The countdown to Britain’s yet-unmanaged departure from the European Union is causing anxiety across the country – with the stock market appearing as one noticeable exception.

The STOXX® UK 180 Index had a total return of 33% between the ‘Brexit’ vote on Jun. 23, 2016 and the end of July this year.1 The STOXX® UK 50 Index added 36%. Both gauges reached a record high in July when including dividends.

Gains this year are particularly noteworthy, considering the UK government failed three times to agree to separation terms with the EU, and new Prime Minister Boris Johnson has pledged to exit the Union in October with or without a deal. Economists have warned that an unmanaged departure could cause significant economic disruption.

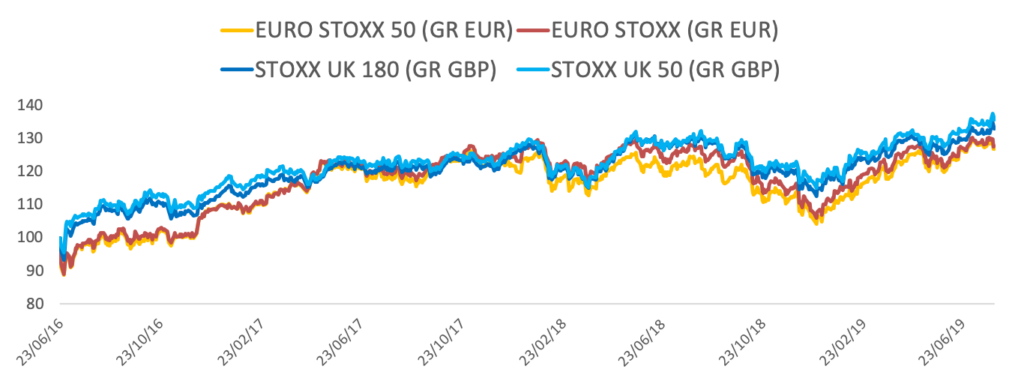

Figure 1 shows the performance of the STOXX UK 180 Index (in dark blue) and the STOXX UK 50 Index (in light blue) against the EURO STOXX® Index and the blue-chip EURO STOXX 50® Index in their local currencies. UK stocks have fared better than their Eurozone counterparts in the aftermath of the Brexit vote.

Figure 1

UK stocks have also outperformed gilts, which often act as safe havens in times of uncertainty. Yields on ten-year UK government bonds are roughly at similar levels to June 2016.

A key variable in this performance has been the downward move in sterling. The UK currency has fallen 18% against the dollar since the Brexit vote, aiding British exporters by making their goods cheaper in overseas markets, and by boosting the value in sterling of foreign sales.

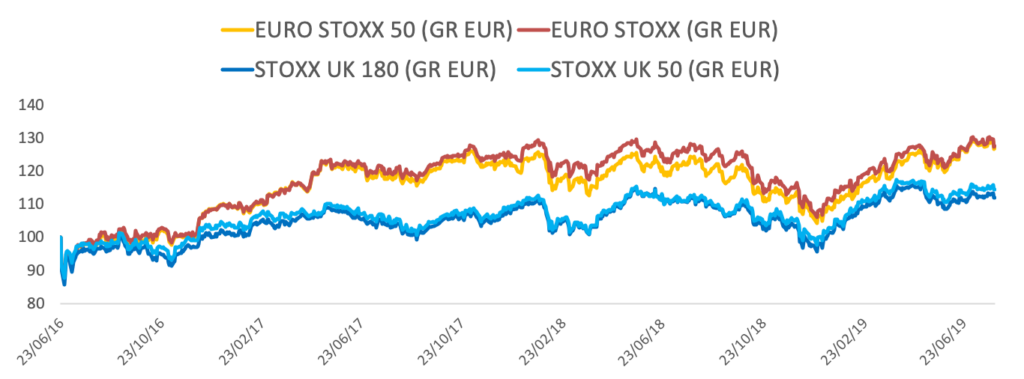

But a weak pound also wipes out UK returns for investors based outside Britain who don’t hedge their currency exposure. Figure 2 shows that, when converting the two UK indices to euros, their returns since June 2016 more than halve. That said, many investors would protect their foreign holdings with currency hedges.

Figure 2

In euros, the STOXX UK 180 Index had a total return of 12% in the period while the STOXX UK 50 Index gained 14%. In both instances, returns were derived almost entirely from dividend payments.

UK economy, profits

In spite of the gains, UK stocks appear 32% cheaper relative to earnings now than they were in June 2016, as corporate profits grew. Higher earnings have come even as UK gross domestic product (GDP) growth decelerated from 2.9% in 2014 to 1.4% in 2018. The Bank of England has forecast growth will slow further to 1.3% in 2019. GDP for the three months ending in June this year showed the first quarterly contraction since 2012, the government said Aug. 9.

Domestic vs. foreign sales

A large part of earnings growth may be explained by the effect of the weaker pound. To assess how important the currency advantage has been on UK stocks, it may help to look at the STOXX True Exposure, or TRU, indices. The indices track companies not only by their country of domicile, but also by the country or region of revenue sourcing.

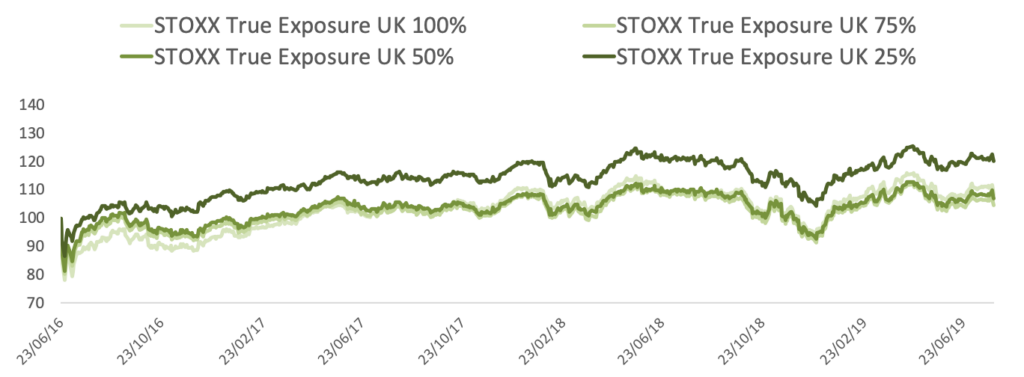

Figure 3 shows the performance of four STOXX True Exposure Indices for the UK, where companies are grouped by the ratio of sales derived domestically: at least 25% (exporters), 50%, 75% and 100% (domestic-focused).

Companies that generate between 26% and 100% of total sales at home have had single-digit returns since June 2016 — ranging from 4.7% to 8.4%. On the other hand, those companies with little relative exposure to their local market (in dark green), stand out, having risen more than 20%. This suggests investors have priced in a better outlook for this latter group.

Figure 3

Run-up to Oct. 31 paved with uncertainty

With just under three months before the scheduled Brexit day on Oct. 31, much can happen on the currency and equity markets fronts. The biggest determinant, i.e. whether the UK will leave the Union abruptly or rather under an agreement that may guarantee a seamless transition for trade, has yet to materialize, casting a shadow on the outlook for UK assets.

The aim of the analysis in precedent paragraphs is to show that investors have several ways to approach a portfolio of UK stocks. Minding factors like currency and revenue exposure is likely to be a decisive driver of returns as the final Brexit chapters unfold.

Featured indices

1 Gross returns equal price return plus pre-tax dividends.