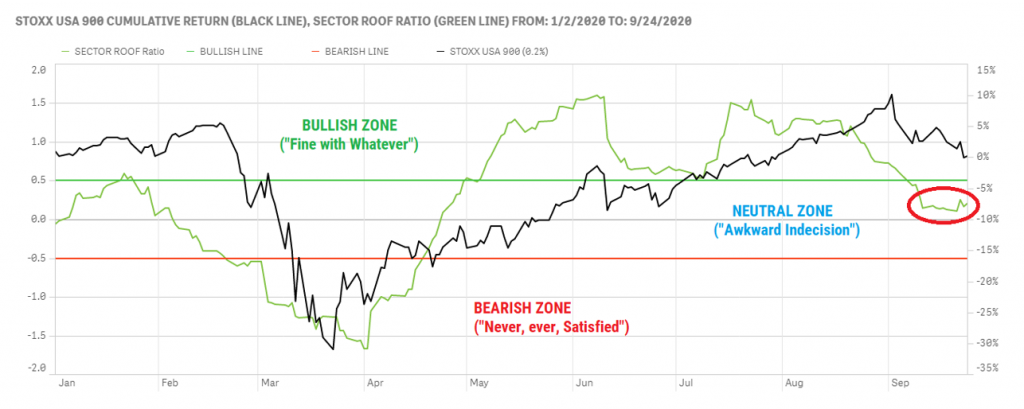

With the US presidential election looming, along with the lack of a second stimulus package and rising Covid-19 cases, risk appetites are taking a hit. According to Qontigo’s Sector ROOF variant for the STOXX®USA 900 index, investor sentiment has retreated to the elusive safety of the neutral zone, where it has flatlined for the last two weeks (see chart below).

For those who feel that ‘neutral’ is better than ‘bearish,’ given the current levels of uncertainty around the globe, we offer the following two observations. First, in today’s quantitatively eased world, neutral is the new bearish. Simply put, with nowhere else to go, bearish has been taken out of play, so risk-taking is not ‘all-or-nothing’ anymore, but ‘all-or-some’ now.

Second, investors only have two speeds, which vary with their confidence levels: fine with whatever when they are risk tolerant, and never, ever satisfied when they are risk averse. Indecision is not in their DNA. They spend their time anticipating the anticipations of others—and are then too impatient to find out if markets live up to the script to remain in the same state for long. To many, being in the neutral zone is as uncomfortable as waiting to see your doctor after a hastily ordered chest X-ray. They need to fast-forward to a bullish state, or rewind to a bearish one, but seem unable to tolerate indecision caused by high levels of uncertainty for very long.

Investment decisions end up falling in two camps: buying or selling, which is fine, and everything else, which is not. It’s as if buying, selling, and holding did not lie on the same continuum. A retreat to the neutral zone so far ahead of the US election and the Q3 earnings season suggests a conclusion on their part that markets may soon suffer from a primarily sentimental bout of uncertainty, whose effects may include the exacerbation of an underlying pre-existing hedging condition. Which is another way of saying “they have no idea what’s coming next”.

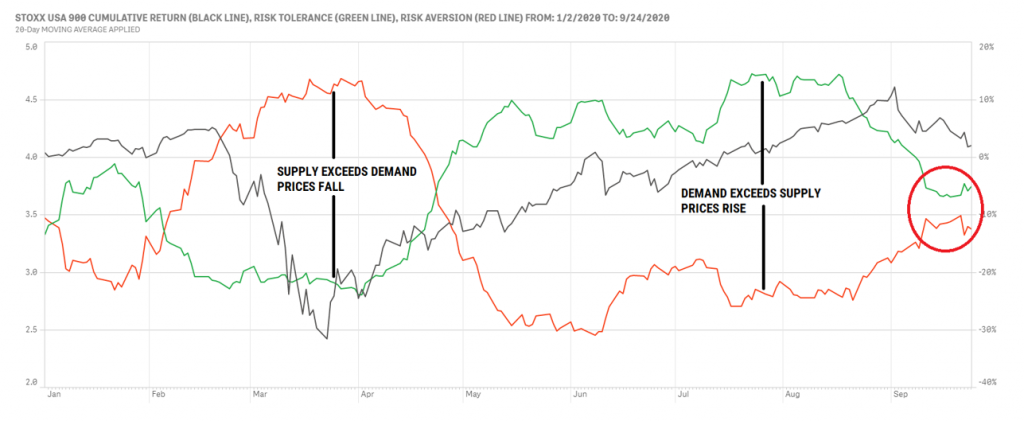

This is confirmed by the current balance between the supply and demand for risk in the chart below. The green line measures the demand for risk (i.e., risk tolerance) and the red line the supply of risk (i.e., risk aversion). When supply far exceeds demand, as was the case in March, the few risk-tolerant investors were able to extract large price discounts from the many risk-averse investors seeking to de-risk their portfolio in a hurry. In this ‘supply > demand’ situation, stock prices tend to fall rapidly. Conversely, when demand outstrips supply, as it has since early May, the many risk-tolerant investors have been forced to offer price premiums to the few risk-averse investors left in the market, in order to acquire their stock. In this ‘demand > supply’ situation, stock prices tend to rise, but more slowly than in the reverse situation, as ‘greed’ seems to be less time-sensitive than ‘fear’.

So, here we are, seemingly stuck in indecision land, but not for long. The bias is on the upside, as investors have interpreted the few data points of economic recovery released thus far as confirmation that the worst of the economic fallout from the pandemic is behind us. Add to that the anticipation of more (as opposed to less) fiscal stimulus in the coming weeks or months, plus the fact that the Fed has taken tail risk out of play until at least 2022 with its unprecedented and seemingly indefinite QE program, and it is not hard to imagine that risk tolerance is more likely to rebound, as risk aversion retreats. For investors who hold prudence as a trusted mistress in the face of uncertainty, be careful that taking the high road does not lead to a dead end.