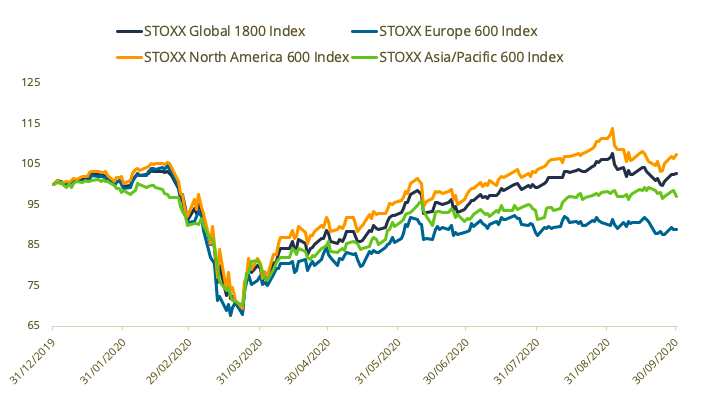

The STOXX® Global 1800 Index fell from a record in September, pulled back by this year’s best-performing stocks, yet managed to post its second consecutive quarterly gain.

The global equity index declined 3.2% in dollar terms1 during the month for a third-quarter advance of 8.2%. The index is now up 2.6% for 2020, having rebounded 50% from the lows in March.

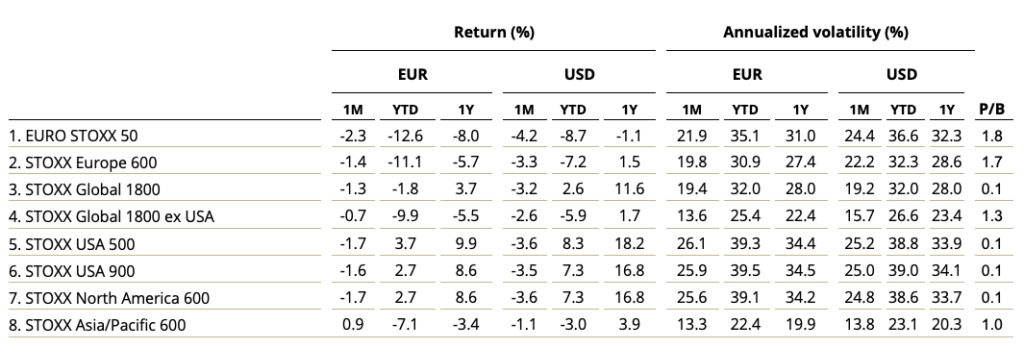

The STOXX® North America 600 Index and the STOXX® USA 500 Index fell 3.6% in dollars in September, after both reached a record high at the start of the month.2 The pan-European STOXX® Europe 600 Index declined 1.4% when measured in euros, while the Eurozone’s EURO STOXX 50® Index lost 2.3%. The STOXX® Asia/Pacific 600 Index decreased 1.1% in dollars.

Taking profits

A second wave of COVID-19 contagion and speculation that some stocks’ valuations may be overstretched prompted investors to take profits during the month that ended. Sectors tied to economic growth and stocks that have led gains since late March paced September’s pull-back.

Exhibit 1 – Returns since start of 2020

Exhibit 2 – Benchmark indices risk and return characteristics

Emerging markets and developed nations

All but four of the 25 developed markets tracked by STOXX slid during September when measured in dollars, led by the STOXX® Poland Total Market Index’s 9.2% retreat. The STOXX® Developed Markets 2400 Index shed 3.2% in dollars and 1.3% in euro terms.

The STOXX® Emerging Markets 1500 Index fell 1.7% in dollars. Fifteen of 21 national developing markets tracked by STOXX declined during the month. The STOXX® Indonesia Total Market Index dropped the most, shedding 11.6%.

All but two of 20 Supersectors in the STOXX Global 1800 Index fell in the month. The STOXX® Global 1800 Energy Index dropped 12.6%, followed by declines in gauges tracking the Banks (-7.6%) and Technology (-5.4%) Supersectors. The two exceptions to the losing trend were the STOXX® Global 1800 Consumer Products & Services Index, which climbed 0.6%, and the STOXX® Global 1800 Chemicals Index, which added 0.5%.

Factor-based strategies

Momentum, this year’s winning factor, led losses in September as investors sold stocks that have done best in recent months. The STOXX® Global 1800 Ax Momentum Index, which tracks shares with the highest cumulative return over the last year excluding the most recent month, fell 2.7%, trailing all other STOXX Factor Indices. The index is still up 21.6% this year.

Similarly, the STOXX® Global 1800 ESG-X Ax Momentum Index lost 2.6%, the most among the STOXX® ESG-X Factor Indices covering a global portfolio. The ESG-X Factor indices were introduced in May and cover major regions and countries. They implement the same factor-based methodology of the STOXX Factor Indices, seeking exposure to five style signals, but do so on slightly smaller universes that exclude stocks based on the responsible polices of leading asset owners.

In Europe, the STOXX® Europe 600 Ax Quality Index gained 1.5% in euros, leading returns within its group.

Elsewhere, six of the eight EURO STOXX® Multi Premia® and Single Premium Indices outperformed their benchmark in the month that ended. The reversal premium was the worst-performing factor, while quality was the best one.

Sustainability strategies

The STOXX® Global 1800 ESG-X Index came up broadly in line with its benchmark during September, allowing investors to generate market-type returns while complying with sustainable policies. The EURO STOXX 50® ESG-X Index outperformed its benchmark.

The EURO STOXX 50® ESG Index outperformed its benchmark by 26 basis points. The ESG index, which is derived from the iconic EURO STOXX 50 Index and incorporates negative exclusions and ESG scoring into stock selection, has beaten its benchmark by nearly 4 percentage points so far in 2020.

The DAX® 50 ESG Index, which excludes companies involved in controversial activities and integrates ESG scoring into stock selection, fell 1%, beating the flagship DAX®.

Climate benchmarks

The STOXX Paris-Aligned Benchmark Indices (PABs) and the STOXX Climate Transition Benchmark Indices (CTBs) covering the Eurozone market came up ahead of their benchmark during September. Those covering global markets underperformed.

The PAB indices are based on liquid securities from a selection of STOXX benchmark indices and follow the EU Paris-aligned Benchmark (EU PAB) requirements outlined by the European Commission’s Technical Expert Group (TEG) on climate benchmarks.

The CTBs, which also follow the requirements outlined by the TEG, form portfolios that are on a decarbonization trajectory. The PAB and CTB indices were introduced in June.

Finally, the STOXX® Global Climate Change Leaders Index, which selects corporate leaders that are publicly committed to reducing their carbon footprint, lagged the benchmark STOXX Global 1800 by more than 1 percentage point during September.

Minimum variance

Minimum variance strategies outperformed by a significant margin in global and US portfolios during the month that ended. The STOXX® Global 1800 Minimum Variance Index lost 1.6%, while the STOXX® Global 1800 Minimum Variance Unconstrained Index fell 1.7%. The STOXX® USA 900 Minimum Variance Index retreated 0.3% and the STOXX® USA 900 Minimum Variance Unconstrained Index declined 1.2%.

The STOXX® Europe 600 Minimum Variance Index dropped 1.7% and its unconstrained version lost 1.2%.

The STOXX® Minimum Variance Indices come in two versions. A constrained version has a similar exposure to its market-capitalization-weighted benchmark but with lower risk. The unconstrained version, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

Thematic indices

The STOXX® Thematic Indices seek exposure to the economic upside of disruptive global megatrends and follow two approaches: revenue-based and artificial-intelligence-driven. Sixteen of 22 STOXX revenue-based thematic indices outperformed the STOXX Global 1800 Index during September.

Five of them had a positive return in the month, led by the STOXX® Global Breakthrough Healthcare Index’s 2.1% advance. At the other end, the STOXX® Global Sharing Economy Index shed 4.3%.

Year-to-date, the STOXX® Global Smart Cities Index is the best-performing gauge in the STOXX Thematics family, having risen 46.1%.

Two of three STOXX artificial-intelligence-driven thematic indices, the STOXX® AI Global Artificial Intelligence Index and its ADTV5 version, continued their streak of outsized relative returns during September.

Featured indices

STOXX® Global 1800 Index

EURO STOXX 50® Index

STOXX® Europe 600 Index

STOXX® North America 600 Index

STOXX® Asia/Pacific 600 Index

STOXX® USA 500 Index

STOXX® Developed Markets 2400 Index

STOXX® Emerging Markets 1500 Index

STOXX® Global 1800 Minimum Variance Index

STOXX® Europe 600 Minimum Variance Index

STOXX® Factor Indices

STOXX® ESG-X Factor Indices

EURO STOXX® Multi Premia® and Single Premium Indices

EURO STOXX 50® ESG Index

DAX® 50 ESG Index

STOXX® Paris-Aligned Benchmark Indices

STOXX® Climate Transition Benchmark Indices

STOXX® Global Climate Change Leaders Index

STOXX Thematic Indices

1 All results are total returns before taxes unless specified.

2 Record levels excluding dividends (price returns).