Potential triggers this week: Powell’s testimony before congress, US Job report Friday, worldwide PMI data, trade data for the US, factory orders for Germany, and retail sales for Japan. Although the US transition seems to be getting on, no concession has yet been made by President Trump and he remains in office for another two months …

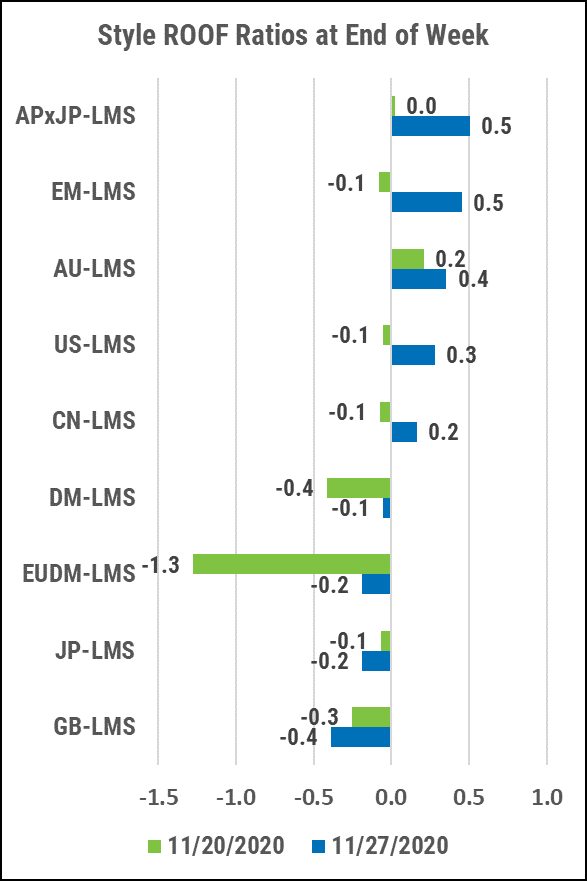

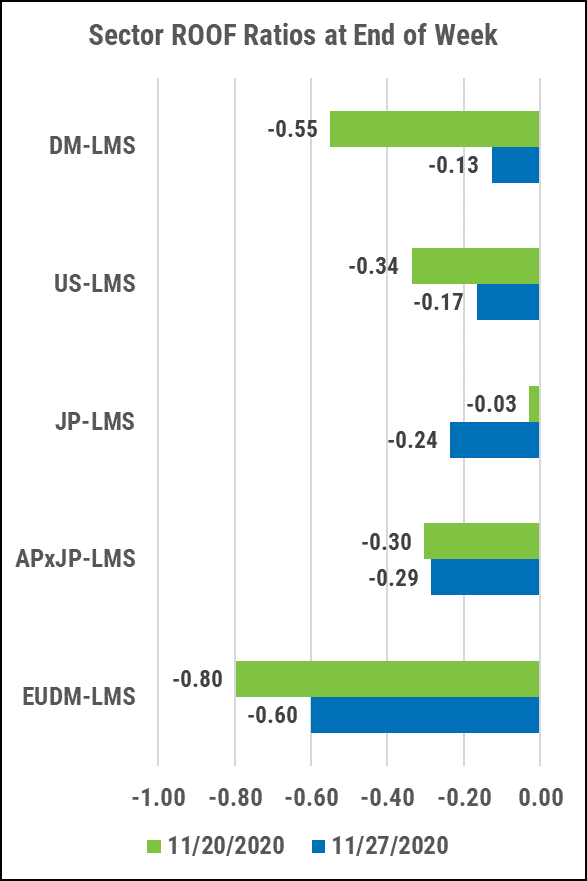

Summary: Sentiment continued to improve for a third consecutive week in all markets we track except the UK and Japan. The inflection point for sentiment was provided at the start of the month with several positive vaccine-related news and has continued to act as a deflator for risk aversion and a reflator for risk tolerance. The UK is the exception to this story as it still faces a Brexit deadline in addition to the second wave of COVID-19 cases currently battling Europe. By contrast, developed Europe experienced the biggest jump in sentiment last week rising from deep in bearish territory to neutral. Asia ex-Japan also saw a large improvement in sentiment last week helping markets there to score their best month in several years. At these levels investors’ cautious optimism seems more due to declining risk aversion levels than rising risk tolerance ones. As risk appetite recovers globally, we could see further gains for the traditional year-end rally.

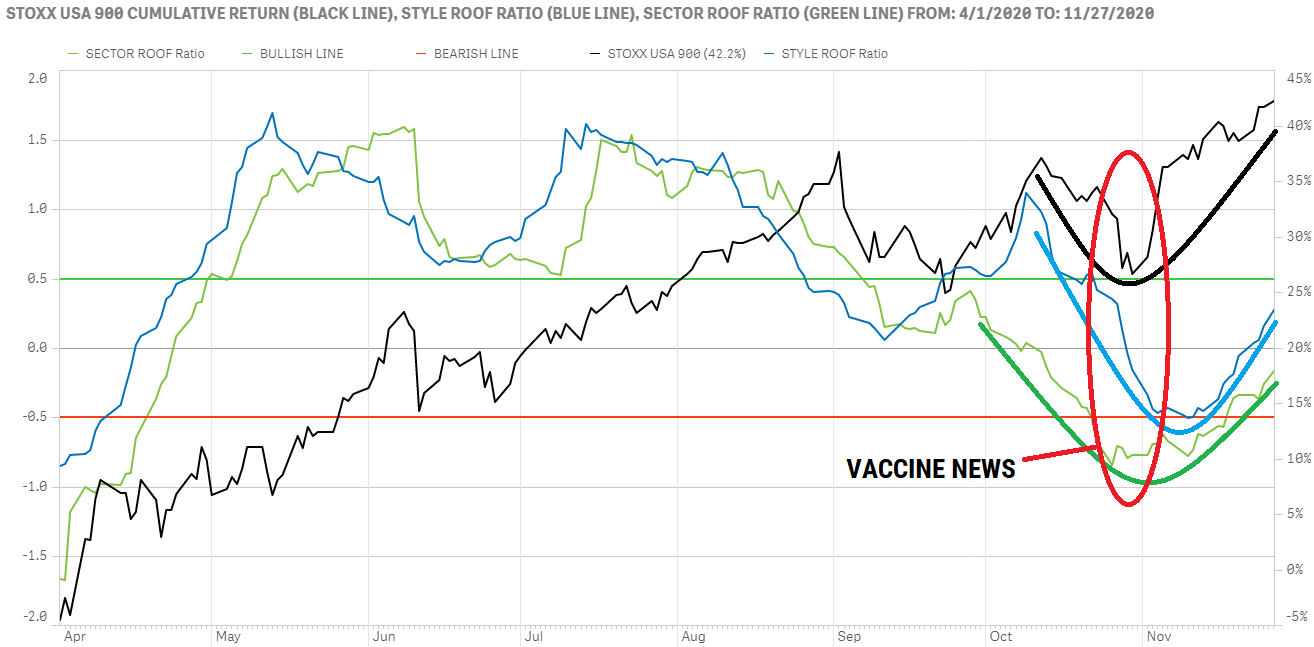

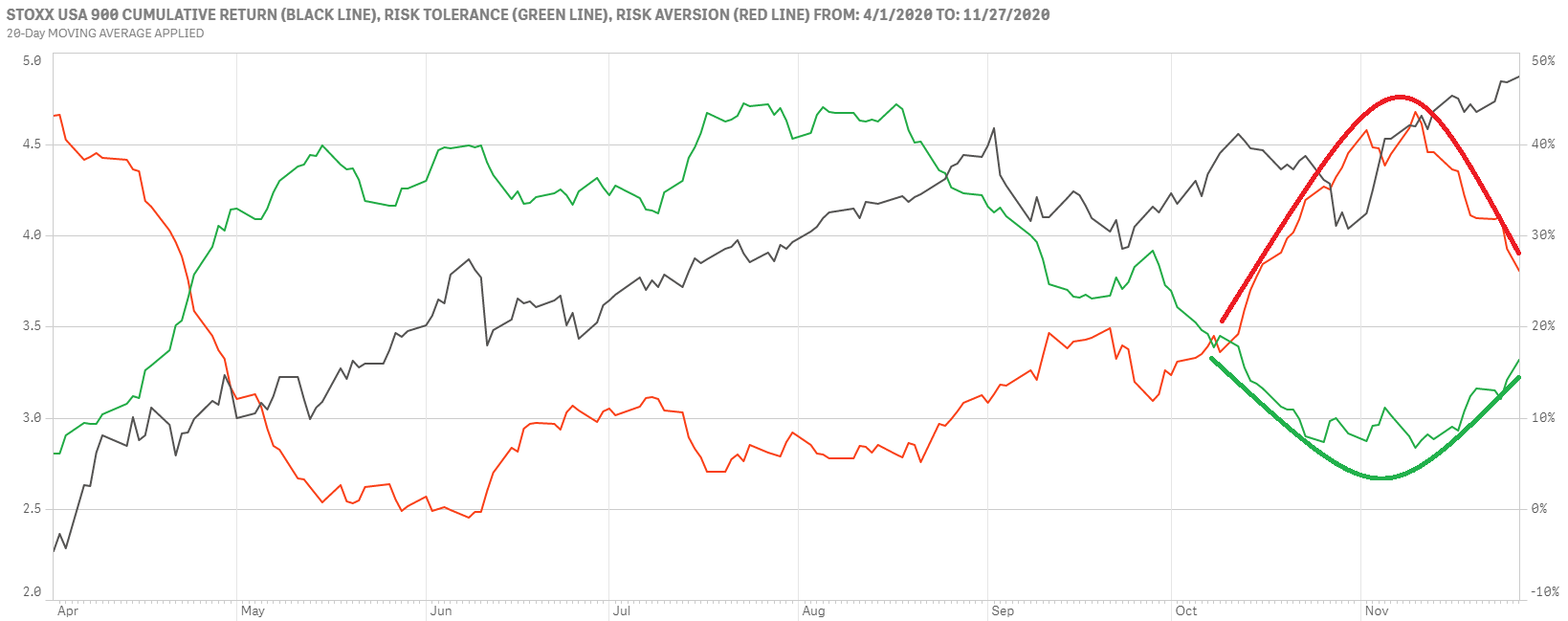

US investor sentiment continues to improve lending support to the market rally.

Both of our ROOF Variants continued their recovery from Bearish to Neutral last week and seem headed for the top of the Neutral range (top chart). These levels indicate that US investors are not yet confident but are cautiously optimistic. The news of several potential vaccines was a key turning point for sentiment and the improving narrative around the transition of power to the Biden team is also helping risk aversion levels decline.

The supply and demand balance for risk continues to improve (bottom chart), with risk aversion levels declining for a third consecutive week while risk tolerance rises for the second week in a row. The STOXX USA 900 has been rising ahead of sentiment all November, helped by a rotational trade that see new money entering the market on sectors previously left out of the COVID-rebound rally. Still, it will take a few more weeks of improving sentiment for net risk appetite to turn positive again.

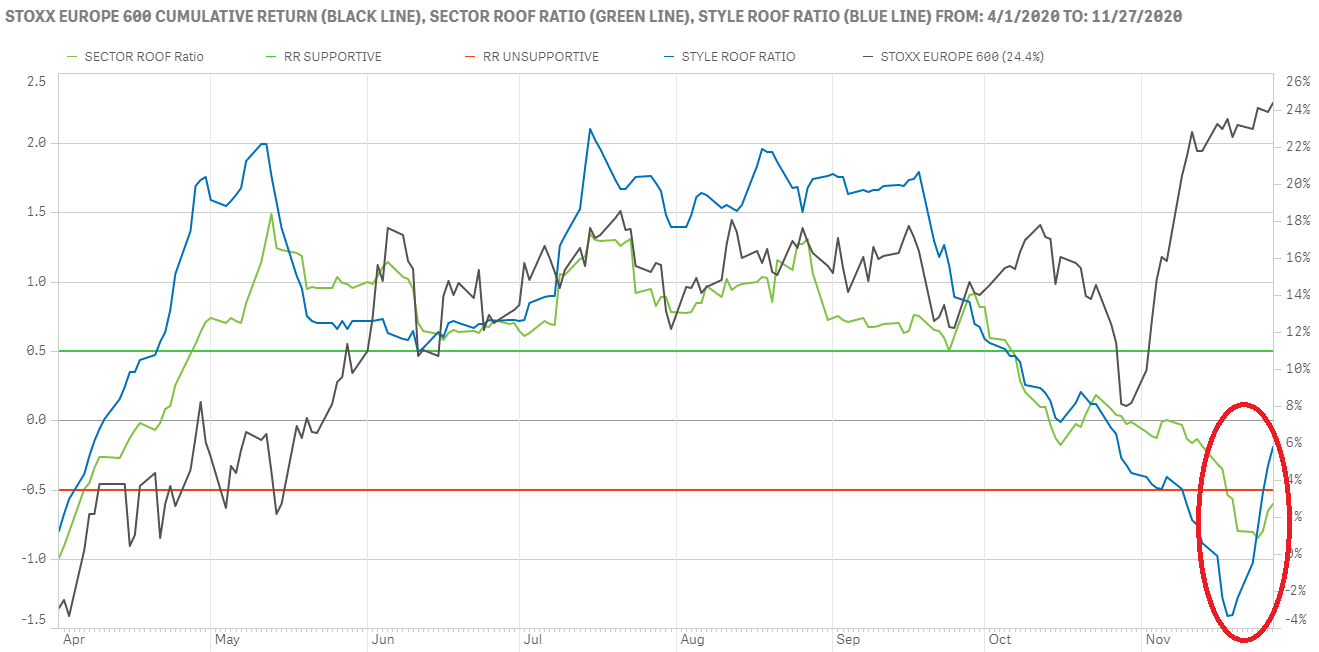

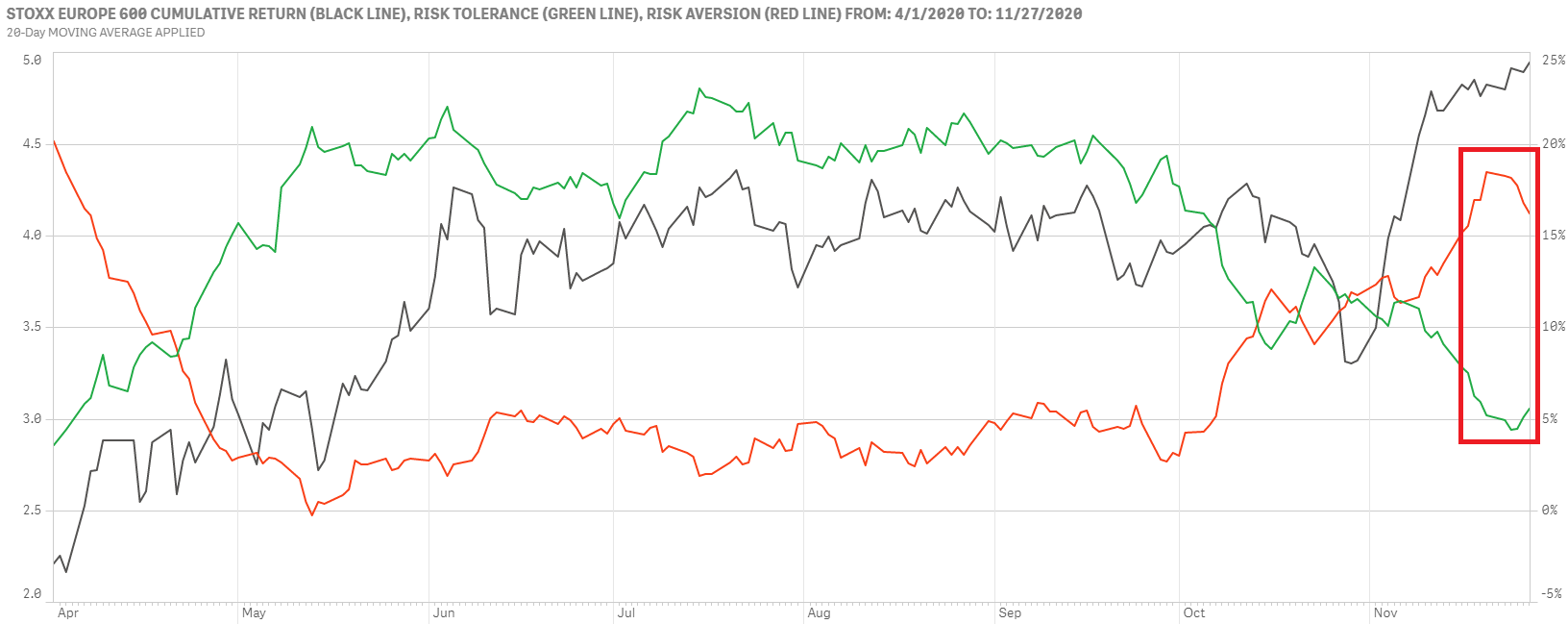

Sentiment in Europe finally rebounds after weeks of ignoring other markets.

Investors in Developed Europe seem to have gotten the vaccine memo two weeks after their US counterparts. Both of our ROOF Ratios for the STOXX Europe 600 bounced off their bearish territory lows and seem headed for the neutral zone (top chart). Markets, meanwhile, had ignored the deteriorating sentiment and were well ahead of its risk appetite for some time now.

Risk tolerance timidly rose off its lows last week as risk aversion made a more substantial retreat from its seven months high (bottom chart). The balance remains in favor of risk aversion, but risk appetite seems to be headed back up. At this level investors are not yet optimistic but merely hopeful. Markets have been well ahead of this change in sentiment, so caution is still advised as Europe remains in the midst of its second wave and facing increased social unrest ahead of what could be a very weak winter holiday season for many parts of the economy.

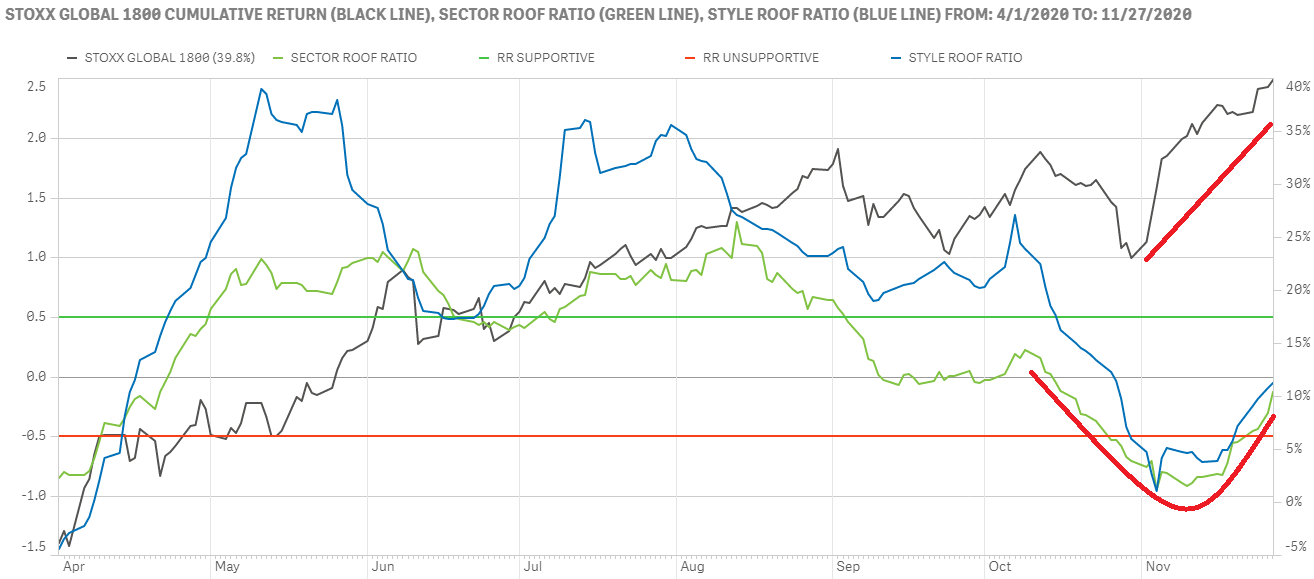

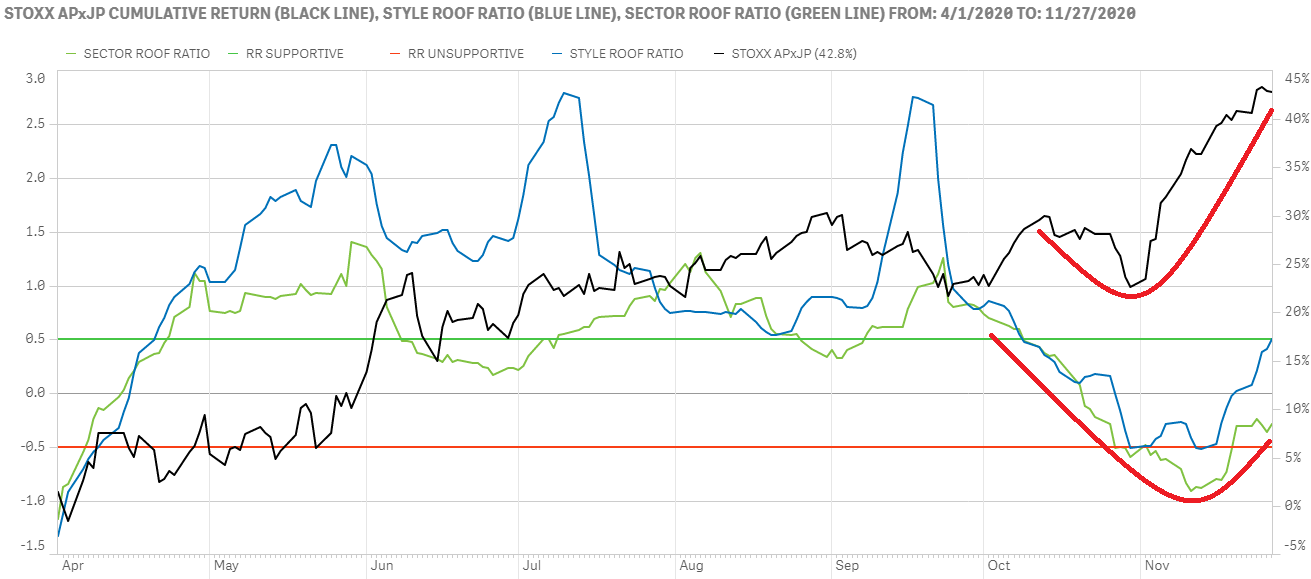

Sentiment continues to recover for both Global and Asia ex-Japan investors.

Investor sentiment for the STOXX Global 1800 continued to recover last week breaking through to the neutral zone form its previously bearish stance (top chart). The disconnect between market performance and sentiment has now closed with both going in the same direction (up). The co-movement of both our ROOF Ratios (Style and Sector) also indicates a broad sentiment recovery with the momentum to rise further in the near term, lending support to more market gains.

The STOXX Asia Ex-Japan 600 index has had one of its best performing months in multiple years, helped by recovering sentiment (bottom chart). Both ROOF Ratios are now headed in the same direction with the Style variant about a week ahead of its Sector peer and seemingly headed for the bullish zone (> +0.5). As sentiment improves and the rotational trade into sectors previously avoided due to the pandemic continues, the Sector ROOF Ratio should catch-up to its Style peer.