Stocks fell in February as the military conflict in Ukraine and sanctions imposed on Russia prompted investors to sell shares in all industries except basic-resources and energy companies.

The STOXX® Global 1800 index dropped 2.6% last month when measured in dollars and including dividends.1 The index retreated 2.8% in euros.

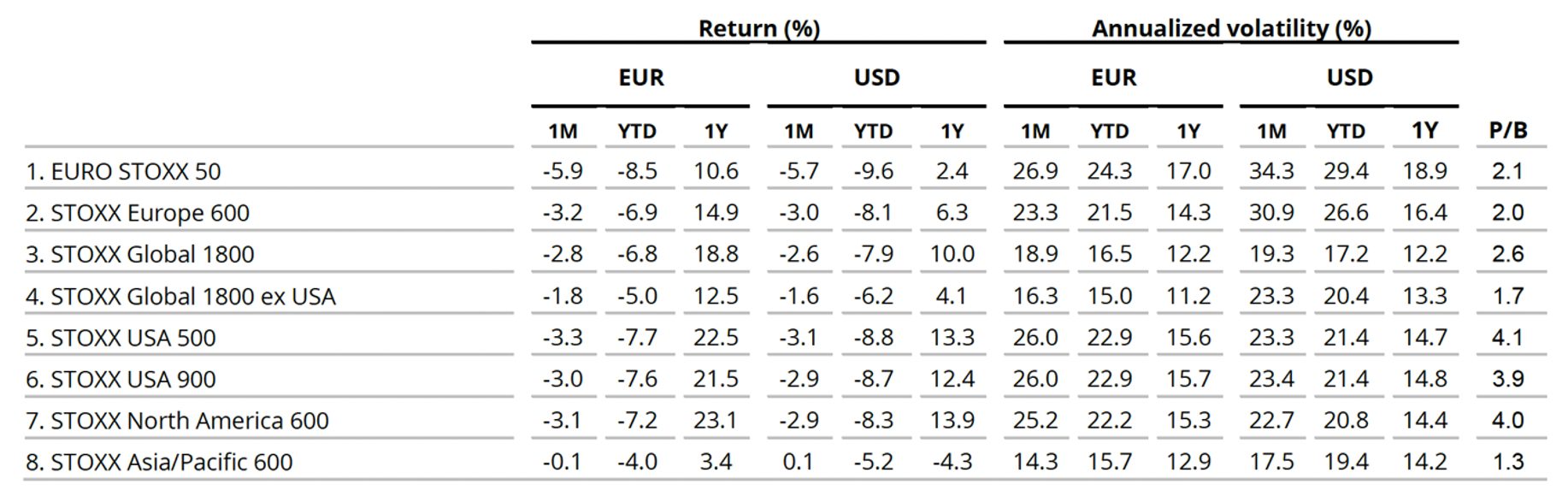

The pan-European STOXX® Europe 600 lost 3.2% in euros, while the Eurozone’s EURO STOXX 50® decreased 5.9%.2 The STOXX® North America 600 slid 2.9% in dollars and the STOXX® USA 500 fell 3.1%. The STOXX® Asia/Pacific 600 added 0.1%.

Figure 1: Benchmark indices’ February risk and return characteristics

The start of a military clash in Ukraine on February 24 sent shockwaves across financial markets at a time when investors are already contending with rampant inflation and the prospect of higher-than-expected interest rate hikes.

| For a complete review of all indices’ performance last month, visit our February index newsletter. |

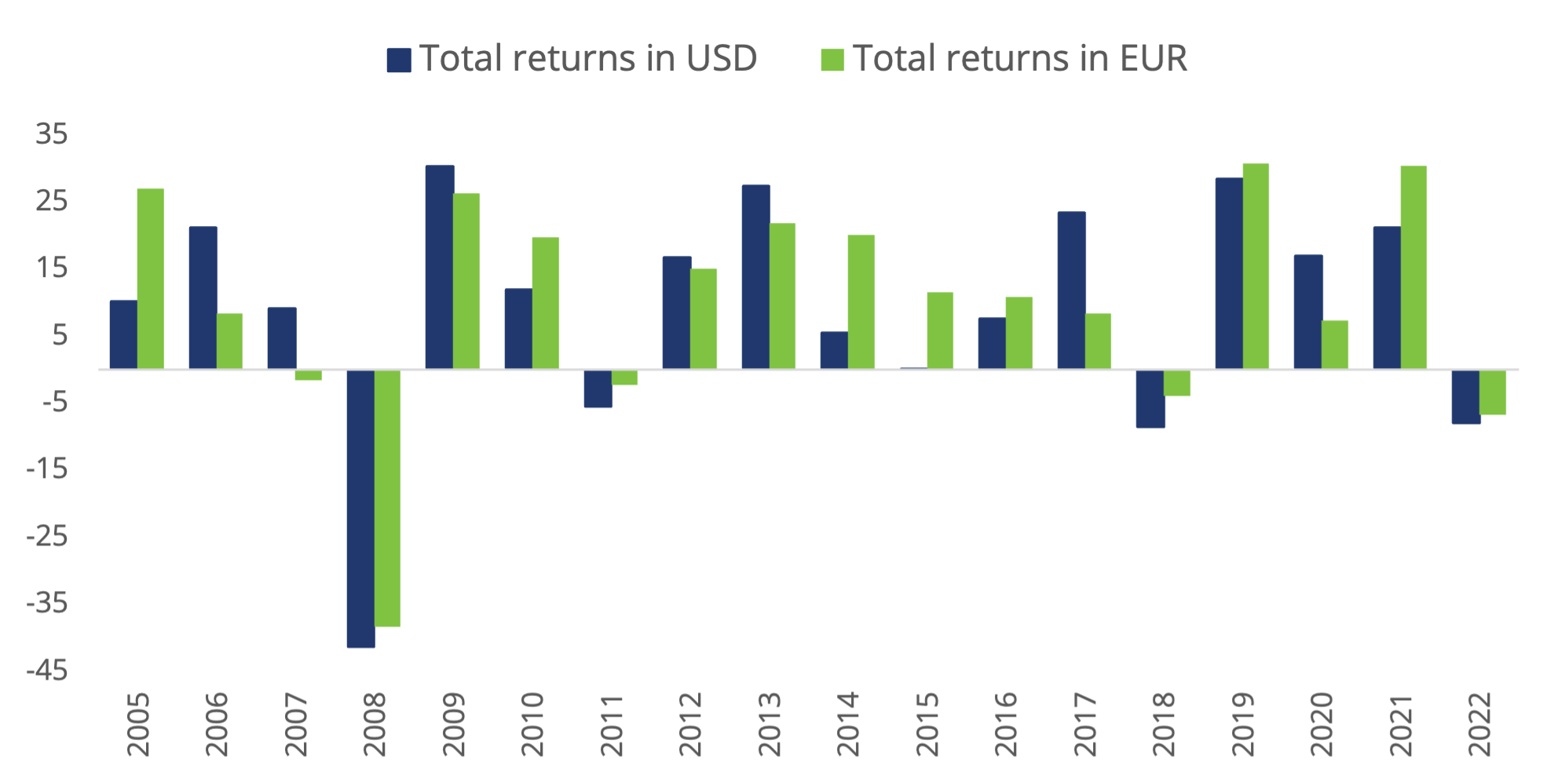

The STOXX Global 1800 posted in 2021 its third consecutive double-digit annual advance and has now gained in nine of the past ten years. Returns have amounted to an average of 13.9% per year over the last decade.

Figure 2: Annual % returns for STOXX Global 1800 index

Figure 3: Returns since January 1, 2020

Volatility jumps

The EURO STOXX 50® Volatility (VSTOXX®), which tracks EURO STOXX 50 options prices, spiked to 35.3 at the end of last month from 27 in January. A higher VSTOXX reading suggests investors are paying up for puts that offer insurance against stock price drops. The index climbed to 86 in March 2020 as governments restricted work and social activities.

The VDAX-New®, which tracks volatility in German equities, rose to 34.2 from 26 in January.

Developed and emerging markets

All but six of 25 developed markets tracked by STOXX fell during February when measured in dollars. The STOXX® Developed Markets 2400 index dropped 2.4% in dollars and 2.6% in euros.

Emerging markets performed better as many are commodities exporters. Ten of 21 national developing markets rose in the month on a dollar basis. The STOXX® Emerging Markets 1500 index still declined 2.5% in the US currency and 2.7% in euros.

Basic-resources, energy shares jump

All but two of 20 Supersectors in the STOXX Global 1800 retreated in the month. The STOXX® Global 1800 Basic Resources was the top performer after gaining 9.7% on expectations of industry supply shortfalls from Russia. The STOXX® Global 1800 Energy came in second with a 5.4% advance, adding to January’s 13.6% jump. At the other end, the STOXX® Global 1800 Automobiles & Parts (-6.3%)3 yielded the worst return.

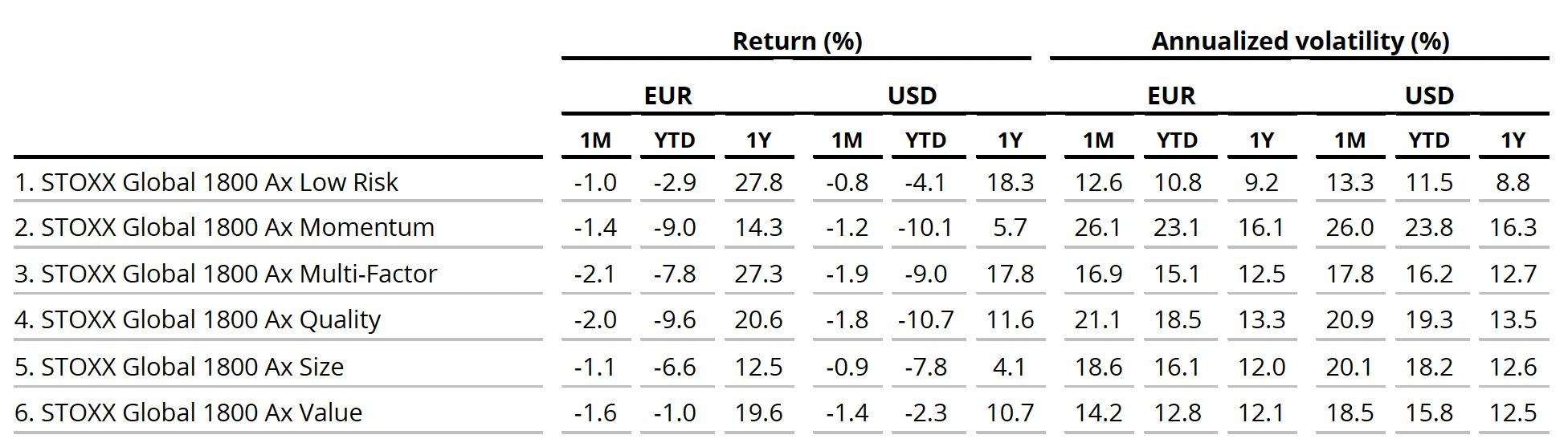

Factor investing outperforms

All factor strategies covering global markets beat the STOXX Global 1800 benchmark last month, according to the STOXX Factor indices. The STOXX® Global 1800 Ax Low Risk showed the best relative performance during the month after losing only 0.8%.

Figure 4: STOXX Factor (Global) indices’ February risk and return characteristics

Climate benchmarks

Many climate indices underperformed following a jump in energy shares during the month. The STOXX Paris-Aligned Benchmark indices (PABs) were among them, with the STOXX® Global 1800 PAB index falling 3.5%. The PAB indices follow the requirements outlined by the European Commission’s climate benchmarks regulation.

The STOXX® Willis Towers Watson World Climate Transition Index declined 3.1% in February. The STOXX Willis Towers Watson Climate Transition Indices (CTIs) were introduced in October 2021. They employ a unique Climate Transition Value at Risk (CTVaR) methodology that quantifies the anticipated impact of an economic transition on equity valuations. The CTIs look beyond carbon emissions and make a forward-looking, bottom-up evaluation of asset repricing risks in a decarbonization pathway.

Among the STOXX Low Carbon indices, the EURO STOXX 50® Low Carbon (-6.3%) trailed the EURO STOXX 50 by 42 basis points in February. Elsewhere, the STOXX® Global Climate Change Leaders (-2.8%), which selects corporate leaders that are publicly committed to reducing their carbon footprint, lost 20 basis points more than the STOXX Global 1800 benchmark last month. The Climate Change Leaders index outperformed by 4.7 percentage points in 2021.

ESG-X and ESG indices

The STOXX® Global 1800 ESG-X index dropped 2.8%. The STOXX® ESG-X indices are versions of traditional, market-capitalization-weighted benchmarks that observe standard responsible exclusions of leading asset owners.

Within indices that combine exclusions and ESG nest-in-class integration, the EURO STOXX 50® ESG index (-6.7%) underperformed its benchmark by 84 basis points during February. Germany’s DAX® 50 ESG index (-7.4%), which excludes companies involved in controversial activities and integrates ESG scoring into stock selection, underperformed the benchmark DAX® (-6.5%).

Sustainability indices

Among other STOXX sustainability families, the STOXX® Global 1800 ESG Broad Market index declined 3% in the month. The STOXX ESG Broad Market indices apply a set of compliance, product involvement and ESG performance exclusionary screens on a starting benchmark universe until only the 80% top ESG-rated constituents remain.

Next, the STOXX® Global 1800 ESG Target lost 3.5%, the EURO STOXX® ESG Target fell 6.1% and the DAX® ESG Target dropped 7.4%. The STOXX and DAX ESG Target indices seek to significantly improve the benchmark portfolio’s ESG profile while mirroring its returns as closely as possible. The indices implement, through a series of constraints, an optimization process to maximize the overall ESG score of the portfolio while constraining the tracking error to the benchmark.

Finally, the STOXX® Global 1800 SRI slipped 3.9%. The STOXX SRI indices apply a rigorous set of carbon emission intensity, compliance and involvement screens, and track the best ESG performers in each industry group within a selection of STOXX benchmarks.

Thematic indices

There were mixed performances relative to the benchmark from the STOXX® Thematic indices in the month that ended. The STOXX® Global Sharing Economy led losses with a 9.3% retreat, while the STOXX® Global Smart Cities (1.7%) was one of only two to post a positive return.

The STOXX Thematic indices seek exposure to the economic upside of disruptive global megatrends and follow two approaches: revenue-based (22 indices) and artificial-intelligence-driven (three indices).

Among the STOXX artificial-intelligence-driven thematic indices, the STOXX® AI Global Artificial Intelligence index (-1.6%) and its ADTV5 version (-1.7%) outperformed the STOXX Global 1800 index during February, but the iSTOXX® Yewno Developed Markets Blockchain index (-4.7%) posted a wider loss than the benchmark’s.

Dividend strategies

Dividend strategies beat benchmarks last month. The STOXX® Global Maximum Dividend 40 (1.7%) selects only the highest-dividend-yielding stocks. The STOXX® Global Select Dividend 100 (-1%), meanwhile, tracks companies with sizeable dividends but also applies a quality filter such as a history of stable payments.

Minimum variance

Minimum variance strategies also outperformed last month. The STOXX® Global 1800 Minimum Variance fell 1.4% and the STOXX® Global 1800 Minimum Variance Unconstrained declined 1.1%. The STOXX®Europe 600 Minimum Variance index lost 1.9%, as did its unconstrained version.

The STOXX Minimum Variance Indices come in two versions. A constrained version has similar exposure to its market-capitalization-weighted benchmark but with lower risk. The unconstrained version, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

1 All results are total returns before taxes unless specified.

2 Throughout the article, all European indices are quoted in euros, while global, North America, US, Japan and Asia/Pacific indices are in dollars.

3 Figures in parentheses show last month’s gross returns.