Creating Intelligent Climate Investment Solutions

STOXX Climate Benchmark Indices are designed to facilitate the shift towards a low-carbon economy and align investments with the Paris Climate Agreement.

Part of the Qontigo Sustainable Investment Ecosystem, the STOXX Climate Transition Benchmark Indices and STOXX Paris-Aligned Benchmark Indices are constructed to follow and exceed the EU Climate Benchmarks2 requirements. The indices encourage climate stewardship and corporate engagement to meet carbon reduction goals.

- STOXX Paris-Aligned Benchmark Indices (PABs) – These indices incorporate stringent carbon emission limitations in stock selection, in line with the global warming target of the Paris Climate Agreement3. They aim for 60% greenhouse gas (GHG) intensity reduction.

- STOXX Climate Transition Benchmark Indices (CTBs) – These indices allow for more sectorial diversification and help investors adopt a portfolio decarbonization trajectory. They aim for 40% greenhouse gas (GHG) intensity reduction.

Subscribe to receive more sustainability-related content from Qontigo

STOXX® Paris-Aligned Benchmarks

EURO STOXX PAB

EURO STOXX Total Market PAB

STOXX Europe 600 PAB

STOXX Global 1800 PAB

STOXX USA 500 PAB

STOXX USA 900 PAB

STOXX® Climate Transition Benchmarks

EURO STOXX CTB

EURO STOXX Total Market CTB

STOXX Europe 600 CTB

STOXX Global 1800 CTB

STOXX USA 500 CTB

STOXX USA 900 CTB

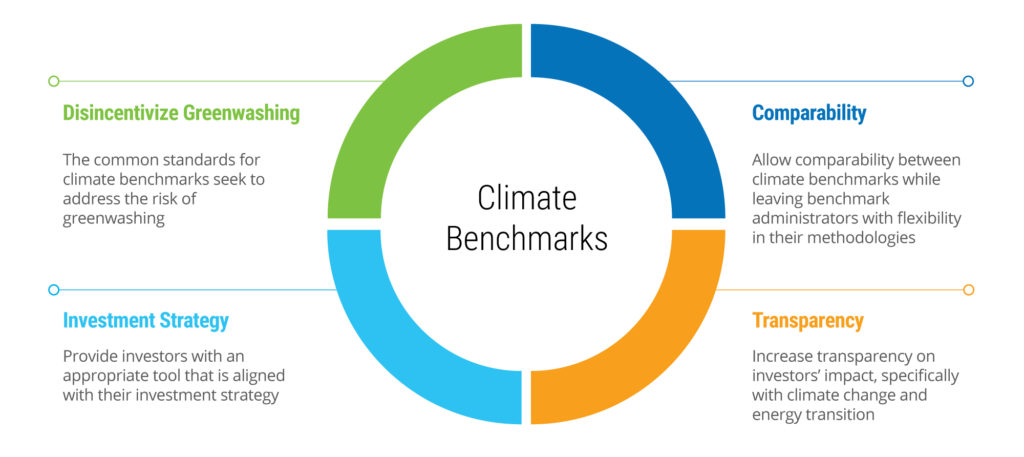

EU Climate Benchmarks Objectives

Related Video

Superior Design Criteria Sets STOXX Indices Apart

The construction of STOXX indices adds vital steps that emphasize the climate objectives

Scope 3 Inclusion4

Scope 3 data is used from inception to account for companies’ direct and indirect emissions

Sustainable Development Goals 13, Climate Action5

Securities that have significant obstruction to SDG 13 Climate Action are not eligible

Science-Based Targets

Qontigo aspires to influence companies to set and have approved science-based targets and therefore only includes companies that will fulfill the Science-Based Targets initiative (SBTi) by March 2030 in the indices

Climate Leaders

Indices will reward energy-efficient companies that are ready to seize opportunities arising from the transition to a low-carbon economy, and those that are well-positioned to meet their carbon budget targets

Our open architecture allows us to integrate the world’s leading climate data from our data partner ISS ESG. This includes the most complete set of carbon data, science-based targets and emission scenarios, which are used to overweight climate leaders and underweight the laggards. In addition, the indices are screened for controversial activities involvement.

STOXX Paris-Aligned Benchmark (PAB) Indices

These indices incorporate stringent carbon limitations in line with the overall long-term global warming target of the Paris Agreement and aim for 60% greenhouse gas (GHG) intensity reduction.

STOXX Climate Transition Benchmark (CTB) Indices

These indices allow more diversification and are designed to assist investors in the transition to a low-carbon economy by adopting a decarbonization trajectory. They aim for 40% greenhouse gas (GHG) intensity reduction.

Related Research

1 Inclusion of companies fulfilling the Science-Based Targets initiative (SBTi) by 2030

2 EU Technical Expert Group Report on Climate Benchmarks and Benchmarks´ ESG Disclosures, September 2019

3 Paris Agreement, December 2015

4 Technical Guidance for Calculating Scope 3 Emissions

5 Only applicable to STOXX PAB Indices