The Metaverse is expected to grow into a trillion-dollar investment opportunity within the present decade. Yet, its emerging nature also means that many of the technologies associated with it are still in relatively early stages of their development cycle, with only limited attributable revenues. .

Christoph Schon

As Senior Principal for Applied Research, Christoph generates insights into market trends with a particular focus on multi-asset class analysis and thematic investing.

Investors who want to benefit from its huge potential will therefore have to find alternative, forward-looking ways of identifying the leading innovators in the space. As such, patents can be a reliable leading indicator for innovation activities.

In a new whitepaper1, we explore the rationale and methodology behind the recently launched STOXX® Global Metaverse Index (the ‘STOXX Global Metaverse’). For the construction of the index, Qontigo has partnered with EconSight, a specialist patent analytics provider with a sophisticated classification system, to identify companies with an advantage in cutting-edge technologies.

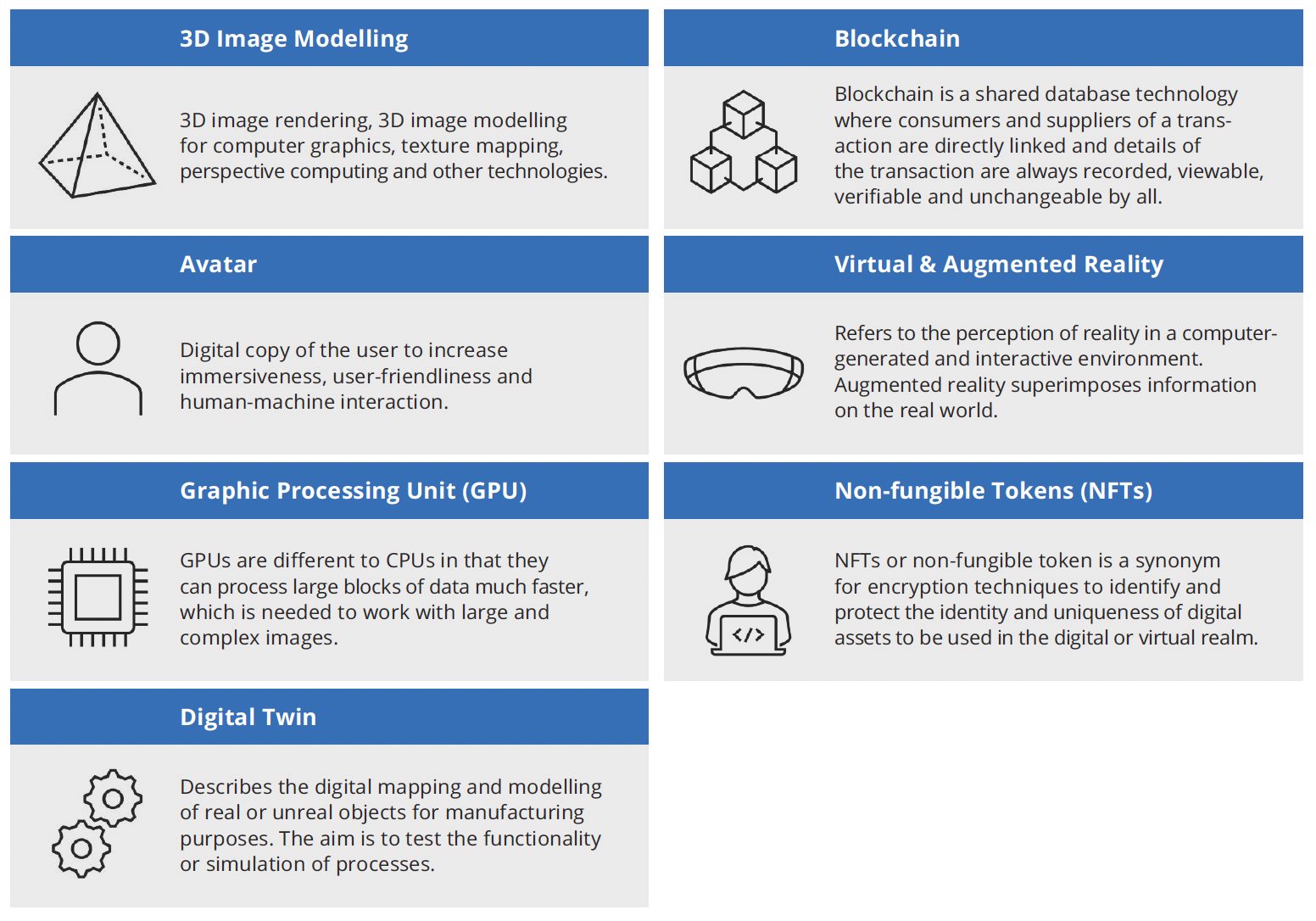

The EconSight taxonomy maps tens of thousands of often very technical and specific patent classes to around 400 understandable and applicable technologies. Out of those, Qontigo and EconSight have identified the seven technologies shown in Figure 1 as essential for the functioning and adoption of the Metaverse.

Figure 1 – Metaverse technologies and definitions

The companies to be included in the STOXX Global Metaverse are chosen from the STOXX® Global Total Market (‘STOXX Global TMI’) universe. After initial liquidity, market-capitalization and ESG filters are applied, stocks are selected on two criteria:

- The number of high-quality patents (HQPs) in the relevant technologies.

- The company’s patent specialization.

This dual selection process ensures a good balance of established players and emerging innovators.

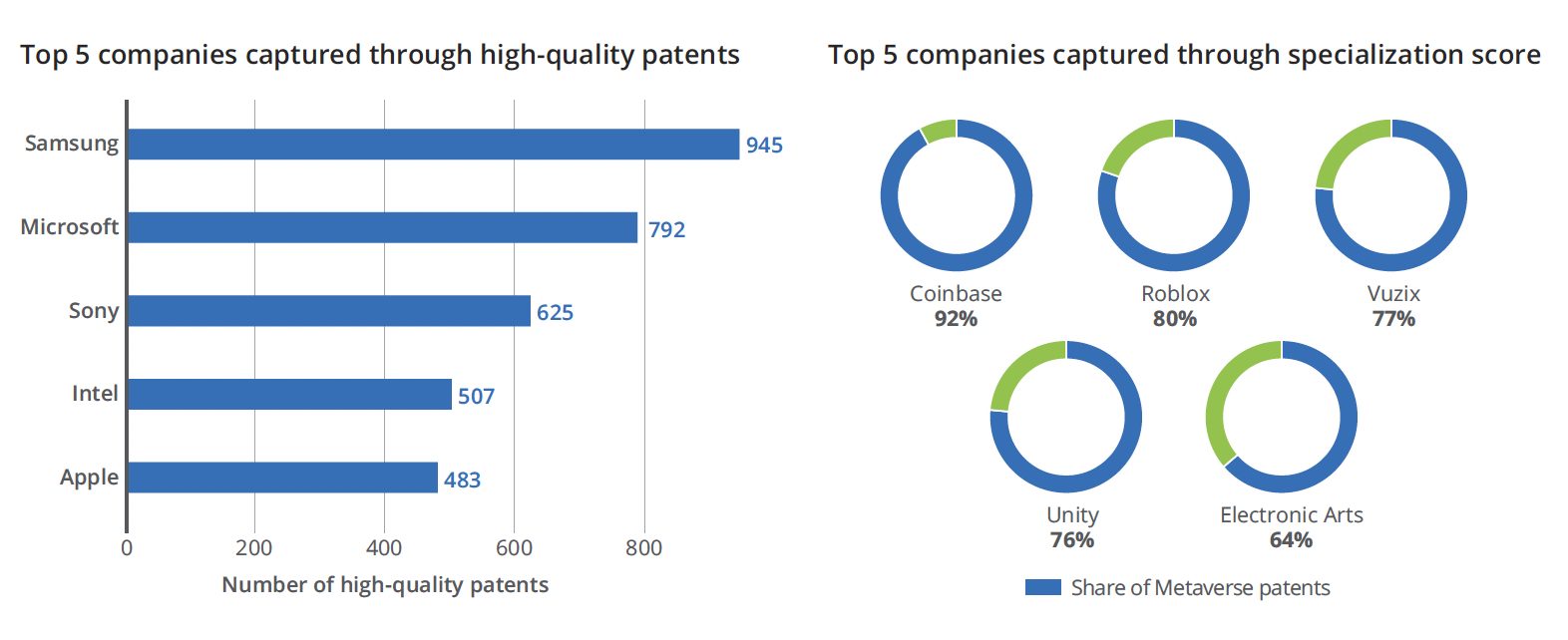

EconSight calculates patent quality as the product of the frequency with which a patent is cited (technological relevance) and the number of countries in which the IP protection is applied for (market coverage). The companies with the highest degree of specialization in a technology are identified by dividing the number of associated patents by the firm’s entire portfolio of active patents. Figure 2 shows the top five innovators currently included in the STOXX Global Metaverse, captured in terms of their HQPs and those identified by their degree of specialization.

Figure 2 – Capturing companies operating in the Metaverse

Individual stocks are initially equal-weighted in the index and later the weight is adjusted by the companies’ respective specialization scores. This means that smaller firms with a high level of expertise in Metaverse technologies can get a bigger allocation of capital than huge tech giants with a wider range of business activities. For example, niche players Coinbase (specialization score of 92%) and Roblox (80%) have more than 1.5 times the market-value weights of generalists such as Apple, Amazon, or Alphabet, whose Metaverse patents make up less than 10% of their total IP portfolio.

Sign up to receive valuable insights, news, and invitations as soon as they are published.

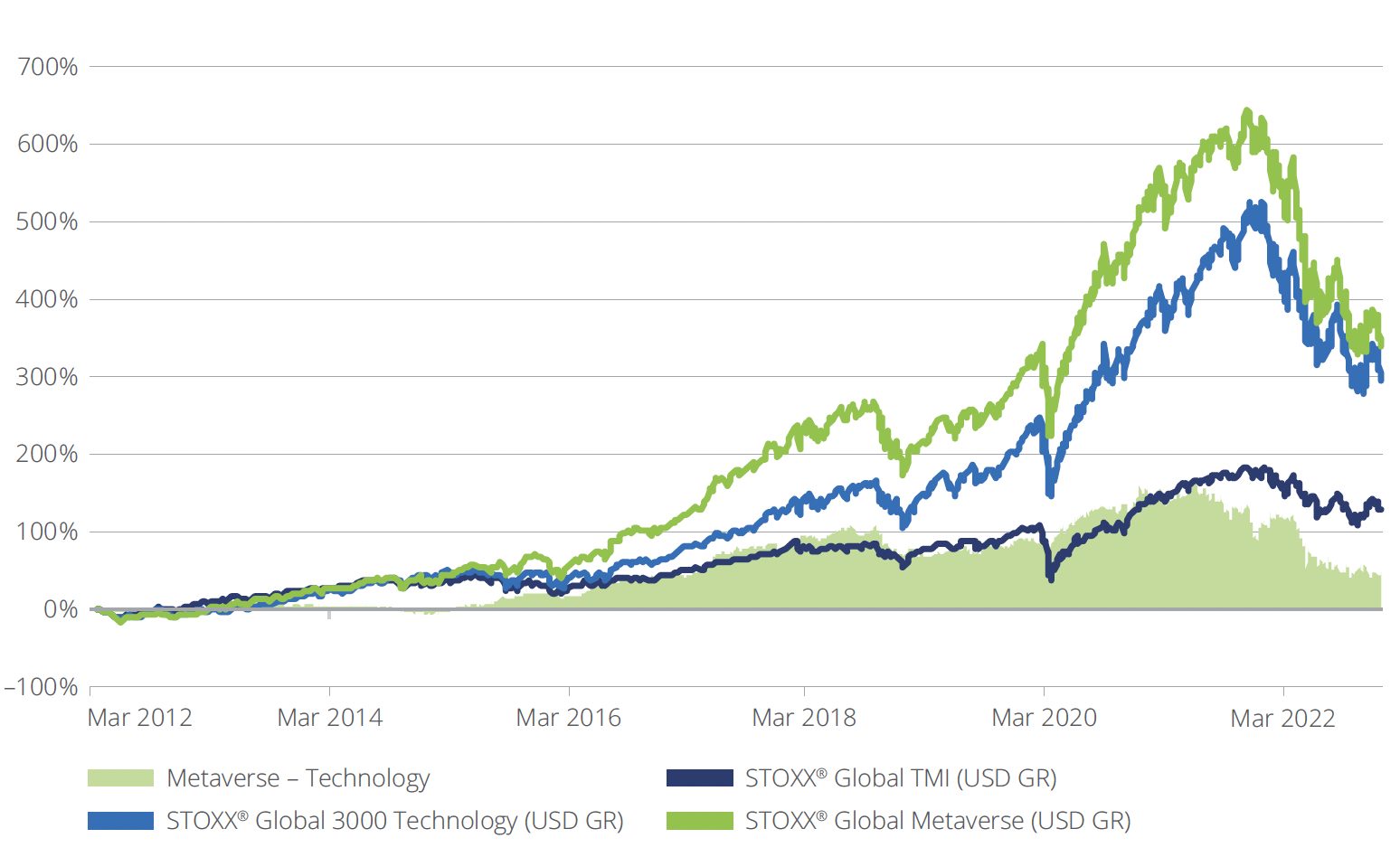

Subscribe >Outperformance since 2012

The STOXX Global Metaverse’s strong exposure to online and video game manufacturers turbo-charged gains during the global lockdowns introduced at the onset of the coronavirus pandemic in March 2020. The green line in Figure 3 shows the cumulative USD gross return of the STOXX Global Metaverse since March 2012. The light green area exhibits its excess performance over the STOXX® Global 3000 Technology benchmark (depicted in light blue). The dark blue line represents the total return of the broader STOXX Global TMI universe.

Figure 3 – Cumulative USD gross returns since March 19, 2012

Recent market turmoil

Like many other technology and growth-focused benchmarks, the STOXX Global Metaverse was hit disproportionally hard by the 2022 market downturn. Due to the evolving and dynamic nature of the Metaverse, many of the anticipated revenues and profits will only materialize in the (distant) future, making the share prices of the associated companies particularly vulnerable to rises in inflation and interest rates.

That being said, the COVID-19 pandemic has irrevocably transformed the way we work, shop, entertain and educate ourselves, moving many of these aspects of our daily lives into virtual environments. At the moment, most of the associated activities are still two-dimensional, but they are bound to become more immersive, as the underlying technologies become more powerful and cost-effective. Producers of graphic processing units, 3D imaging and rendering software, and virtual/augmented reality equipment are likely to benefit from this.

As more and more transactions are conducted online, digital security will become imperative, as users require tamper-proof ways of proving and protecting their (virtual) identities and property, such as blockchain and non-fungible tokens. Finally, hardware and software providers as well as the numerous access portals and platforms, will have to agree on common standards to enable the different, decentralized virtual worlds to interconnect and interoperate in a single, transcending Metaverse.

Identifying the most innovative firms will be key to successful investing in such an environment of rapid innovation. High-quality patent data are likely to be an essential ingredient in this.

1 Schon, C., ‘The future of life, the Metaverse, and everything – Using patent data to capture the greatest innovators at the next digital frontier,’ Qontigo, January 2023.

Qontigo is a leading global provider of innovative index, analytics and risk solutions that optimize investment impact. As the shift toward sustainable investing accelerates, Qontigo enables its clients—financial-products issuers, asset owners and asset managers—to deliver sophisticated and targeted solutions at scale to meet the increasingly demanding and unique sustainability goals of investors worldwide.

Qontigo’s solutions are enhanced by both our collaborative, customer-centric culture, which allows us to create tailored solutions for our clients, and our open architecture and modern technology that efficiently integrate with our clients’ processes.

Part of the Deutsche Börse Group, Qontigo was created in 2019 through the combination of Axioma, DAX and STOXX. Headquartered in Eschborn, Germany, Qontigo’s global presence includes offices in New York, London, Zug and Hong Kong.