The latest addition to our expanding risk model suite is a Carbon Emission Price factor. With sustainability playing an increasingly important role in investor decision making, the new factor tracks a stock’s sensitivity to carbon-emissions prices. The factor is calculated by using the one-year node from the Axioma Constant Maturity Futures Curve based on the European Carbon Emission Allowances (EUA) futures traded on the European Energy Exchange (EEX).

The intuition behind the factor sensitivity requires some explanation. The factor uses returns based on the price of the carbon allowance. A high return means the price of the allowance has increased, making it more expensive to buy the allowance. Many carbon-inefficient European companies would theoretically be hurt by this and have a negative exposure, as they would need to buy more carbon allowances. That said, firms can benefit if they already hold a substantial number of allowances (either because they were granted them or they purchased them when prices—up substantially this past year—were lower). For example, if the price of carbon futures goes up, companies can sell their allowances at higher prices to other companies that need them. In addition, although carbon emission allowances are usedby many companies in Europe to meet regulatory requirements, any investor can trade them, and the number of market participants has increased steadily.

It is also important to note that the Carbon Emission Price factor is not a measure of carbon emissions. A company may have high emissions but hold enough carbon offsets to hedge their carbon exposure and, therefore, not be particularly sensitive to changes in carbon prices.

This is why some Energy companies, for example, do not show highly negative exposures. Similarly, not all airlines are equally sensitive to the carbon price, because although airlines received more than half their EUA credits for free until 2020 (and therefore as a group may show less sensitivity than one would expect), some (both within and outside of the EU) operate far more efficiently than others.

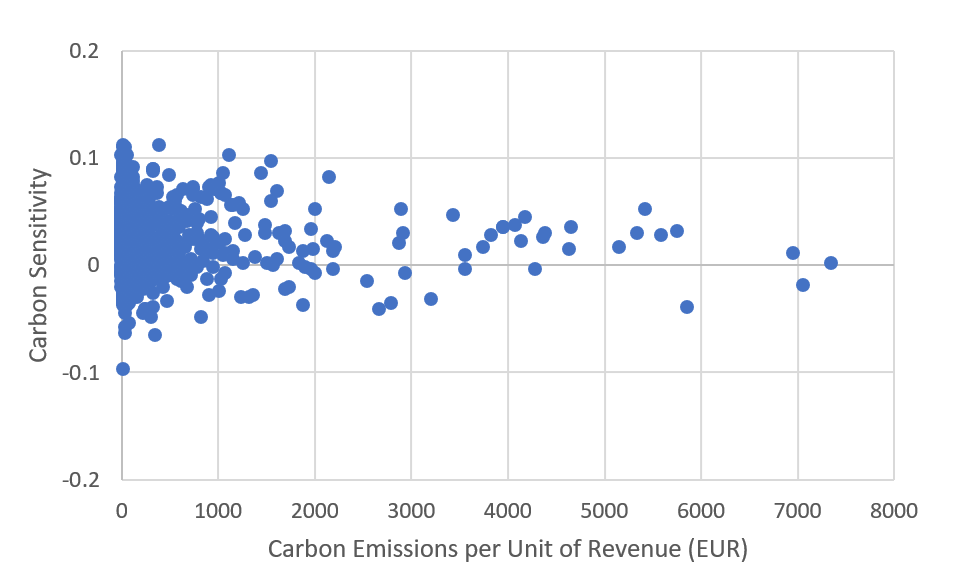

In fact, there is no correlation between carbon sensitivity as measured by the Axioma Macroeconomic Projection Model (Macro Model) and emissions, whether measured in total or per unit of revenue (as shown in Exhibit 1 for the STOXX Global 1800). Note that even when the universe is limited to the European market, where the relationship could be expected to be stronger, the correlation is still close to zero.

Exhibit 1. Carbon Sensitivity vs. Emissions, STOXX Global 1800, July 31, 2021

Note: Two extreme outliers were excluded for clarity, but there was little impact on the overall correlation.

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >Further insight can be gained from sectors’ exposure distributions

Fundamental factors in the Axioma models are constructed so the average across a broad, diversified set of stocks will be zero. However, similar to the other macroeconomic factors in the model, the universe average for the Carbon Emission Price factor can be positive or negative, depending on how stock prices move with the risk factor.

Across a broad universe of stocks, sensitivity to the factor was on balance positive as of July 31, 2021. This could be the result of the effectiveness of the offset market in convincing companies to purchase carbon offsets, although only European companies are required to hold the carbon offsets1. Other companies may trade the futures on speculation or to hedge carbon exposure. Obviously, non-EU-regulated companies may also be affected by energy prices and thus be correlated with the price of carbon futures.

We are mainly interested in how the exposures are distributed and have looked across economic sectors to gain some understanding of what to expect from the factor.

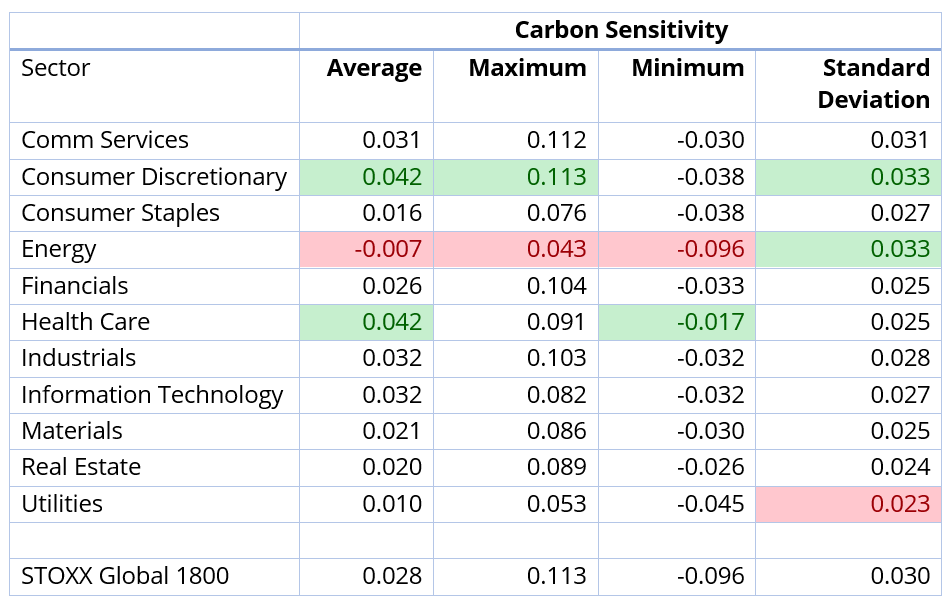

In Exhibit 2 we show the average, maximum, minimum and standard deviation of sensitivities by global developed-market sector. The results bear out our general intuition about the new carbon factor. Energy has the lowest average sensitivity (noted by the pink highlight), as well as the lowest maximum value, the lowest minimum value by far, and one of the two highest standard deviations. While the average score for Utilities is positive, it is lower than all other sectors except Energy, and the maximum and minimum are also next in line after Energy. Utilities also has the lowest variability in exposures. (As a reminder, a high positive exposure suggests the company benefits from a rising price of carbon futures.)

Although not shown, of the 15 companies with the most negative sensitivities, 10 are Energy companies and the rest are Utilities. No Energy companies appear in the top third of sensitivities and no Utilities are in the top 20%. These results confirm the intuition that Energy and Utilities are more likely to be more negatively impacted by rising carbon futures prices than other sectors.

Correspondingly, Health Care and Consumer Discretionary show the highest average sensitivities (highlighted in green, and again, meaning they are less sensitive to, or even benefit from, higher carbon prices). In addition, Health Care has the least negative exposure (with the next-in-line twice as negative), and Consumer Discretionary contains the company with the highest sensitivity. There is an intuitive appeal that Health Care is less negatively impacted by carbon prices, whereas Consumer Discretionary’s positive sensitivity is a bit less intuitive, and may be more related to the correlation between the strong stock-price performance in that sector and carbon futures.

Exhibit 2. Carbon Factor Exposures (Sensitivities) by Sector, July 31, 2021

Conclusion

The growing market for trading carbon allowances in Europe has led to a way of measuring the price of carbon. This allows us to measure an additional source of risk for companies, based on how they are exposed to that changing price, even beyond those subject to European regulations. While the Carbon Emission Price factor’s contribution to risk is relatively small right now, as the importance of sustainability in investor choices grows, we expect the significance of this factor to grow as well.

“Uncertainty around growth and inflation expectations, the future path of the pandemic, and the unravelling of concentration risks in some sectors are some of the potential factors that can lead to increased volatility in EM in the near term. A well-diversified low-volatility strategy can help investors manage these risks.”

Can You Trust Your Risk Number?

In risk management a lot of focus and attention is (rightly) put on models and methodologies used to compute ex-ante risk measures. And in the context of a multi-asset class universe which is vast by nature, perfect data (market data, terms and conditions provided by the user) and bug-free algorithms are not always possible.

Download >[1] Another possible explanation is that recent increases in the price of carbon have paralleled the positive returns for stocks; as of December 31, 2019, the average sensitivity was slightly negative.

Qontigo is a leading global provider of innovative index, analytics and risk solutions that optimize investment impact. As the shift toward sustainable investing accelerates, Qontigo enables its clients—financial-products issuers, asset owners and asset managers—to deliver sophisticated and targeted solutions at scale to meet the increasingly demanding and unique sustainability goals of investors worldwide.

Qontigo’s solutions are enhanced by both our collaborative, customer-centric culture, which allows us to create tailored solutions for our clients, and our open architecture and modern technology that efficiently integrate with our clients’ processes.

Part of the Deutsche Börse Group, Qontigo was created in 2019 through the combination of Axioma, DAX and STOXX. Headquartered in Eschborn, Germany, Qontigo’s global presence includes offices in New York, London, Zug and Hong Kong.