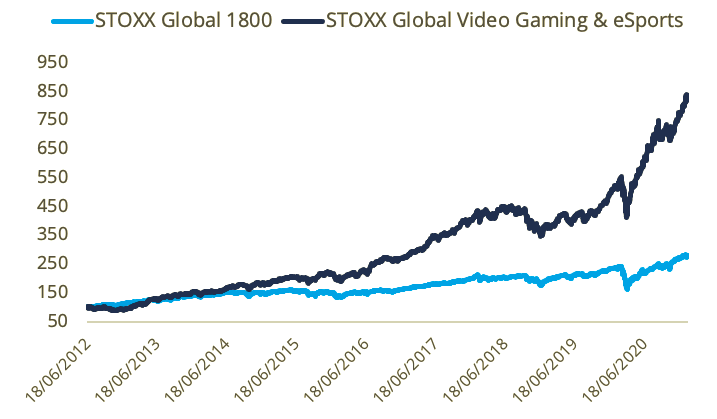

One of 2020’s strongest performances among the Qontigo Thematic Indices came from the STOXX® Global Video Gaming & eSports Index, as a growing number of enthusiasts for online games drives record sales of related hardware and software.

The STOXX Global Video Gaming & eSports index climbed 56% last year, compared with a 17% advance for the benchmark STOXX® Global 1800 Index.1 The gains reflect the positive underlying fundamentals in the industry: revenue from sales of premium game consoles grew 28% last year, while 1.2 billion spectators tuned in to watch gaming video content, 18% more than in 2019.2

Hardware producers can barely keep up with demand. Nintendo Co. and Sony Corp. this month boosted their annual earnings forecasts thanks to bumper sales of their game devices. Revenue at Microsoft Corp.’s Xbox unit climbed 40% in the fourth quarter amid record deliveries. Analysts have forecast shipments of next-generation consoles including PlayStation and Xbox will rise exponentially by 2024.3 Meanwhile, software producers including Take-Two Interactive and Activision Blizzard are smashing profit estimates and sales records.

While lockdowns in 2020 boosted demand for stay-at-home entertainment, making the video gaming industry a larger moneymaker than the global film business,4 there is a growth trend that far exceeds last year’s events. In fact, video gaming was chosen as part of the Qontigo Thematics indices precisely because it represents a long-term disruptive concept with strong economic potential (Exhibit 1). With ever-improving technologies and capabilities, and rising consumer engagement, the industry is investing for a multi-year demand cycle.

Exhibit 1 – Video gaming & eSports index vs. benchmark

Screening for beneficiaries of change

The STOXX Global Video Gaming & eSports Index selects stocks that generate at least 50% of revenue or EUR 2 billion in sales from 15 Revere sectors (RBICS) associated with the theme. For a complete list of those sectors, please visit the index rule book here.

Qontigo’s thematic concepts are investable using a passive methodology that observes principles of replicability and liquidity. Selected companies to the video gaming index must have a 3-month median daily trading value greater than EUR 1 million.

Distinctive index characteristics

Three methodology characteristics of the video gaming index stand out:

- Revenue-based, rather than solely market-cap-weighted: this weighting method guarantees more accurate exposure to the theme and helps limit unintended investments in other industries that may result from selecting stocks based only on size.5

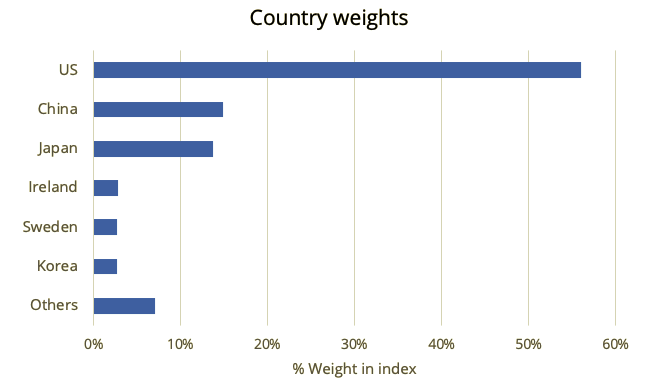

- Diversification (79 stocks): a high number of constituents helps spread risk across regions and sub-sectors.

- ESG screening: the index excludes companies that Sustainalytics considers to be non-compliant with its Global Standards Screening assessment or to be involved with controversial weapons. This will be of relevance to the increasing number of asset owners and asset managers who abide by responsible-investing rules.

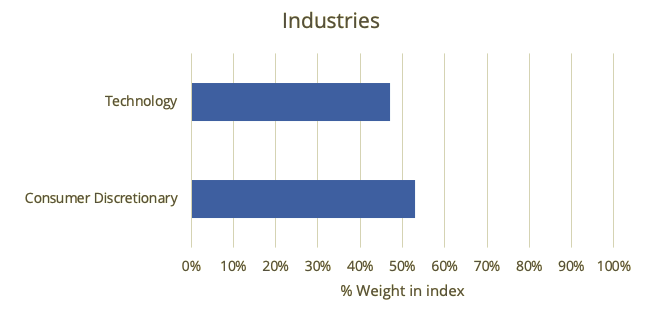

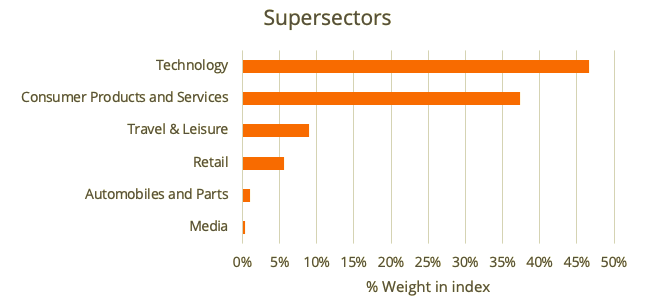

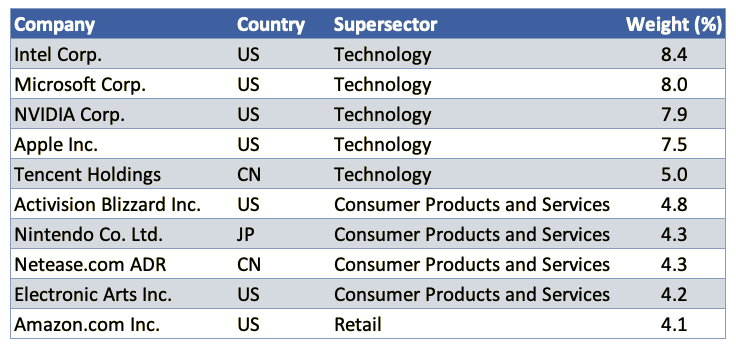

Exhibits 2 through 4 look more closely at the composition of the STOXX Global Video Gaming & eSports index.

Exhibit 2 – Video gaming & eSports index sectorial exposure

Exhibit 3 – Country exposure

Exhibit 4 – Top ten constituents

The index underlies the FSITC Global Video Gaming & eSports Fund, an open-ended fund in Taiwan managed by First Securities Investment Trust Co.

A disruptive and compelling trend

Last December YouTube announced that consumers watched a whopping 100 billion hours of footage on YouTube Gaming during 2020, double the amount in 2018. Thematic investing attempts to capitalize on broad, disruptive, compelling and often hard-to-predict trends that are changing our society. With its legions of fans growing each year, video gaming has emerged as a prime example of such trends.

1 Gross returns in USD.

2 Superdata, ‘2020 Year in Review, Digital Games and Interactive Media.’

3 CNBC, ‘Sony hikes profit forecast after selling 4.5 million PS5 consoles in the holiday quarter, Feb. 3, 2021.

4 The pandemic-related restrictions have given a big boost to online gaming. MarketWatch has reported that global videogame revenue is expected to have surged 20% to $180 billion last year, according to IDC data. Such revenue would top the combined sales of the global movie and North American sports industries. See MarketWatch, ‘Videogames are a bigger industry than movies and North American sports combined, thanks to the pandemic,’ Jan. 2, 2021.

5 Companies are weighted by the multiple of each company’s revenue exposure to the theme by their free-float market capitalization.

6 The Verge, ‘YouTube Gaming had its best year ever with more than 100 billion hours watched,’ Dec. 8, 2020.