By Thomas Pfiffner and Adrien-Paul Lambillon, Finreon1

When it comes to evaluating the success of equity portfolios or constructing a traditional passive investment strategy, the go-to instrument has usually been the market capitalization-weighted index. The idea behind it is simple: stocks’ allocation reflects their size and position in the real economy, creating an objective and neutral representation of the market.

These indices epitomize the notion of a passive strategy and capture what many see as a ’static’ approach: a simple ‘buy and hold’ strategy that mimics what the broad market does. This portfolio has no apparent active risk decisions and is somewhat neutral to specific market developments and performance persistence. But this classic passive allocation, however, is actually far from static.

Why? Over the last 30 years, financial market research has identified various sources of returns, so-called factors. It has been shown that a large part of the performance generated by a portfolio can be explained through the exposure to these factors. A vast body of scientific papers concludes that these risk premia can generate long-term excess returns to the market.

For example, Nobel laureate Eugene Fama showed that small (size factor) and undervalued stocks (value factor) systematically beat the market. Since then, other such sources of returns have been discovered, including the momentum factor (stocks with above-average returns in the recent past). This blog reviewed the most-widely tracked factors in a previous post.

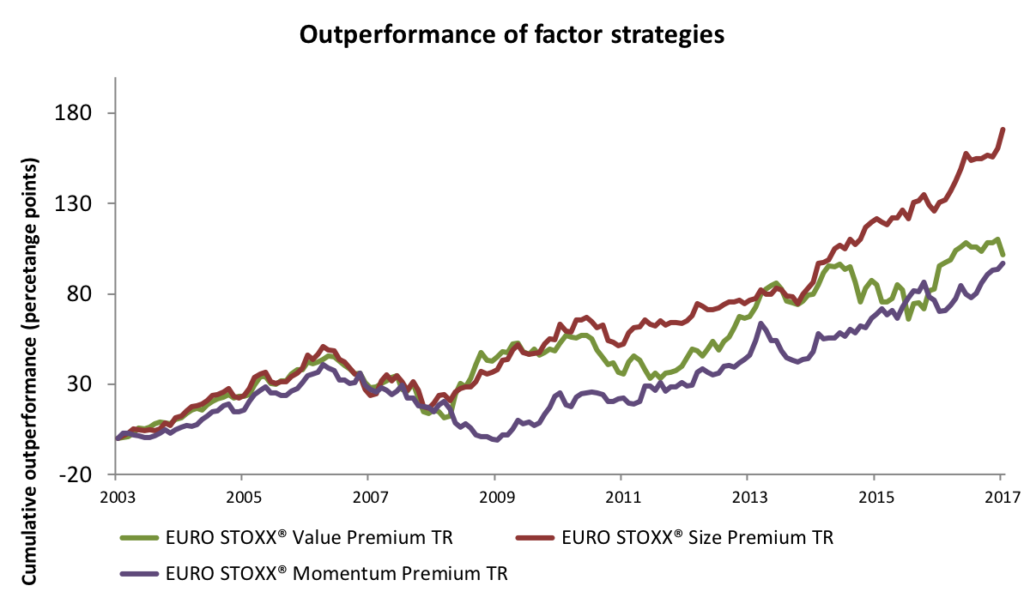

Figure 1 shows the performance of three of these factors, as represented by the EURO STOXX® Single Premium Indices, relative to the total return of the EURO STOXX® Index. The EURO STOXX Single Premium and Multi Premia® Indices aim to capture seven proven risk premia: value, size, momentum, residual momentum, reversal, low risk, and quality.

Figure 1

The problem with the market portfolio is that, as its composition changes, it dynamically increases or decreases its exposure to these and other sources of returns over time. This alters its properties and potential returns on a random basis. Depending on the market phase, value, size or momentum, for example, can prevail. Market cap-weighted strategies therefore unconsciously and unsystematically invest in a fraction of the available drivers of stock returns and thus randomly build up exposures to the various factor premia.

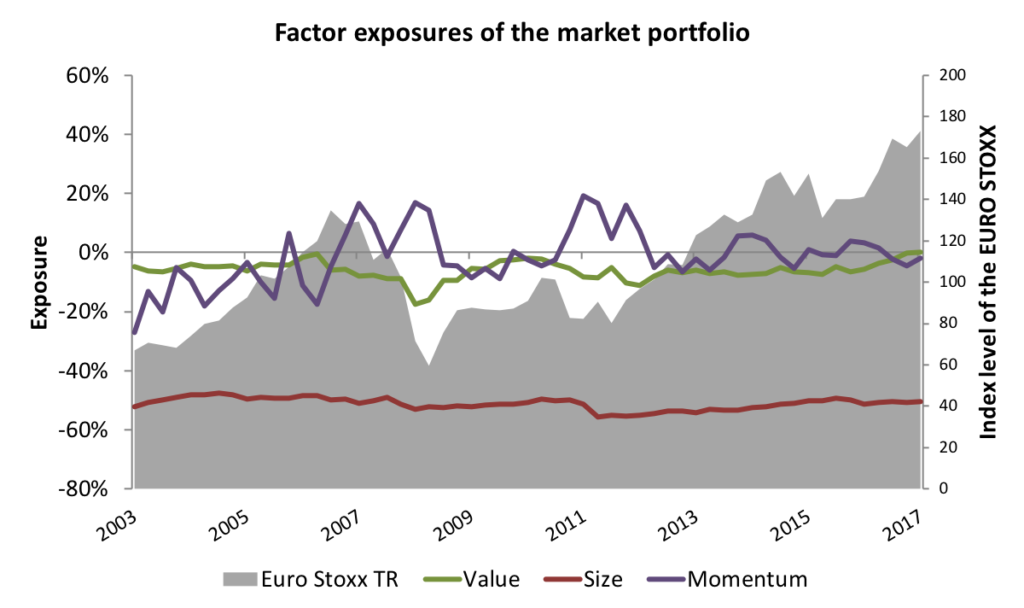

Figure 2 shows the EURO STOXX’s performance and its changing exposure to three factors. The zero line denotes where a factor exposure of the index is neutral. For example, the market cap-weighted EURO STOXX has a chronical underexposure to size as it assigns a larger representation to the biggest stocks.

Figure 2

Not only do these fluctuations undermine the transparency of a passive strategy, they also pose a risk. This risk is especially pronounced during periods of bubble formation. For instance, during the dotcom bubble (1995-2000), the market portfolio increased its momentum exposure over time as the cycle’s winning stocks kept on outperforming, gaining in weight. This happened at the expense of size- and value-exposed shares. At the peak of the bubble, the market portfolio consisted to a large extent of risky (high beta) momentum stocks, while small and undervalued stocks had lost significantly in weight. The burst of the bubble thus hurt momentum stocks especially, while value and size stocks performed significantly better on the whole, helping to protect a portfolio from major losses.

Due to these relationships, the passive market portfolio may be hit particularly hard, especially in overstretched markets. Direct, diversified investment in the various sources of returns, on the other hand, enables a gentler ride through such turbulences, thereby increasing the long-term return potential while reducing risk.

As mentioned earlier, a big disadvantage of market cap-weighted investments is their systematic negative exposure to remunerated sources of return, which has a lasting negative impact on long-term performance. For example, Figure 2 shows the average negative exposure to size and value in the EURO STOXX Index. This phenomenon is of structural nature since, by definition, market cap-weighted indices overweight large firms due to the coupling of price and weight. The valuation of such companies may thus differ from their fundamental value. Market-capitalized portfolios therefore have a ‘growth’ bias and overweight overvalued stocks.

For this reason, investors may wish to systematically manage factor exposures within their portfolios in order to ensure a constant positive allocation to the various factors and so be able to optimally exploit their premia in the long term. A direct, diversified investment in the various sources of return enables an efficient portfolio based on targeted management of the exposures.

As academia and empirical evidence have shown, factor returns in excess of the market and idiosyncratic risk play a key role in driving a portfolio’s performance. Most passive investors leave their exposure to these sources of returns uncontrolled and dependent on the fluctuating and random composition of a market cap-weighted index. Through targeted investments to exploit factor premia systematically this situation can be mitigated.

1Finreon, a spin-off from the University of St. Gallen in Switzerland, provides asset-management solutions based on the latest financial research