By Yi-Cheng Shih at IIGF and Antonio Celeste at Qontigo*

While China’s economy has grown rapidly in recent years to become the world’s second-largest, the country’s uptake of sustainable investments has lagged that of other markets.

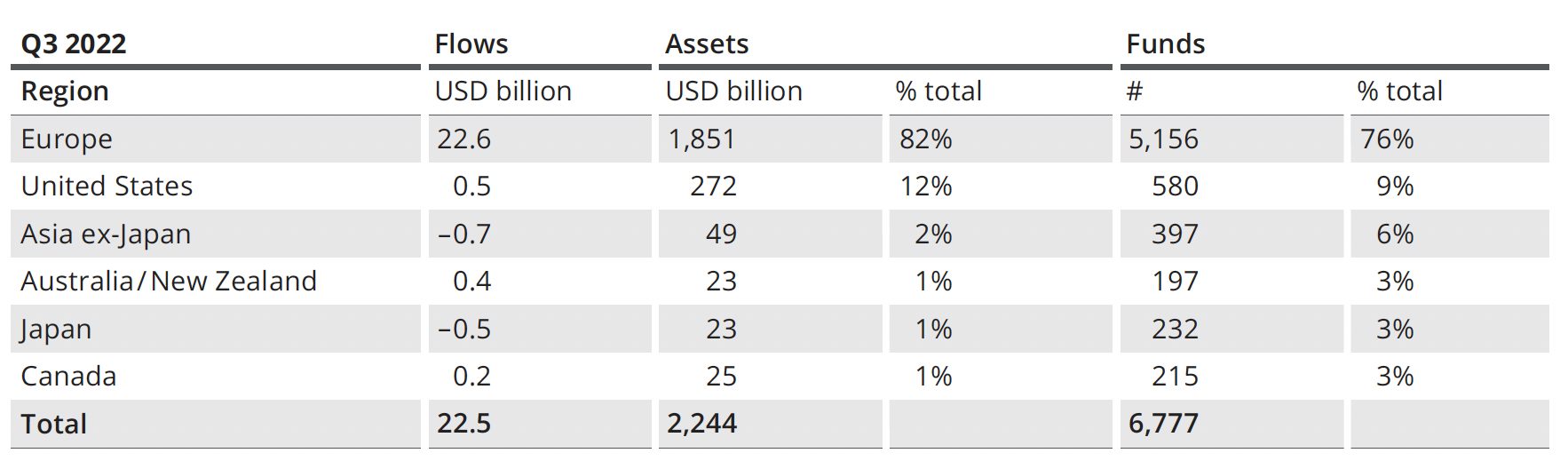

In 2021, China’s gross domestic product (GDP) was USD 17.7 trillion, or 18.5% of the world’s GDP1. That’s just behind US GDP of USD 23 trillion. China’s sustainable funds’ assets, meanwhile, totaled USD 33.2 billion in the third quarter of 2022, or 1.4% of the global sustainable fund industry. That compares to Europe’s USD 1.9 trillion (82% of total) and the US’ USD 272 billion (12%).

Figure 1 – Global sustainable fund assets

Emissions

As the economy expands, China’s CO2 emissions rose 4.4% in 2021 from a year earlier, to 12.5 gigatons, making the country the world’s most polluting.2

However, a more positive trend emerges when looking at the evolution of China’s emissions. The country emitted 0.5 kilograms of CO2 per USD 1,000 of GDP in 2021, less than the 0.52 kg. of CO2 registered in 2020. This downward trend has been observed over the past ten years (China had 0.78 kg. of CO2/USD 1,000 of GDP in 2011), demonstrating that the country is on a positive path of environmental efficiency.2

The role of government

The push for Environmental, Social and Governance (ESG) investing in China began in 2016 with the Guiding Opinions on Building a Green Finance System3, regulatory guidelines that set the stage for mandatory environmental disclosure for listed companies. Four years later, China committed to achieving peak carbon emissions by 2030 and carbon neutrality by 2060.

2022 marked an important milestone: the Ministry of Ecology and Environment has issued the Measures for Business Disclosure of Environmental Information by Law. In June 2022, China Enterprise Reform and Development Society (CERDS) published voluntary guidelines to establish uniform ESG disclosure practices. Most of the indicators are in line with ESG issues highlighted in international standards, such as climate change and labor rights. Also in June this year, the China Banking and Insurance Regulatory Commission (CBIRC) issued guidelines calling for banks and insurers to include ESG requirements in their management processes and risk management systems, improve ESG disclosure and reduce the carbon intensity of their portfolios. The guidelines will be mandatory as of June 1, 2023.

China’s efforts have produced tangible results in terms of ESG disclosure: as of mid-2020, 1,021 companies listed on the Shanghai and Shenzhen stock exchanges had published annual ESG reports, up from 371 companies in 2009, according to a recent report from the World Economic Forum and PwC China4.

About IIGF

A key actor in the evolution of ESG reporting in China is the International Institute of Green Finance (IIGF), part of the Central University of Finance and Economics. The leading think-tank in Beijing has the goal of supporting the development of green finance in China and internationally. IIGF specializes in research, policy consulting and training on market applicability. Its expertise covers credit, bonds, insurance, carbon trading, information disclosure and risk assessment at the local, national and international levels. In addition, IIGF is a member of:

- the China Society for Finance and Banking’s Green Finance Committee.

- the Green Securities Committee of the Securities Association of China.

- the Investment and Finance Committee of the China Association of Environmental Protection Industry.

Many challenges exist with data pertaining to the ESG performance of Chinese corporations. China has distinct corporate governance requirements through its state-led governance model. Additionally, language barriers and different disclosure rates and standards make it all the more difficult for international providers to fully assess and integrate China’s market-specific nuances of ESG data.

IIGF’s ESG analysis takes into account localized Chinese features to address the shortcomings of international indicators that only understand the Chinese market and ESG development too narrowly, especially when it comes to the cultural differences (not least due to language barriers). The IIGF database includes five factors and functions: ESG rating results, industry performance, specific indicator scores, quantitative data and exclusive ESG analysis reports. This covers public companies and funds.

New index

Qontigo, part of Deutsche Börse Group, is leveraging its open and curated ESG data architecture to collaborate with IIGF. As such, the firm can access IIGF’s unique coverage of Chinese A companies, with strong expertise on environmental performance, intrinsic understanding of social and governance specificities, and analysis of ESG drivers of financial materiality.

The launch of the STOXX® China A 900 Large ESG Index aims to enable investors to identify companies in the local market that are best aligned with, and contributing to, sustainability objectives.

The index tracks the performance of the largest 300 securities by free-float market capitalization in the STOXX® China A 900 benchmark after a set of compliance, involvement and ESG performance screens are applied. The index uses data from IIGF to apply exclusionary screens. Companies that are assessed by IIGF to be non-compliant with the UN Global Compact Principles, or involved in controversial weapons, tobacco or thermal coal are not eligible for selection.

The remaining securities are ranked in descending order of their IIGF ESG scores within each of the 11 ICB Industry groups. The STOXX China A 900 Large ESG index selects the top-ranking securities in each of the ICB Industries until the number of selected securities reaches 80% of the largest 300 securities by free-float market capitalization from the STOXX China A 900 index.

The path ahead

The Chinese government has made many efforts to promote sustainable investments, a move that should lead to greater ESG disclosure.

The relatively small size of the Chinese ESG market, compared with those in Europe and the US, shows that there is strong potential for growth. The role of investors will be important in guiding Chinese companies to improve their ESG profile, and dialogue between the two parties can be really effective if the ESG specificities of the Chinese market are understood and addressed properly.

Chinese public corporations are systemically important for the country to be able to deliver on its sustainability targets. For investors, the time is ripe to assume a key role in this transition by investing in companies with innovative and best-in-class sustainability performance.

* Yi-Cheng Shih is Chief Academic Advisor of IIGF. Antonio Celeste is Director for Sustainability Product Management at Qontigo.

1 International Monetary Fund, World Economic Outlook Database.

2 Source: https://countryeconomy.com/

3 Regulation Asia, ‘Perspectives from China: The Green Wave,’ Aug. 21, 2022.

4 WEF, ‘A Leapfrog Moment for China in ESG Reporting,’ March 24, 2021