Potential triggers for sentiment this week1 :

- US: Q3 earnings reporting season starts with big banks, FOMC minutes, CPI and retail sales

- APAC: China inflation and Japan machinery orders

- Europe: Eurozone industrial output and UK jobs report

1 If sentiment is bearish/bullish, a negative/positive surprise on these data releases could trigger an overreaction.

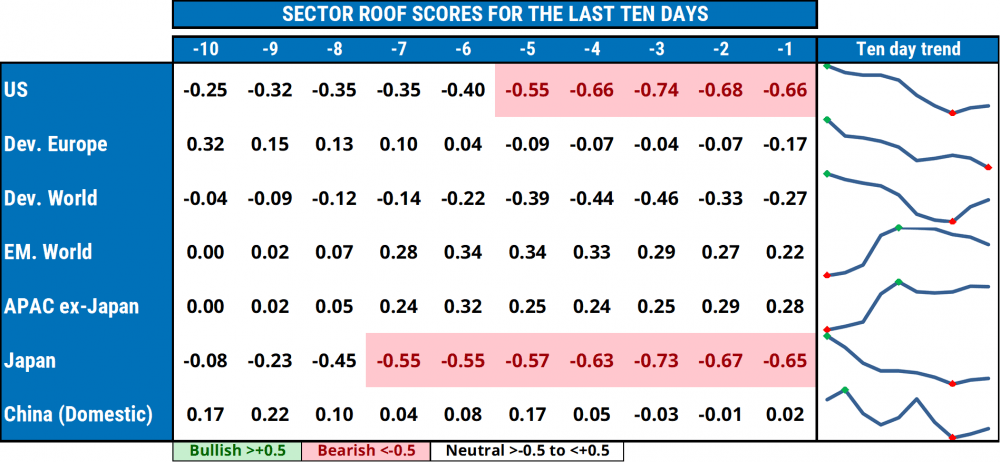

Summary of changes in investor sentiment from the previous week:

- Investor sentiment weakened further last week in all markets we track. The US and Japan are now in bearish territory, followed by the developed world and developed Europe where investors are becoming increasingly skeptical. Asia Pacific ex-Japan and Emerging markets remain cautiously optimistic but pared some of that optimism last week. China was only open one day and ended directionless for now, in neutral.

- The global decline in sentiment is weighing on markets and preventing a sustainable rebound from the corrections experienced in September. This divergence between markets and sentiment has been actively growing since late July. Markets, flushed with QE liquidity, have been defiantly rising all summer. Investors, meanwhile, have adopted the political strategy of the ‘wedge’ to markets.

- In this version of the Principle of the Wedge, investors decide not to act bullish now for fear of raising expectations that they may continue to act bullish in the future — expectations that they fear they will not have the courage of satisfying. Implied in this strategy is the lack of conviction in any market rally given the uncertain macro environment.

- The stock market, like a cult, is easy to join but difficult — and sometimes very costly — to leave. A reminder that struck a chord in the consciousness of investors at a time when easy monetary policies have made risk assets trade at inflated prices. For the risk-averse investor, the skeptical mentality is at least as important as any armor of principle — especially when you have a positive year-to-date performance to protect in the home stretch.

- Interestingly, the sentiment map is also divided along consumer/producer economies. In the consumer-driven markets of the US, developed world, developed Europe and Japan, sentiment is increasingly negative. In the producer-driven markets of the emerging world and Asia ex-Japan, which benefit from rising commodity prices, sentiment has (so far) resisted becoming negative. Evidently, rising oil prices is something consumers despise even more than global warming.

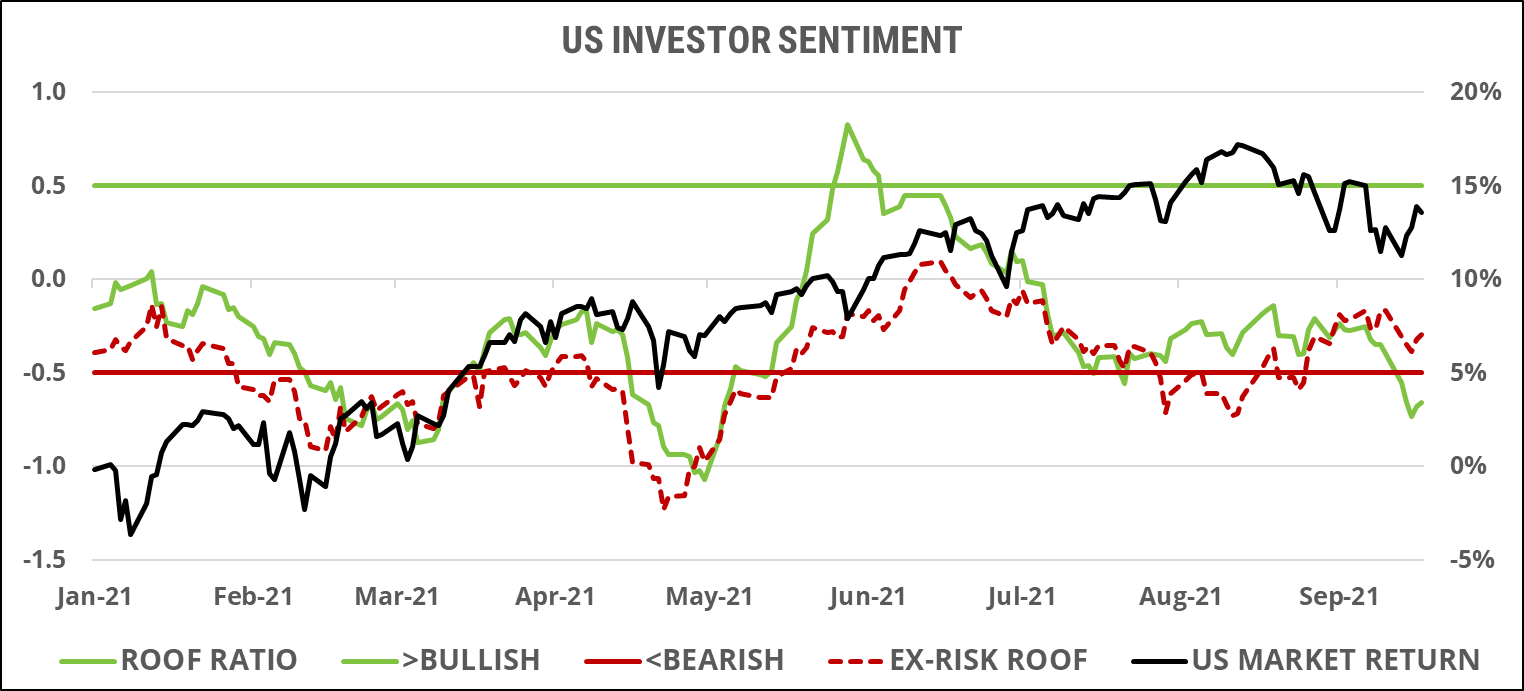

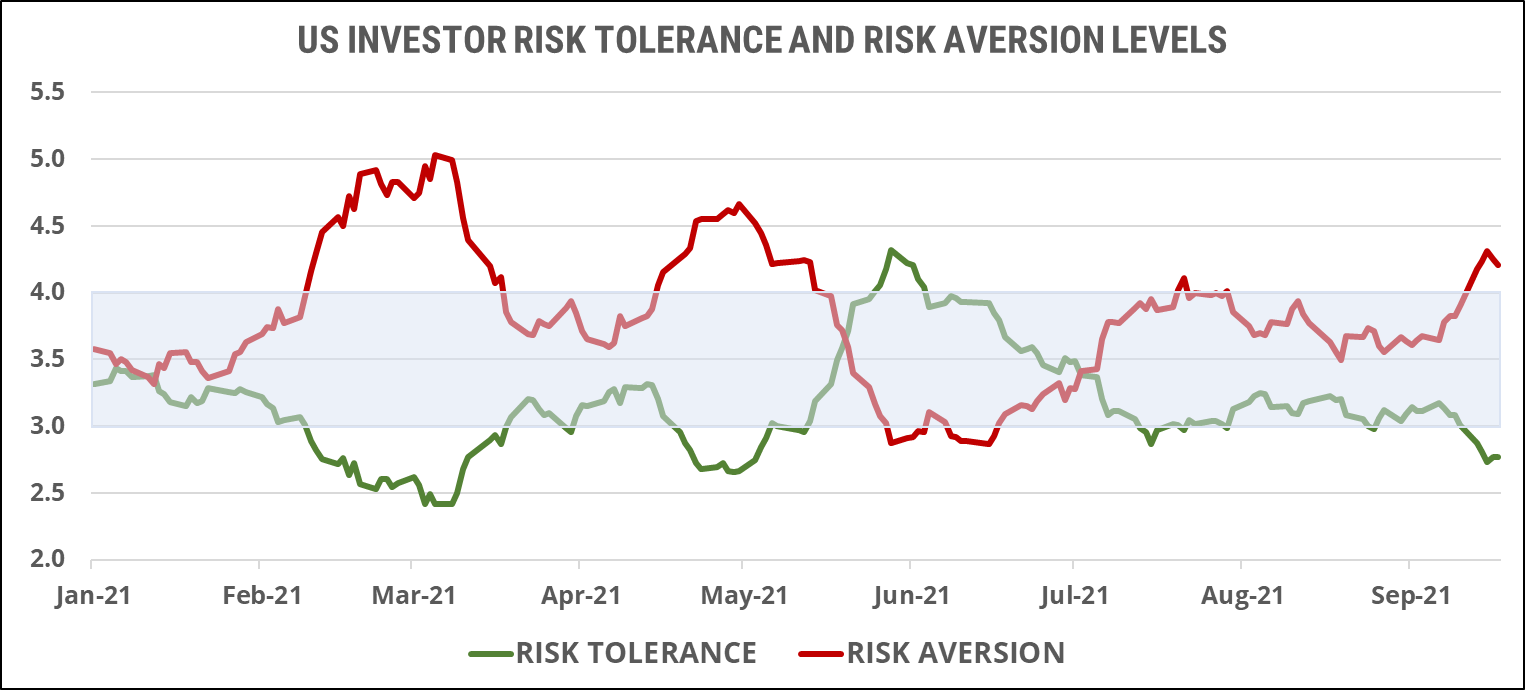

US investor sentiment:

Last week, markets and sentiment tentatively resumed their game of chicken, but, if sentiment remains in the driver’s seat (as it was in September), markets could continue to give up more of their year-to-date gains in the short term. The current bearish sentiment is diagonally opposed to its bullish highs of early June, yet markets are still some 5% higher. This week will see Q3 earnings releases by JPMorgan Chase, Citigroup and Wells Fargo, as well as the minutes from the last FOMC meeting. As a clearer picture emerges from the reporting season, one way or another, markets, or sentiment, will have to right this wrong.

Last week saw the gap between risk aversion (red line) and risk tolerance (green line) jump to its highest level since May. At this stage, the large imbalance in the supply and demand for risk has the potential to create an emotional market correction if this negative bias is triggered into action. On the plus side, the last time we were in this situation, in May 2021, a strong Q2 earnings season gave investors the courage of their conviction and saw sentiment rise from bearish to bullish in just a few weeks. Q3 earnings, however, will not benefit from the low year-on-year base effect that Q2 2021 had, so more weight will be given to CEO’s forward guidance and any clarity they can bring to the impact of the macro environment on the economy.

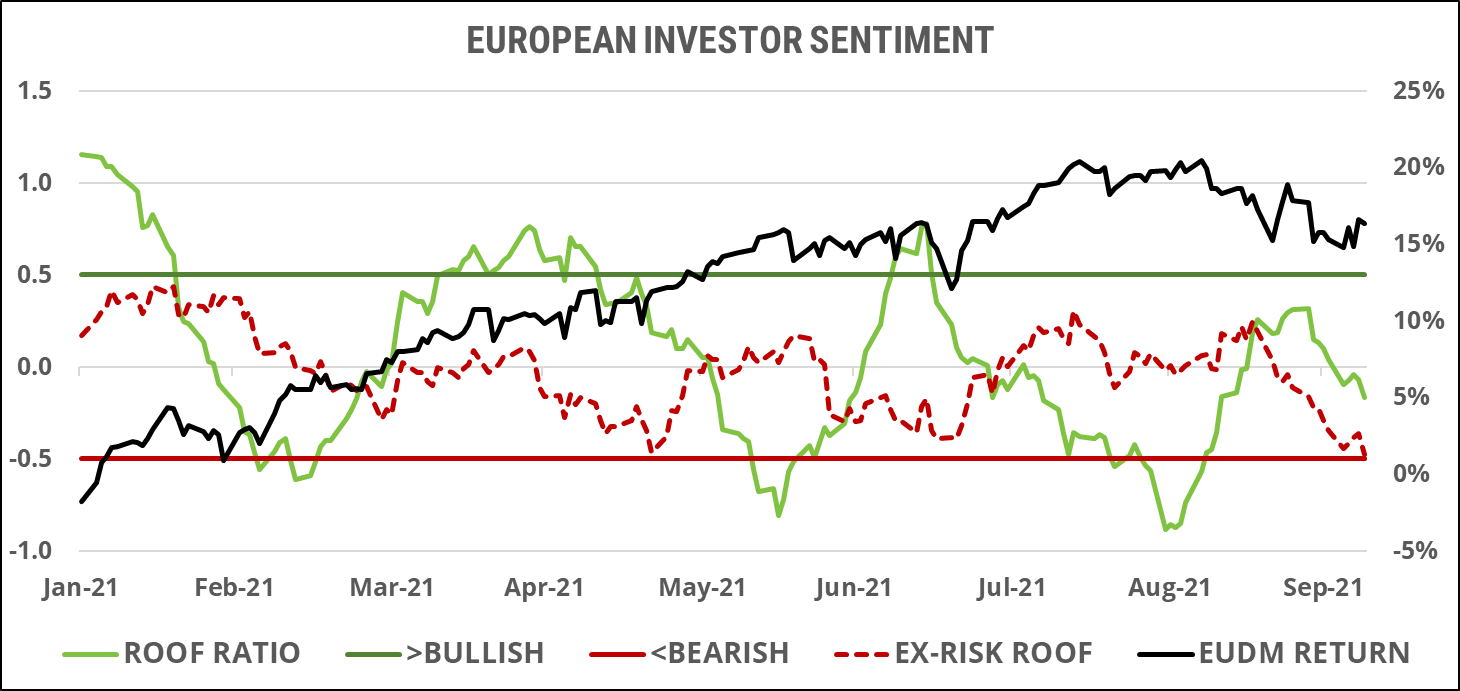

European investor sentiment:

Having failed two weeks ago to recover the bullish highs of last June or April, sentiment among developed Europe investors last week turned around to descend towards the bearish zone. Markets yielded the call for tempered enthusiasm but after a seven-month rally, they have some downside left before they can even be said to enter correction territory. Unlike the US, however, markets, rather than sentiment, seem to be in the driver’s seat in Europe. Three times this year, sentiment took a dive into the bearish zone and was ignored by the market, which kept powering upwards. Will October be different? Will we see a passing of the guards? The key determinant will be volatility. Markets were able to ignore sentiment during the summer because volatility was low and the downside risk of being wrong, even lower. But, being defiant in the face of higher volatility and potentially costlier losses for being wrong may take more courage than investor sentiment may provide, especially with year-to-date performances to protect.

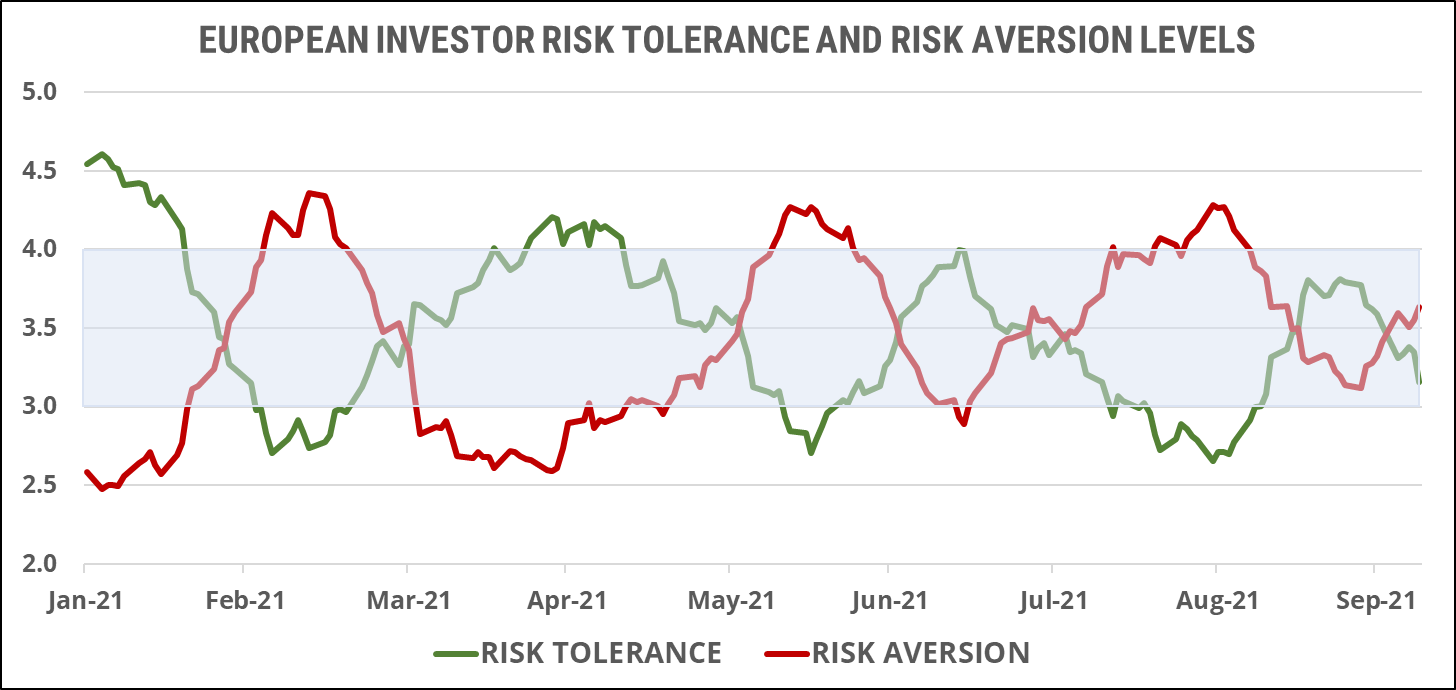

For the seventh time this year, risk aversion (red line) and risk tolerance (green line) have traded places as the dominant sentiment. Last week reversed the slight dominance of risk tolerance over risk aversion, giving the latter the lead going into this week. The imbalance between the two remains small, translating into a somewhat neutral risk appetite, but the underlying trend (highlighted in last week’s note) of lower highs for risk tolerance and lower lows for risk aversion remains in place and points to momentum being in favor of the latter going forward.

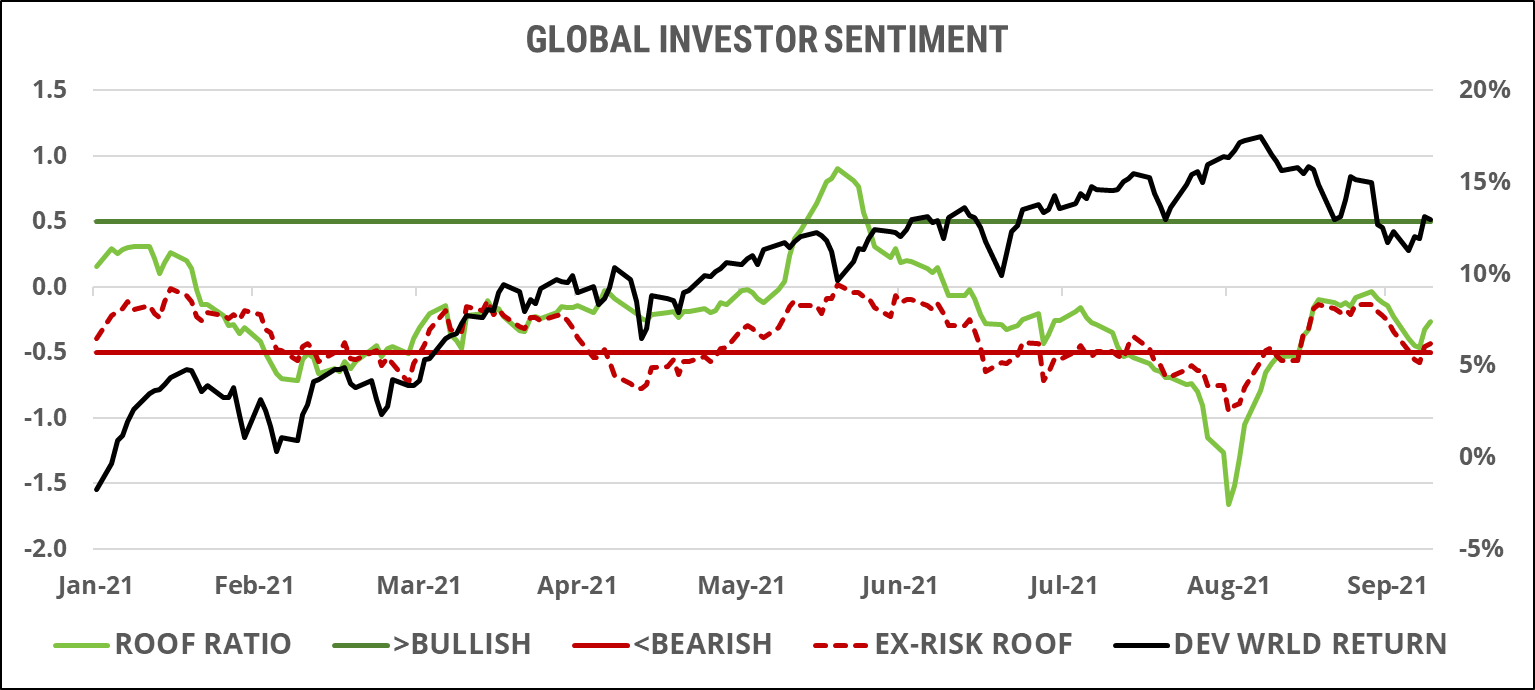

Global developed markets investors sentiment:

In global developed markets,the divergence between markets and sentiment of June and July turned into a convergence in August and a parallel downward move since mid-September. After narrowly avoiding a dip into the bearish zone early last week, sentiment and markets ended with a slight rebound. Like their US and European peers, global developed market investors have a lot of year-to-date performance to protect and may not feel like risk-taking in the fourth quarter is something they will get rewarded for. Even if some optimism persists among them, investors seem to lack the courage of their conviction at this late stage in the year, and may need further fiscal or monetary assurances to return to their bullish ways.

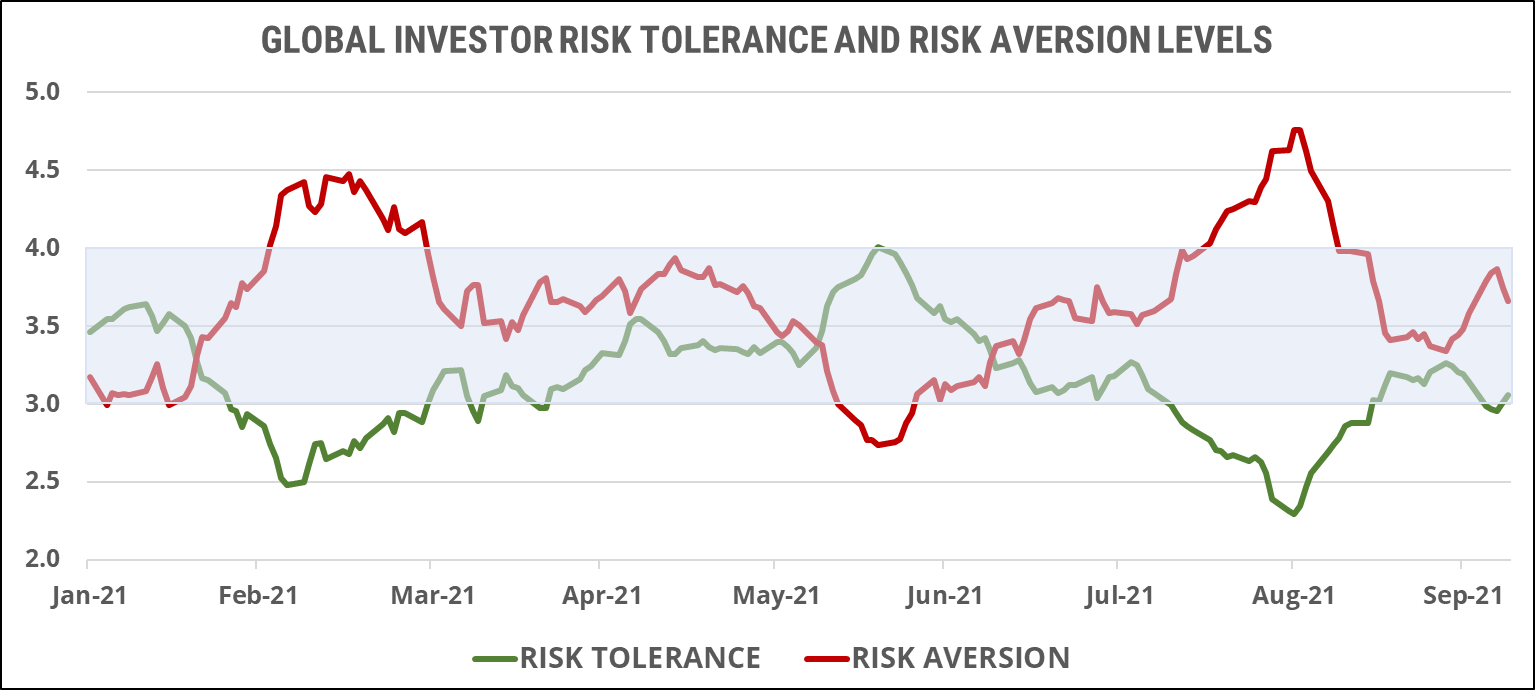

Risk tolerance (green line) and risk aversion (red line) converged back towards each other last week, keeping overall risk appetite neutral. Global developed market investors have only been ‘emotional’ twice this year, once during the taper tantrum of February and once during the low-volume month of August. The rest of the year, they have been ambivalent as to how they really ‘felt’ about risk, safe in the belief that central banks will keep underwriting risk-taking for them. News of a combination of persistently higher inflation and a return to more volatile markets may turn their indifference into a more worried stance, in sympathy with their US and European peers (i.e., ambivalence is not the same thing as not caring).

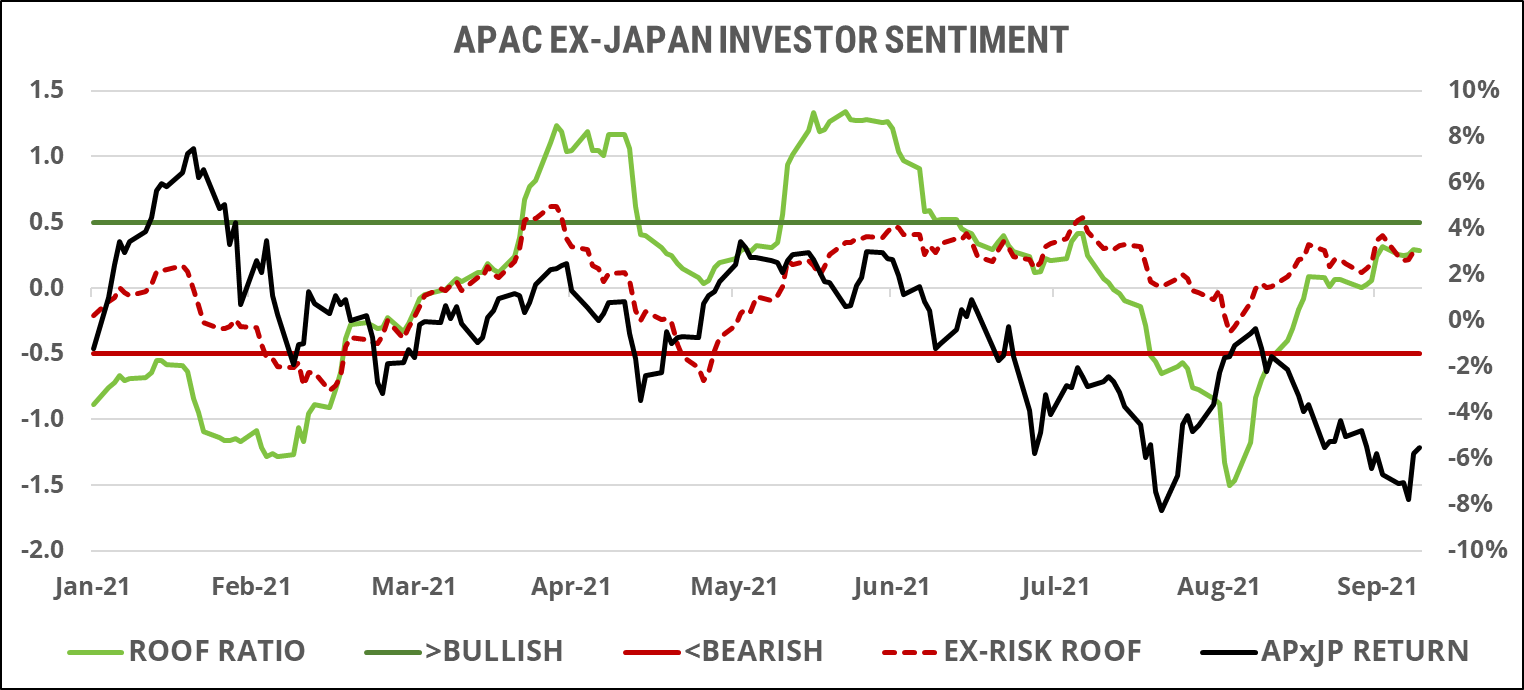

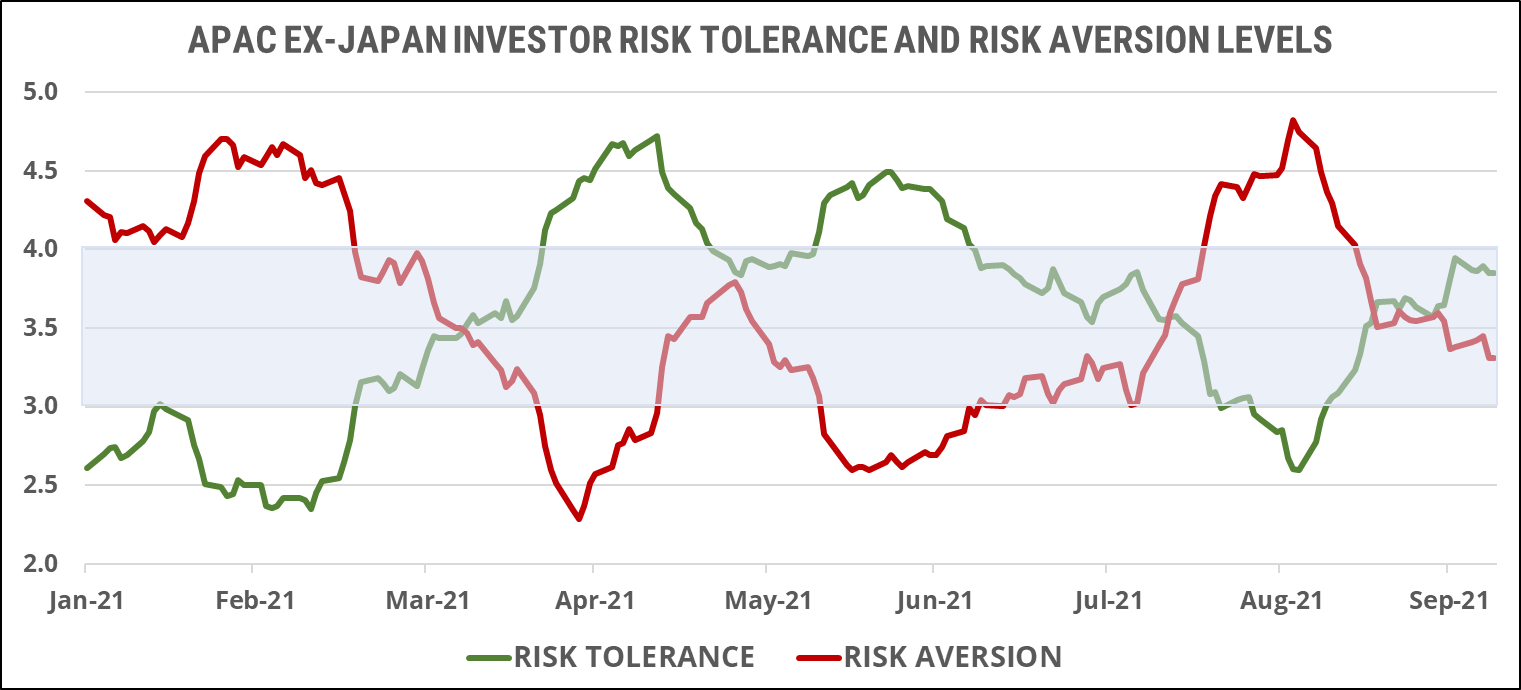

Asia ex-Japan markets investor sentiment:

Sentiment and markets in Asia ex-Japan ended their partnership in mid-August. Since then, markets have declined in tandem with their global peers but in the face of locally rising sentiment. Last week saw the first attempt by markets to correct this divergence, indicating that sentiment may have risen enough to tilt the balance in its favor once again. Asian markets are down year-to-date so there isn’t much performance to protect, and a final hooray of risk-taking might be the last chance regional investors have for positive returns for 2021. If market volatility remains in the manageable range, and sentiment edges ever closer to the bullish zone, we could see markets continue to rally in the near term.

Late September’s rally in risk tolerance (green line) seems to have been short-lived and corrected slightly last week. Risk aversion (red line), meanwhile, continued to decline, indicating that the pause in risk tolerance is not linked to a feeling of rising risk aversion. Still, regional investors seem to lack the courage of their convictions for now, seeing as these are not being mirrored by investors in other regions. For now, Asia ex-Japan investors appear content to keep a neutral risk appetite, albeit with a slight positive bias.

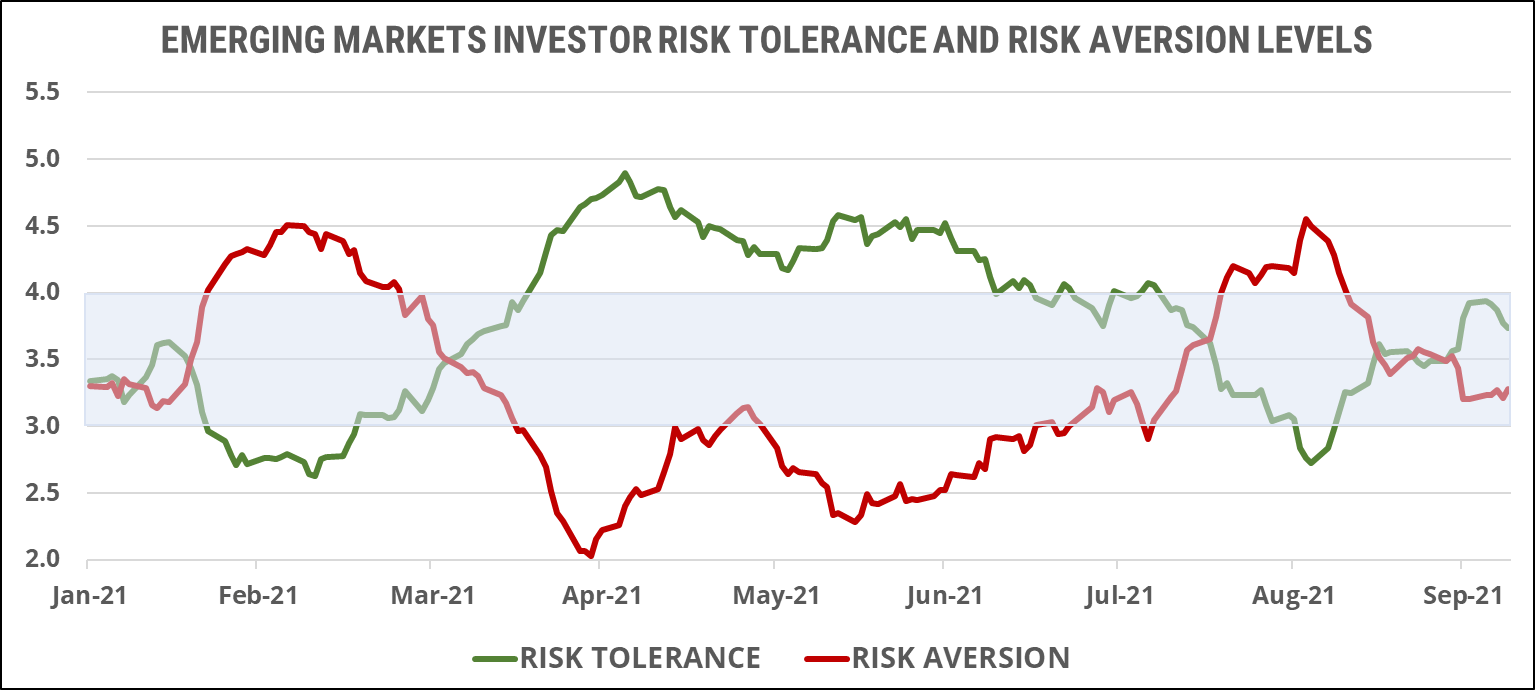

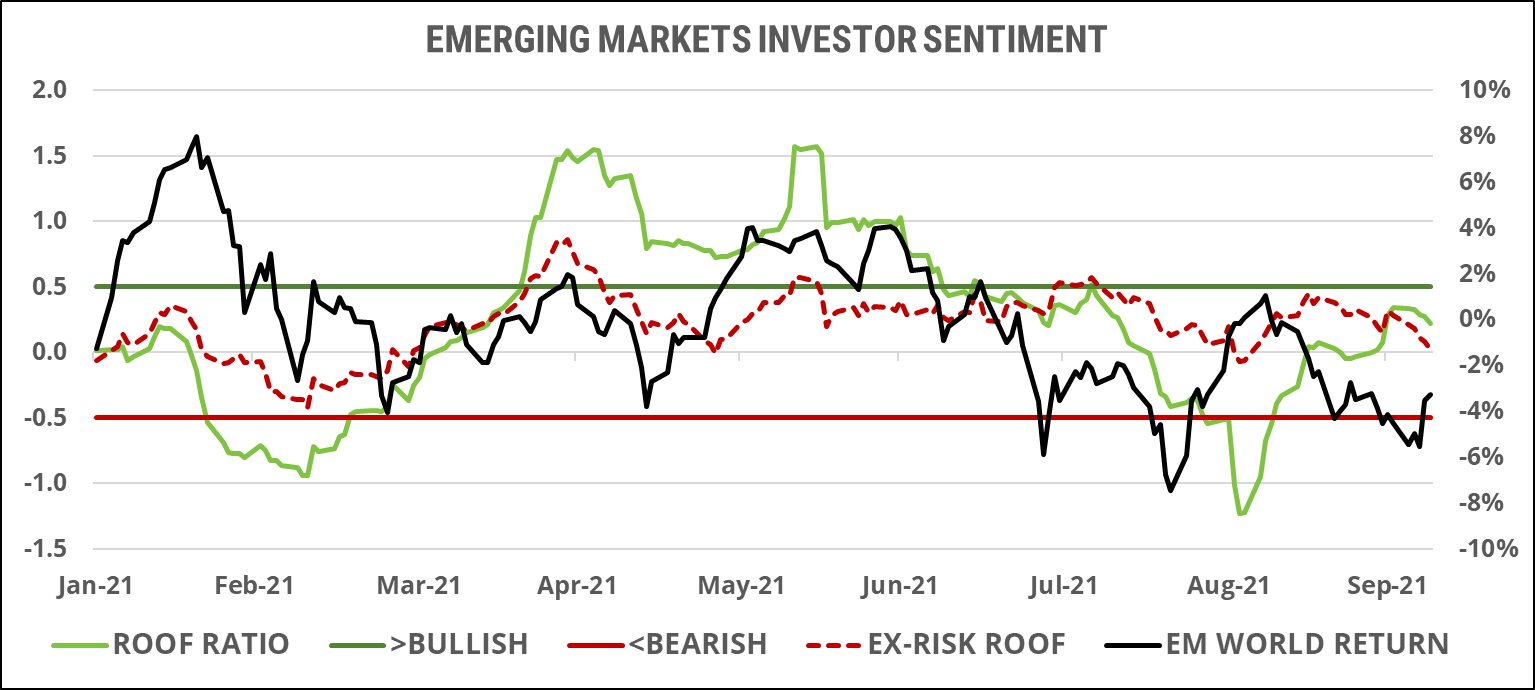

Global emerging markets investor sentiment:

Global emerging market investor sentiment converged with markets last week, ending a month-long divergence that saw markets fall in September in the face of rising sentiment. Like their Asia ex-Japan peers, investors in this region have been more positive than in developed regions since mid-August but this cautious optimism had not been strong enough to lift markets until last week. Emerging markets are also facing negative year-to-date returns and, given a more positive sentiment here than in developed markets, investors may want to follow their Asia ex-Japan peers in a last batch of risk-taking to try and square the performance ledger for the year. Any sudden rise in market volatility, however, may tip the balance in favor of a more bearish sentiment that would stifle any rally attempts.

Risk aversion (red line) and risk tolerance (green line) halted their growing divergence last week, resulting in a balanced supply and demand for risk. This neutral risk appetite once again highlights the lack of conviction investors have that increasing risk tolerance will be rewarded with increased returns. Any rise in market volatility, and therefore in potential downside risk, will send them back to the sidelines.