Last October, the Securities and Exchange Commission (SEC) adopted the 18f-4 Rule, which regulates the use of derivatives by investment firms. We were joined during a recent Risk.net webinar by a panel of practitioners who outlined what this important legislation entails, and how firms are preparing for it.

Philip Hinkle, partner at Dechert LLP, started with a high-level overview of the rule and of its framework’s legal implications, including the different types of fund companies that fall within the regulation’s scope, what types of derivatives and transactions are covered, and what specific reporting and compliance impositions are incorporated.

Among the practical requirements is the demand to have a written derivatives risk management program overseen by an appointed derivatives risk manager, as well as a clear internal reporting and escalation process. Asset managers servicing funds must implement and report on risk guidelines that take into account limits on fund leverage risk based on absolute and relative value-at-risk (VaR), stress testing and VaR backtesting.

Rule 18f-4 calls for intense work and preparation, said Hinkle, but it is a welcome development to harmonize and bring clarity to a regulatory framework that, to date, has been based on an outdated patchwork of guidance.

The fact that registered funds and business development companies are finally getting definite and clear regulation for derivatives use “is something that everyone across the industry is happy to have, even though it is going to take a tremendous amount of work to implement,” Hinkle said. “I urge everyone to be focusing on this rule now.”

Make early decisions

Lance Dial, managing director and counsel at Wellington Management, agreed. He described 18f-4 as a rule that modernizes an antiquated regulatory structure and levels the playing field for funds. Dial put the focus on how his firm’s sub-adviser clients are preparing for the implementation of the rule with the deadline of Aug. 19, 2022 in mind.

Dial advised companies to take a first step towards adopting the new framework by studying their strategies, and categorizing whether they are either ‘limited derivatives user’ or ‘full-compliance’ funds. Secondly, they should review their existing risk-control processes and determine if these can be scaled and adapted for the new legislation, or, instead, whether a new process is needed.

Thirdly, firms should identify their compliance objectives: who is going to calculate the various risk analyses? Does the company need to hire new employees for this? Lastly, does the company have the expertise in derivatives risk management so that it can build its existing research, or would it be easier to buy a turnkey solution to plug into existing systems?

All this represents a colossal enterprise that runs across teams and functions, said Dial. Several areas, from portfolio management to risk, and from compliance to product management, will be impacted.

“Make these decisions early on,” he said. “Recognizing early on that this will require extraordinary coordination is key to hitting the compliance date of August 2022.”

A robust risk analytics engine

It was up to Ping Jiang, our head of multi-asset solutions for the Americas, to give examples of the type of calculations and reporting that firms will be subject to. According to Jiang, an efficient risk analytics engine should meet three important criteria:

- First, it must cover all derivatives and securities for current and future investment needs, and be able to capture potential non-linear risk as well as the basis risk between derivatives and cash securities.

- It must be scalable and stable. “This is a daily VaR requirement,” Jiang said. “For some of the funds, the VaR computation could be very intense. You want to have a system that is architectured to reliably handle the high computation tasks you need on a daily basis.”

- It must have robust stress tests functionalities and risk diagnostic tools. These are key to identify the sources of risk and their change over time, ensure the efficient hedge of risk trades, and help in the communication with boards and regulators.

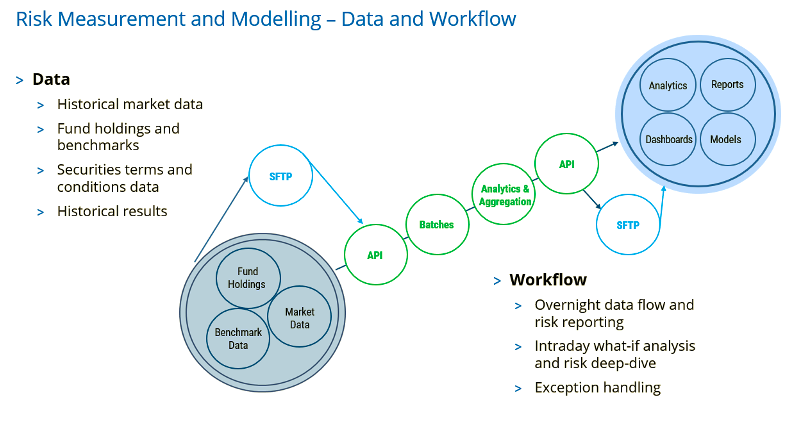

Jiang used the illustration below to show how the risk measurement and modelling works: from a data set that includes historical market data, fund holdings and benchmarks, securities terms and conditions data, an API-based system runs the analytics and aggregation process that includes overnight data flow and risk reporting, intraday what-if analysis and a risk ‘deep-dive,’ and the handling of exceptional situations when risk limits are breached. The historical results are properly stored for potential future audits and analyzed by the business intelligence tools.

Finally, Jiang presented examples of portfolio risk analysis required by the new SEC rule, and of related reports that Qontigo helps produce for clients. Some of the examples can be found here.

“Boards are very serious about risk regulation and fund-management companies are viewing this as an opportunity not just to invest and comply with regulation but also to invest in a useful risk management practice,” said Jiang.

Sea change ahead

To conclude, the panelists agreed that the impact and work entailed by Rule 18f-4 can’t be overestimated. Companies need to start planning their responses now to be ready for the new framework’s due date in 2022.

“This is a very comprehensive regulation,” said Wellington’s Dial. “It is a sea change for US mutual fund derivatives regulation and it’s an opportunity to do something that can be very useful and beneficial in the long run for all of our shareholders.”

Looking for help on how to comply with the SEC derivatives rule or want to chat with one of our experts? Visit qontigo.com/derivatives-rule for a no-obligation consultation.

1 For a more comprehensive report and analysis of Rule 18f-4 from Dechert LLP, you can read an overview and whitepaper here.