The exhaustive global index offering allows investors to slice and dice the world’s equity markets along region, country, size and sector indices with a consistent methodology and international standards – leaving no gaps or overlaps in their coverage.

Qontigo has introduced the STOXX® World indices, a modular suite that allows investors to flexibly build portfolios covering a broad and liquid universe of markets.

The STOXX World Indices comprise Qontigo’s largest pool of markets and stocks to date and employ the same transparent and rules-based standards as all STOXX solutions. With turnover and market-capitalization filters in the stock selection to ensure they are tradable and representative, the indices track the performance of large-, mid- and small-cap stocks from a full range of developed and emerging markets, as well as derived sector strategies.

To find out more about this launch, we sat down with Axel Lomholt, Chief Product Officer for Indices & Benchmarks at Qontigo.

Axel, what do the STOXX World indices bring to the Qontigo menu?

“We are expanding our index offering to address the demand from specific segments of the market — namely asset owners, asset managers and ETF issuers.

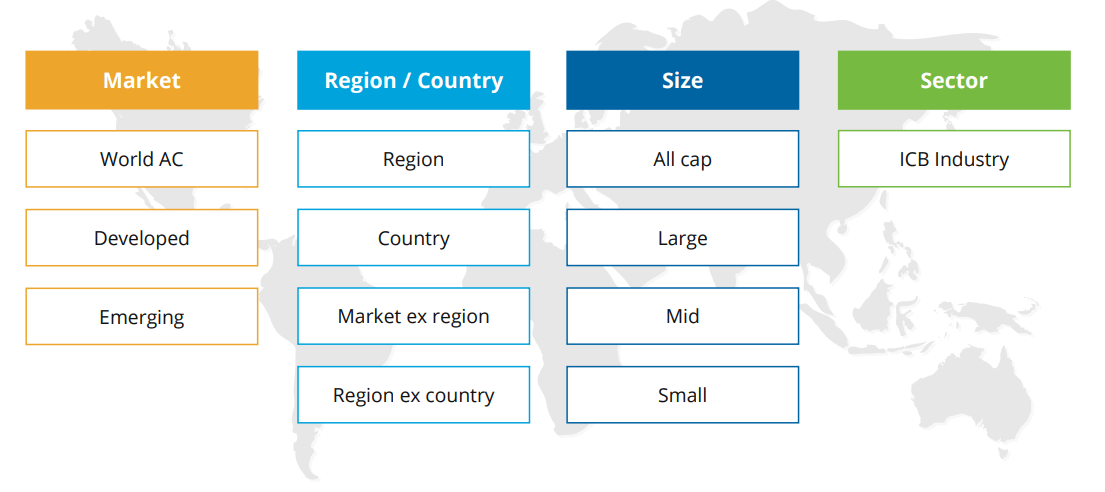

There are two defining features of the STOXX World Indices: their exhaustive scope and their modularity. Starting from the broad universe of the STOXX® World AC All Cap Index[1], the parent index can be sliced and diced by region, country, size and sector[2] into building blocks that leave no gaps or overlaps in investors’ allocations. Each stand-alone index in the STOXX World family uses the same methodology as the parent index, ensuring consistency, as well as transposability and ease of use across portfolios.

The composition process of each index is based on clear rules and selection filters, with the overarching objective that the entire index family is tradable and representative of underlying markets.”

Exhibit 1 – STOXX World indices: building block approach

You’ve mentioned some of the client segments the STOXX World Indices have been thought for. How can they use these indices?

“The indices have been designed for asset allocation, performance assessment, product development and research. As underlyings for investment products and as portfolio benchmarks, they comply with the requirements under Europe’s UCITS regulation[3] and the Regulated Investment Company (RIC) framework in the US.[4]

The STOXX World Indices follow industry standards, which will further facilitate their adoption. One additional point is that our research shows the indices have small tracking errors to other benchmarks in the market.”

How do the STOXX World indices fit in a landscape where investors’ requirements are becoming increasingly more specific and sophisticated?

“As investors’ needs evolve, the new index suite can be used as the basis to create highly targeted solutions in the three focus areas of sustainability, factors and thematics. These are segments where Qontigo, thanks to its open architecture and client-driven focus, has had a leading and innovative position in recent years.

We are also able to deliver customization and specific exposures by using the analytics and portfolio optimization tools of Axioma, drawing on the full value proposition of Qontigo. The STOXX World Indices will allow investors to combine a consistent view of world markets with analytics-enhanced strategies based on desired styles, ESG factors or themes.”

Qontigo’s team has built indices since 1998. Why are you introducing a new global index suite now?

While STOXX has a leading legacy position with structured-product issuers thanks to popular indices such as the EURO STOXX 50® and DAX®, the ETF market has seen outstanding growth and evolution in recent years. That’s where Qontigo, since its creation in 2019, wants to grow and innovate. We’ve successfully launched new solutions for this segment in the past three years, such as the DAX® ESG Target and STOXX® Global Metaverse for respective ETFs managed by BlackRock, the iSTOXX® Northern Trust Developed Markets Low Volatility Climate ESG Index for FlexShares and the STOXX® USA ETF Industry for Kiwoom Asset Management. We want to further expand our offering with a comprehensive, yet flexible, suite of indices. This comes at a time when ETF issuers are playing a key role in supporting the construction of investors’ portfolios. As such, they need competitive and tailored solutions, and this creates new opportunities for index providers.

We are driven to help issuers, but also asset allocators and investment managers, build their strategies and meet client objectives in an efficient way, piece by piece, benefitting from Qontigo’s expertise and customization capabilities.”

To find out more about the STOXX World index suite, please visit our STOXX World product page or schedule a meeting with our Sales team.

1 AC stands for All Countries.

2 STOXX indices use the ICB sector classification.

3 Directive 2009/65/EC of the European Parliament and of the Council of 13 July 2009 relating to undertakings for collective investment in transferable securities (UCITS).

4 See ‘Investment Company Act of 1940,’ in USEC, ‘The Laws That Govern the Securities Industry.’

Qontigo is a leading global provider of innovative index, analytics and risk solutions that optimize investment impact. As the shift toward sustainable investing accelerates, Qontigo enables its clients—financial-products issuers, asset owners and asset managers—to deliver sophisticated and targeted solutions at scale to meet the increasingly demanding and unique sustainability goals of investors worldwide.

Qontigo’s solutions are enhanced by both our collaborative, customer-centric culture, which allows us to create tailored solutions for our clients, and our open architecture and modern technology that efficiently integrate with our clients’ processes.

Part of the Deutsche Börse Group, Qontigo was created in 2019 through the combination of Axioma, DAX and STOXX. Headquartered in Eschborn, Germany, Qontigo’s global presence includes offices in New York, London, Zug and Hong Kong.