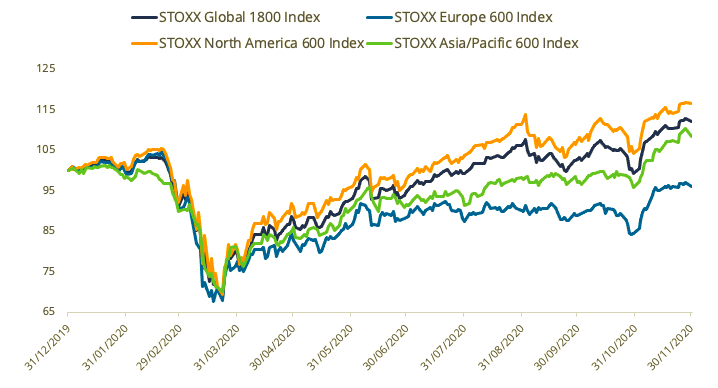

Stocks jumped in November, with many benchmarks posting their best month on record, as three drugs manufacturers announced that their experimental vaccines are widely effective in preventing the COVID-19 virus.

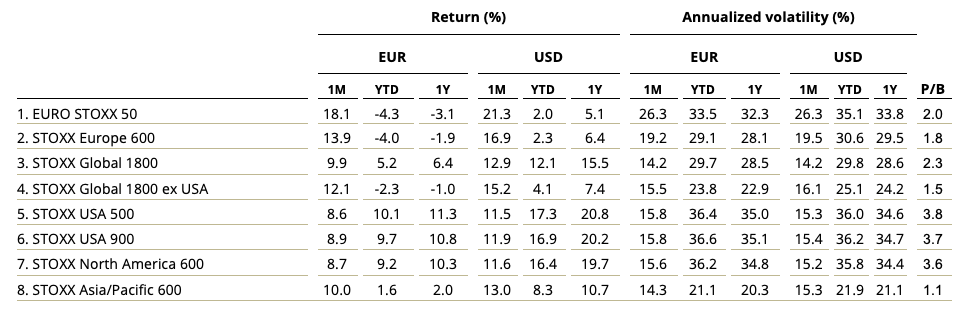

The STOXX® Global 1800 Index surged 12.9% in dollar terms, its biggest monthly increase since data begins in 2004, to log a 12.1% gain for 2020. The benchmark rose 9.9% in euros during the month as the greenback fell 2.7% against the common currency.

The Eurozone’s EURO STOXX 50® Index rose 18.1% when measured in euros, its steepest monthly advance ever, while the pan-European STOXX® Europe 600 Index gained 13.9%, its best performance for any month since 2001 except April 2009. The STOXX® North America 600 Index climbed 11.6% in dollars and the STOXX® USA 500 Index gained 11.5%, also their best showing since April 2009. The STOXX® Asia/Pacific 600 Index increased 13% in dollars, a record monthly gain.

Leaving lockdowns behind

Investors have placed expectations that a COVID-19 vaccine is the catalyst needed to resume economic activity following three quarters of lockdowns and social disruption across the world. Pfizer, Moderna, AstraZeneca and their partners unveiled positive test results for their respective coronavirus drugs in November, paving the way for mass vaccination starting as early as this month.

In the US, Democrat challenger Joe Biden was called the winner of the Nov. 3 presidential election. The Republican party, however, obtained a strong foothold in Congress, raising expectations that the new government will need to follow consensual policies and may fail to increase taxes and regulation as pledged during the campaign.

Exhibit 1 – Returns since start of 2020

Exhibit 2 – Benchmark indices’ November risk and return characteristics

Gains across all markets

All 25 developed markets tracked by STOXX advanced during November when measured in dollars. The STOXX® Luxembourg Total Market Index led returns after soaring 30.7%. The STOXX® Developed Markets 2400 Index rose 13.1% in dollars and 10.1% in euro terms.

Widespread buying also lifted all 21 national developing markets tracked by STOXX. The STOXX® Greece Total Market Index went from bottom in October to top in November, adding 35.1%. The STOXX® Emerging Markets 1500 Index gained 14% in dollars and 11% in euros.

Likewise, all 21 Supersectors in the STOXX Global 1800 Index advanced in the month, led by some of this year’s worst performers. The STOXX® Global 1800 Energy Index rose 28.5%, followed by a 24.5% advance in the STOXX® Global 1800 Automobiles & Parts Index and a 22.7% gain in the STOXX® Global 1800 Banks Index.

Factor-based strategies

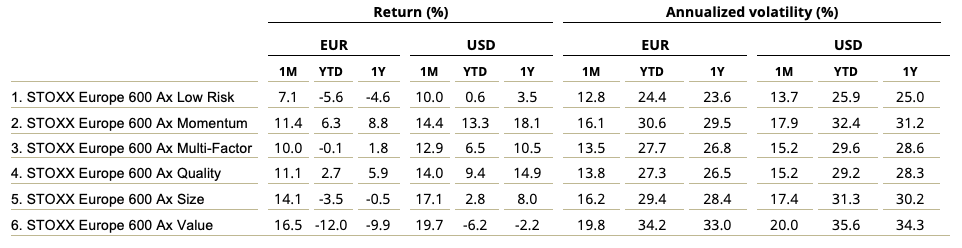

Amid expectations for an economic rebound, investors snapped so-called value stocks, a style that has been strongly out of favor this year. The STOXX® Global 1800 Ax Value Index rose 14.4%, leading returns within the STOXX Factor Indices and paring its retreat in 2020 to 7.3%.

In Europe, the STOXX® Europe 600 Ax Value Index (16.5%) did better than all other factor indices, while the STOXX® Europe 600 Ax Low Risk Index (7.1%) came out last in its group for a second month in a row (Exhibit 3).

Exhibit 3 – November performance, STOXX Factor Indices: Europe

In US factor portfolios, however, it was Momentum that led all other strategies during November, extending the outperformance this year. The STOXX® USA 500 Ax Momentum Index rose 13.2% in the month.

Within the STOXX® ESG-X Factor Indices, the STOXX® Global 1800 ESG-X Ax Value Index (14.3%) also outperformed its counterparts. The ESG-X Factor indices implement the same factor-based methodology of the STOXX Factor Indices, seeking exposure to five style signals, but do so on slightly smaller universes that exclude stocks based on the responsible polices of leading asset owners.

Factor Market Neutral indices

Value was also the best-performing strategy within the iSTOXX® Europe Factor Market Neutral Indices, which hold a short position in STOXX Europe 600 futures to help investors neutralize systematic risk. The iSTOXX® Europe Value Factor Market Neutral Index added 2.4% on a net-return basis. The iSTOXX® Europe Carry Factor Market Neutral Index was the month’s worst performer after falling 2.9%. The Carry index targets stocks with high growth potential based on earnings and dividends.

Minimum variance

Minimum variance strategies underperformed heavily against November’s increased risk-taking background. The STOXX® Global 1800 Minimum Variance Index added 9.4%, while the STOXX® Global 1800 Minimum Variance Unconstrained Index rose 8.9%. The STOXX® Europe 600 Minimum Variance Index climbed 8.5% and its unconstrained version increased 8.2%.

The STOXX® Minimum Variance Indices come in two versions. A constrained version has a similar exposure to its market-capitalization-weighted benchmark but with lower risk. The unconstrained version, on the other hand, has more freedom to fulfill its minimum variance mandate within the same universe of stocks.

Dividend strategies

By contrast, it was a very strong month for certain dividend strategies. The STOXX® Global Maximum Dividend 40 Index (14.8%), which selects the highest-dividend-yielding stocks, beat the STOXX Global 1800 Index by almost 2 percentage points.

The STOXX® Global Select Dividend 100 Index (18.9%), which tracks companies with sizeable dividends but also applies a quality filter such as a history of stable payments, topped the benchmark by more than 6 percentage points and posted its strongest monthly return since data begins in 2012.

The STOXX® Global Select 100 EUR Index (6.1% in euros), on the other hand, underperformed the STOXX Global 1800 Index. The index blends increasing dividend yields with low volatility and has posted double-digit percentage losses for this year.

Sustainability strategies

The STOXX® Global 1800 ESG-X Index (12.8%) came up broadly in line with its benchmark during November, allowing investors to generate market-type returns while complying with sustainable policies. The EURO STOXX 50® ESG-X Index (17.5%) underperformed its benchmark slightly.

The EURO STOXX 50® ESG Index (17.6%) also lagged its benchmark by few basis points. The ESG index, which is derived from the iconic EURO STOXX 50 and incorporates negative exclusions and ESG scoring into stock selection, has outperformed by more than 3 percentage points so far in 2020.

The DAX® 50 ESG Index (14.9%), which excludes companies involved in controversial activities and integrates ESG scoring into stock selection, produced returns that were similar to those of the flagship DAX® (15%).

Climate benchmarks

Among STOXX’s climate indices, the STOXX® Europe Climate Impact Ex Global Compact Controversial Weapons & Tobacco Index (14.4%) topped the benchmark STOXX Europe 600 by 50 basis points during November. The STOXX® Global Climate Impact Ex Global Compact Controversial Weapons & Tobacco Index (13%) beat the STOXX Global 1800 by 15 basis points.

The STOXX Paris-Aligned Benchmark Indices (PABs) and the STOXX Climate Transition Benchmark Indices (CTBs) showed diverse performances during November.

Thematic indices

The STOXX® Thematic Indices seek exposure to the economic upside of disruptive global megatrends and follow two approaches: revenue-based and artificial-intelligence-driven. Thirteen of 22 revenue-based thematic indices outperformed the STOXX Global 1800 Index during November.

The STOXX® Global Electric Vehicles & Driving Technology Index (20%) led gains in the index family for a second consecutive month. The STOXX® Global Pet Care Index came out last even if it still rose 6.8%.

Year-to-date, the STOXX® Global Smart Cities Index is the best-performing gauge in the STOXX Thematic Indices family, having risen 65.8%.

All three STOXX artificial-intelligence-driven thematic indices outperformed the benchmark STOXX Global 1800 in the month that ended, led by a 16.5% increase for the STOXX® AI Global Artificial Intelligence Index.

Featured indices

STOXX® Global 1800 Index

EURO STOXX 50® Index

STOXX® Europe 600 Index

STOXX® North America 600 Index

STOXX® Asia/Pacific 600 Index

STOXX® USA 500 Index

STOXX® Developed Markets 2400 Index

STOXX® Emerging Markets 1500 Index

STOXX® Global 1800 Minimum Variance Index

STOXX® Europe 600 Minimum Variance Index

STOXX® Factor Indices

STOXX® ESG-X Factor Indices

iSTOXX® Europe Factor Market Neutral Indices

EURO STOXX 50® ESG Index

DAX® 50 ESG Index

STOXX® Paris-Aligned Benchmark Indices

STOXX® Climate Transition Benchmark Indices

STOXX® Global Climate Impact Ex Global Compact Controversial Weapons & Tobacco Index

STOXX Thematic Indices

1 All results are total returns before taxes unless specified.

2 STOXX Maximum Dividend 40 Index is calculated in net returns.