In our analysis of style factors for Axioma’s recently released UK version 4 model, we noted that many factors fared better in the UK than in a number of other developed-market regions (see blog post here). We introduced three new traditional style factors with that release[1], as we have with most of the other V4 models. As in other regions, these factors are important drivers of total and active risk. While Version 4 of our Canada model also showed some big differences between Canada and other markets, Canada stood out most in terms of factor volatility.

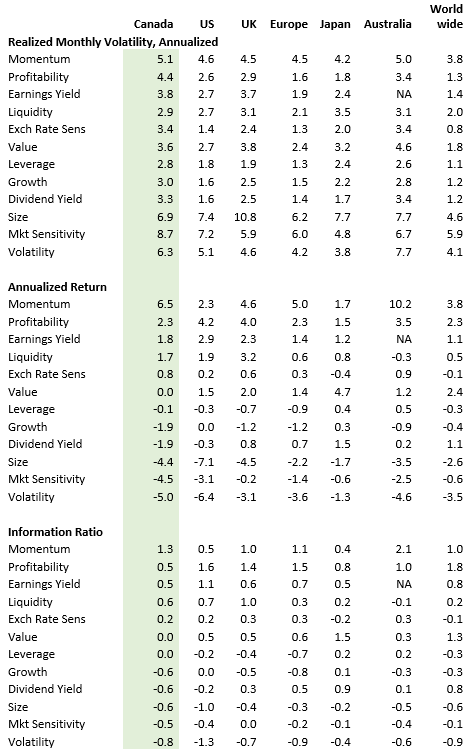

Certain factors, especially those expected to be compensated sources of risk (such as Medium-Term Momentum and Earnings Yield) have higher realized volatility in Canada than in most or all of the seven other developed-market regions for which we have models. For example, realized annualized volatility for Profitability and Market Sensitivity in Canada is more than a full percentage point higher than in the next-highest regions (Australia and the US, respectively). The volatility differences are smaller between Canada and other regions, where Canada still has the highest volatility (Momentum, Earnings Yield, Leverage and Growth).

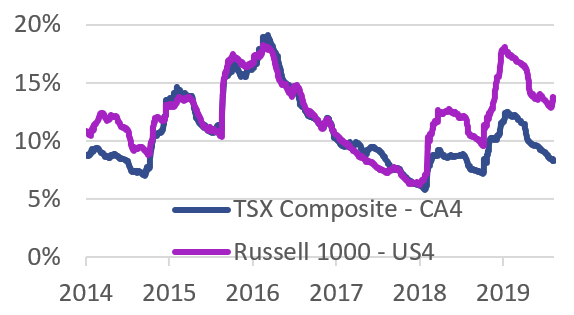

The higher style factor volatility stands in stark contrast to that of the market as a whole. As we often show in our Insight reports, the Canadian market tends to have volatility lower than or equal to many of its peers. The chart at right contrasts the US and Canadian market levels of risk over the past several years.

Higher Risk, Higher Return?

The higher volatility of the style factors suggests that style-based managers may need commensurately higher return forecasts to justify bets on the factors, although that calculus can and should change based on the current level of volatility predicted by the risk model. Looking at the long-term average annualized returns and corresponding information ratios, we see that some factors are more appealing as investment tilts than others (see table below for details).

Comparing across geographies for factors where risk is typically expected to be compensated, Momentum’s return and information ratio in Canada are quite high, and bested only by those in Australia. Profitability has produced a decent return in Canada, although not as high as in many other regions. That said, Profitability’s high level of volatility tamps down its information ratio, which is lowest in Canada, compared with other regions. Earnings Yield’s return also looks better than most regions, except the US and the UK, but its historical volatility renders the information ratio at the lower end of all the developed markets. Low Volatility has fared better in Canada on average than in any other region except the US, but the magnitude of the information ratio for that factor is relatively low, too. Returns to Growth and Dividend Yield are negative, and the lowest of the developed-market regions[2]. Finally, the non-existent return to Value in Canada stands in sharp contrast to what we see elsewhere, where the factor’s return is positive and information ratios are generally at reasonable levels.

To conclude, style factors tend to be more volatile in Canada than they are in other developed markets, which has a dampening effect on their information ratios[3]. While it may be a bit more difficult to use certain factors to generate returns in Canada, they are still important components of portfolio risk, perhaps even more so in Canada than elsewhere.

Source: Axioma

[1] The Canada version 4 model includes some additional factors unique to that market, notably Residual Oil and Residual Gold factors, added because we believe the effects of oil and gold are not completely captured in the energy and gold industries. In other words, other segments of the market exhibit sensitivities to these commodities that contribute to their risk. See our marketing materials for more detail.

[2] While most factors produce returns in the same direction across regions, Dividend Yield produces strong returns and information ratios in Japan and in the Worldwide model; returns are reasonable in Europe, but weak elsewhere.

[3] As a side note, style factors in aggregate seem to account for a higher portion of benchmark risk than in most other regions, except the UK.