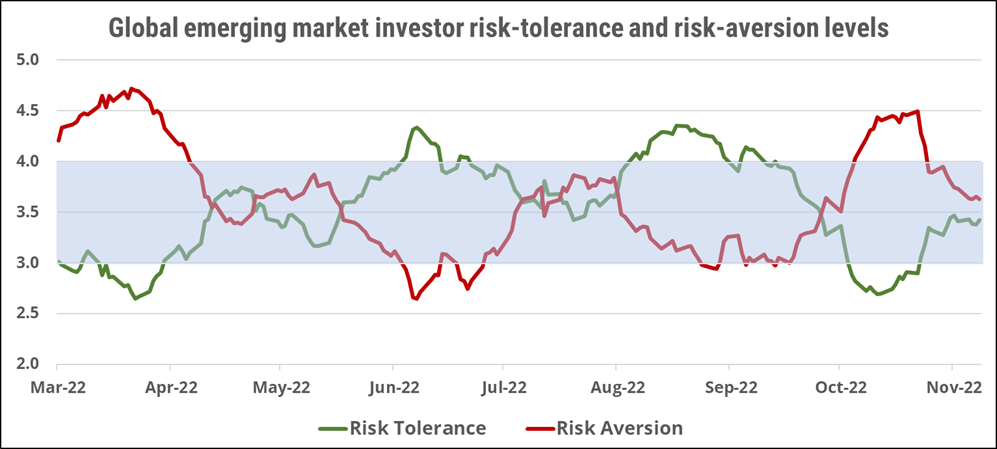

Global emerging markets investor sentiment

Sentiment among global emerging-markets investors (green line) failed to capitalize on an improving macro picture, ending last week slightly negative and unchanged from the previous week. Hopes that the global macro picture will not get rapidly worse are battling fears that it still very well could. It matters not to investors that the US Federal Reserve will raise interest rates at a lower increment from now on if the destination is still higher than previously expected. Debt servicing among emerging markets is not a short-term issue and with a global stagflation scenario still the base case for 2023, the divergence among individual economies will increase next year. On the positive side will be energy- and commodities-producing countries with current account surpluses, and on the negative side will be those countries needing to pay higher prices for energy imports and facing higher interest-rate charges on their national debt. The COVID situation in China will also add to the uncertainty for emerging-markets investors, capping any rebound in either sentiment or valuations.

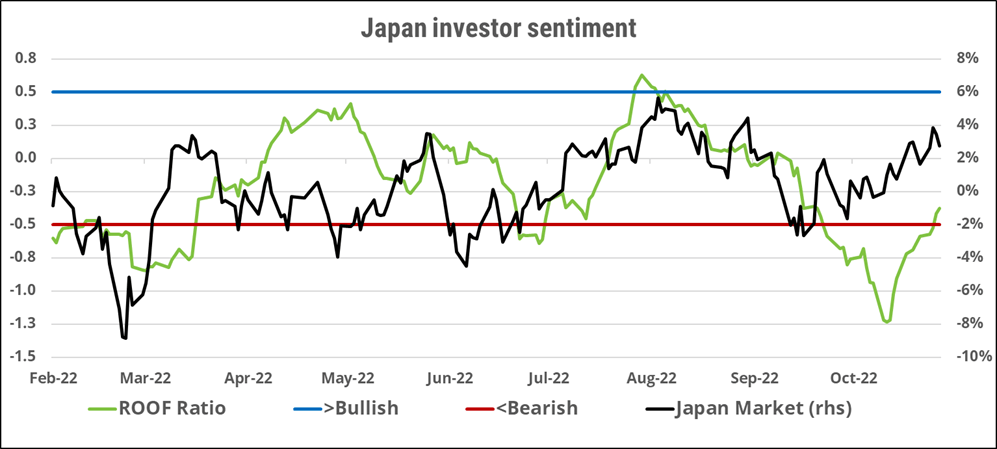

Japan market investor sentiment

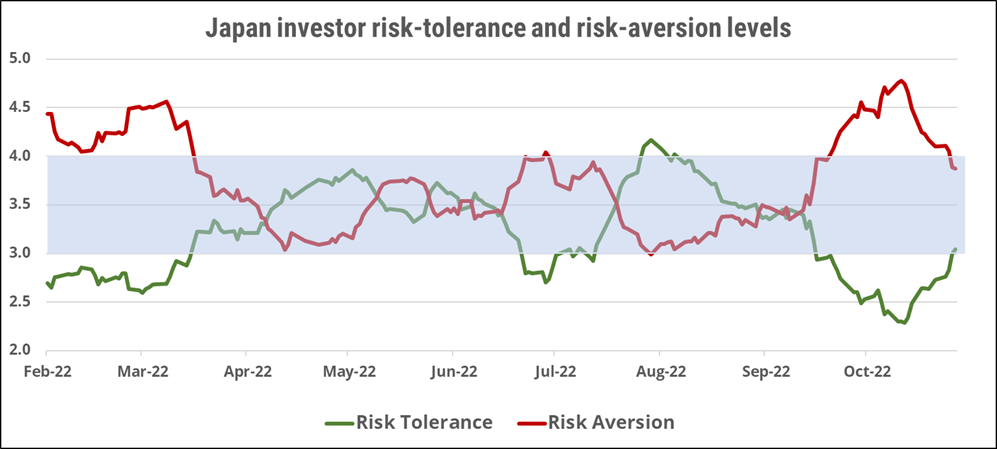

Sentiment among Japanese investors (green line) recovered from being the most bearish across all markets the prior week but ended still very negative last week, with only sentiment among Chinese investors being worse off. Stability in the currency market helped drive a return of foreign investors to the Japanese market last week, pushing up valuations of key exporters and helping them recover further from their September lows. For markets to rise further from here, though, sentiment needs to become positive, as it did in May and August of this year. If investors remain risk-averse, the current market rally will run out of steam and become vulnerable to changes in exchange rates once again.

China (domestic) investor sentiment

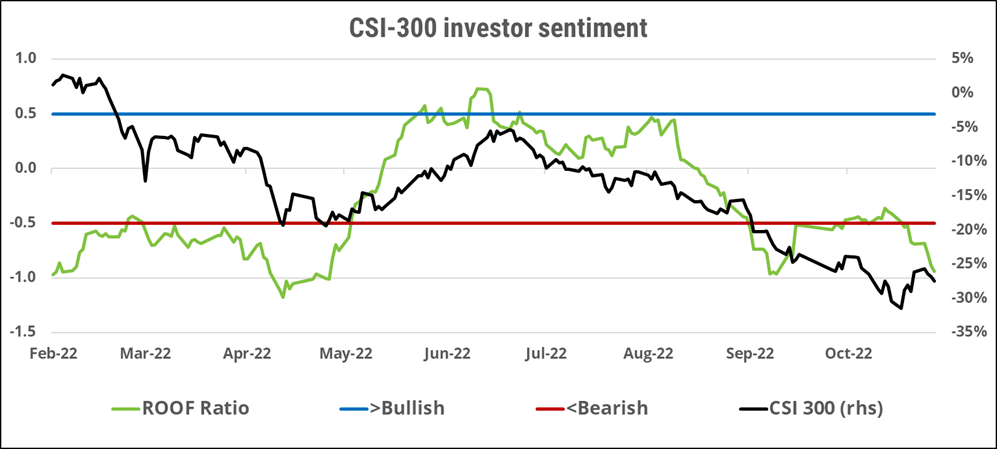

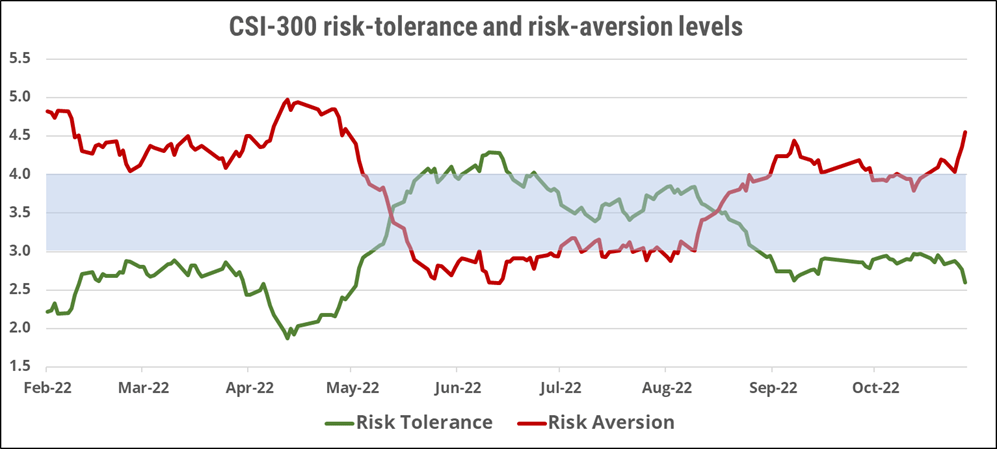

Sentiment (green line) among Chinese (A-shares) investors reversed course last week, ending more bearish than the prior week as authorities moved quickly to dispel rumors of an end to the country’s Zero-COVID policy. Rising new infection cases are causing local authorities to re-impose some lockdown measures at key industrial cities and raising the prospect for more damaging supply-chain disruptions. China’s economic growth has already fallen below the official target for 2022 and there are growing fears that 2023 will see further downward revisions due to ongoing lockdowns. Also weighing on sentiment is the unknown status of the US-China relationship as well as the fate of the heavily indebted real estate sector. The only positive for Chinese investors this past week was the lack of a red wave win in the US midterm election, with many losing Republican candidates having run an anti-China campaign. The news that the election results will have weakened Donald Trump’s potential 2024 presidential bid will also have been greeted favorably by Chinese leaders.

1 If sentiment is bearish/bullish, a negative/positive surprise on these data releases could trigger an overreaction.