Where do risk and sector performance stand in China and global Developed Markets YTD?

Key takeaways:

- YTD market returns are positive for global Developed Markets and only slightly negative for China

- Volatility has risen worldwide but current levels remain below historical medians

- Info Tech’s return in China is double that of global Developed Markets

- Chinese Communication Services and Health Care posted strong positive returns YTD

- Utilities have thrived in global Developed Markets but took one of the worst hits in China

- Energy has been the worst performer in both geographies

China vs. Global Developed World

Stocks around the globe have been rising and falling on news of the containment or spread of the coronavirus. After markets tanked in mid-January, when the virus crossed China’s borders, equities have been on an upward trend in February. In the US—which constitutes a large proportion of the global developed markets—investors appeared to shift their focus from virus fears and more toward earnings and economic reports, which recently lifted US indices to fresh records.

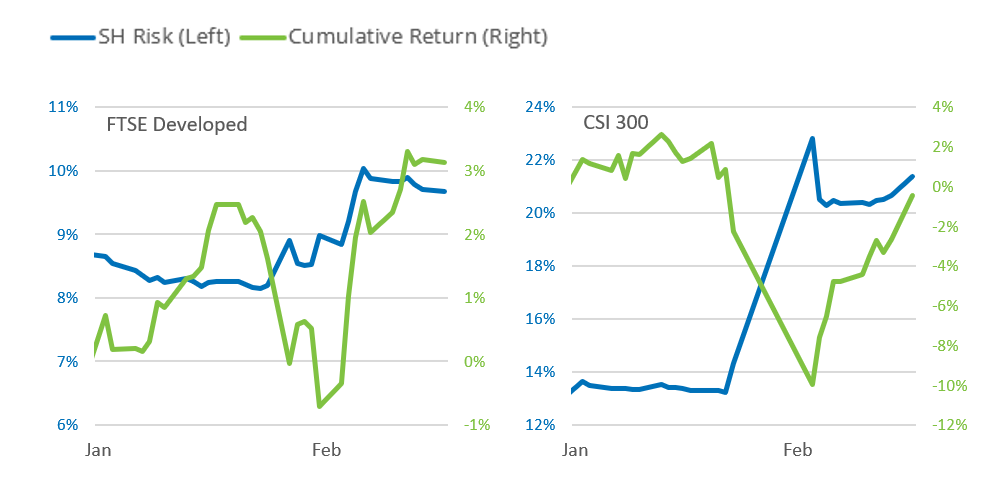

In aggregate, FTSE Developed Markets recorded a 3% cumulative year-to-date (YTD) return as of Monday. Though down slightly year to date, the Chinese market saw a rebound this month. As represented by the CSI 300 index, the Chinese market suffered an expected but abrupt fall of about 8% after its exchanges reopened following the extended New Lunar Year holiday. Since then Chinese stocks have been lifted by both the Chinese government’s efforts to limit economic fallout from the outbreak, and the China tariff relief on US imports.

The abrupt drop meant that volatility in China shot from 14% to 23% after domestic markets reopened on February 3, and has since stabilized near 20%, after subsiding somewhat following the initial jump. But news of a surge in coronavirus cases last week pushed China’s risk up over the past five days, reaching 21% on Monday. Still, China’s current level of risk remains below the near-term peaks seen in June of last year, when the US-China trade spat was at its height, and below the 15-year risk-forecast median, as measured by Axioma’s short-horizon China fundamental model.

Global developed markets also saw risk climb for most of 2020, though it started to subside after reaching a year-to-date high of 10% at the end of the first week in February. The current level of short-horizon risk for FTSE Developed Markets stands at 9.7%, well below the 15-year median of 13%, as measured by Axioma’s short-horizon Worldwide fundamental model.

Sector Returns

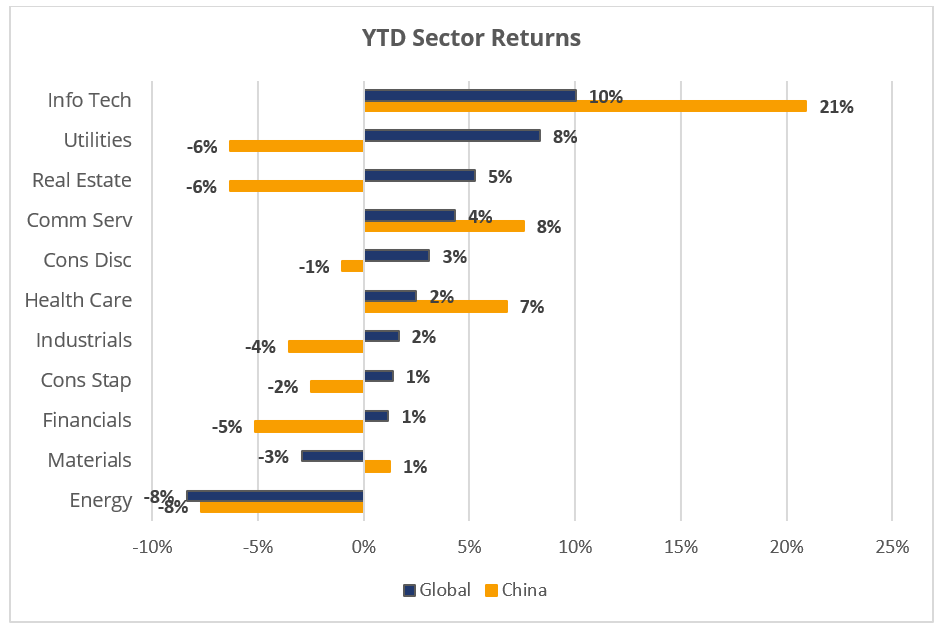

All sectors in the FTSE Developed, except Materials and Energy, have seen positive YTD returns. Technology stocks continued to drive the increase in the global developed market into 2020, reporting a YTD return of 10% last Monday, the highest among the 11 sectors in the global index. Interestingly, Utilities have posted the second-best YTD return (of 8%) as investors seem to be attracted by the defensive nature of the sector, in contrast to the aggressive character of technology. Utilities have followed an upward trend so far in 2020, even when all other sectors dipped in the second half of January on virus fears. (See more details on the US Utilities sector in the blog post Investors Turn to Utilities to Immunize Portfolios Against Coronavirus Volatility.) Materials and Energy, two sectors highly sensitive to China’s economic demand, fell 3% and 8% year to date, respectively.

Technology stocks have had a fantastic run in 2020, even in virus-stricken China. Info Tech bounced back strongly in February, after the sector plunged along with all other sectors in the CSI 300 immediately after Chinese markets reopened. Info Tech is now reporting a YTD gain of 21% (more than double that of the global Info Tech sector). Communication Services, Health Care, and Materials were the only other Chinese sectors to record positive YTD returns. Communication Services was lifted by a handful of Media and Entertainment companies. Given the health crisis, it is not surprising that the Health Care sector saw a considerable gain YTD. Energy, Utilities, Real Estate, and Financials were the hardest hit Chinese sectors.

The chart below shows YTD returns, denominated in USD and CNY, for sectors in the FTSE Developed and CSI 300 indices, respectively, as of February 17, 2020.

Sector Risk

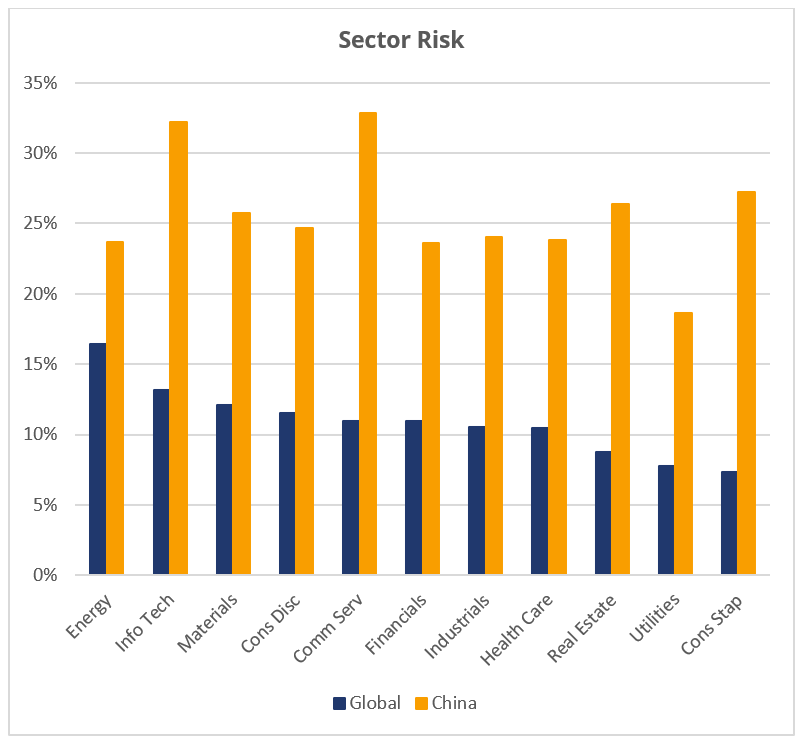

The risk[1] of Chinese sectors is more than double and, in some cases, more than triple that of global developed sectors, except for Energy—which is still about 50% riskier in China. The risk of Real Estate, Utilities, and Consumer Staples in China was more than triple that of their counterparts at the global level.

This relative riskiness of the Chinese sectors mirrors the top line risk. China’s risk of 21% is more than double that of the FTSE Developed (9.7%).

Communication Services and Info Tech are the riskiest sectors in China, with risk forecasts topping 30%. Utilities is the only Chinese sector with risk below 20%.

At the global level, Info Tech was also the second-riskiest sector, but here it followed Energy. Utilities and Consumer Staples were the least risky sectors in the FTSE Developed.

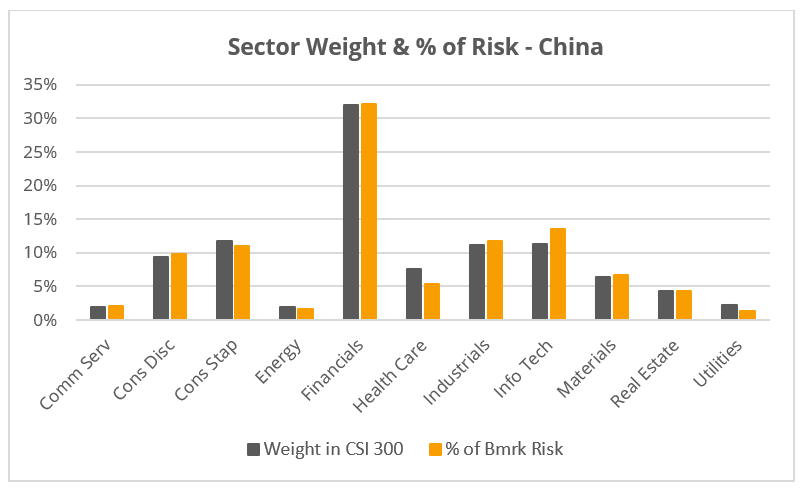

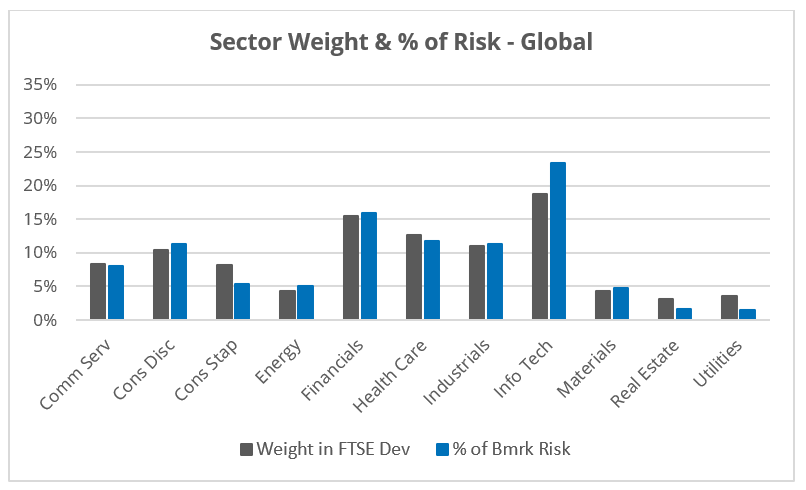

The following two charts show the weights of each sector and their contributions to benchmark risk in CSI 300 and FTSE Developed. The Financial sector in China dominates the benchmark, with its weight surpassing 30%. Financials’ contribution to CSI 300 risk is only slightly higher than the sector’s weight. For all sectors, except Consumer Staples, Energy, Health Care, and Utilities, their contributions to benchmark risk were higher than their weights in the Chinese index. Technology contributes more to risk than to weight, although the difference is relatively small.

Sector weights are more evenly distributed in the FTSE Developed. Info Tech has the largest weight in the global developed index (close to 19%) and, in contrast to China, its contribution to benchmark risk greatly surpassed its weight. Most other sectors in the FTSE Developed saw little difference in their weights and contributions to risk.

In summary, equity markets have bounced up and down on vacillating coronavirus worries, resulting in heightened market volatility. Global developed markets still see positive year-to-date returns. China, however, was unable to rise above the red line, despite the recent government interventions, as the coronavirus strongly impacted the Chinese economy through closed factories, disrupted supply chains, and reduced spending (to name a few of the issues China is facing). Still, the risk of both China and aggregate developed markets remained below the long-term median.

What China and the developed world have in common is that technology stocks seem to have been immune to the economic impact of the virus outbreak, at least so far [2]. In fact, Info Tech’s YTD return in China was twice that of tech stocks in the global developed market. Health Care and Communication Services were among the only other sectors to still see strong returns YTD in China. In contrast, all but Materials and Utilities saw positive YTD returns in FTSE Developed.

Info Tech was the second-riskiest sector in both geographies, while Communication Services took first place in China and Energy was the riskiest sector in Developed Markets. However, the largest contributors to benchmark risk were Financials in China and Info Tech in Developed Markets.

We expect the Chinese market to take a severe hit in the first quarter, which would have ramifications at the global level. But once the outbreak is contained, we expect markets to recover in the following quarter. For more details on how to prepare for the impact of the outbreak, see blogpost What does it take to recover from the coronavirus? Mostly time and liquidity.

Footnotes:

[1] Sector risk is calculated by creating a portfolio of all stocks in a particular sector in the CSI 300 and FTSE Developed. The weights of Chinese sectors are based on CSI 300 weights, which are then rescaled to add to 100%. The risk of each Chinese sector portfolio is then calculated using Axioma’s China short-horizon fundamental model. Similarly, the weights of global sectors are based on FTSE Developed weights, which are then rescaled to add to 100%. The risk of each global sector portfolio is then calculated using Axioma’s Worldwide short-horizon fundamental model.

[2] Apple’s announcement on Tuesday suggests the impact of the outbreak is starting to be seen in technology stocks.