Trading in futures on the STOXX® Europe 600 ESG-X Index (FSEG) was the busiest on record in December, as more investors turn to the exchange-traded derivatives to manage their responsible portfolios.

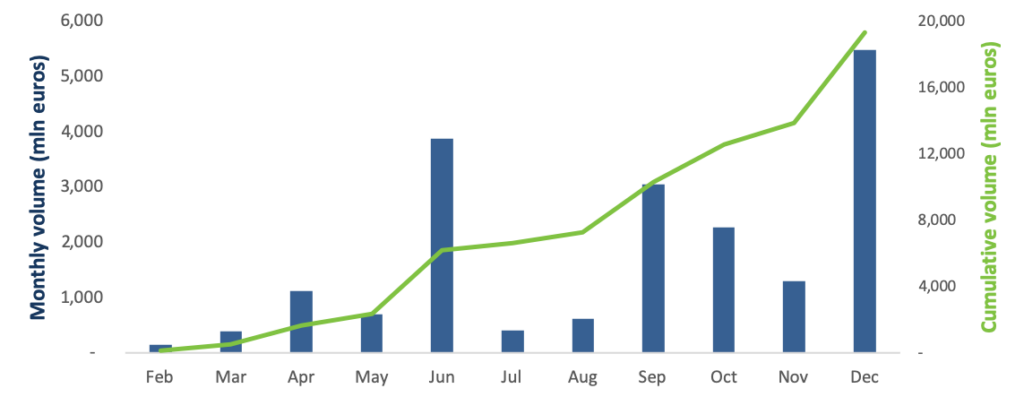

Over 177,000 FSEG contracts have exchanged hands this month on Eurex, for a notional value of 5.5 billion euros, the most on both counts for any month since launch in February 2019 (Chart 1).

A daily volume high was set on Dec. 17, when almost 70,000 contracts traded ahead of the Dec. 20 roll. STOXX Europe 600 ESG-X Index futures are the most popular in a suite of six STOXX ESG derivatives listings on Eurex.

Chart 1: Notional value of FSEG trades

The number of outstanding STOXX Europe 600 ESG-X Index futures contracts reached almost 67,000 on Dec. 19, for an open interest worth over 1 billion euros in notional value. The index is a version of the popular STOXX® Europe 600 Index that observes standard responsible exclusions based on feedback from large asset owners.

More than 660,000 ESG derivatives contracts based on STOXX indices have traded on Eurex this year.

More flexibility in the toolkit

Futures were launched this year to give investors the ability to hedge, take positions and lower trading costs with instruments that are fully compliant with environmental, social and governance (ESG) principles. Market participants have been quick to embrace the products, in line with the rapid growth of ESG mandates and mainstream sustainable portfolios in the region.

“Trading figures point to a very positive trend in ESG derivatives adoption, and this is coming from institutional end-clients and asset owners,” said Willem Keogh, Head of ESG and Thematic Solutions at STOXX’s parent Qontigo. “Deep liquidity in this segment will facilitate the transition to sustainable strategies that we are seeing across the global asset-management industry.”

ESG menu spans strategies, regions

The first futures — which tracked the STOXX Europe 600 ESG-X Index, STOXX® Europe Climate Impact Ex Global Compact Controversial Weapons & Tobacco Index and EURO STOXX 50® Low Carbon Index— were listed in February. In October, Eurex introduced options on the STOXX Europe 600 ESG-X Index and futures and options on the STOXX® Europe ESG Leaders Select 30 Index.

In February 2020, sustainable investing will reach a new chapter when Eurex lists futures on the STOXX® USA 500 ESG-X Index, the first derivatives in Europe tracking ESG exclusions on US stocks and the first to include a screening for thermal-coal mining and coal-fired power plants.

STOXX’s ESG-X family is composed of versions of established STOXX benchmarks. They exclude companies in breach of the United Nations Global Compact principles of human and labor rights, the environment and business ethics. They also incorporate negative product-involvement screens for tobacco and controversial weapons (including anti-personnel mines), as well as a unique exclusion for thermal-coal mining and coal-fired power plants.

With all the listings, investors have access to an entire derivatives menu covering ESG exclusions and ESG integration, low carbon and climate impact strategies. STOXX cooperates with leading data provider Sustainalytics for ESG screenings and scores.