Potential triggers this week: Minutes from the Fed and ECB meetings. US second estimate of Q3 GDP, alongside durable goods orders, and personal income and outlays. GDP updates from Germany and France. Flash PMI surveys for the US, UK, and Eurozone. And US political theatrics.

Summary: Multiple positive news regarding potential vaccines has helped sentiment rebound off its previous week lows except in developed Europe and the UK, where it continues to worsen. This recovery has raised the ROOF Ratio for most markets from bearish to neutral, and while investors there are not (yet) optimistic, they seem hopeful. In contrast, the mood of European and UK investors seems to be stuck in some sort of pessimist’s paradise where if things look bad, they are probably worse than they think. Markets have been rising well ahead of sentiment for most of November and the latter still has quite a lot of catching up to do to support current levels, never mind any attempt at higher ones. On the pandemic front, things can still get worse before they get better and winter has not even begun. The next five weeks will likely see sentiment seesaw as authorities adjust their Covid-19 policy responses to avoid having the year-end holiday season become a super spreader event and the seven dwarfs all be named Sneezy.

US investor sentiment recovers on positive vaccine news.

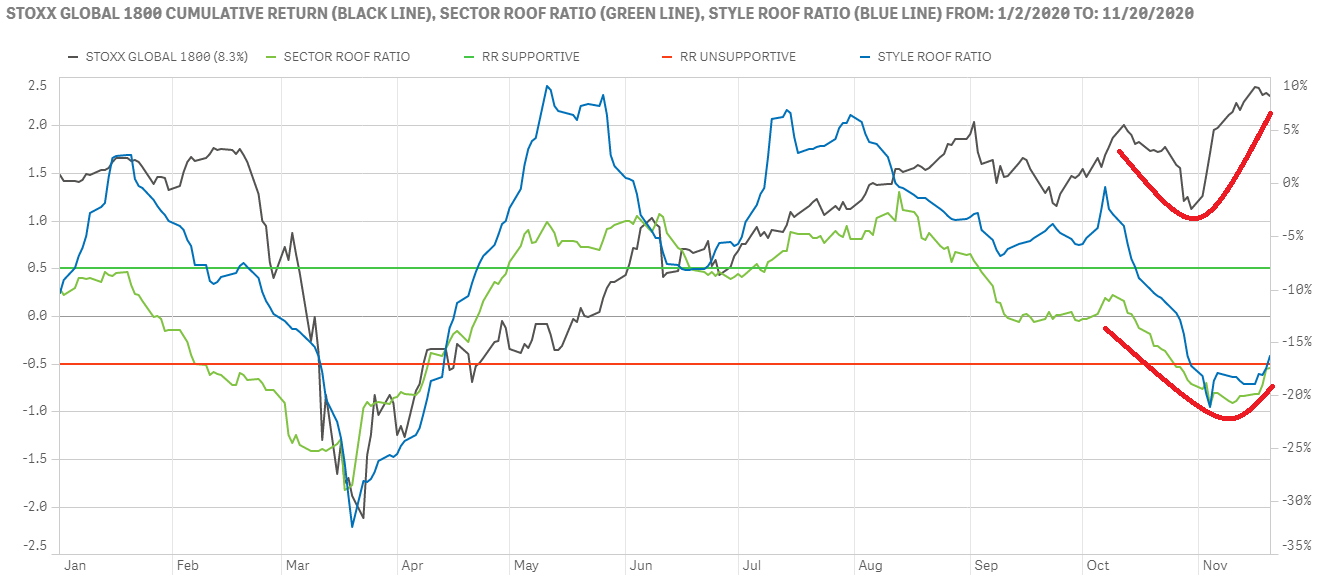

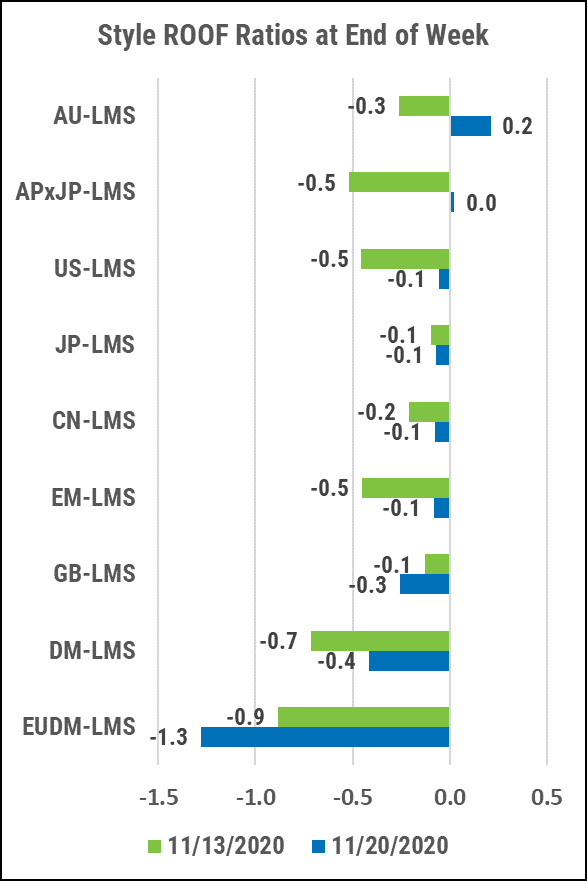

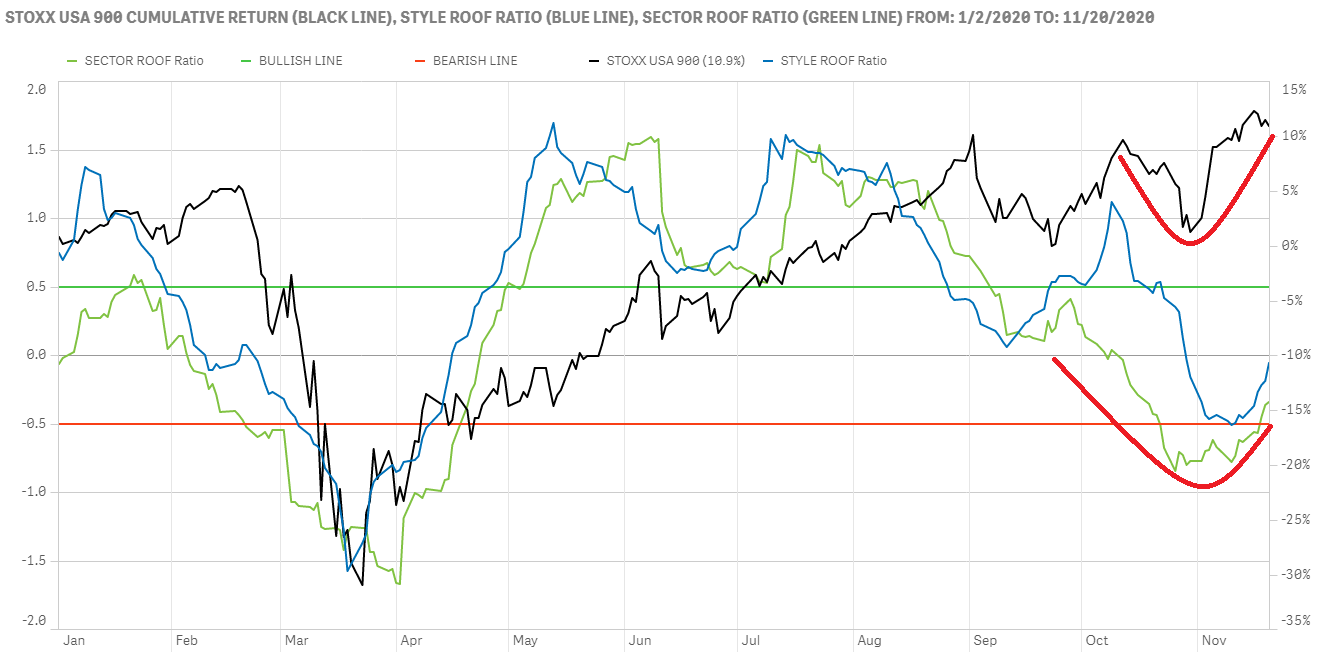

After bottoming out in bearish territory last week, the ROOF Ratio for both our Style (blue line) and Sector (green line) variants staged a recovery to the neutral zone last week (top chart). At these levels, US investors can no longer be labelled pessimistic but cannot yet be labelled optimistic either; at best they can be called hopeful.

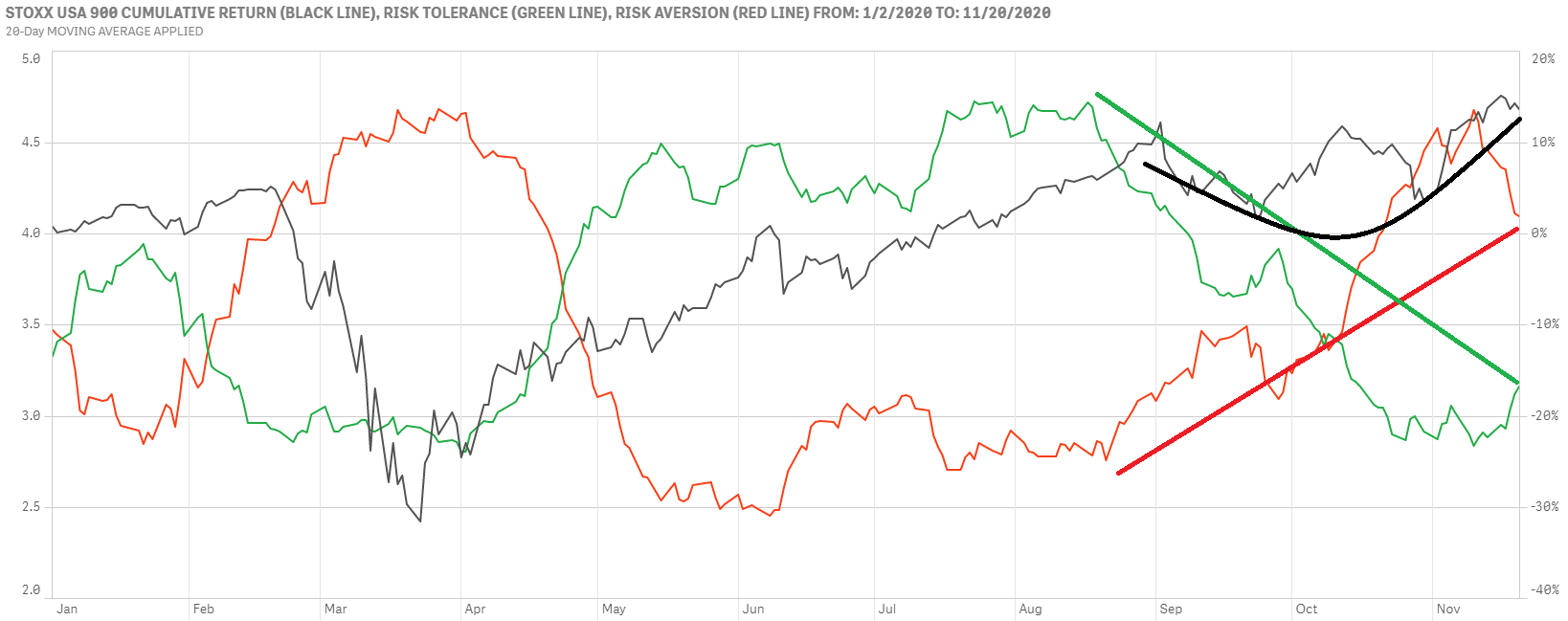

After a bout of profit taking in September, the STOXX USA 900 index has staged multiple attempts at new highs, even in the face of deteriorating sentiment. Last week saw risk aversion (red line) decline and risk tolerance (green line) rebound for the first time in a month, but the imbalance between the two remains in risk aversion’s favor (bottom chart). Unless the gap closes and risk appetite becomes positive again, the current market rally will remain on very thin sentimental ice.

Sentiment in Europe continues to worsen in line with the pandemic narrative.

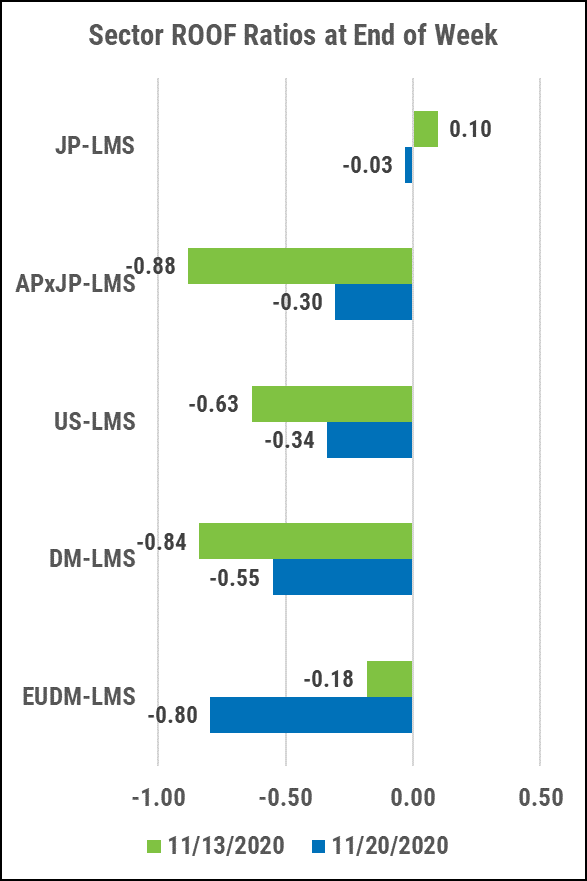

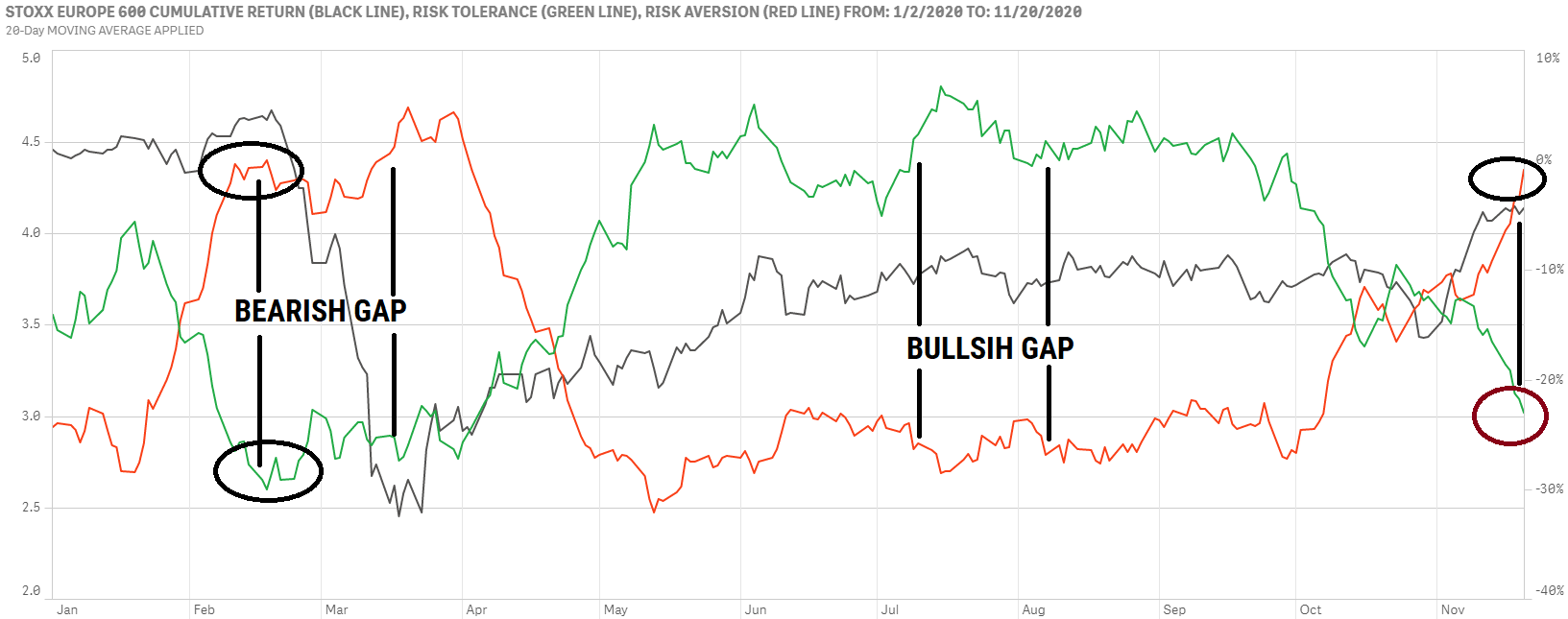

Sentiment in Developed Europe continued to worsen last week as the pandemic narrative in that region seems stuck in a deadly cycle of increased infections followed by increased social distancing measures. Sentiment pulled markets up, back from the Covid crash in April and May (phase A in top chart), kept markets stable during the summer (phase B in top chart), but has been unsuccessful at pulling markets down in November (phase C in top chart).

The situation looks even worse if we focus on the gap between the demand and supply of risk (bottom chart). The bearish gap (risk aversion (red line) higher than risk tolerance (green line)) we are in now is reminiscent of the one we saw in February this year and means that sentiment is dangerously weak. In this stage, investors are prone to over-reaction on the downside in the case of negative news and will tend to ignore positive ones.

Sentiment rebounds with US peers for both Global and Asia ex-Japan investors.

Global investors’ sentiment followed US investors into a rebound from bearish territory to the edge of the Neutral zone (top chart). The rebound was driven by US, Japan, and Asia ex-Japan sentiment which rose with the news of several vaccines becoming available early next year. Having a vaccine means lockdowns will not be the only way to fight the spread of the virus next year. Still, markets here too are dangerously ahead of sentiment and it will take a couple of weeks of strong risk tolerance to be back at equilibrium. Until then, markets remain vulnerable to negative news.

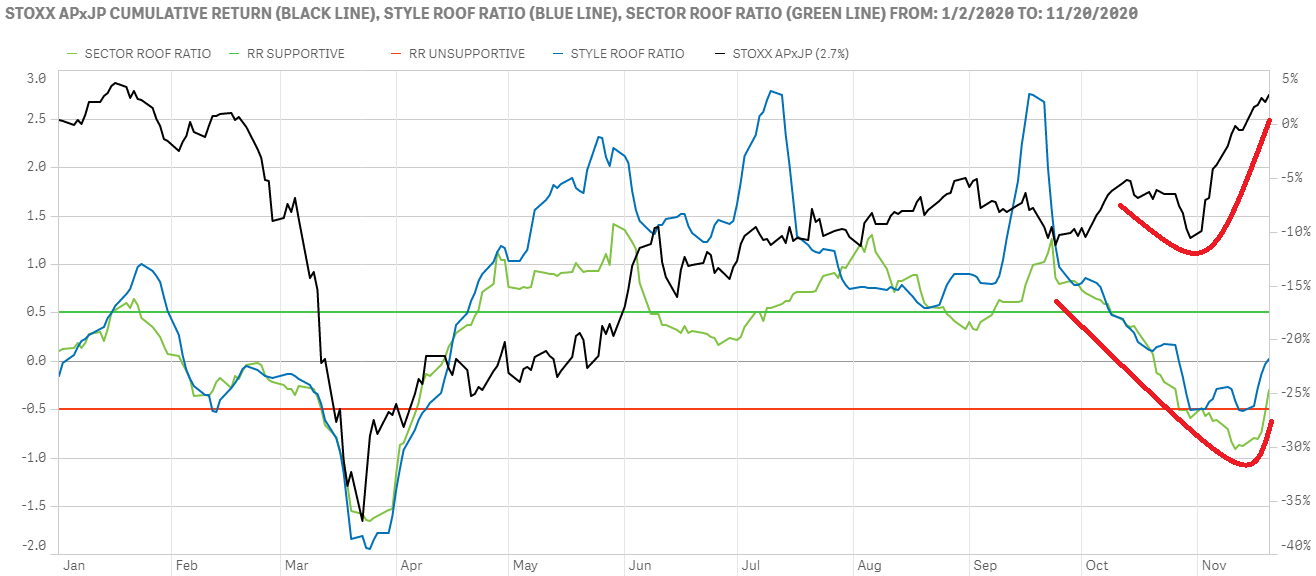

Sentiment in Asia ex-Japan had a similar rebound last week, piercing back up into the Neutral zone for the first time this month. There remains a large gap here too between recent market performance and sentiment and a single week of positive risk appetite will not be enough to support a lasting market run from these levels, especially in the event of negative news.