As demand for sustainable investing in the German market grew strongly in recent years, Qontigo has introduced three alternatives to the benchmark DAX® that meet specific needs of investors with diverse responsible objectives. They are the DAX® 50 ESG, DAX® ESG Target and DAX® ESG Screened indices.

Three different goals

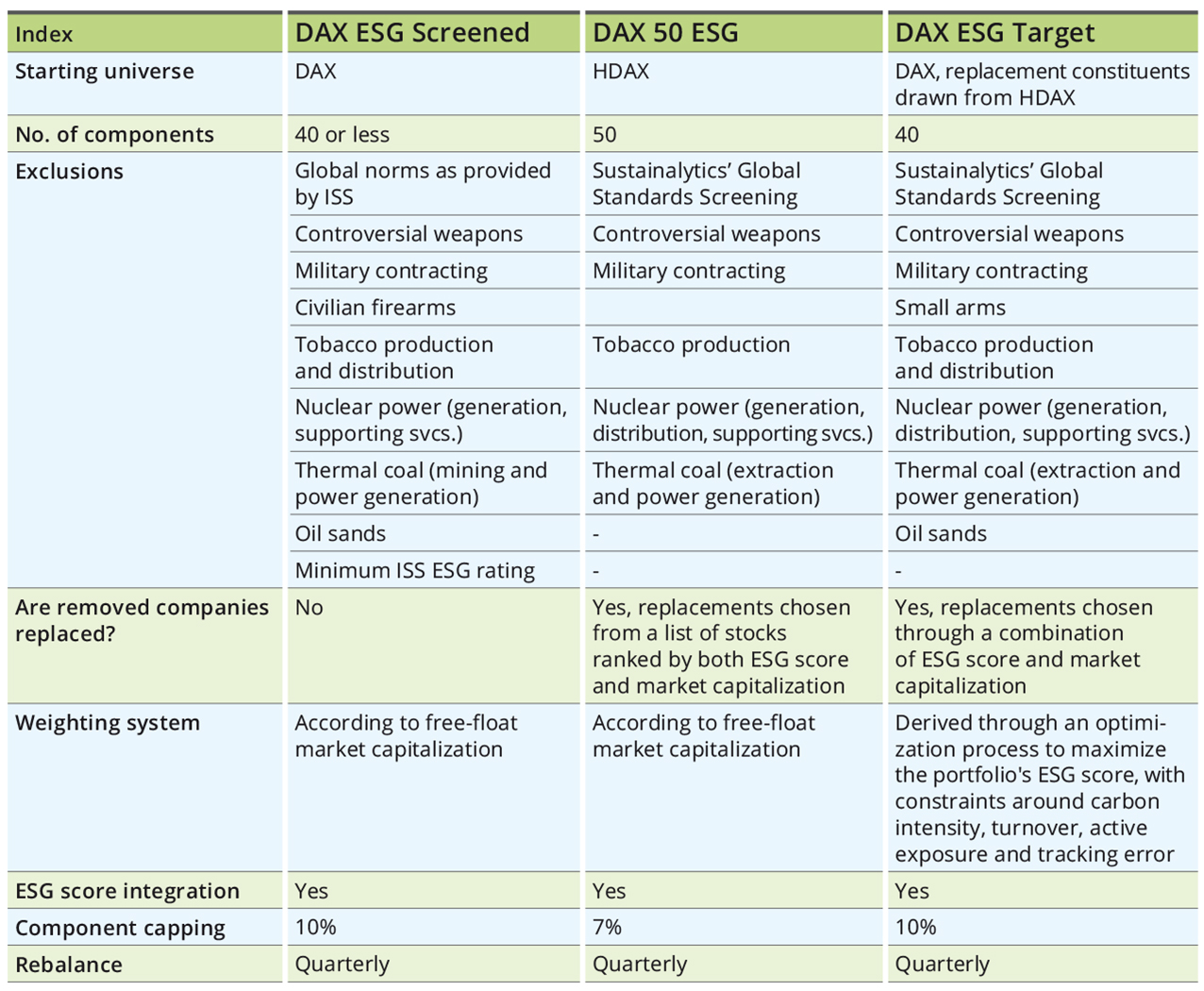

While the DAX ESG Screened represents a straightforward negative-screening strategy, the other two indices combine exclusionary screening and best-in-class ESG integration. All three were also specifically designed with distinct characteristics in terms of selection and weighting process, and currently serve as underlying for respective ETFs.

DAX ESG Screened – excluding controversial companies

The objective of the DAX ESG Screened index is to reflect the performance of the DAX after removing companies that fail ISS-ESG screenings for global norms, controversial weapons, product involvement, and a minimum ESG rating.

Removed companies are not replaced, and, therefore, the DAX ESG Screened index will typically have fewer holdings than its parent index. The ESG index weightings are based on free-float market capitalization with a weight cap of 10%.

Sign up to receive valuable insights, news, and invitations as soon as they are published.

Subscribe >DAX 50 ESG – a broader-market benchmark

The DAX 50 ESG was conceived as a broad-market ESG benchmark that aims to reflect, but has a larger composition than, the flagship DAX®.

The selection universe for the DAX 50 ESG is the HDAX®, which groups all equities that belong to either the DAX, MDAX® or TecDAX® indices. From the starting universe, a set of filters are applied to exclude companies deemed in breach of global norms or involved in products and services that are undesirable from a sustainability standpoint (Figure 1).

The DAX 50 ESG is composed of the 50 remaining stocks with the highest rank in two quantitative parameters: free-float market capitalization, and ESG score as calculated by Sustainalytics.1 Selected index components’ weights are capped at 7%.

Since November 2020, investors can access futures and options on the DAX 50 ESG on Eurex. The index also underlies ETFs from Credit Suisse Asset Management and Lyxor Asset Management.

DAX ESG Target – Optimized weighting

The DAX ESG Target, meanwhile, aims to provide an optimized ESG alternative to the DAX that additionally reduces the portfolio’s carbon intensity by at least 30%, while limiting the tracking error.

The index firstly applies a set of compliance, product involvement and ESG performance exclusionary screens on the DAX. Removed companies are replaced by the largest stocks in the broader HDAX that also have the highest ESG scores, until reaching 40 constituents.

From that selection pool, an optimization weighting process is implemented to maximize the portfolio’s overall ESG score subject to a number of constraints. These constraints rely on Axioma’s risk models and include an ex-ante tracking error limit to the benchmark of 1.5%, individual security weights, a maximum cap on quarterly turnover, and limits to active industry exposures. This ensures the portfolio’s return will not stray too far from that of the benchmark. There is also a carbon intensity reduction target.

Since May 2021, the DAX ESG Target underlies an ETF managed by BlackRock’s iShares.

Figure 1 – Fundamental comparison: DAX ESG Screened, DAX 50 ESG and DAX ESG Target

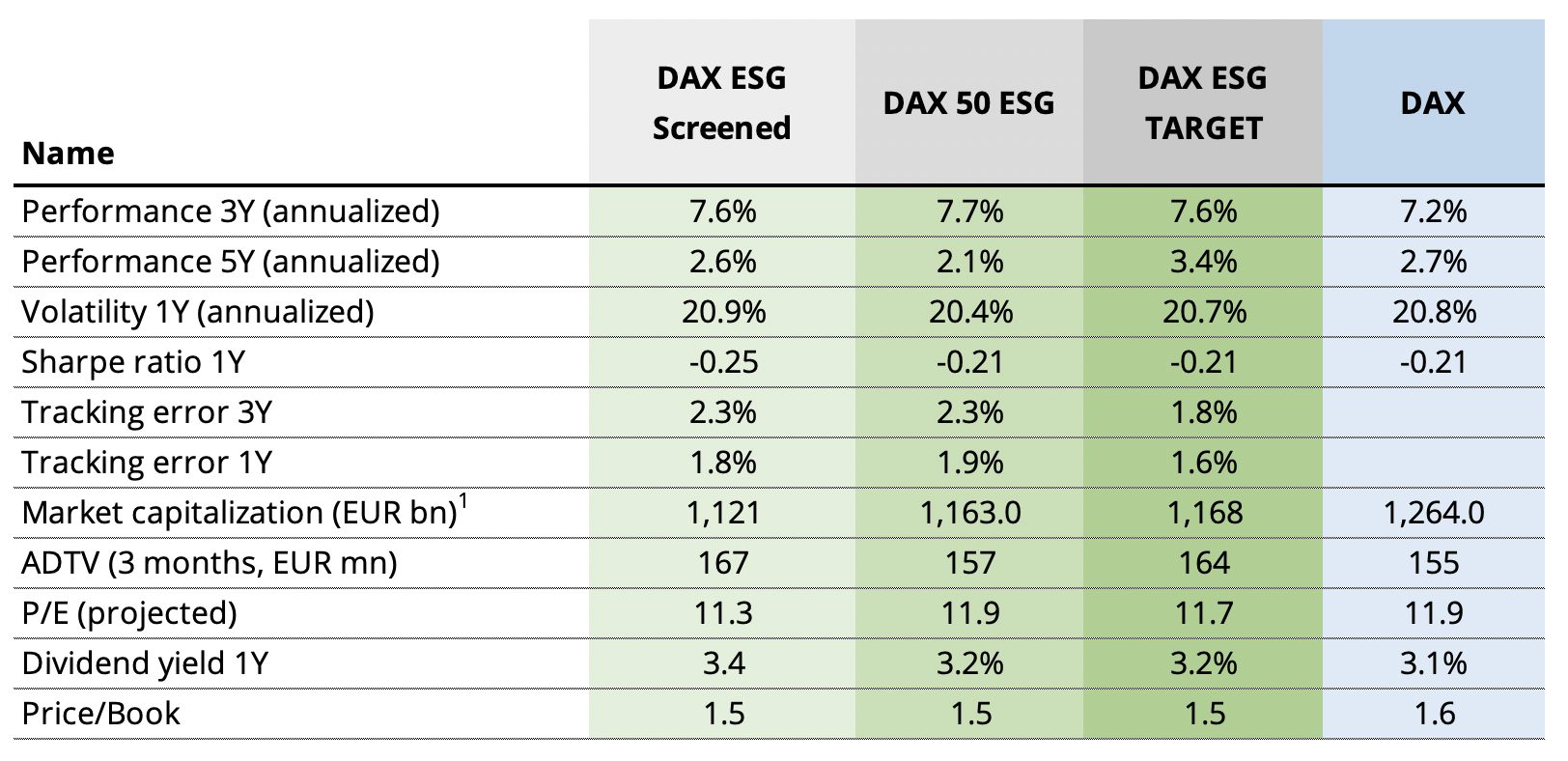

Figure 2 shows that in the past five years, the DAX ESG Target has outperformed the DAX while the DAX 50 ESG has underperformed. The DAX ESG Screened has come out broadly in line with the benchmark.

Figure 2 – Risk and returns characteristics

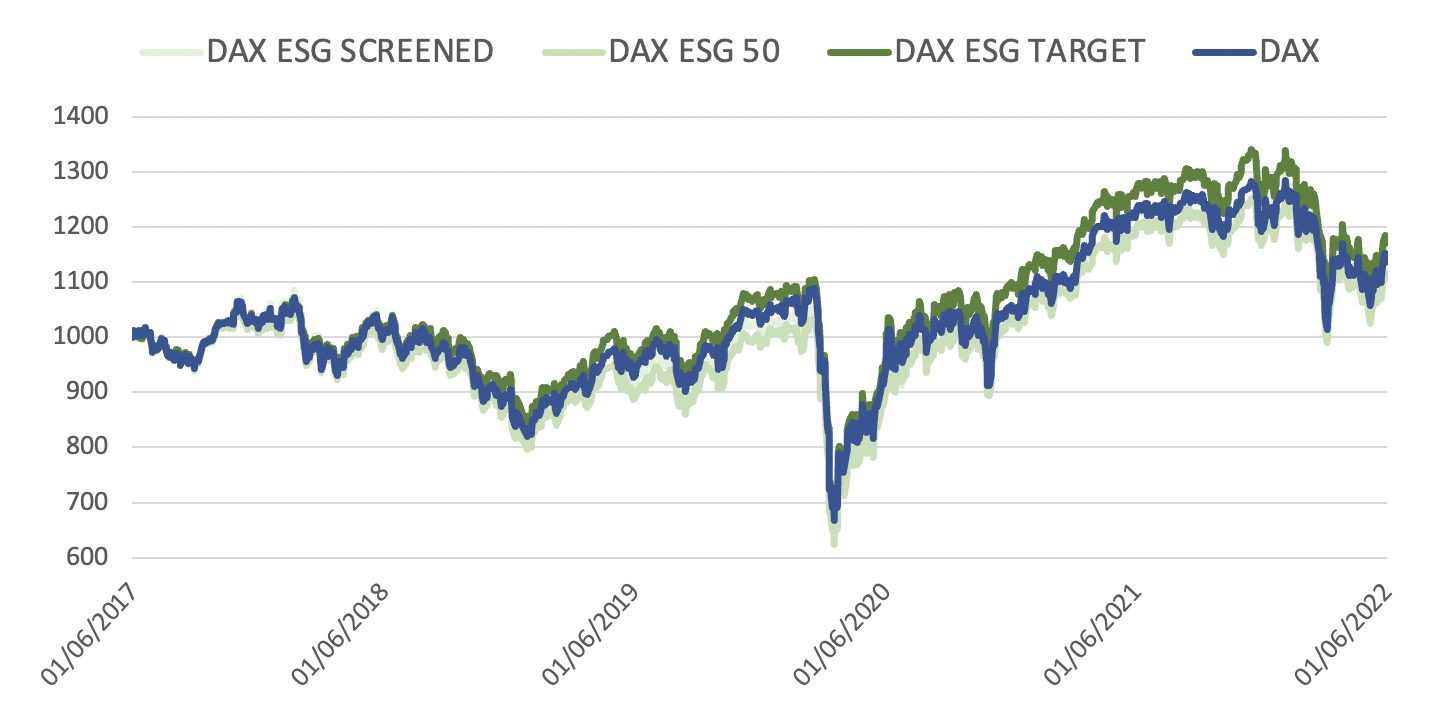

Figure 3 shows the indices’ performance since June 2017.

Figure 3 – Returns performance

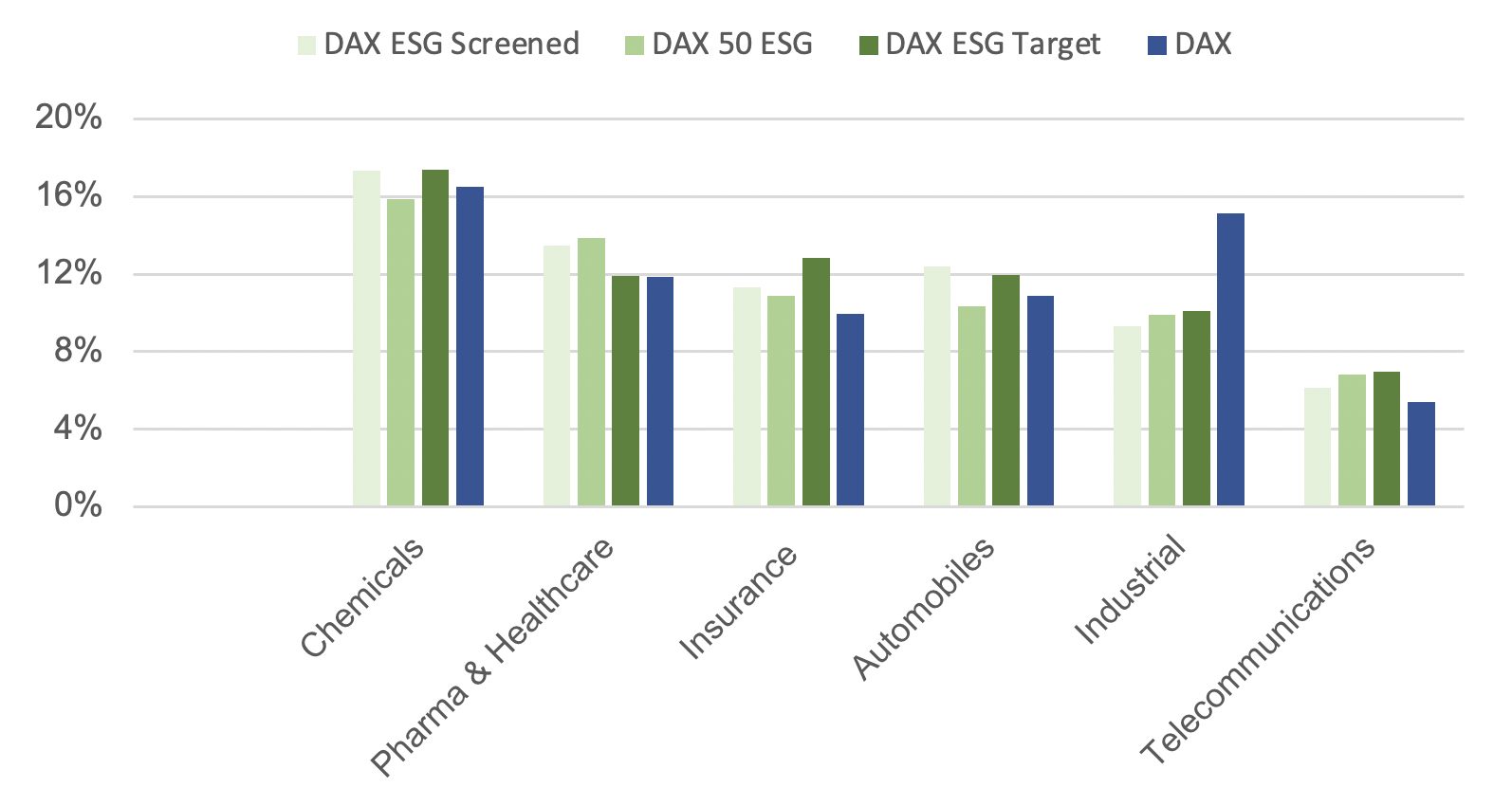

In terms of sector allocation (Figure 4), the three ESG indices share the same top industry exposures with the benchmark, and differences in weight are mostly not significant. One exception is the underweight to Industrials, a result of removing Airbus SE, MTU Aero Engines AG and Rheinmetall AG due to their military contracting status. Insurance and telecommunications are among noticeable overweights in the ESG portfolios.

Several utilities — not a top 5 sector — are also screened out from the ESG portfolios due to their exposure to thermal coal and nuclear power activities.

Figure 4 – Sector allocation, top 5 sectors

Common objectives

The DAX ESG Screened, DAX 50 ESG and DAX ESG Target provide investors with more sustainable versions of the flagship DAX benchmark. All three follow a transparent methodology3, and share the same minimum trading volume criteria as does the benchmark DAX, which guarantees liquidity and replicability. The ESG indices enhance the sustainable profile of the resulting portfolio, while showing risk-return characteristics that are not far off from those of the benchmark.

Conclusion

When it comes to ESG, investors need solutions that are tailored to their individual views and objectives. Qontigo currently offers three sustainable indices to invest in the German equity market — one that aims to reflect the benchmark DAX minus controversial companies, another one that is broader in scope and has a more diversified composition, and finally one with an optimized weighting approach and lower carbon emissions. Having the three options is a deliberate decision in a market segment where one size does not fit all.

1 Norms-based screening for the DAX ESG Screened index excludes companies that ISS-ESG considers are in breach of human rights, labor standards, environmental protection and anti-corruption principles established in the United Nations Global Compact and the Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Enterprises. For the DAX 50 ESG and DAX ESG Target, Sustainalytics’ Global Standards Screening assessment identifies companies that violate or are at risk of violating commonly accepted international norms and standards, enshrined in the UN Global Compact, the OECD Guidelines, the UN Guiding Principles on Business and Human Rights (UNGPs), and their underlying conventions.

2 Like with the DAX, the composition of DAX 50 ESG is reviewed quarterly based on the Fast Exit and Fast Entry rules and semi-annually in March and September based on the Regular Exit and Regular Entry rules.

3 For more information on the DAX 50 ESG, please visit the Guide to the DAX Equity Indices. To read more about the DAX ESG Target and DAX ESG Screened, visit the Guide to the DAX Strategy Indices.

Qontigo is a leading global provider of innovative index, analytics and risk solutions that optimize investment impact. As the shift toward sustainable investing accelerates, Qontigo enables its clients—financial-products issuers, asset owners and asset managers—to deliver sophisticated and targeted solutions at scale to meet the increasingly demanding and unique sustainability goals of investors worldwide.

Qontigo’s solutions are enhanced by both our collaborative, customer-centric culture, which allows us to create tailored solutions for our clients, and our open architecture and modern technology that efficiently integrate with our clients’ processes.

Part of the Deutsche Börse Group, Qontigo was created in 2019 through the combination of Axioma, DAX and STOXX. Headquartered in Eschborn, Germany, Qontigo’s global presence includes offices in New York, London, Zug and Hong Kong.