ROOF Scores

Market sentiment indicators

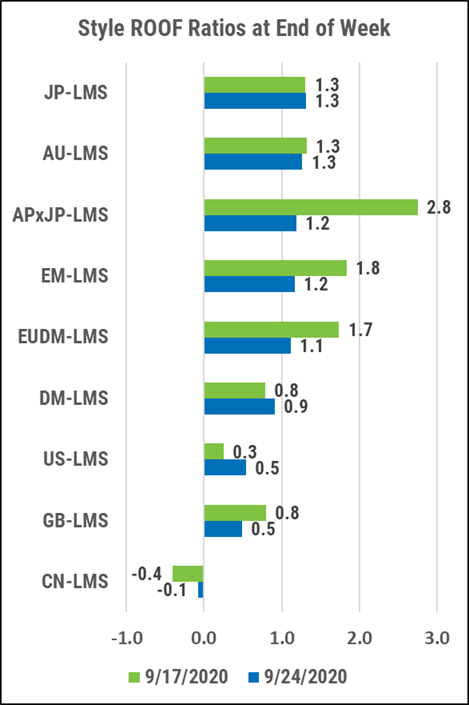

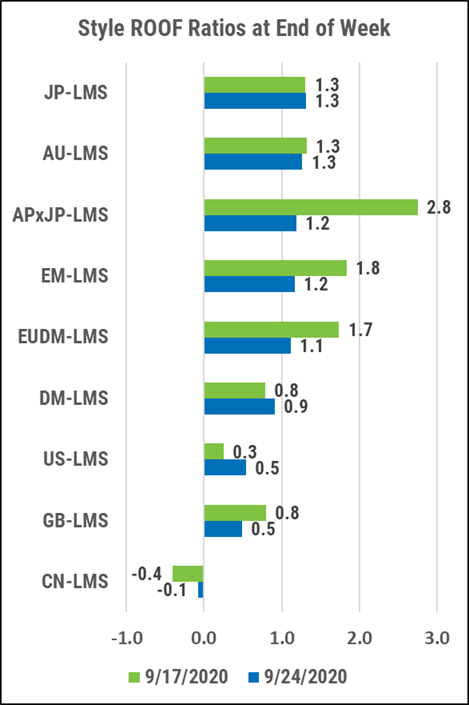

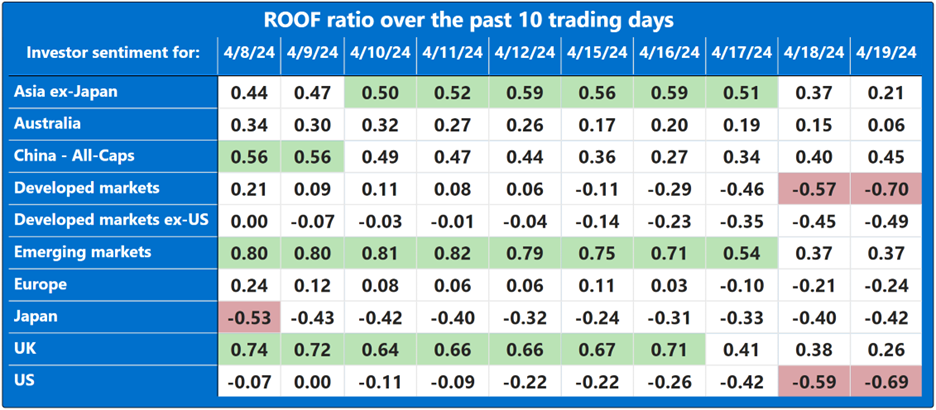

ROOF Scores (Risk-On/Risk-OFF) were created to quantify investors’ risk appetite, using investor behavior as a guide to whether they are risk-tolerant (bullish), neutral or risk-averse (bearish).

We produce two variants of the ROOF Scores per market — Style and Sector — using the Axioma fundamental multi-factor risk models. Additionally, both variants incorporate metrics on the recent change in overall market risk.

The ROOF Scores use a bottom-up methodology allowing us to quantify the implied sentiment of the average investor in the market as well as the active sentiment of any portfolio against its benchmark.

*Last updated on April 22, 2024