Potential triggers for sentiment this week1 :

- US: Earnings reports from Pfizer, AMD, Airbnb, Uber, Moderna, PayPal and Starbucks. Federal Reserve’s interest rate decision and jobs report.

- Europe: Bank of England meeting; Eurozone GDP and inflation data.

- APAC: China manufacturing and services PMI.

- Global: Corporate earnings, forward guidance, consumer spending trends and the upcoming interest rate decision in the US will be the focus this week, but this could just be a commercial break from ongoing macro and geopolitical concerns.

Summary of changes in investor sentiment from the previous week:

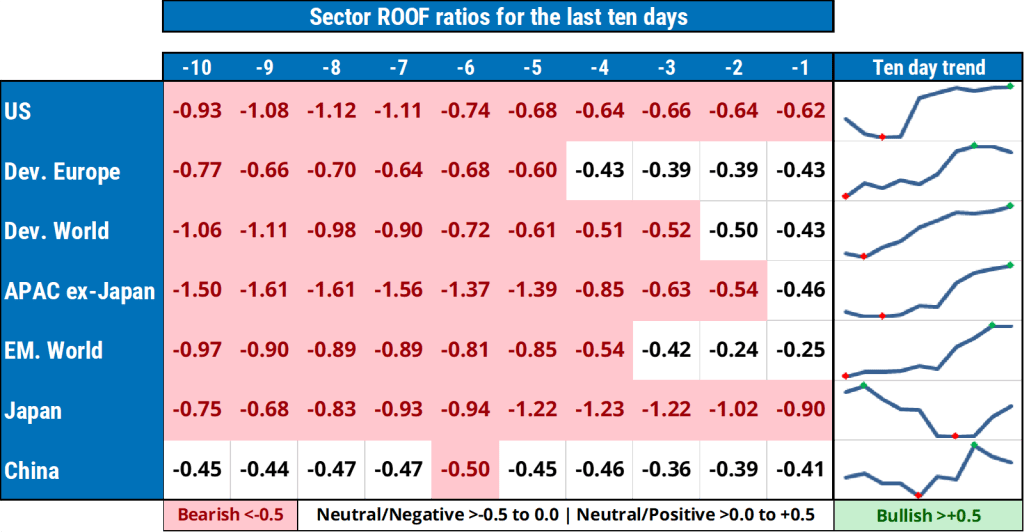

- Investor sentiment staged a mild recovery last week in all markets we track, still ending negative but no longer as bearish as the previous week. Only the mood of US and Japanese investors remained in the basement, but both were also off their lows. Credit for this bump in sentiment goes to ‘not-as-bad-as-feared’ earnings reports, and a resilient set of economic data. At the midway point in the Q3 reporting season, earnings have managed to halt the fall in sentiment by simply painting a mixed picture instead of a bleak one.

- Markets have priced in another jumbo 75bps rate hike from the Federal Reverse for this week, as nothing in last week’s batch of resilient economic data will stay their hand. Consensus, for now, is that this should be followed by ‘smaller’ 50 bps hikes at their December meeting, and, possibly, even smaller ones thereafter. Or ‘something like that,’ one might add, just in case, to widen the margin of error.

- Uncertainty is volatility’s oxygen, and nothing fills up its lungs with it more than earnings surprises, the impact of which is directly related to the sentimental context at the time. Last week’s earnings misses from big tech names combined with a propensity for overreaction from a bearish sentiment, turned the so-called ‘pandemic profiteers’ into ‘stagflation hostages’ (e.g., Alphabet -9.1%, Microsoft -7.7%, Meta -24.6%, Amazon -6.8%).

- The dim macro and geopolitical outlook remain a drag on sentiment, and in light of that — or, rather, in dark of that — October’s positive market performance, seems even more of a seasonal outlier. Some (volumes remain low2) investors have decided to switch to the earnings station on their radios, but you can’t realistically take the macro and geopolitical networks off the air — at best flipping channels will only temporarily reduce their ratings.

- Sentiment is not so much a reflection of reality as of investors’ nerves, and, on the whole, the sidelines provide one’s nerves with far fewer irritants than a volatile market. Low volumes indicate that most investors are opting for a rest rather than trying to settle a score with reality. This leaves only the risk-tolerant few in the market, for investing they must, or, as the philosopher would have put it, “I invest, therefore I am.”

Jump to a specific market

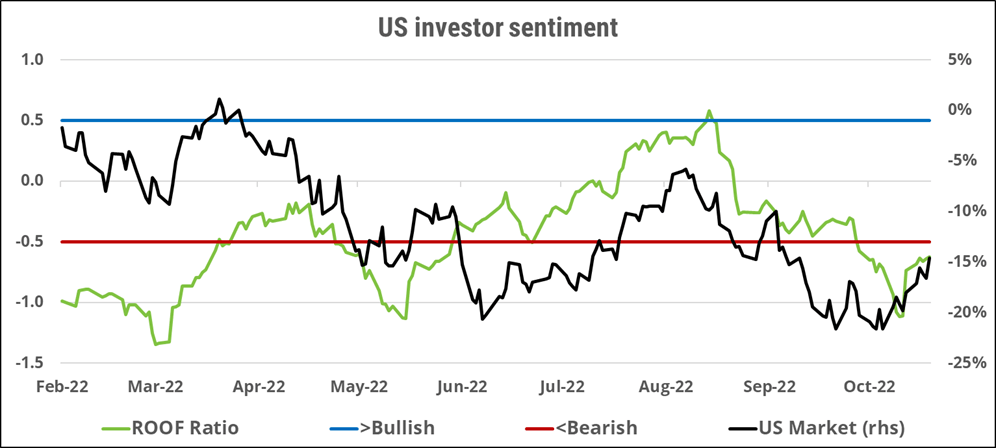

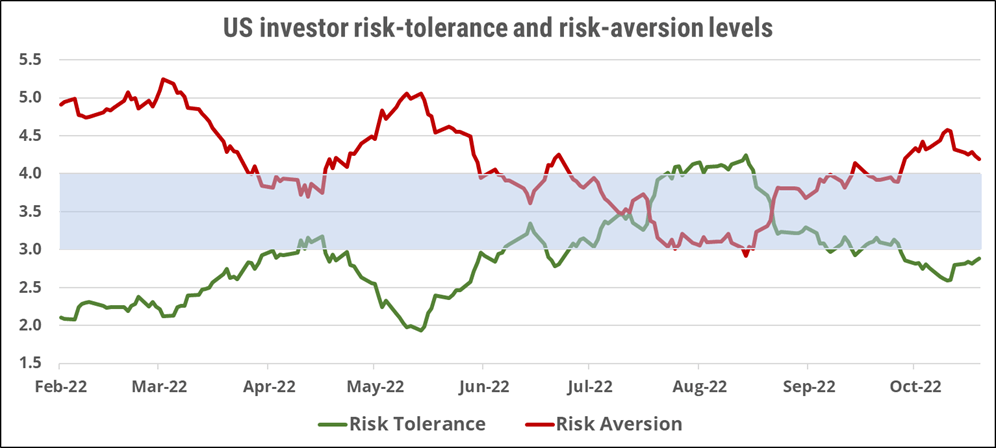

US investor sentiment

Sentiment among US investors (green line) recovered slightly last week but remains bearish for now. Corporate earnings are still being delivered in the background but this week’s interest rate decision and the October jobs report on Friday is likely to bring the macro picture back into focus for investors. Absent of any destabilizing drama from the geopolitical theater, sentiment will take its cue from actions by central banks in their fight against inflation, and hints of their consequences on the economy. The latter has been more resilient than feared, but lower guidance by key consumer discretionary companies bring dark clouds over this year-end’s holiday shopping season. On the one hand, the housing market is already showing signs of strains, on the other hand the travel and hospitality industries are finding it hard to keep up with demand. Conflicting nuggets of information are likely to be on the menu for some time until inflation shows a sustainable downtrend allowing central banks to release the breaks on the economy. As if uncertainty wasn’t high enough, US investors will also have to contend with the outcome of close mid-term elections later this month as well. Risk aversion remains higher than risk tolerance, translating to more of a downward bias than an upward one when it comes to investors’ reaction to news.

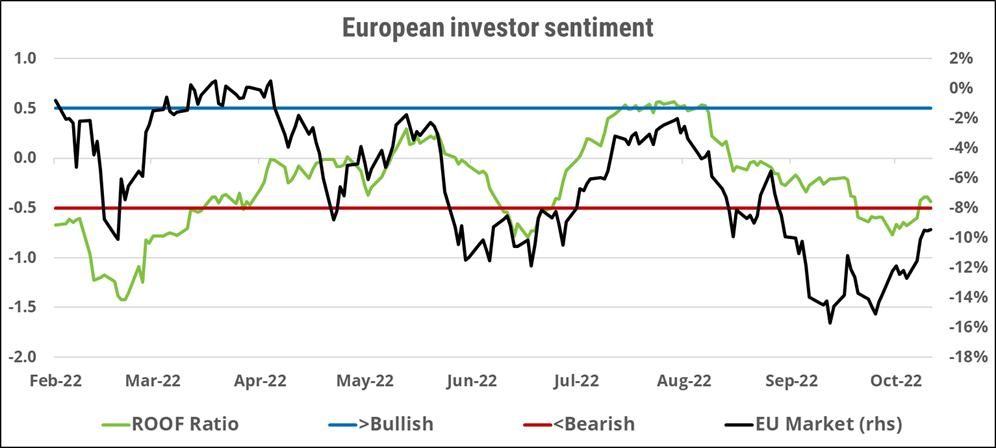

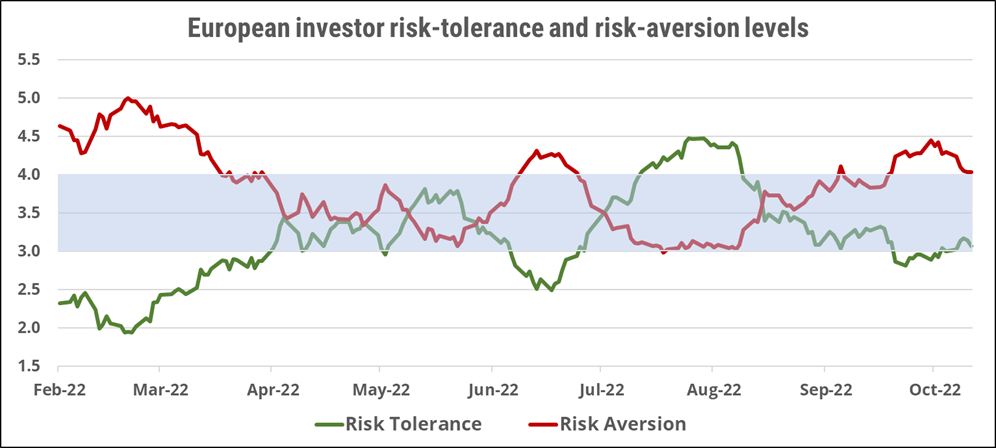

European investor sentiment

European investors’ sentiment (green line) made a timid recovery last week, ending just above the bearish range in very negative territory. Low volumes call into question both the recovery in sentiment, absent any positive fundamental news, and the October market rally. The more likely explanation is that lower oil and natural gas prices, together with a return to calm in the UK, have let investors temporarily take their focus off the macro and geopolitical situation and onto corporate earning reports. Markets have all but erased their September losses initiated by the political events in the UK, but with risk aversion still higher than risk tolerance, investors will need more good news to chase valuations higher. Memories of the failed July rally are still fresh in their minds.

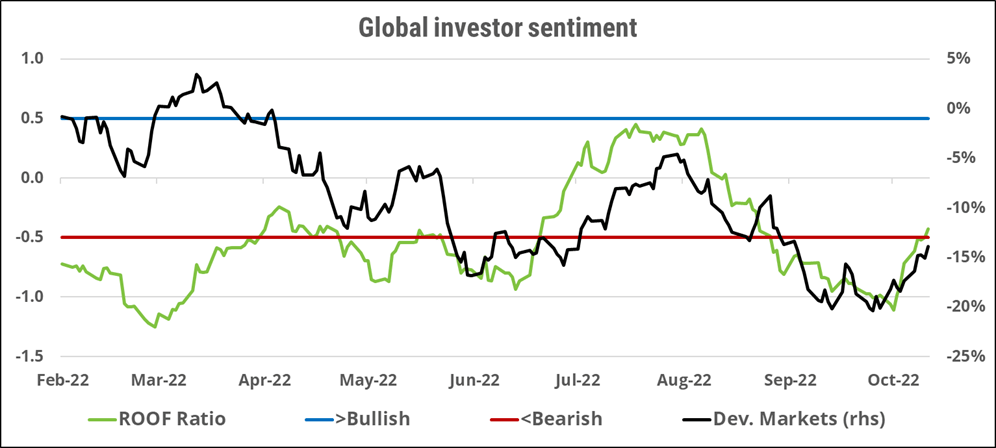

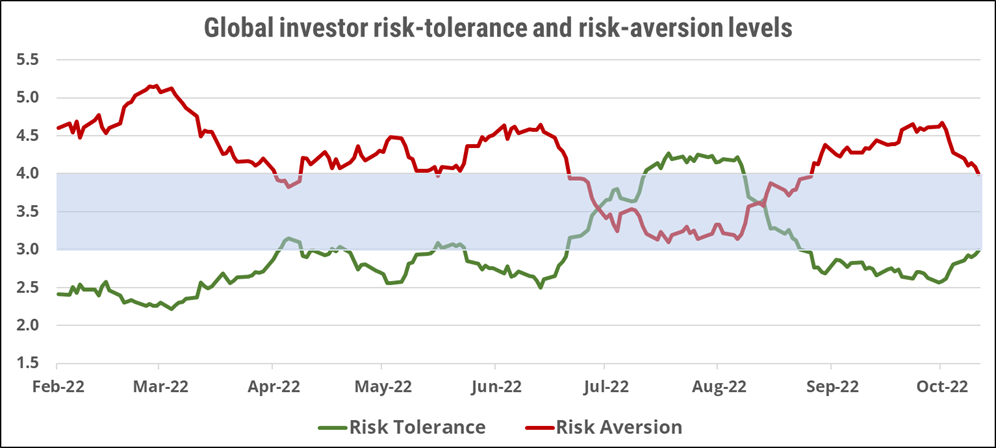

Global developed markets investor sentiment

Sentiment among global developed-markets investors (green line) recovered in line with other developed markets to end the week very negative but no longer bearish. In addition to lower energy prices and market risk levels, global investors benefitted from a calmer currency market with the retreat of the US dollar against other major currencies. As with other markets, volumes remain anemic compared to Q1 this year, and are indicative of a lack of confidence on the part of investors that recent improvements will last. Their requirements for returning to markets with a more positive sentiment remain the same, namely sustainable evidence that inflation is on the retreat, that resolution to the war in Ukraine is in sight, that central banks will pivot to more dovish monetary policies, and that a deep economic recession can be avoided. Until then stagflation remains the base case scenario for which they have positioned themselves and getting them off the sidelines will be near impossible.

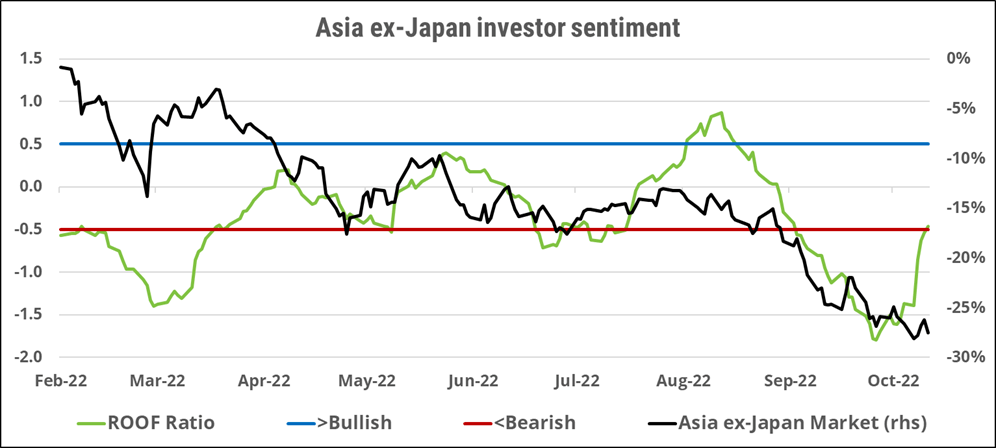

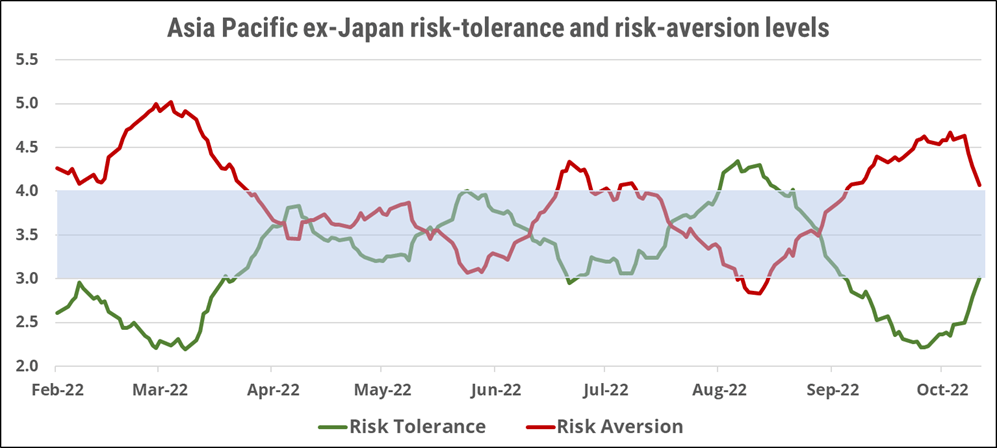

Asia ex-Japan markets investor sentiment

Sentiment among Asia ex-Japan investors (green line) rebounded sharply last week, ending just above the bearish level (<-0.5) for the first time since mid-September. The improved sentiment, however, was not enough to pull markets out of their recent downtrend as both Hong Kong and Chinese markets declined last week on continued geopolitical worries. Fundamentals remain negative for equities in the region, pressuring any market rally into a temporary one until the situation improves. Despite last week’s reversal, risk aversion remains much higher than risk tolerance, indicating a negative bias in how investors will interpret incoming news, especially negative one. Valuations are cheap, and increasingly so when compared to ones from developed markets, but risk appetite remains negative for the time being, making any attempt at revaluation a fool’s errand in the short term.

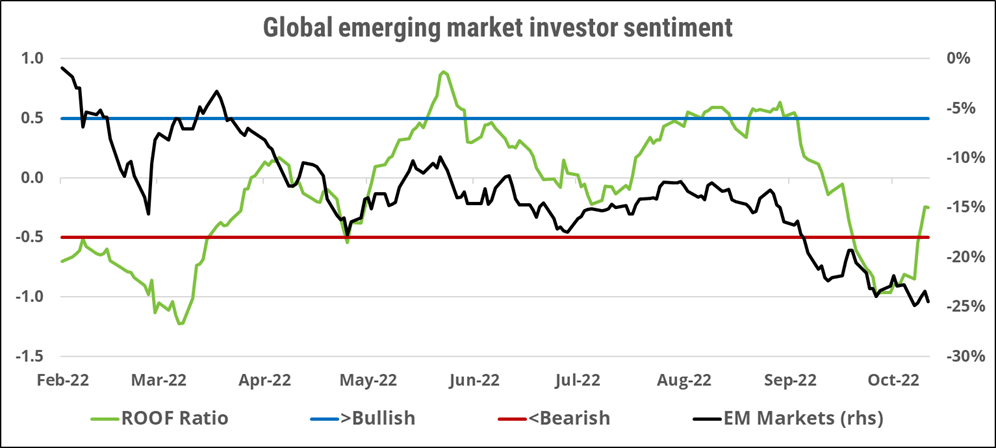

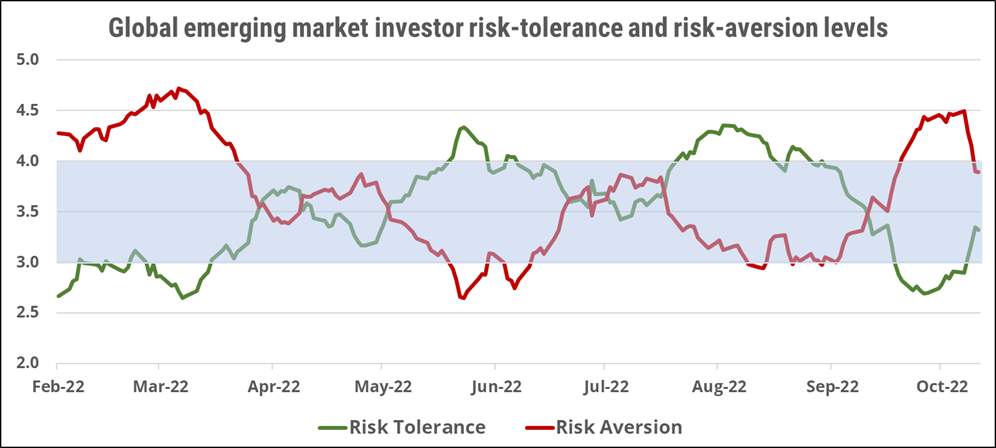

Global emerging markets investor sentiment

Sentiment among global emerging-markets investors (green line) also rose last week, ending close to a neutral level. Global emerging markets benefit from a strong economic and financial diversification. Latin America has outperformed Asia ex-Japan, commodity-exporting countries have outperformed commodity-importing ones, countries with positive current accounts have outperformed countries with deficits, etc. Yet, because of China’s weight in EM benchmarks, these have trended down year-to-date, despite two separate periods of bullish investor sentiment. Commodities and geopolitics play a bigger role in emerging markets, and investors need to pick and choose wisely when positioning themselves in those markets. The current trend towards de-globalization and ‘nearshoring’, or ‘friendshoring,’ is changing the landscape for investors who need to adopt new investment metrics into their strategies. In the near term, sentiment remains negative and most investors on the sidelines, increasing the odds of further downward market moves.

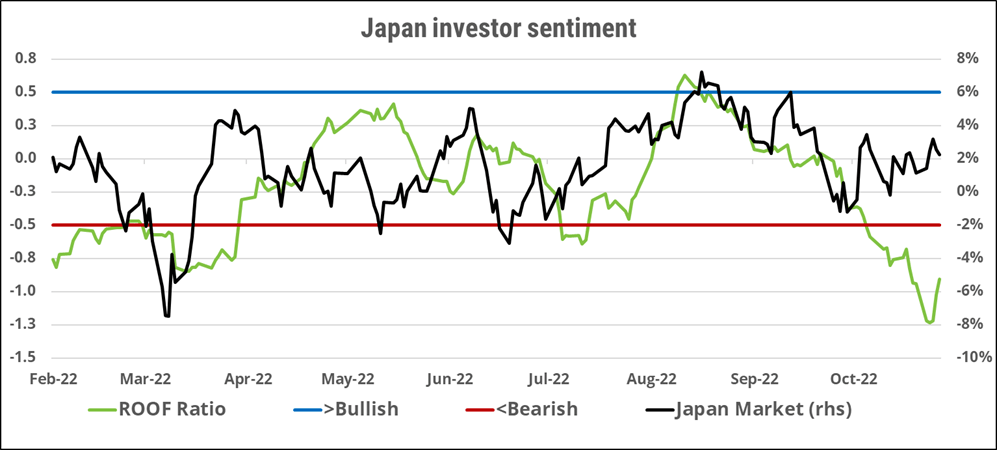

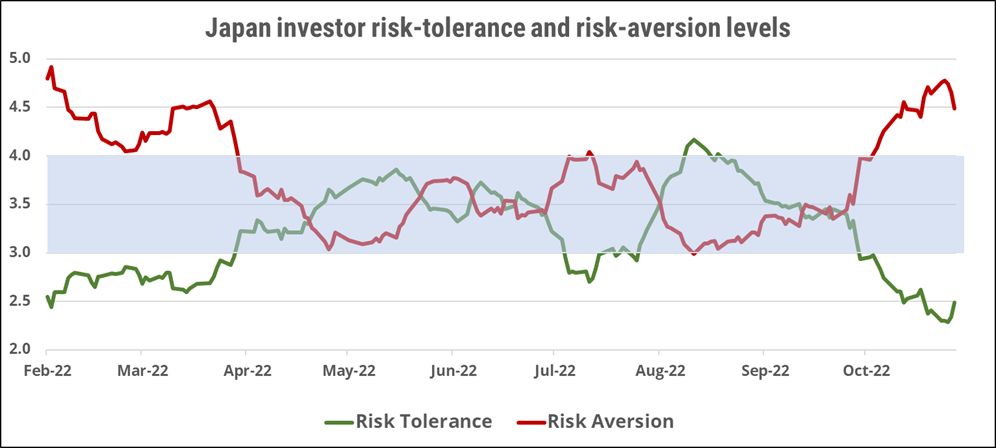

Japan market investor sentiment

Sentiment among Japanese investors (green line) ended last week higher than the previous week but still bearish. The combination of a very weak currency and higher-than target inflation remains a concern for investors, especially given the BoJ’s persistent easy monetary policy. A rising new COVID-19 infection rate and the fear of renewed lockdowns, and their impact on consumer spending ahead of the holiday season, is adding to the drag on sentiment. Risk aversion remains almost twice as high as risk tolerance, resulting in a market environment where overreaction to negative news is more likely than underreaction, or even a rapid turnaround in sentiment. Investors in Japan are sitting on smaller year-to-date losses than their global peers and seem happy to stay the course for the remainder of the year, unless corporate guidance turns negative during the ongoing reporting season.

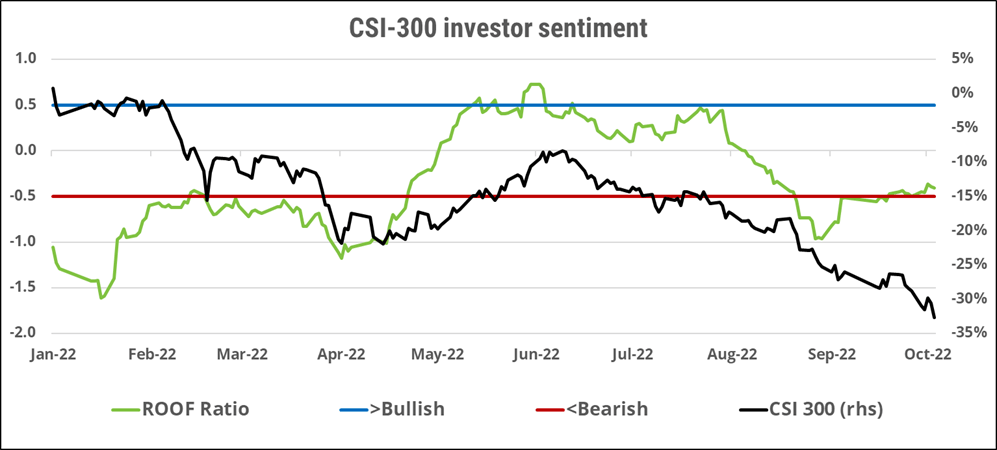

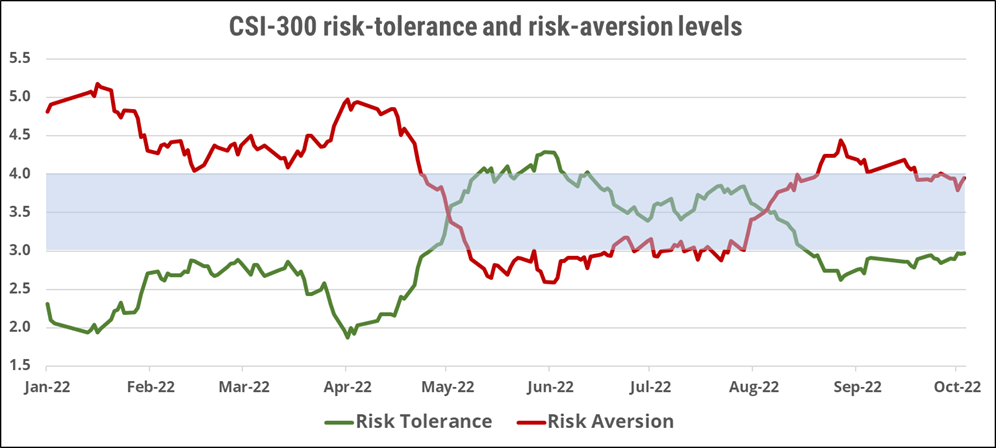

China (domestic) investor sentiment

Sentiment (green line) among Chinese (A-shares) investors ended last week virtually flat versus the prior week and remains very negative. Most investors are likely to remain on the sidelines until either the global macro picture improves, driving renewed demand for China’s manufacturing sector, or until it becomes clearer what the recent concentration of political power means for the country going forward. The US-China relationship is top of mind for investors who have already reacted to the latest degradation by selling the Chinese tech sector as well as US-listed companies. The domestic market will continue to be swayed by the fluid status of this relationship as it remains a key political football between Democrats and Republicans in the US ahead of both November’s mid-term elections and the 2024 US presidential elections. Since the start of the year, risk aversion has been higher than risk tolerance in seven out of ten months, and remains so going into November. This negative bias will keep markets under pressure for the time being, with downside risk trumping upside potential.

1 If sentiment is bearish/bullish, a negative/positive surprise on these data releases could trigger an overreaction.

2 See chart 27 in the Equity Risk Monitors