As part of its Thematic Indices family, Qontigo’s STOXX unit introduced, starting in 2017, the STOXX® Global Millennials and STOXX® Global Ageing Population indices. Both follow a revenue-based stock selection methodology to gain exposure to companies that raise the most sales from business sectors associated with the respective themes.

A new whitepaper1 from Melissa Brown and Anran Su2 at Qontigo looks in detail into the risk and returns of these two indices. The analysis is an opportunity to compare two strong demographics trends and related investing ideas, and allows us to explore the possibilities of thematic portfolios. According to ETFGI, USD51 billion flowed globally into thematic funds in 2021 through May, bringing total assets invested to a record USD414 billion.

“Together, these two generations represent a significant source of economic growth around the world and present interesting investment opportunities if investors can accurately capture their contributions,” Brown and Su write in the whitepaper. “However, they also have vastly different behaviors, and their needs and spending habits therefore differ greatly.”

Different social groups

Just as the two cohorts and their respective lifestyle and consumer habits, the two indices couldn’t be more dissimilar. Moreover, the indices’ distinct stock and sector allocations are the result of two different weighting methodologies. The Ageing Population index is equal-weighted3, while the Millennials index’s constituents are weighted according to their free-float market capitalization adjusted for their exposure to the targeted business sectors.

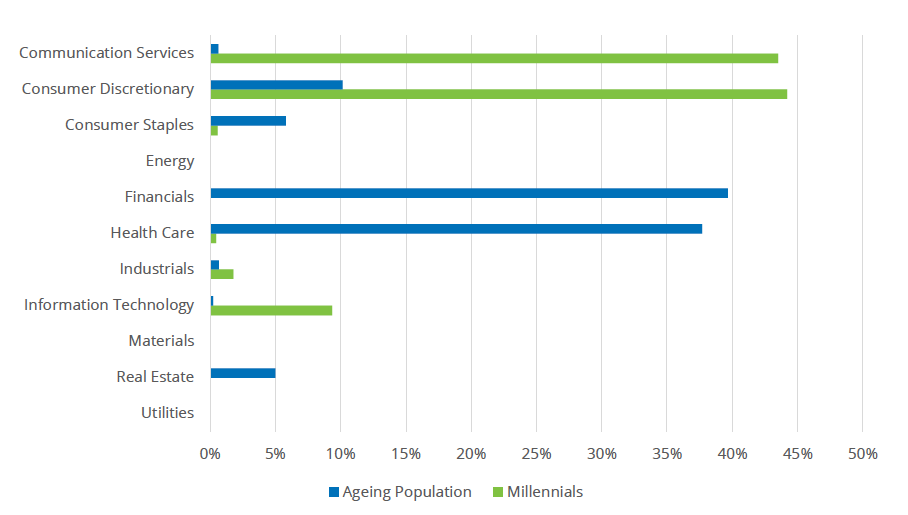

As the authors note in the whitepaper, the two indices provide little overlap in their sector exposure (Figure 1).

Figure 1 – Average sector weights June 2012 – June 2021

Figure 1 also highlights that the Millennials and Ageing Population indices’ exposures are each concentrated in only a couple of industries, of course this being a feature by design. The Millennials methodology’s overweight of Consumer Discretionary stands out, reflective of the younger cohort’s spending on live experiences and ‘must-have’ latest trends. The index is also exposed to Communication Services and Information Technology, not surprising given that this is a ‘connected’ generation.

The older folks’ index, on the other hand, is disproportionally exposed to Health Care companies and Financials, which provide services around medical care, laboratories, pharmaceuticals, financial planning, asset management, insurance, etc. Baby boomers’ disposable income also exposes the Ageing Population index to the Consumer space (yachts! golf courses! cruise trips!) and to Real Estate.

Style-factor exposure

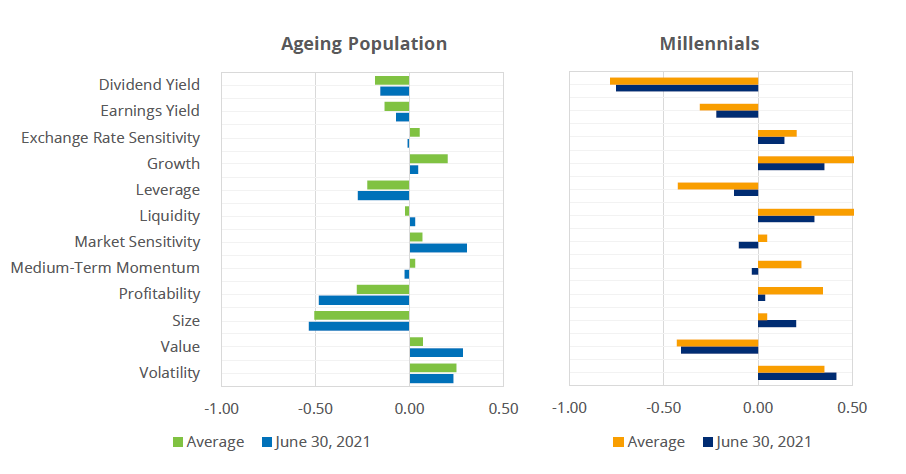

Brown and Su also run an analysis of style-factor exposure of both indices. These style factors can impact how indices will perform in different market environments and may be considered in the portfolio construction process, they explain. Here, there are differences between the two indices too, although not as pronounced as one might expect.

Figure 2 – Style-factor exposures

The Ageing Population index had less pronounced style-factor exposures relative to the benchmark. Its most notable ones — which stand out even more when comparing them against the Millennials Index — were to low Profitability and small Size. However, it was Market Sensitivity that drove the single-biggest contribution to returns from a style-factor perspective.

Millennials had more pronounced style-factor exposures, especially negative ones to Dividend Yield and Value, and a high exposure to Growth, Liquidity, Medium-Term Momentum, Profitability and Volatility. As the whitepaper explains, Medium-Term Momentum and Profitability were determinant in the performance of the Millennials Index. On the other hand, its negative exposure to Value hindered performance over the period.

Did betting on the old or the young pay better?

So, how did all this affect performance? We won’t reveal the indices’ returns on this post, but you can view them by downloading the whitepaper here. One hint: one of the two indices has had a particularly strong performance since 2012, returning twice as much as the other one. Was it the more volatile, Growth-oriented gauge of the millennials? Or did the consumer space and small caps help the older-generation index disproportionately?

Structural trends

As the authors write, both the Millennials and Ageing Population themes offer interesting propositions as investment cases. Yet, investors should analyze the stocks, industries and characteristics of each portfolio, ask themselves if the themes fit their investment objective, and study how they will impact their overall risk.

While wealth naturally transfers to Millennials, it is also true that more and more people are entering the Ageing cohort, feeding the latter’s economic strength. These dynamics are examples of impactful, long-term structural trends of our modern world that investors can capture through theme-focused strategies. Evaluating the risk-return trade-off that such themes offer should be a first step before adopting them.

For a deeper look into Qontigo’s entire thematics offering, please see our dedicated page or visit one of our past articles.

1 ‘Mind the (Generation) Gap,’ Qontigo, August 2021.

2 Melissa Brown is Managing Director, Head of Applied Research at Qontigo. Anran Su is Associate at Qontigo Client Services.

3 The equal-weighting methodology in these thematic indices goes through an adjustment formula. To find out more about it, please see the index guide.

Do you want to stay up to date?

Receive valuable insights, news, and event invitations as soon as they are published.