In our recent whitepaper, The Correlation See-Saw, we examined the dramatic shifts in multi-asset class relationships that characterized the first five months of 2018. As markets alternated between concerns about inflation and central bank policy on the one hand, and political risk and safe-haven buying on the other, we analyzed the impact on the risk of Axioma’s global multi-asset class model portfolio. While cross-asset class correlations had been relatively stable during the so-called “Trump rally” of 2017—providing a lot of diversification opportunities for US-based, balanced investors—swings have become more frequent and severe since the beginning of the new year. It is therefore more important than ever for investment managers to constantly monitor their portfolio risk, with a particular focus on changes in risk factor interactions.

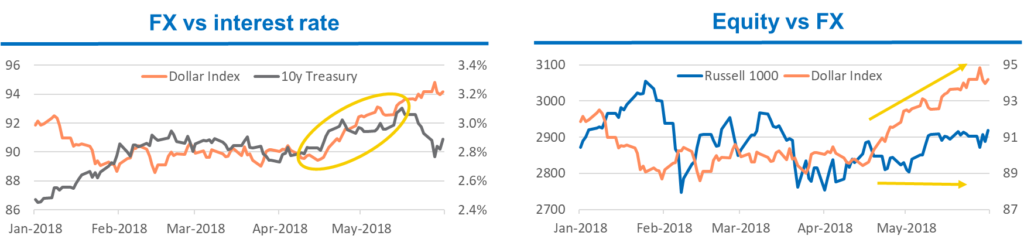

In recent weeks, we noted a strong, positive relationship between interest rates and the value of the US dollar against its major trading partners. When market players turned their attention toward increasing inflationary pressures and the respective countermeasures from the Federal Reserve Bank in the second half of April, long Treasury yields started to rise. This was both a reaction to higher inflation expectations and in anticipation of higher short-term rates. The latter were considered good news for the USD, which profited from a widening interest rate differential, particularly in relation to its European rivals. At the same time, the stock market moved mostly sideways.

Figure 1. Major asset class movements

The near-zero correlation of share prices with both fixed income and foreign currency returns provided a certain degree of diversification in Axioma’s USD-denominated model portfolio, although much of it was outweighed by the positive relationship between interest rate and FX returns. The latter meant that bond returns not only appeared to be more strongly correlated across regions, but also moved more in line with non-US assets in general. This resulted in higher risk contributions in all of these categories.

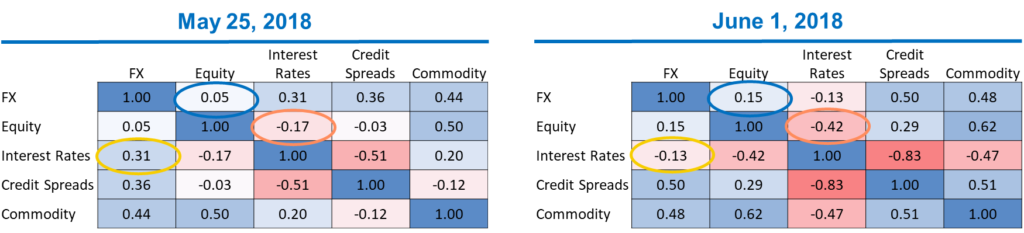

Figure 2. Multi-asset class risk type return correlations

The recent shift of market focus toward political risk—namely the seeming inability of Italy’s leading political parties to form a stable government and the saber-rattling from the White House on steel and aluminum tariffs—once again jumbled major asset class relationships. When the Italian president vetoed the first cabinet proposal, European investors forsook the equity market for the safety of German government issues, only to reverse the move when an agreement was reached in the following days. The resulting strong negative interaction of stock and bond returns provided a large increase in portfolio diversification, substantially reducing the risk contributions from both asset classes.

Currency performance, on the other hand, was more mixed. While the JPY/USD exchange rate was largely determined by safe-haven flows, the euro reacted primarily to events in Italy. This led to a significant decrease in the so far positive interaction of interest rate and FX factor returns, which further enhanced the risk-reducing capabilities of the fixed income assets, as bond and currency returns decoupled.

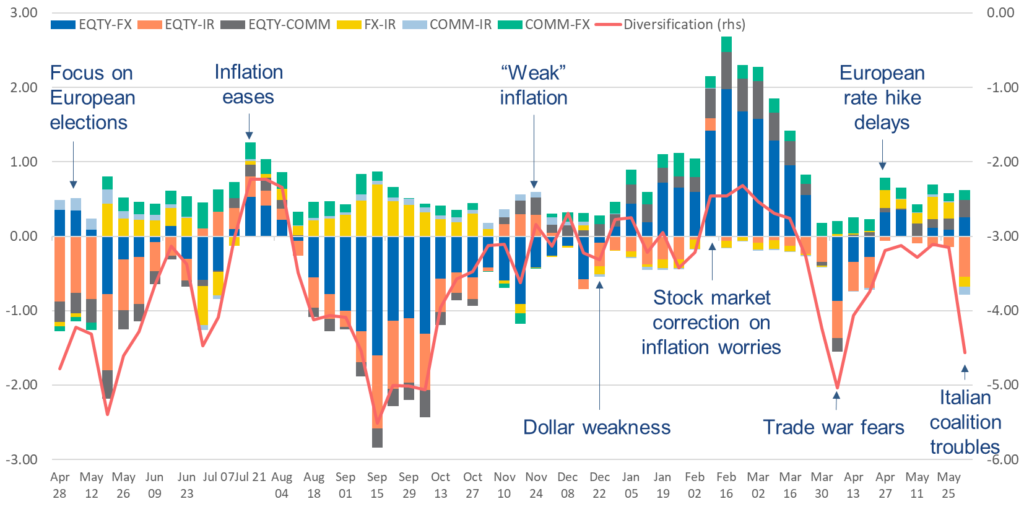

Figure 3. Portfolio risk contributions from pairwise factor covariances

Figure 3 shows the contributions to portfolio risk from the most significant pairwise relationships among the factor groups over the past year. For example, the orange bars represent the interplay of stock and bond prices. We see that it was close to zero in the second half of April and most of May, but turned more negative as political risk increased in Europe. The same was observed at the end of March, when the market focus shifted from inflation worries to trade war fears.

It is also interesting to note the interaction between FX and interest rate returns, which is represented by the yellow bars in figure 3. This relationship had been consistently positive throughout April and May, but flipped signs as bond and foreign-currency returns started to diverge. Combined with the offsetting price movements of equity and fixed income instruments, this significantly improved the diversification effect denoted by the negative red line on the right-hand scale.

The recent sudden change in asset class relationships highlights how quickly they can tip, emphasizing yet again the importance of closely monitoring portfolio risk and its underlying drivers. If you want to be kept up-to-date on current trends in multi-asset class risk, we invite you to subscribe to our weekly Risk Monitor highlights emails here. Or if you would like to learn more about our Axioma Risk™ multi-asset class risk analysis platform, feel free to contact us at sales@axioma.com.