Stocks extended a recovery to a second month in May as investors welcomed the resumption of some economic activities in the wake of the novel coronavirus pandemic.

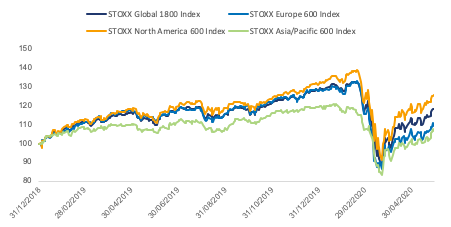

The STOXX® Global 1800 Index rose 5% in dollar terms1 in the month after surging 10.8% in April. The index is still 7.7% down for the year and 10.7% below a Feb. 12 high, as the world’s economy may be set for its widest annual contraction since the 1930s.

The STOXX® North America 600 Index climbed 5.2%. The pan-European STOXX® Europe 600 Index rose 3.5% when measured in euros, while the Eurozone’s EURO STOXX 50® Index added 4.9%. The STOXX® Asia/Pacific 600 Index increased 4.4% in dollars.

In May, European countries and the US started easing some of the restrictions in place since March and aimed at limiting social contact and slowing the spread of COVID-19. The lockdowns have already inflicted a historical blow to the global economy. International Monetary Fund Director Kristalina Georgieva said last month that the economic contraction this year may be worse than initially foreseen. The IMF forecast in April that developed economies may shrink 6.1% in 2020.

Chart 1 – Returns since start of 2019

Central banks and governments around the world have channeled an unprecedented level of stimulus to support the global economy amid the slump. On May 27, the European Commission unveiled a proposal to offer a mix of grants and loans worth 750 billion euros.2

Developed markets top emerging nations

All but four of 25 developed markets tracked by STOXX climbed during May when measured in dollars.3 The STOXX® Developed Markets 2400 Index rose 5.1% in dollars and 3.5% in euro terms.

The STOXX® Hong Kong Total Market Index was the worst performer among the 25 developed markets, shedding 6.2% during the month, after China drafted a new national security law for Hong Kong, which critics say will abolish the autonomy of the island.

Developing nations didn’t fare as well, with the STOXX® Emerging Markets 1500 Index advancing only 0.7% in dollars. All but six of 21 national markets tracked by STOXX advanced during the month.

All 19 supersectors in the STOXX Global 1800 Index rose in May, led by the STOXX® Global 1800 Construction & Materials Index’s 9.1% advance.4 The STOXX® Global 1800 Insurance Index came out last, rising 0.9%.

Minimum variance lags behind

The strong rebound in risk appetite has continued to weigh on minimum variance strategies, which overweight stocks with the lowest historical volatility.

The STOXX® Global 1800 Minimum Variance Index returned 1.5 percentage points less than the benchmark STOXX Global 1800 Index, after underperforming by 3.1 points in April. The STOXX® Global 1800 Minimum Variance Unconstrained Index lagged by 3 percentage points in May. The STOXX® Europe 600 Minimum Variance Index underperformed its index by 3.2 percentage points, while the unconstrained version did so by 1 point.

The STOXX® Minimum Variance Indices come in two versions. A constrained version has a similar exposure to its market-capitalization-weighted benchmark but with lower risk. The unconstrained version, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

Dividend strategies out of favor

Dividend strategies underperformed for a fifth consecutive month.

The STOXX® Global Maximum Dividend 40 Index, which selects the highest-dividend-yielding stocks, rose 3.6% in dollars on a net-return basis. The STOXX® Global Select Dividend 100 Index, which tracks companies with sizeable dividends but also applies a quality filter such as a history of stable payments, gained 0.8% on a gross-return basis. The STOXX® Global Select 100 EUR Index, which is measured in euros, fell 0.2%. The index blends increasing dividend yields with low volatility.

Quality, momentum rule

The STOXX® Factor Indices, which seek to capture proven sources of equity risk and return, show investors favored quality and momentum stocks on a global basis during May.

The STOXX® Global 1800 Ax Quality Index, which selects stocks with the highest profitability ratios, added 8.4%. The STOXX® Global 1800 Ax Momentum Index, which tracks shares with the highest cumulative return over the last year excluding the most recent month, gained 8.2%.

On a regional basis, momentum and quality also paced gains in Asia, the US and Europe during May. As was the case with the global portfolio, low risk was among the worst-performing factors at a regional level.

Market-neutral

Four of seven iSTOXX® Europe Factor Market Neutral Indices, which hold a short position in futures on the STOXX Europe 600 to help investors neutralize systematic risk, posted a positive return during May.

The iSTOXX® Europe Carry Factor Market Neutral Index was the best performer after adding 1.2% on a net-return basis during the month. The iSTOXX® Europe Value Factor Market Neutral Index came out last.

All EURO STOXX® Multi Premia® and Single Premium Indices, which are exposed to the market’s systematic risk, recorded gains in the month that ended, with mixed performances relative to the EURO STOXX® benchmark. Momentum and size were May’s leading factors in the Eurozone, according to this index family.

Sustainability strategies

The STOXX® ESG-X Indices came slightly ahead of their benchmarks during May, allowing investors to generate above-market returns while complying with sustainable policies.

Among STOXX’s ESG and Sustainability indices, the STOXX® Global ESG Impact Index and STOXX® USA ESG Impact Index lagged their respective benchmarks by more than 80 basis points during the month.

The EURO STOXX 50® ESG Index, on the other hand, came ahead of its benchmark by 24 basis points. The ESG index, which is derived from the EURO STOXX 50 Index and incorporates negative exclusions and ESG scoring into stock selection, has outperformed its benchmark by more than 3 percentage points in 2020.

The DAX® 50 ESG Index, which excludes companies involved in controversial activities and integrates environmental, social and governance (ESG) scoring into stock selection, rose 7.1%, beating the 6.7% advance in the flagship DAX®.

Combining ESG and factors

The STOXX® ESG-X Factor Indices were introduced in May. They implement the same factor-based methodology of the STOXX Factor Indices, seeking exposure to five style signals, but do so on slightly smaller universes that exclude stocks based on the responsible polices of leading asset owners. Tracking the performance of their standard factor counterparts, the STOXX® Global 1800 ESG-X Ax Momentum Index and STOXX® Global 1800 ESG-X Ax Quality Index led gains among the global ESG-X Factor indices.

The STOXX ESG-X Factor family includes 30 indices covering major regions and countries. On a dollar basis, the STOXX® USA 900 Ax Quality Index was the group’s best performer during May.

1 All results are total returns before taxes unless specified.

2 BBC, “Coronavirus: Von der Leyen calls €750bn recovery fund ‘Europe’s moment’,” May 27, 2020.

3,4 Returns net of taxes.