It’s no secret that factor indices have been underperforming of late, as we ourselves have documented extensively in both blog posts and more lengthy analyses. For investors with shorter investment horizons, that may be enough said. But what about those with a long-term focus?

To address this question, we examined the long-term performance of the recently introduced STOXX factor indices. And we will spare you the suspense. According to our tests, the vast majority of the STOXX factor indices (and their underlying factors) have delivered over the long term[1]. Even for Value, where returns in the Global universe are about on par with those of the market over the full history, there is a diversification advantage from its low average correlation with the other factors. We also see that the factor indices produce drawdowns at different times, also underscoring their diversification benefits.

These results are attributable, at least in part, to the fact that not all factor indices are created equal. Indices are constructed to maximize exposure to the factor of choice, while minimizing other, unintended bets. Because of their construction, the performance of the STOXX factor indices better reflects the underlying factor than the offerings of many competitors in the marketplace. (See “STOXX Factor Indices: Targeted Factor Exposures with Managed Liquidity and Risk Profiles” for a detailed description of how the indices are constructed.)

There is no question that many factors are cyclical and tend to fare best after a drawdown has driven investors off. Since the STOXX factor indices are built on economically sound and straightforward principles that have proven themselves in both academic and practical applications we believe the recent underperformance represents a cyclical downturn and not a secular trend. And we are not alone in this conviction: In a recent article, Bloomberg’s Justina Lee compiled the opinions of a number of quant industry heavyweights on imagining “The Next Decade in Global Finance”. While their view of quants’ paths differed, they generally agreed that factor-based investing will be rewarded, and quants will continue to be important market participants.

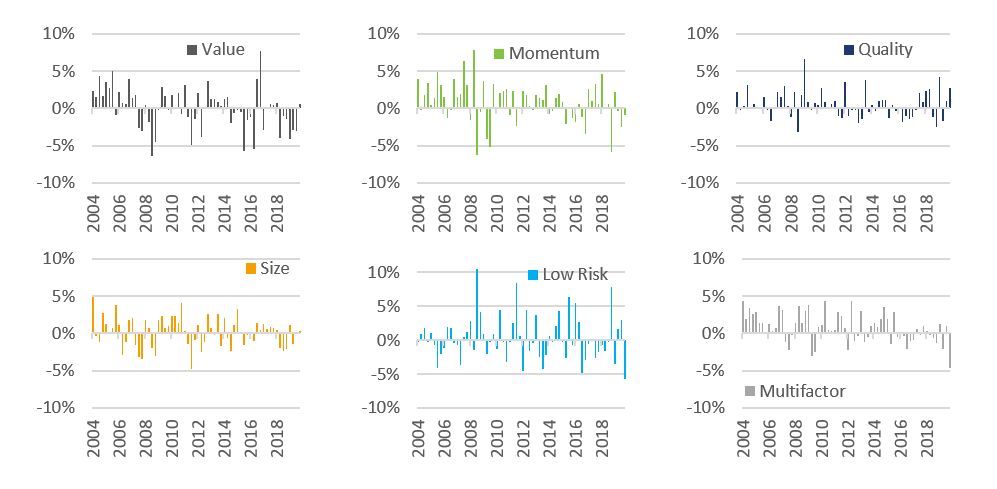

So, let’s dig a little deeper. Figure 1 shows quarterly active returns for each of the six indices based on the STOXX Global 1800. Over time it is clear these factor portfolios rarely have long runs of quarterly underperformance and, with the exception of Value, have far more positive quarters than negative. The magnitude of active returns over the past 12 quarters was not statistically different from prior performance of the single-factor indices, even if eyeballing them it looks as if some have declined.

Recent performance for the multifactor index has also been rough, with active performance in Q4 2019 worse than any of the other factor indices except low risk, and more negative than ever before. 2019 performance was lower than for any single-factor index except Value. And although there does seem to be a statistical difference between the relatively poor quarterly returns of the last two or three years and higher-performing prior years, we believe this performance is a result of this somewhat unusual market environment dominated by Technology stocks, as well as a deliberate preference for lower beta stocks, which tend to fall behind in strongly rising markets. In addition, in a November 2019 blog post where we observed lagging performance for a similar kind of multifactor portfolio (although US-only), we noted “at least a portion of the negative active returns could be traced to: (1) unusually poor performance in a few factors, particularly Value; (2) a number of factors faring better on the short side, thereby cutting off much of the return possibility for managers unable to short; and (3) other limitations, such as being confined to invest in a large-cap universe, may have had some impact as well, although it actually helped for some factors.” The STOXX Global 1800 Multifactor index is not limited to a large-cap universe, but we believe the other two theories hold.

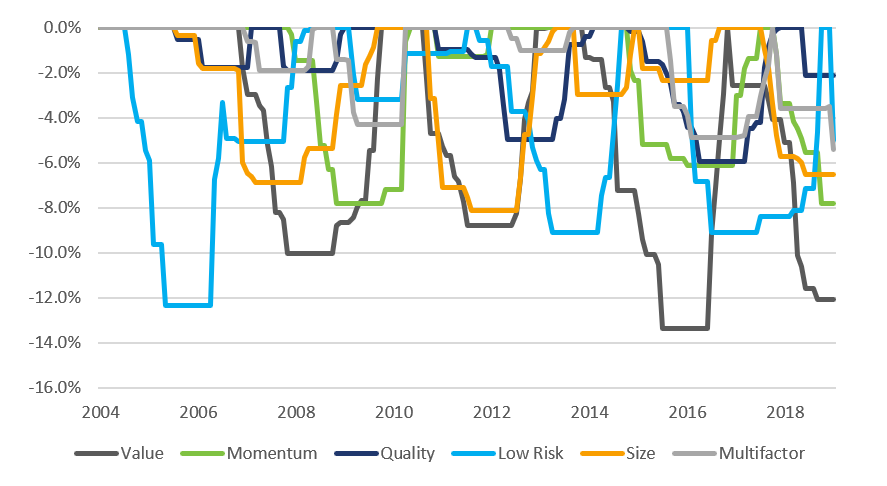

Figure 2 highlights the maximum 12-month drawdown in active return for each of the portfolios. It is clear from this chart that (1) factors tend to snap back quickly from a drawdown, and (2) they experience drawdowns at different times, thereby providing substantial diversification. Finally, while the current drawdown for the multifactor index is larger than at any time in the past, it is still relatively small when compared with those of other single factors.

For the factors that underly the STOXX indices, strong long-term results that nevertheless include cyclical downturns, and philosophies driven by sound economic rationales underscores our conviction in their efficacy and value.

Figure 1. Quarterly Active Returns, STOXX Global 1800 Factor Indices

Figure 2. 12-Month Drawdown, STOXX Global 1800 Factor Indices

[1] We focused these tests on the Global factor indices. The Global 1800 index which underlies all the global factor indices, and therefore our backtest results, start in 2004.