By Saumya Mehrotra, Associate Principal, Sustainable Investment at Qontigo; and Rodolphe Bocquet, Global Head of Sustainable Investment

With the proliferation of carbon-reduction programs and net-zero announcements by companies across the world, investors need to ensure that corporate greenhouse gas (GHG) reduction targets are genuine and aligned with global climate goals.

Establishing science-based targets (SBTs)1 is a way for companies to publicly demonstrate their intent and commitment to reduce GHG emissions in alignment with the Paris Agreement’s ambition to drastically limit global warming by 2050.2

With climate action becoming an ever-stronger pillar in portfolio construction, having a scientifically verified measure of carbon reduction commitments by businesses can prove to be an invaluable tool for asset managers. Investors need to understand if and how an organization is addressing its climate-related risks and opportunities. For companies, science-based target setting not only helps them comply with global climate goals: the exercise also brings substantial economic, management and reputational benefits.3

However, as with any other financial metric, investors need to look at a company’s SBTs in the context of several other climate-related indicators to achieve a complete and robust analysis of its performance. These may include climate risk governance, physical and transition risk exposure, and GHG reduction momentum.

Why companies should set SBTs

Targets adopted by companies to reduce GHG emissions are considered ‘science-based’ if they are in line with the latest climate science assessment as to what is needed to meet the Paris objective: i.e., to curb global warming to “well below” 2°C above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5°C.

According to the Science-Based Targets initiative (SBTi),4 which has developed the most recognized method of science-based target-setting, the exercise can also help companies achieve the following:

- Boost revenue and lower costs by developing new, low-carbon business models.

- Improve employee, supplier and customer partnerships, and reduce emissions across supply chains.

- Prepare for regulatory changes.

- Improve reputation with increasingly conscious consumers.

Target setting proves useful

Data show that science-based target setting is working. The SBTi has reported that the typical company with science-based targets has reduced its direct (scope 1 and 2) emissions at an annual rate of 6.4% per year since 2015, exceeding the 4.2% rate needed for the 1.5°C warming goal.5 All while global emissions from energy and industry have increased. In 2020, 1.5°C became the most common target temperature classification among SBTi subscribers.

A recent analysis of 338 companies with approved science-based targets found they have reduced their combined emissions by 25% since 2015. That amounts to the annual emissions from 78 coal-fired power plants).6

How can companies set science-based targets?

There are several methodologies to establish SBTs, all of which include assessing the following:

- How much a company can emit to stay within the 2°C warming limit, also known as carbon budget.

- The approach with which to assign carbon budget to companies.

- An emissions scenario detailing the amount and timeline of emissions.

To set SBTs, a company is required to calculate Scope 1 and 2 carbon emissions and screen Scope 3 emissions to determine whether a target is needed.7 Companies that commit to set science-based targets have 24 months to develop and submit their targets for validation. To ensure that targets remain aligned, companies are required to review and, if necessary, revalidate them every five years.

Generalist and sector-specific approaches

There are currently two target-setting methods used by the SBTi to assess corporate GHG emission reduction targets:

- The Absolute Contraction Approach (ACA), defined as ‘a one-size-fits-all method” that ensures companies cut emissions in line with global decarbonization pathways.’ This is the most popular approach.8

- The Sectoral Decarbonization Approach (SDA)9 is an alternative method that uses sector-specific intensity metrics for some of the most carbon-intensive activities, such as transportation, power generation or mining.

Case Study: how we future-proof our indices using science-based targets

As mentioned, investors should consider SBTs in conjunction with other climate-related measures to develop a robust model for assessing the risks and opportunities present in their portfolio.

This was the philosophy adopted by Qontigo when we introduced the STOXX Paris-Aligned Benchmark (PAB) and Climate Transition Benchmark (CTB) Indices last July.

To future-proof our indices and optimize impact for clients, the STOXX PABs and CTBs go beyond the minimum requirements of the European Union Climate Benchmarks regulation. Additional enhancements include the count of Scope 3 emissions from day one, the incorporation of green/brown revenue thresholds, and the use of carbon budget data in the weighting process to ensure indices are aligned with the International Energy Agency’s 2°C scenario until 2050.

Importantly, the STOXX Climate Benchmark Indices mandate science-based carbon-target setting using a phased approach.

How science-based target setting affects the composition of STOXX’s climate benchmarks

One of the requirements of the EU PAB methodology is to increase the weight of companies that set evidence-based targets under strict conditions to avoid greenwashing. The STOXX PAB Indices meet and build on this requirement by weighting securities by their free float market-cap times their target-setting score. The indices overweight companies with SBTi-approved targets, and even more so those with approved targets and a consistent reduction in annual GHG intensity of at least 7%.

STOXX uses information provided by ISS ESG to identify three groups of companies: those that have not yet committed to the SBTi; those that have committed to the SBTi but do not yet have verified targets; and those with concrete emissions reduction targets verified by SBTi. The PAB indices allow securities a transition period of up to ten years to have science-based targets approved and published.10

To access a whitepaper on the STOXX Paris-Aligned Benchmark Indices, including a full analysis of index and benchmark’s climate risks, click here.

Why has Qontigo chosen SBTs as a key characteristic of the PAB indices?

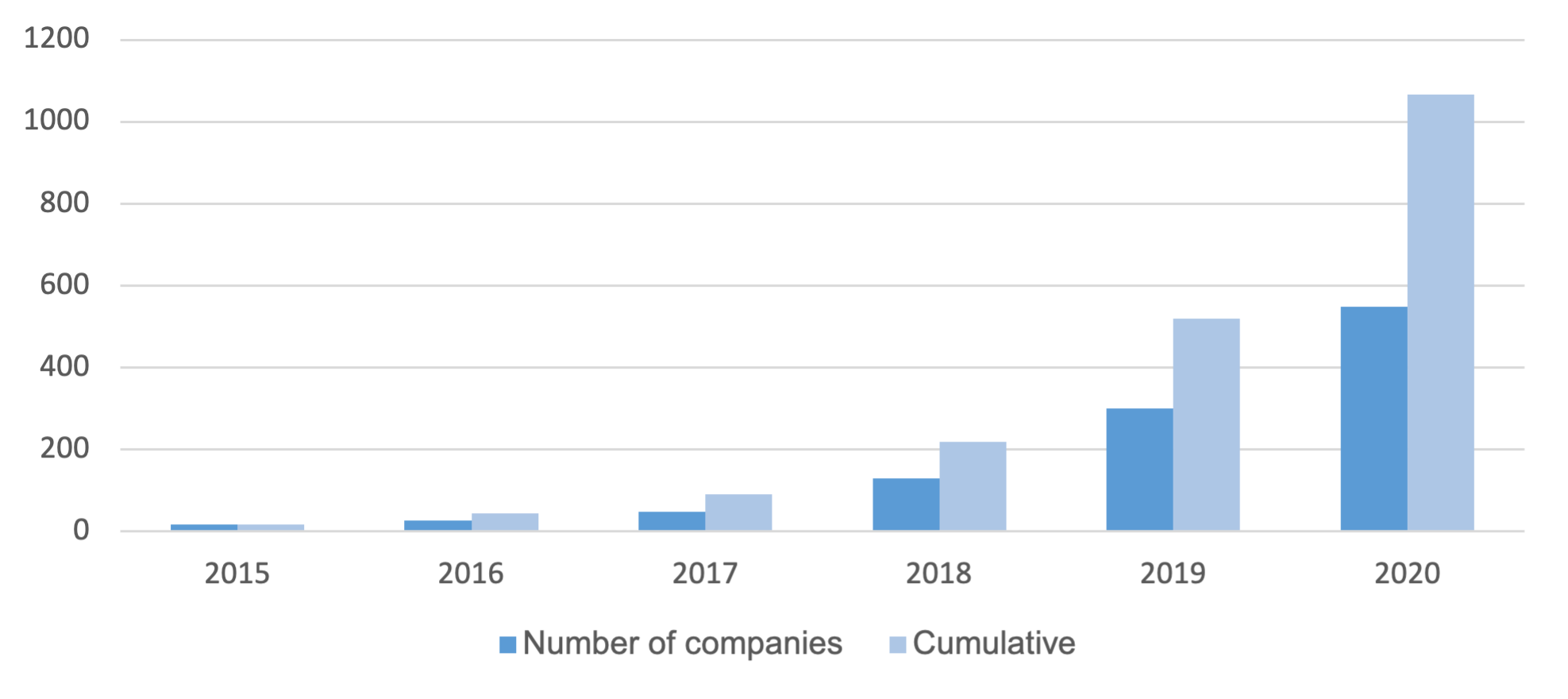

As of February 2021, 1,205 businesses across the world have committed to or set approved emissions-reduction targets in line with the SBTi, a truly global and widely recognized framework. The number of companies committing to the SBTs and getting their targets verified has grown steadily since the SBTi’s inception (Exhibit 1).

Exhibit 1 – YoY growth in number of companies setting targets

In October 2020, as part of a CDP campaign, 137 global financial institutions, holding nearly 20 trillion dollars in assets, called on more than 1,800 high-impact companies to set 1.5°C science-based emissions reduction targets and achieve net-zero emissions by 2050 at the latest.

At Qontigo we believe the SBTi methodology is a rules-based and empirical method to gauge companies’ commitment to fight global warming. These characteristics fulfill our criteria to incorporate only best-of-breed data in our indices.

A key metric to advance corporate responsibility and investor action

Companies, and the global capital markets that finance their operations, are at the center of the fight against global warming. Initiatives such as the SBTi are key to advance the cause, and with more signatories, companies with science-based targets could cover up to 24% of global emissions from energy and industry in the next five years.11 SBTs can also facilitate the role of investors in backing those corporate pioneers doing the most to manage climate risks and tackle climate opportunities.

With the incorporation of science-based targets in the STOXX climate indices, we have raised the level of innovation in our sustainability solutions toolbox. The indices are already utilized as an engagement and pressure mechanism with companies, and provide an efficient vehicle to investors wishing to adopt a responsible approach in the face of the global temperature crisis.

1 Science-based targets determine unique emissions mitigation pathways for individual businesses and industries, based on 2°C or 1.5°C temperature ceiling pathways determined by climate scientists. The science-based method can help remove the arbitrary approach to setting GHG reduction targets, replacing it with an approach governed by an agreed-upon global target that can enable companies to set aggressive yet reasonable goals, considering their standing in the global economy.

2 In 2018, the Intergovernmental Panel on Climate Change warned that global warming must not exceed 1.5°C to avoid the catastrophic impacts of climate change. According to the latest climate science, we need to halve emissions by 2030 – and drop to net zero by 2050 – to reach those goals.

3 To explore in more detail the benefits brought to companies that set science-based targets, see Galvin D., ‘Six business benefits of setting science-based targets,’ Science Based Targets Initiative, Jul. 9, 2018.

4 The SBTi is a collaboration between CDP (formerly the ‘Carbon Disclosure Project’), the United Nations Global Compact, the World Resources Institute and the World Wide Fund for Nature. Its objective is to promote and facilitate corporate science-based target setting by providing companies with a framework, technical assistance, and resource material.

5 ‘2020 Progress Report,’ SBTi.

6 ‘330+ target-setting firms reduce emissions by a quarter in five years since Paris Agreement,’ SBTi, Jan. 26, 2021.

7 If Scope 3 emissions comprise more than 40% of the total footprint, a target will need to be set.

8 Two-thirds of the targets approved by the SBTi in 2020 used the ACA method to set targets limiting global warming to 1.5°C.

9 The SDA is utilized by several organizations as a science-based method for companies to set GHG reduction targets necessary to stay within reference climate scenarios. An example of this is the Transition Pathway Initiative’s Carbon Performance methodology, which assesses how companies’ carbon performance now and in the future might compare to the international targets and national pledges made as part of the Paris Agreement, using the modelling conducted by the International Energy Agency (IEA) for its biennial Energy Technology Perspectives report. The current version of the SDA supports 1.5°C targets for power generation, while the methods for other sectors rely on well-below 2°C pathways from the IEA.

10 This transition period will have the following phases: starting in March 2021, securities that have not committed to the science-based initiative will be incrementally underweighted and will not be eligible for selection starting in March 2025. Similarly, securities that have committed to the initiative but that do not have SBTi-verified targets will be incrementally underweighted (March 2021 to March 2030). Starting in March 2030, the STOXX Paris-Aligned Benchmark Indices will only include companies that have their targets verified and published by the SBTi.

11 SBTi Progress Report 2020.