A rebound in the month’s second half helped the STOXX® Global 1800 index record a positive return for May, as investors continue to assess the impact on markets of rising interest rates.

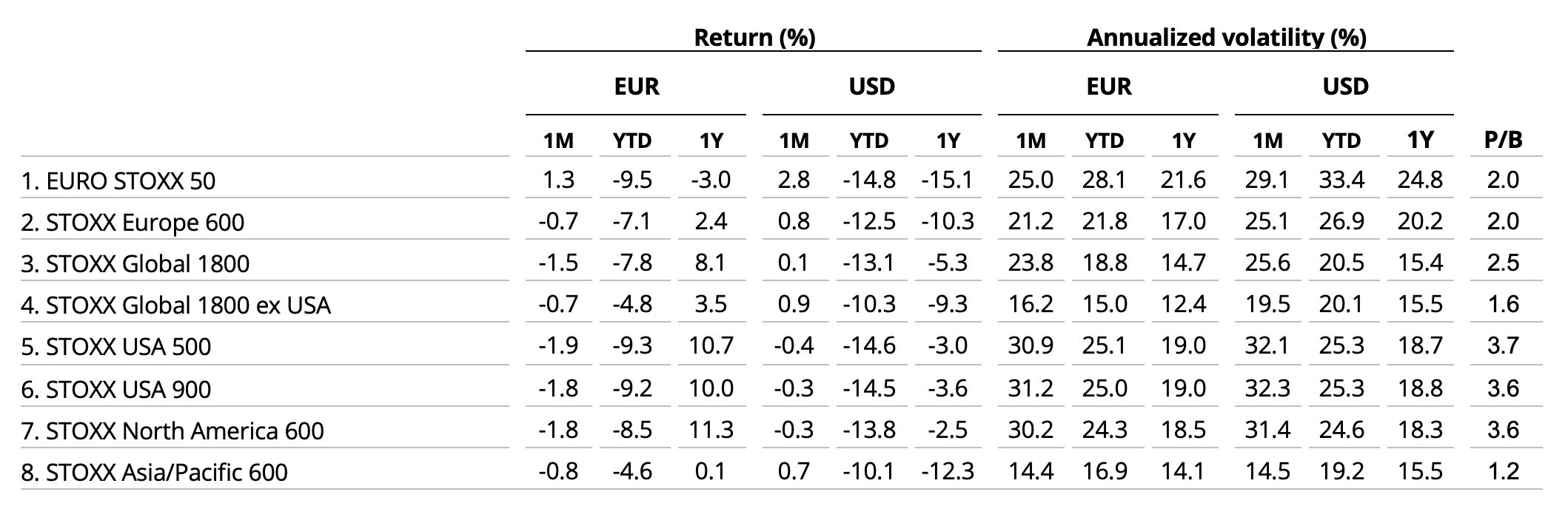

The global benchmark added 0.1% when measured in dollars and including dividends,1 recovering from a loss of as much as 5.6% earlier in the month. The index slumped 8.2% in April, its steepest monthly retreat since March 2020. For May, the benchmark dropped 1.5% in euros after the common currency gained 1.5% against the greenback.

The STOXX® North America 600 fell 0.3% in dollars, while the STOXX® USA 500 slipped 0.4%.2 The pan-European STOXX® Europe 600 dropped 0.7% in euros and the Eurozone’s EURO STOXX 50® increased 1.3%. The STOXX® Asia/Pacific 600 advanced 0.7% in dollars.

Figure 1: Benchmark indices’ May risk and return characteristics

While the Federal Reserve and other central banks are raising interest rates to fight inflation that’s running at multi-decade highs, many companies are warning about the negative effects of an economic slowdown and rising costs. US consumer behemoths Walmart Inc. and Target Corp. cut their profit outlooks during May, citing the impact of inflation on margins.

| For a complete review of all indices’ performance last month, visit our May index newsletter. |

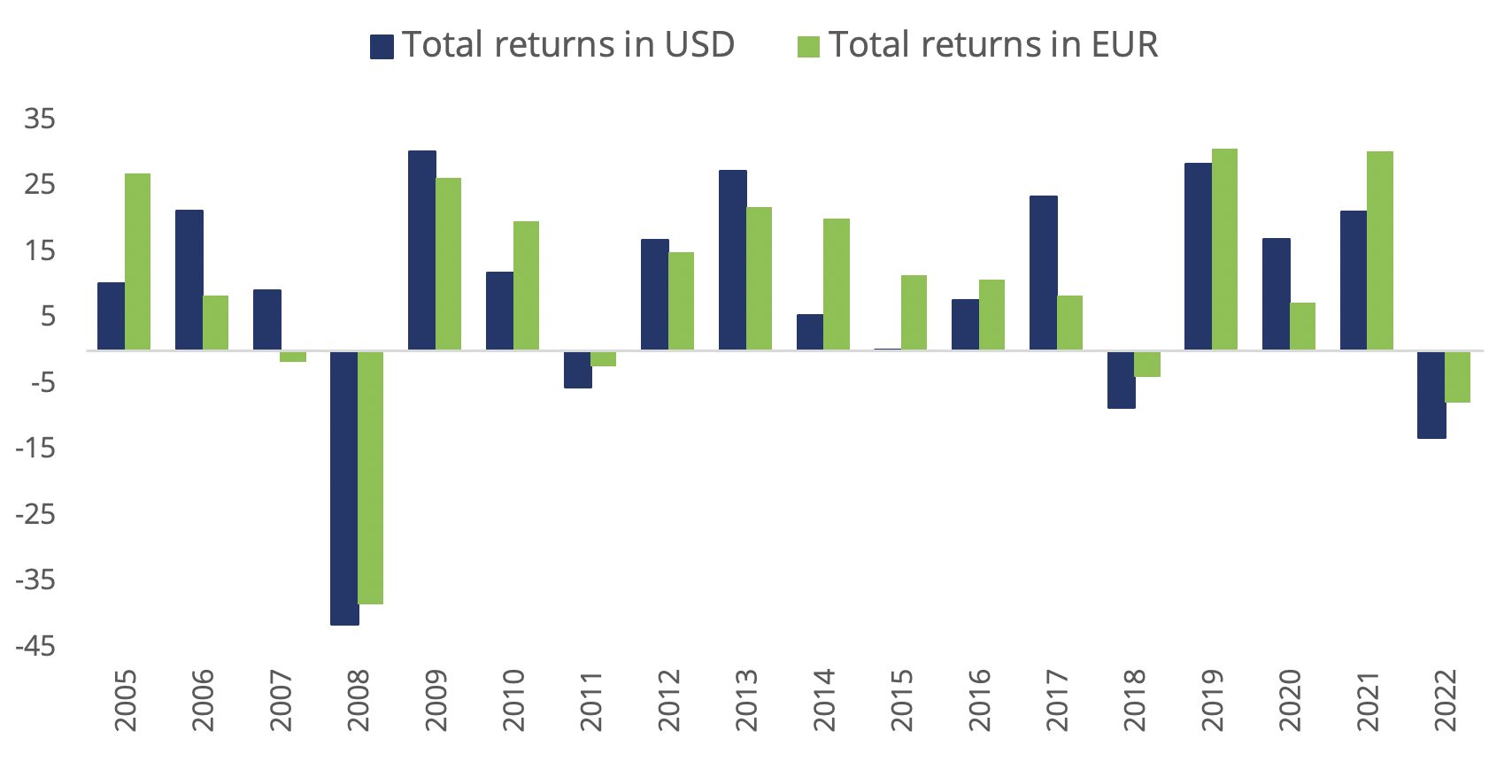

The STOXX Global 1800 posted in 2021 its third consecutive double-digit annual advance and has now gained in nine of the past ten years. Returns have amounted to an average of 13.9% per year over the last decade.

Figure 2: Annual % returns for STOXX Global 1800 index

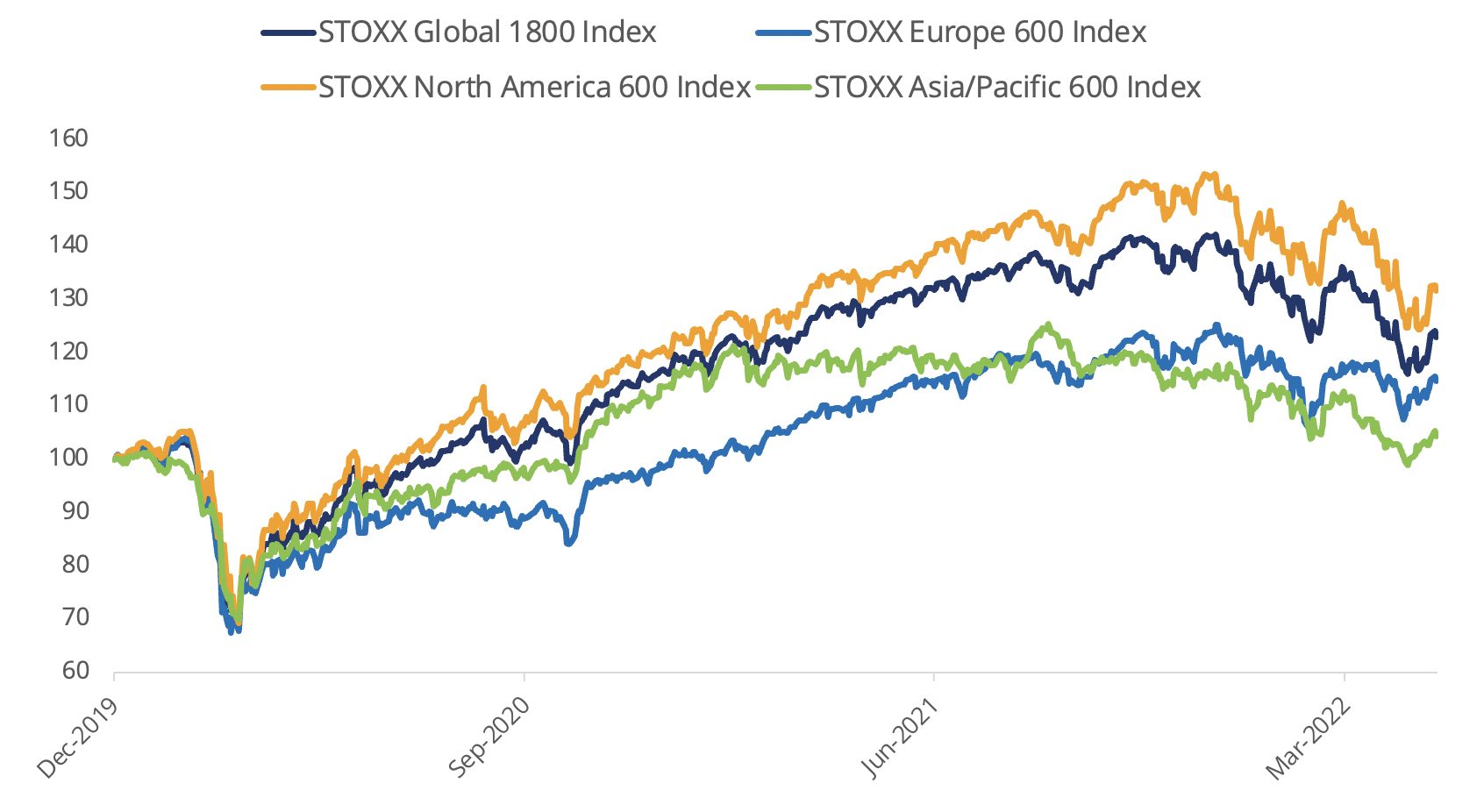

Figure 3: Returns since January 1, 2020

Volatility drops slightly

The EURO STOXX 50® Volatility (VSTOXX®), which tracks EURO STOXX 50 options prices, slipped to 25.2 at the end of last month from 30.8 in April. A higher VSTOXX reading suggests investors are paying up for puts that offer insurance against stock price drops. The VDAX-New®, which tracks volatility in German equities, fell to 23.5 from 29.8 in April.

Developed and emerging markets

Sixteen of 25 developed markets tracked by STOXX rose during May when measured in dollars. The STOXX® Developed Markets 2400 index added 0.1% in dollars and dropped 1.5% in euros.

Eleven of 20 national developing markets advanced in the month on a dollar basis. The STOXX® Emerging Markets 1500 index gained 0.2% in the US currency and lost 1.3% in euros.

Automobiles index leads losses in month

Twelve of 20 Supersectors in the STOXX Global 1800 fell in the month. The STOXX® Global 1800 Automobiles & Parts (-4.9% )3 led losses. At the other end, the STOXX® Global 1800 Energy gained 13.3%, taking its advance in 2022 to 43%.

Factor investing

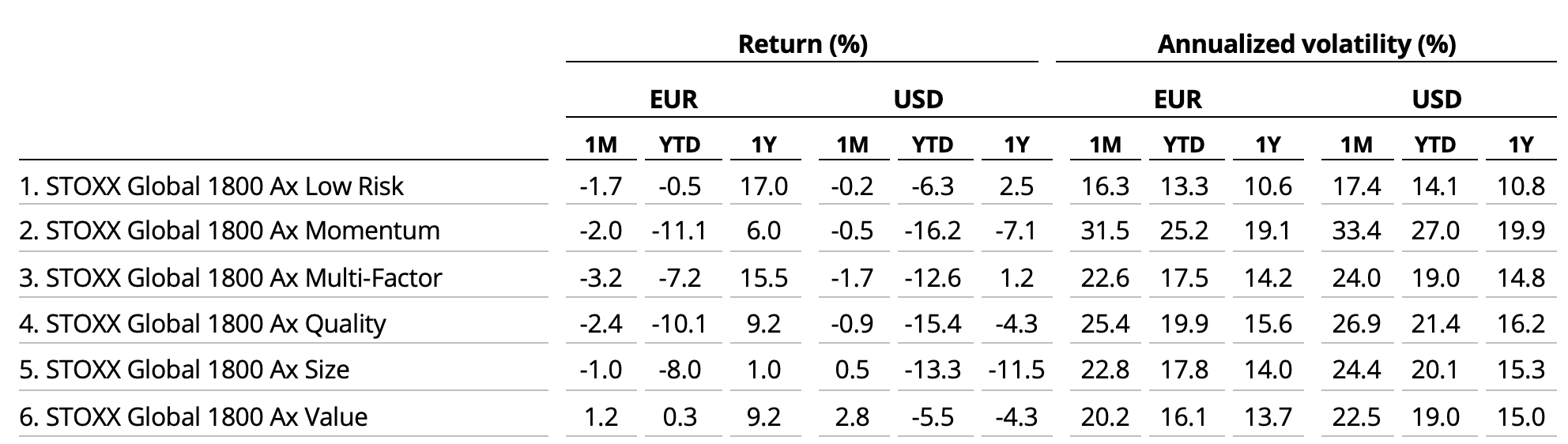

Value stocks jumped during the month, while most other style factors struggled, according to the STOXX Factor indices. The STOXX® Global 1800 Ax Value rose 2.8%.

Figure 4: STOXX Factor (Global) indices’ May risk and return characteristics

Climate benchmarks

Among climate benchmarks, the STOXX® Global 1800 Paris-Aligned Benchmark (PAB) fell 1.2% and the STOXX® Global 1800 Climate Transition Benchmark (CTB) retreated 1.1%. The PAB and CTB indices follow the requirements outlined by the European Commission’s climate benchmarks regulation.

The STOXX® Willis Towers Watson World Climate Transition Index was little changed during the month. The STOXX Willis Towers Watson Climate Transition Indices (CTIs) were introduced in October 2021. They employ a unique Climate Transition Value at Risk (CTVaR) methodology that quantifies the anticipated impact of an economic transition on equity valuations. The CTIs look beyond carbon emissions and make a forward-looking, bottom-up evaluation of asset repricing risks in a decarbonization pathway.

Among the STOXX Low Carbon indices, the EURO STOXX 50® Low Carbon (1.1%) trailed the EURO STOXX 50 by 17 basis points. Elsewhere, the STOXX® Global Climate Change Leaders (-0.1%), which selects corporate leaders that are publicly committed to reducing their carbon footprint, underperformed the STOXX Global 1800 index by 11 basis points last month.

ESG-X and ESG indices

The STOXX® Global 1800 ESG-X index was unchanged in the month. The STOXX® ESG-X indices are versions of traditional, market-capitalization-weighted benchmarks that observe standard responsible exclusions of leading asset owners.

Within indices that combine exclusions and ESG best-in-class integration, the EURO STOXX 50® ESG index (1.6%) beat its benchmark during May. Germany’s DAX® 50 ESG index (2%), which excludes companies involved in controversial activities and integrates ESG scoring into stock selection, slightly underperformed the benchmark DAX® (2.1%).

Sustainability indices

Among other STOXX sustainability families, the STOXX® Global 1800 ESG Broad Market index lost 0.1% in the month. The STOXX ESG Broad Market indices apply a set of compliance, product involvement and ESG performance exclusionary screens on a starting benchmark universe until only the 80% top ESG-rated constituents remain.

The STOXX® Global 1800 ESG Target added 0.2%, the EURO STOXX® ESG Target gained 0.8% and the DAX® ESG Target rose 2.3%. The STOXX and DAX ESG Target indices seek to significantly improve the benchmark portfolio’s ESG profile while mirroring its returns as closely as possible. The indices implement, through a series of constraints, an optimization process to maximize the overall ESG score of the portfolio while constraining the tracking error to the benchmark.

Finally, the STOXX® Global 1800 SRI dropped 0.6%. The STOXX SRI indices apply a rigorous set of carbon emission intensity, compliance and involvement screens, and track the best ESG performers in each industry group within a selection of STOXX benchmarks.

Thematic indices

There were weak performances relative to the benchmark from the STOXX® Thematic indices in the month that ended. The indices seek exposure to the economic upside of disruptive global megatrends and follow two approaches: revenue-based and artificial-intelligence-driven.

Seventeen of the 23 revenue-based thematic indices underperformed the STOXX Global 1800. The STOXX® Global Health & Weight Loss (-5.3%) was the group’s worst performer.

Among the STOXX artificial-intelligence-driven thematic indices, the STOXX® AI Global Artificial Intelligence index (-0.7%) and its ADTV5 version (-0.6%) underperformed the STOXX Global 1800 index during May. On the other hand, the iSTOXX® Yewno Developed Markets Blockchain index gained 0.7%.

Dividend strategies

Dividend strategies showed strong relative performances. The STOXX® Global Maximum Dividend 40 (4.5%) selects only the highest-dividend-yielding stocks. The STOXX® Global Select Dividend 100 (1.9%), meanwhile, tracks companies with sizeable dividends but also applies a quality filter such as a history of stable payments.

Minimum variance

Minimum variance strategies underperformed in May. The STOXX® Global 1800 Minimum Variance fell 1.7% and the STOXX® Global 1800 Minimum Variance Unconstrained rose 0.1%. The STOXX® Europe 600 Minimum Variance index lost 3.5%, while its unconstrained version dropped 2%.

The STOXX Minimum Variance Indices come in two versions. A constrained version has similar exposure to its market-capitalization-weighted benchmark but with lower risk. The unconstrained version, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

1 All results are total returns before taxes unless specified.

2 Throughout the article, all European indices are quoted in euros, while global, North America, US, Japan and Asia/Pacific indices are in dollars.

3 Figures in parentheses show last month’s gross returns.