Many Smart Beta ETFs are bought with the expectation of long-term market outperformance. The factors on which many are based have been proven both academically and empirically to produce excess returns. However, our recent set of stress tests have highlighted three issues that investors and fund managers should understand:

1) Portfolios with names that sound virtually identical can have very different reactions to stressors, suggesting they are not as similar as they sound. For example, should credit spreads widen substantially, we found one Momentum-oriented fund that would be likely to lag the market by almost 3.5% over the ensuing month, whereas a second fund Momentum ETF seemed likely to outperform slightly, for a total—and significant—difference in returns of about 4%.

2) Many “Smart Beta” ETFs are constructed to tilt on a specific factor (say Dividend Yield). But because these funds do not try to neutralize exposures to other factors, they may be quite vulnerable to big moves in other unrelated factors.

3) The impact of a given stress test can vary widely from one period to the next as a fund’s holdings change, as volatilities of underlying risk factors move up or down, or the correlations between factors shift.

These findings confirm and expand upon the analysis of risk characteristics we provided in an earlier paper[1], in which we showed that funds with similar names could have extremely different risk exposures.

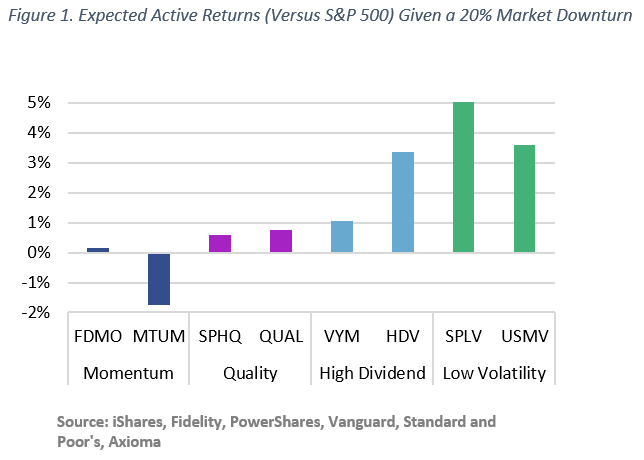

Stress testing is a tool that can help managers and fund investors better understand the potential impact of likely stressors. Many investors use stress tests as a way to determine “worst-case” scenarios for their portfolio returns. For purposes of our tests, we took a slightly different tack. We studied events that would be expected to have a negative impact on the market as a whole, or certain categories of stocks, but would not necessarily be expected to cause our portfolios to underperform. We looked at some well-known historical market events, large unexpected returns in selected style factors and big moves in a few economic variables. For example, we tested what would happen to our selected ETFs, given their holdings as of April 30, 2018, should the market fall by 20% and obtained the results in Figure 1.

Here we see that not only is the reaction different for similar types of funds, but also that in some cases funds that may be viewed as defensive may not be as defensive as expected (see, for example, the high dividend yield fund VYM).

This post is meant to provide a preview of the paper, which goes into much more detail. You can find it here.

[1] See “What’s in a Name? In the Case of Smart Beta It’s Hard to Tell” here.