Potential triggers for sentiment this week1 :

- US: Speeches by several Federal Reserve officials. GDP, manufacturing PMI, consumer confidence and spending data, followed by the jobs report on Friday.

- Europe: Inflation data for Germany, France, Italy, Spain and the Eurozone.

- APAC: China manufacturing PMI.

- Global: The focus remains on how the current negatives for global markets — inflation, COVID-19 lockdowns and social unrest in China and a potential nuclear accident in Ukraine — could worsen the situation in the short term.

Summary of changes in investor sentiment from the previous week:

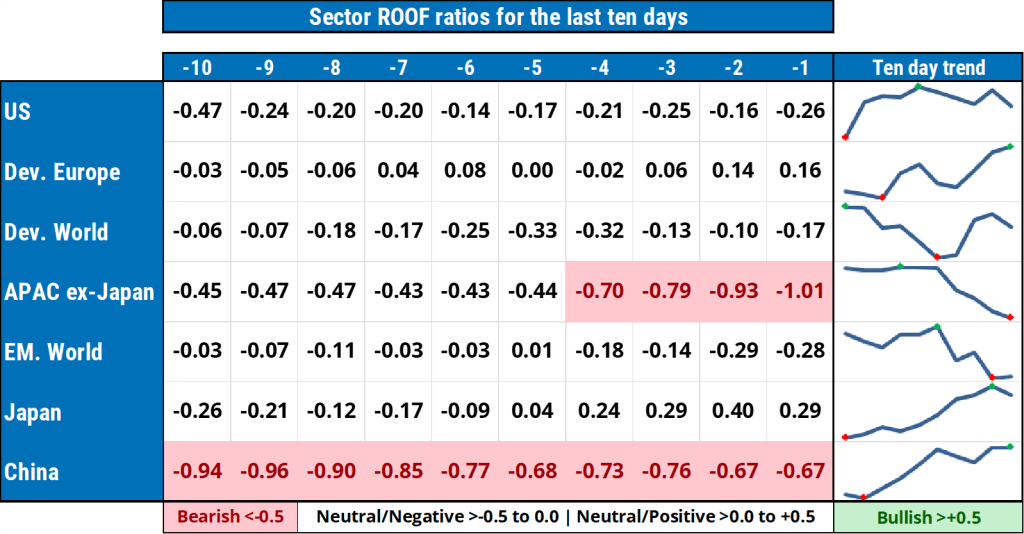

- Investor sentiment was little changed last week, remaining negative in the US, global developed and global emerging markets; becoming slightly more positive in Europe and Japan; turning bearish in Asia ex-Japan; and staying bearish in China. The realities of Zero-COVID policies, higher interest rates, slowing economies and stubbornly high inflation, have neutralized the positive momentum from the interest-rate pivot theory these past two weeks.

- The FOMC minutes read like a love letter and a breakup note all in one, by suggesting smaller rate increases from now on but a higher destination next year than previously thought. The love dispatch was for the pivot hopefuls for whom size does matter. The breakup note was for the economists, who felt like Christians when asked by Romans if they preferred lions or tigers with them in the circus.

- The pivot theory goes something like this: inflation has peaked (possibly) and will start to decline rapidly (perhaps), at which point central banks will become more accommodative (we assume) to prevent the economy from stalling. Forecasting is rarely about what will happen; it’s mostly about what investors think will happen, with reality falling somewhere between objectivity and perception.

- Contrarians, by definition, aren’t paralyzed by the pressures of consensus or uncertainty. They understand that current forecasts — both objective and subjective — are provisional and based on an as-of-now interpretations of facts that are themselves unstable (i.e., inflation could easily rise again next month). So, they simplify, then exaggerate. But don’t forget to add the ‘disposable’ modifier to their strategy.

- Low volumes and weak sentiment are telling us that the pivot theory has found few takers, with most investors staying on the sidelines, sporting an undecided look on their face, waiting for the fundamentals to improve. If contrarians can’t convince them that the stagflation consensus is wrong, none of them are going to care. And in the realm of the stock market, consensus rules. So, this might just be one of those times when all you will get for being right (about smaller rate increases) is that you suddenly become Frank Serpico.

Jump to a specific market

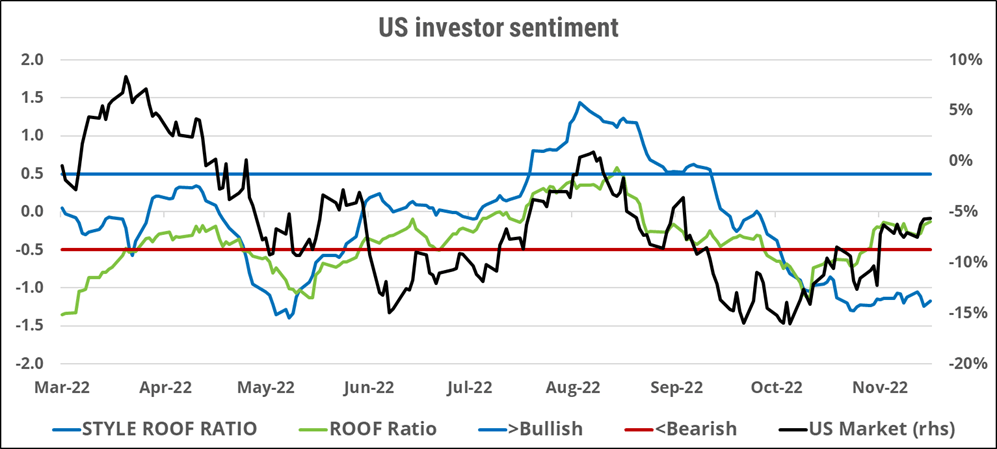

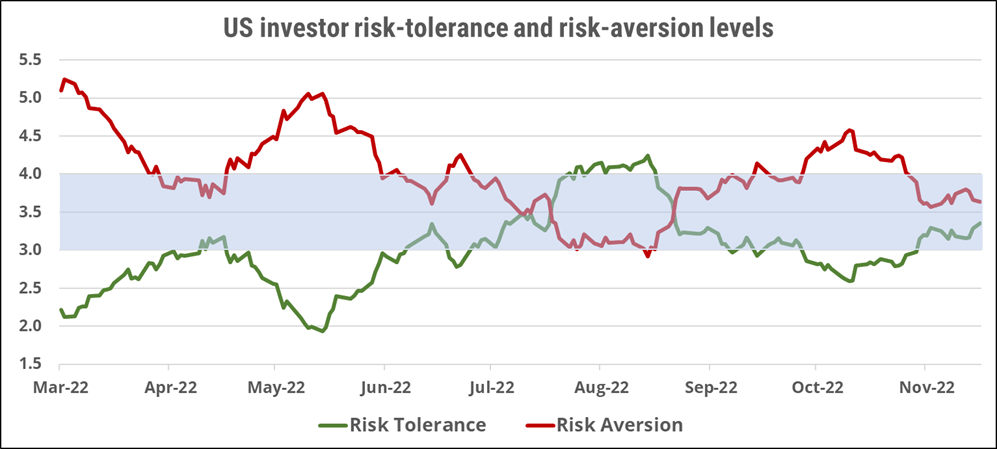

US investor sentiment

Sentiment among US investors (green line) ended a holiday-shortened week unchanged from the negative levels of the previous week. We note that the style factor variant of our ROOF Ratio (blue line), has not recovered from its October lows. This apparent disagreement with its sector ROOF variant indicates that although contrarian investors are chasing risk-tolerant sectors in their implementation of the pivot theory, they are doing so by still favoring assets with risk-averse style exposures — hardly a vote of confidence. And were it not for the drop in market volatility that has lowered risk-aversion levels by removing the need to de-risk portfolios, net risk appetite would be even more negative. Between now and December 13 (the next CPI report) most investors are likely to remain on the sidelines. Patience is not a contrarian virtue, so if the jobs report does not go their way, look for profit-taking to get underway.

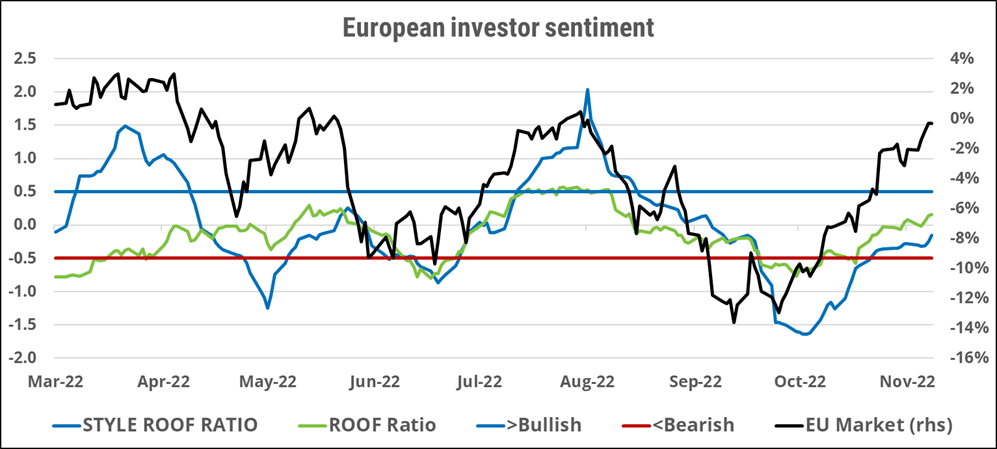

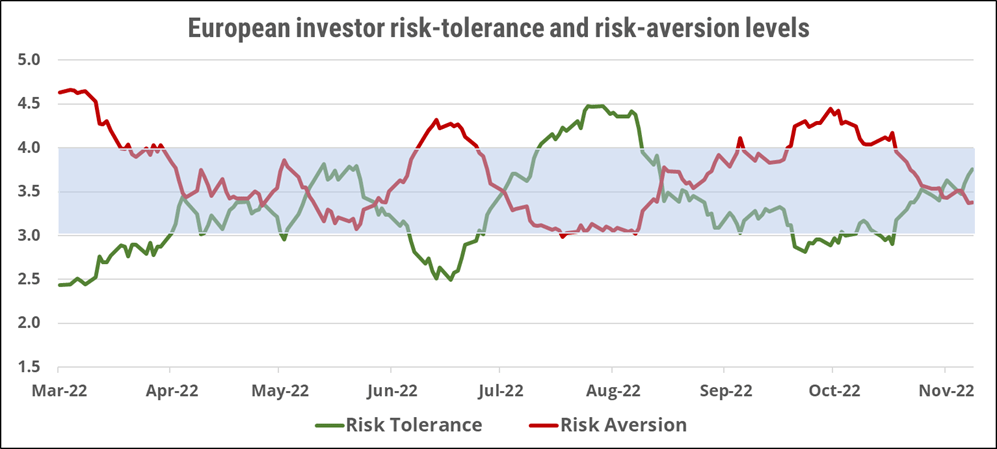

European investor sentiment

European investors’ sentiment (green line) ended the week positive, reaching a level not seen since late August. Unlike in the US market, the style factor variant of our ROOF Ratio (blue line) has also recovered since mid-October, signaling a deeper commitment to the recent rally from European investors, who are implementing a pivot strategy through both sector allocations and risk-tolerant style factor exposures. Average traded volumes remain low, indicating that not all investors feel confident enough to implement a risk-tolerant strategy. For the latter, there remain too many unknown unknowns with binary outcomes that could make a bad macroeconomic situation worse in the short term. The recent rise in markets has now erased half of the year-to-date losses of the STOXX® Europe 600, and if sentiment continues to improve from here, allowing risk-tolerance levels to recover their August highs, this year-end rally could have further to go.

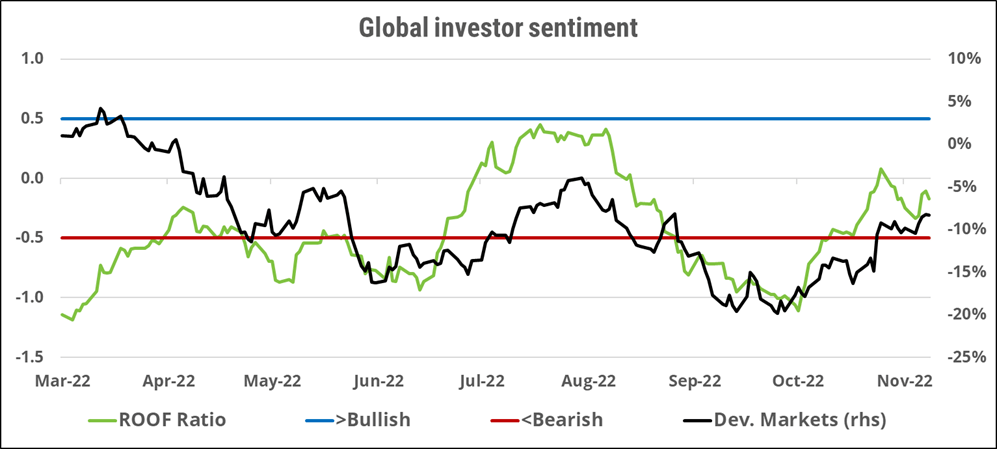

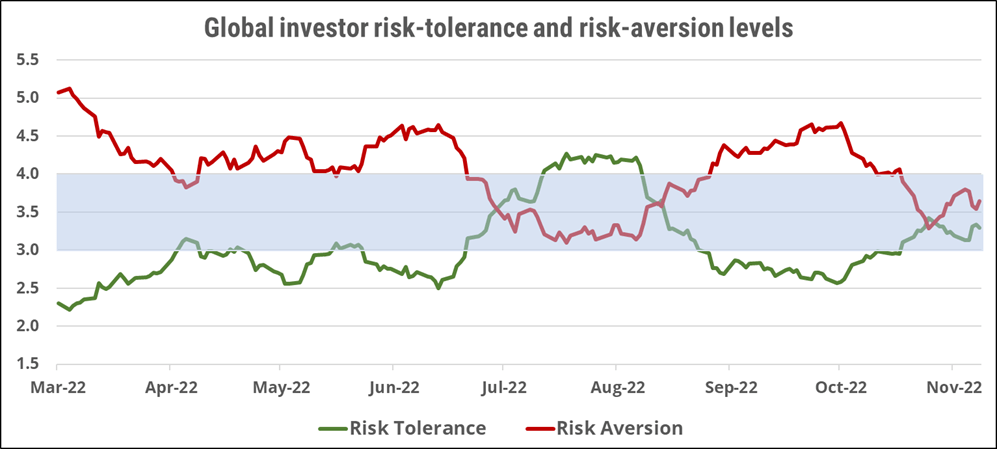

Global developed markets investor sentiment

Sentiment among global developed-markets investors (green line) ended the week negative, nearly unchanged from the previous week. As with US investors, the recovery in sentiment that began in mid-October has stalled, keeping risk appetite in check and weighing on markets. Risk aversion is still the preferred implementation among global investors, who lack the confidence to start deploying more bullish scenarios. Stagflation remains the consensus for the global economy, and many hurdles will need to be cleared before a turnaround can be anticipated. Cross-currency volatility persists because of the ongoing geopolitical uncertainty and is a further source of risk for global investors. Markets have recovered a good deal of their year-to-date losses in the last two months and investors may have to be satisfied with this performance in the short term unless sentiment improves significantly from here.

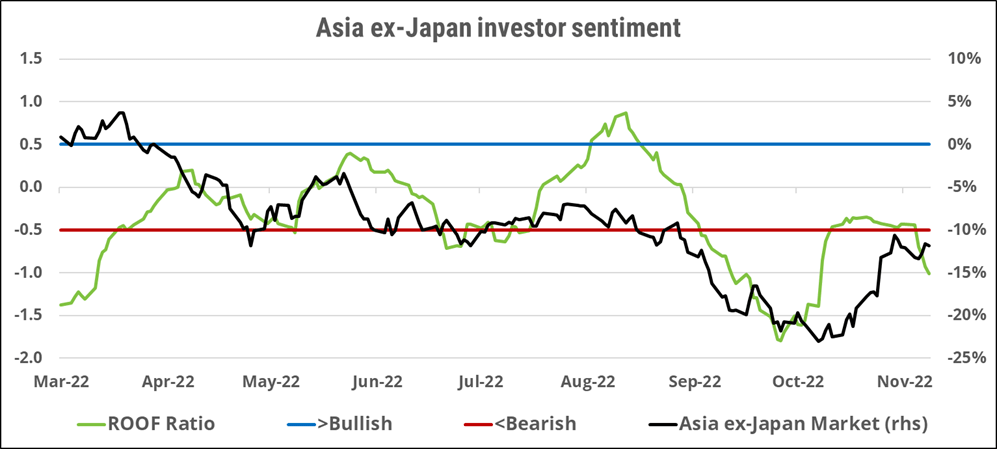

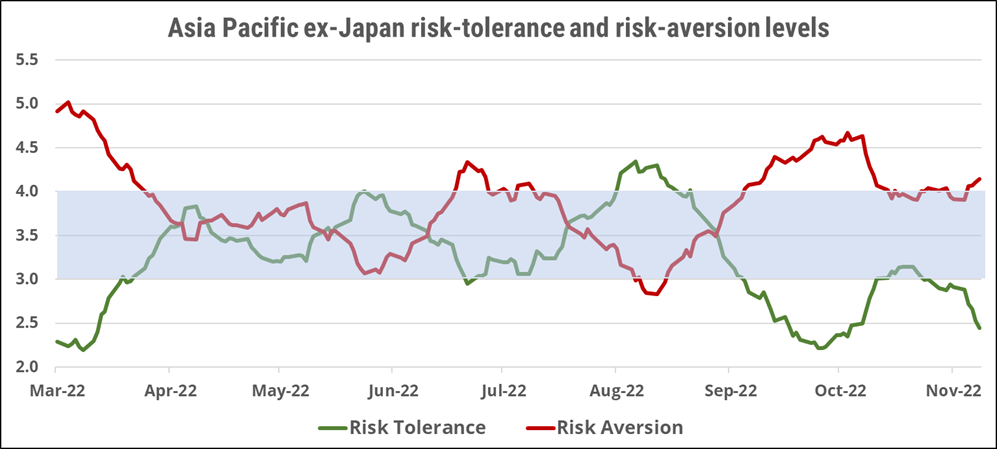

Asia ex-Japan markets investor sentiment

Sentiment among Asia ex-Japan investors (green line) completed its U-turn last week, falling sharply from the previous week and ending bearish for the first time since mid-October. Investors’ mood continues to be swayed by the fluidity of the COVID-19 situation and the associated policy response in China. The immediate impact of this increase in uncertainty has been a sharp drop in risk-tolerance levels as investors rushed to unwind bets on risky assets from the interest-rate pivot strategy. Investors in Asia ex-Japan are now the most bearish among the markets we track, followed closely by Chinese investors. Concerns about the resilience of the global supply chain to further COVID-19 lockdowns in China could continue to pressure risk appetite in the region.

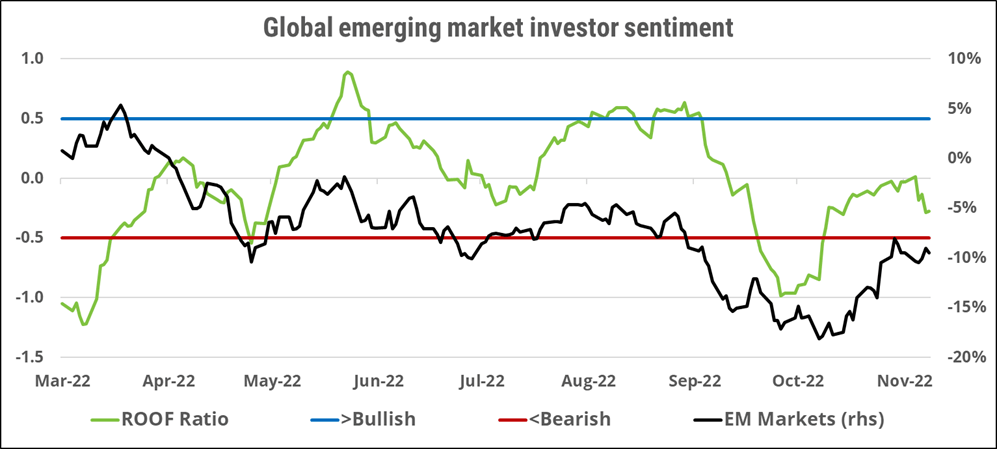

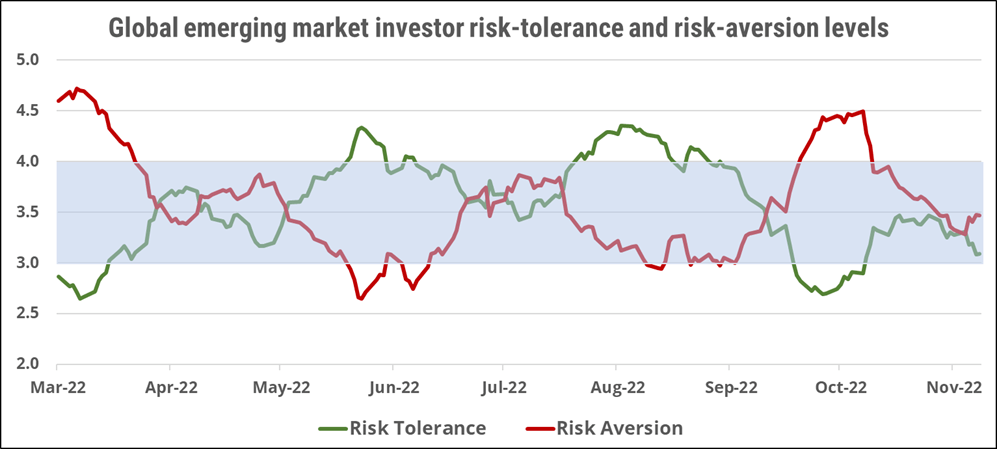

Global emerging markets investor sentiment

Sentiment among global emerging-markets investors (green line) retraced some of its recent gains last week, ending negative. What goes up must come down, as the saying goes, and October’s sharp recovery in sentiment may be in for an equally sharp decline in the short term. This reversal is a direct response to the COVID-19 situation in China, which sits at the crossroads of the global supply chain. Last week’s FOMC minutes will not have helped sentiment either as Federal Reserve officials reaffirmed their commitment to fighting inflation by raising US interest rates and indicated that they have not yet seen any significant signs of a weakening economy that would help them achieve their goal of price stability. Additional signs of a slowing Chinese economy, already growing less than authorities there had predicted, will further soften sentiment among global emerging-markets investors, and drag markets back towards their October lows.

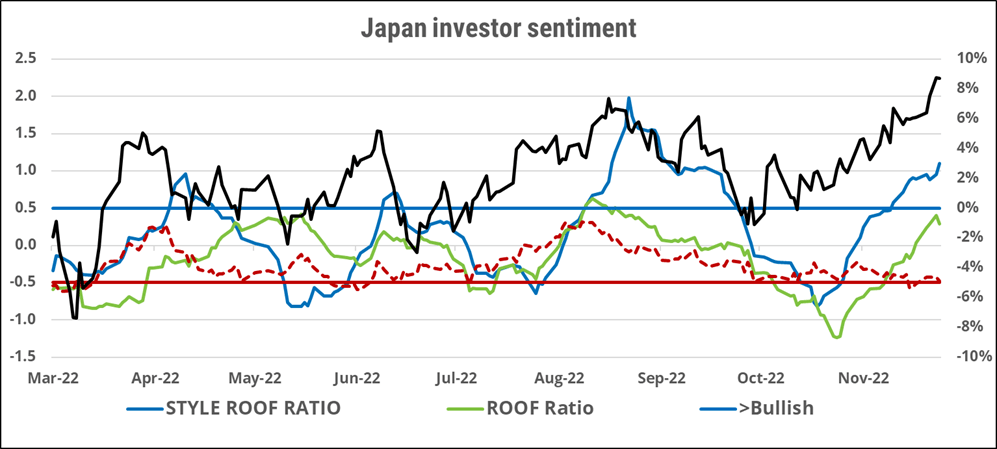

Japan market investor sentiment

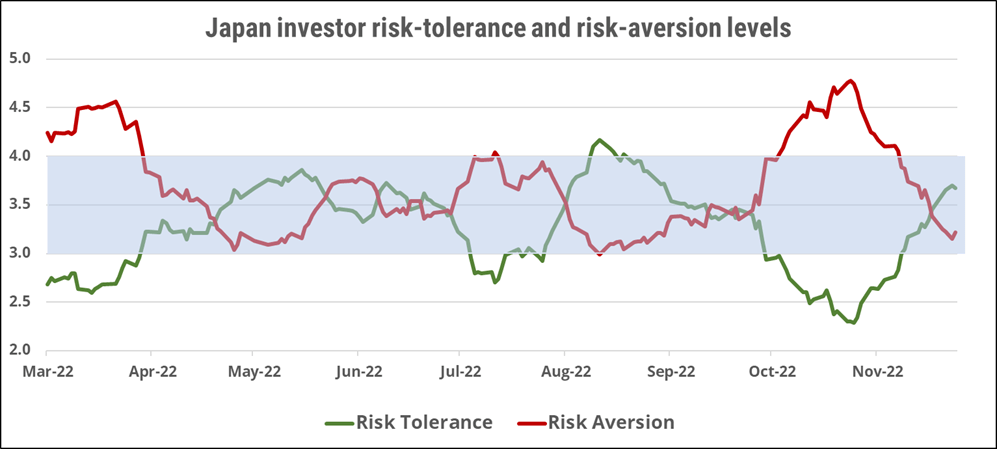

Sentiment among Japanese investors (green line) continued to rise last week, ending strongly positive and at their highest level since August. The recovery in both markets and sentiment in Japan has been accompanied by a surge in average traded volumes and a sharp rise in risk appetite. Of the seven markets we compute ROOF ratios for, the recovery in Japan seems to us the most healthy and sustainable. It is supported equally by a decline in risk-aversion levels and a simultaneous rise in risk tolerance. The style factor variant of the ROOF ratio (blue line) is also in accordance with the sector variant providing a corroborating second opinion. The only dissent comes from the sector allocation (red dotted line), which continues to indicate that Japanese investors have decided to play this rally by chasing risk-averse sectors rather than risk-tolerant ones. In other words, they are overweighting sectors with low price-earnings ratios, high profitability and a positive exposure to Value. If sentiment remains supportive, this market rally could have legs in the near term.

China (domestic) investor sentiment

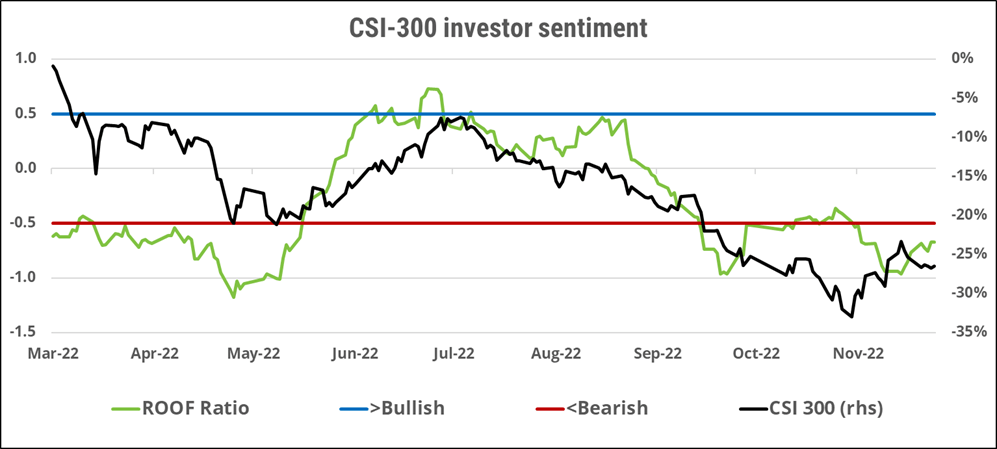

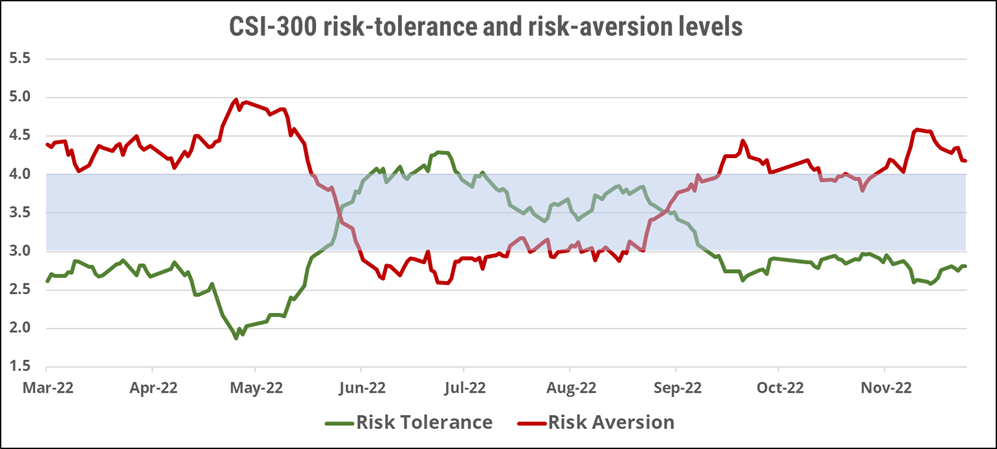

Sentiment (green line) among Chinese (A-shares) investors ended the week bearish, unchanged from the previous week. The recent surge in new COVID-19 infection numbers has been accompanied by sporadic instances of social unrest towards the authorities, which is a new development in China and one that has clearly unnerved investors. This negative news adds to worries about the economic impact of further lockdowns, and global supply chain disruptions ahead of the cold winter months. As far as markets and investor sentiment is concerned, the COVID-19 situation will continue to trump any positive news on fiscal support to the country’s struggling real estate sector. In the short term, look for markets to remain under pressure from a bearish sentiment.

1 If sentiment is bearish/bullish, a negative/positive surprise on these data releases could trigger an overreaction.